9 "sensibly priced" investment ideas for 2025

The set-up for 2025 in financial markets may be markedly different but the conclusion of who will benefit the most remains the same: the US and especially, US equities.

That's the view of Schroders, who argues that investors will need to think a lot more about how Donald Trump's second term in the White House will affect their views on markets. For instance, if Trump were to implement his entire agenda, as is and to the maximum extent, Schroders' economists think that inflation in the US could hit 6%, even if they see higher nominal GDP next year.

While this is not their base case, this scenario could have massive implications for all asset classes - especially when global bonds have rallied, gold and Bitcoin trade at all-time highs, and the Australian stock market is one of the most expensive ex-US on the planet.

Luckily, where there is uncertainty and malaise, there are opportunities to be found. In this wire, I'll share how Schroders' Australian team of Sebastian Mullins (Fixed Income and Multi-Asset), Martin Conlon (Australian Equities), and Claire Smith (Private Equity) are seeing the current landscape. They will also share nine "sensibly priced" (Conlon's words, not mine) assets that could fit into a well-diversified portfolio in 2025.

The key macro briefs

The first section here are quotes from Mullins:

- US exceptionalism will likely continue, thanks to a strong consumer: "Now, with [Trump's return] in mind, we believe, even more so now, that 2025 will continue to be a story of US exceptionalism."

- But... it won't be all smooth sailing: "Potentially, we have higher inflation fears first before we get the pro-growth policies coming through."

- The Federal Reserve is still expected to cut rates, but not as much as the market anticipates: "They may do one more cut [in December] and maybe they're done. They may get 100 basis points [of cuts] all-in and they're done totally. That's not a disaster, it just means that bonds have further to run, in terms of yields going higher."

- And finally, what will it take for China to throw the 'kitchen sink' of stimulus? "I think they're waiting until Trump starts tariffs and then they'll decide what type of kitchen sink they throw! If they come up with a trade deal that's beneficial to both, then they may not be as aggressive."

The next section features quotes from Conlon:

- The Australian economy may not be a useful indicator of where stocks will go: "My overarching observation is that the link between the financial and real economies is getting increasingly tenuous. People are looking to what's going on in the real economy as an indicator of where the stock market is going to go and I'm not sure it gives you the right answer."

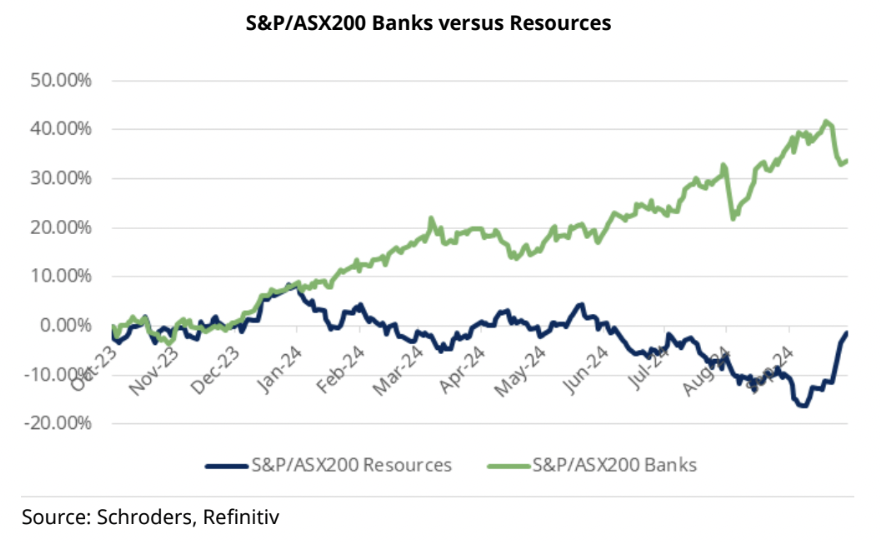

- It's all been about the banks this year: "You've had this situation where large parts of the stock market have done nothing. The banks have gone up 30-40% and the tech stocks have gone up 'crazy' amounts ... No one can really understand why CBA is at $155/share." For Conlon, this move has been "perplexing".

