A crisis facing aged care: Can government support revitalise bed supply ahead of the baby boomers?

The first of the Baby Boomers are now approaching 80 years old and are beginning to enter residential aged care. The scale of the Baby Boomer generation will place immense pressure on the residential aged care sector to provide adequate care and services. This demographic shift, combined with recent reforms aimed at boosting the sector’s profitability, will benefit quality aged care operators like Regis Healthcare (ASX: REG).

The Supply Shortage of Aged Care Beds:

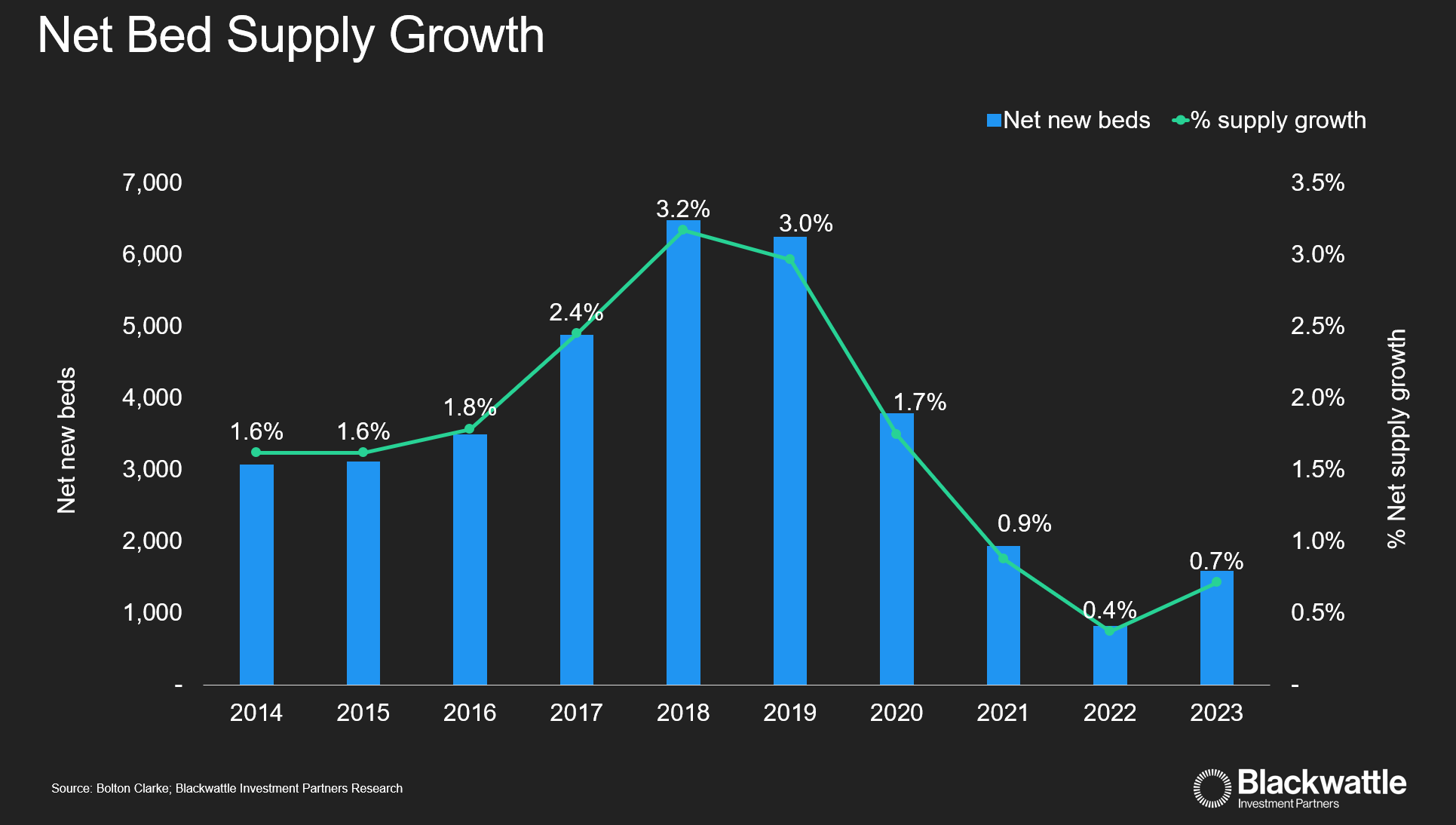

Australia currently has ~225k residential aged care beds, but the sector has recently been struggling with profitability due to limited funding increases and rising operational costs. As a result, net new bed supply growth has stalled at <1% p.a. This limited growth in the number of beds is a major concern ahead of the expected surge in demand for residential aged care services from Baby Boomers.