- Next year, the game plan should be to buy "sensibly priced" stocks: "They might be boring but they're more likely to protect your money than buying stocks at crazy prices."

The last section includes quotes from Smith, who runs a global private equity strategy with investments spread across North America, Europe, China and India:

- Continuation funds also may pose opportunities: These are where "a manager will roll 1, 2, or 3-star assets into a new fund because under the old structure, you may have doubled or tripled your money on a company but you might still see a lot of value in that company and you used to have to sell it to a peer. So now, they have created these new vehicles so you can roll the asset owner over. It greatly reduces the risk."

- Exits from positions may pick up next year, with the IPO market continuing to remain sluggish: "Exits have been a bit off. Our long-term average is 19% of our portfolio in exits we'd do in any one year. 2021 was a euphoric year. We sold a third of our portfolio in 2021 but since then, it's been around 7, 9, and 14%."

General portfolio positioning

On stocks, the team prefer US equities to the rest of the world and the S&P 500 equal-weight approach over the market-cap weighted approach. Or put another way, they would like access to the world's best companies - just without as much leverage to the Magnificent Seven. When Mullins is asked why he takes this position given valuations are so rich, he offers the following:

"Well, Google's P/E ratio is lower than CBA's P/E ratio. Yes, the US market looks expensive but it's case by case," Mullins says.

"We are staying in the large-cap 500 stocks but just reducing our reliance on mega-caps in favour of the more cyclical mid-to-large cap part of the market," he adds.

It also helps when the equal-weight S&P 500 is 25% cheaper on a P/E basis compared to its market-cap-weighted counterpart.

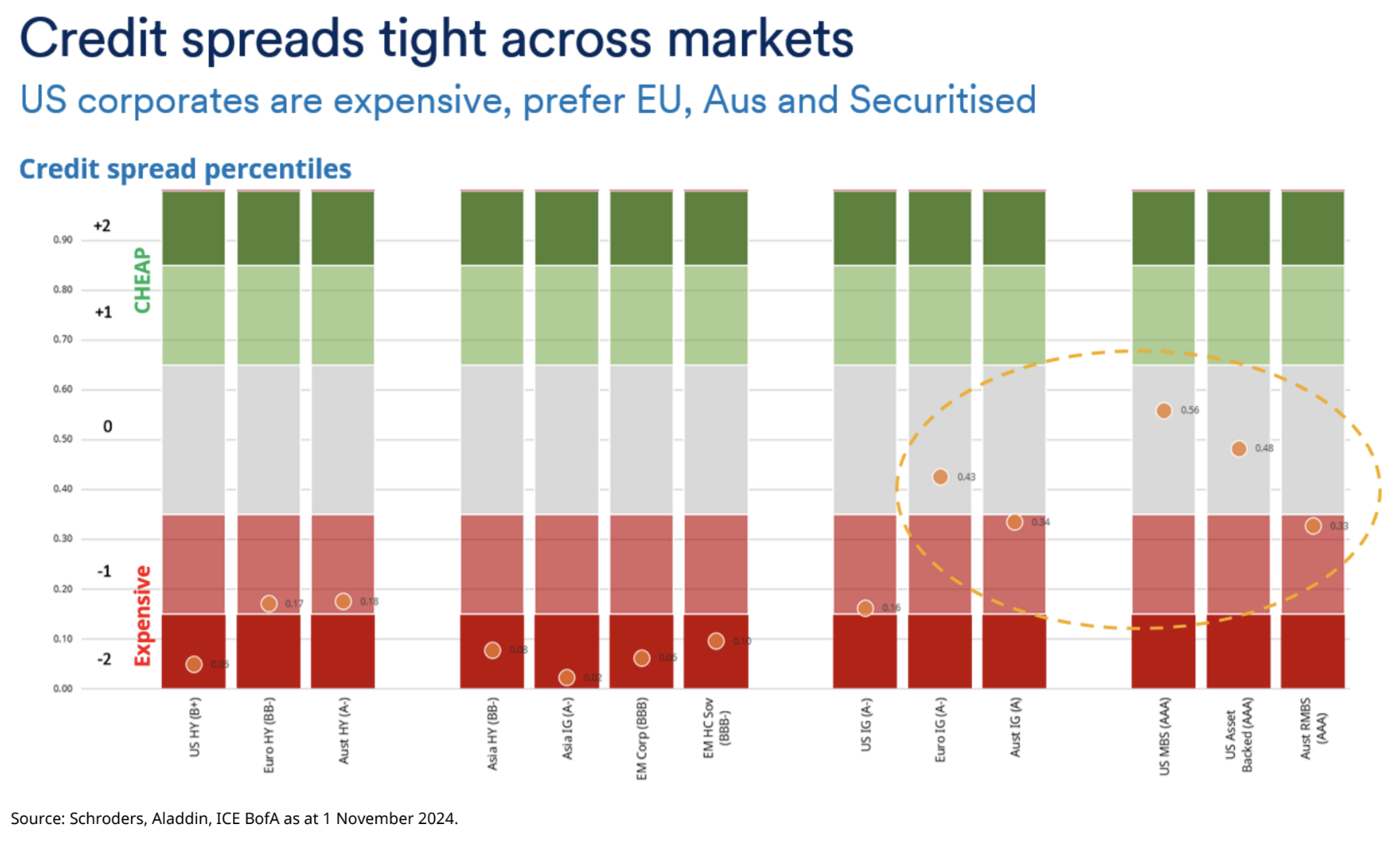

On fixed income, European and Australian assets provide better value than their US counterparts. The latter, Mullins says, is "priced for perfection."

"We're positive on Australian bonds because not much is priced in the Australian curve. We've got 40 basis points worth of cuts out to the end of next year. That's not much at all," he says adding that's especially relevant given the Australian economy is in a much weaker position compared to the US. He expects the first RBA rate cut to come "early or mid-2025."

As for commodities, the answer to the question, 'Do you want commodities when inflation is high?' is dependent on what kind of inflation you have.

"If you have demand-driven inflation or a scarcity of supply, then commodities protect you in that situation. The other one is a monetary debasement situation where they're printing money. That's where you want gold," Mullins says.

And finally, a pro-Trump presidency was a boon period for the US Dollar as a hedge in his first term. They expect something similar to happen this time.

The 9 "sensibly priced" investment ideas

In Australian equities, Conlon provided three sectors worth looking at - energy companies, resources companies (across the board), and the supermarkets:

"Energy and resources were the two big sectors where not much moved. Energy stocks have been pretty awful and resources stocks, in general, have been not great. You've had a few other sectors like supermarkets where prices basically haven't moved in the last 12 months," he says.

"There's been a lot of repricing. Woolworths (ASX: WOW) is now probably at the same P/E as CBA (ASX: CBA) and there are very few stocks left on 15-20x earnings. There are no tech stocks on less than 50x. You've got most of the stuff left behind is generally where we're we are fishing."

He also called out a fourth investment idea - hospital operators (e.g. Ramsay Health Care (ASX: RHC)):

"I don't understand why people want to pay 25x for a data centre and they don't want to pay 10x earnings for a hospital. The replacement cost of hospitals is going up as fast as the replacement cost of a data centre," Conlon says.

In cross-asset land, the order is Australian credit spreads (investment-grade), European credit spreads, and then securitised credit/mortgages.

"In general, credit spreads for Aussie investment grade corporates are relatively wide. I'm not saying they're extremely wide and cheap, but compared to the US, where it's extremely expensive, it looks good ... The US is priced for perfection," Mullins says.

"Most of those corporates, to be honest, are not that impacted by some of the potential lower growth [policies]. We're not expecting default rates to rise just because the economy is weaker."

Finally, the Schroders private equity team are finding a lot of structural opportunities in the small and middle markets (where the best opportunities have apparently been for most of the last two decades) but their favoured sectors here are healthcare and technology.

"We see between 600 and 900 direct investment opportunities a year and we execute on about 50 of those," Smith says.

"Healthcare is currently about 34% of the portfolio at the moment."

"We did a deal recently in the AI space but it's a company that does annotation of data. Its clients are OpenAI, Cohere, and Meta. It takes all the data for those large language models and then annotates what it means. When they feed it up to their large language models, they can then process the data before. We like things like that - the picks and shovels of the AI thematic."

2 topics

3 stocks mentioned

3 contributors mentioned