Growing Demand for Residential Aged Care:

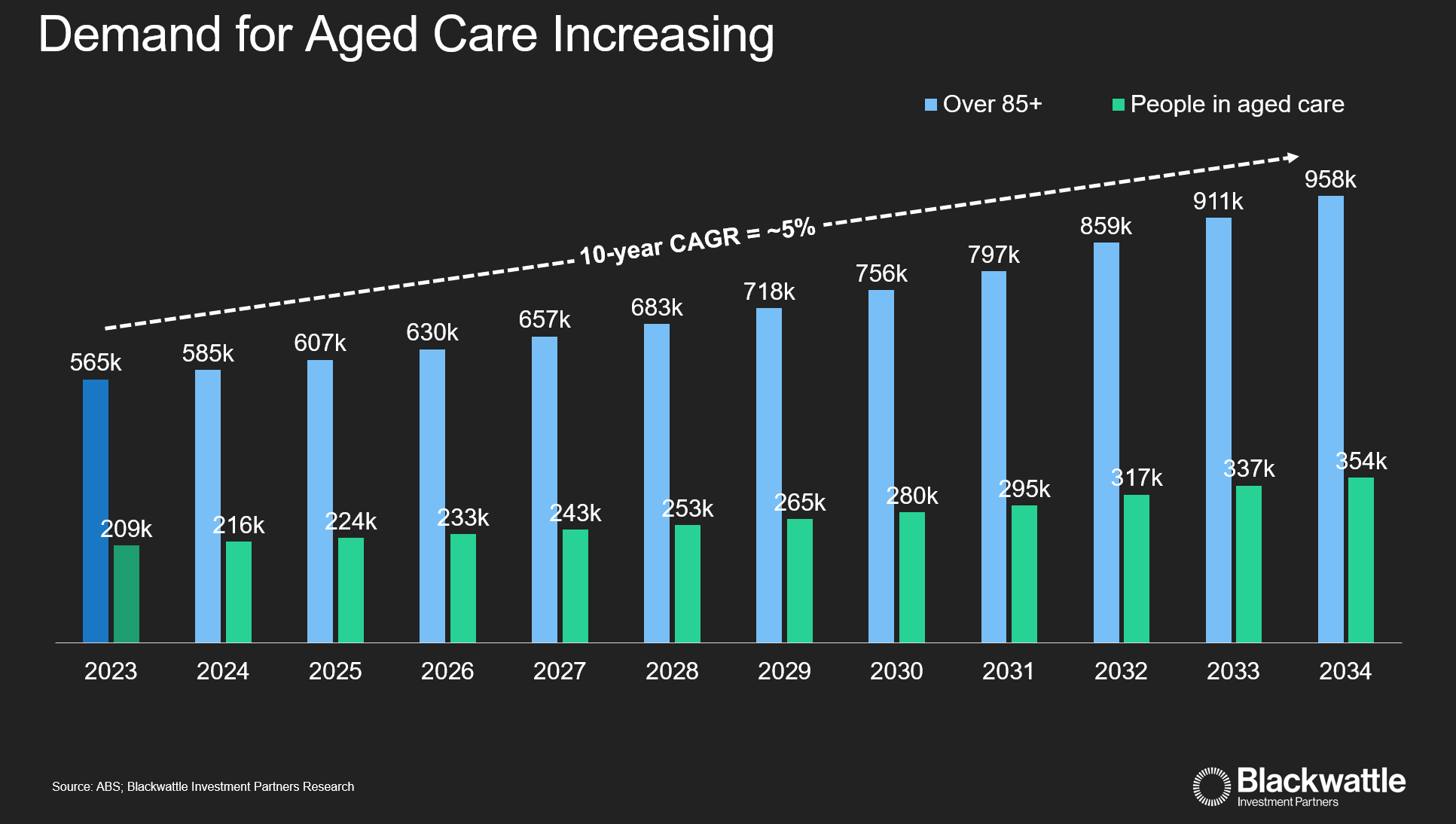

The average age of admission to residential aged care in Australia is 83 for men and 85 for women. Projections indicate that Australians aged over 85+ will soar from 565k in 2023 to 958k by 2034. We estimate that around 350,000 Australians will require an aged care bed by 2034, implying the sector will need to add at least an additional 130,000 net new beds or approximately 13,000 p.a. over the next 10 years to match this demand. This required bed build rate is well above the average of ~1.5k net new beds added p.a. in the last 3 years.

Recent Aged Care Reforms to Boost Sector Profitability:

On 12th September 2024, the Australian government introduced a new Aged Care Act, which received bipartisan support. This legislation addresses critical issues raised by both the Royal Commission and Aged Care Taskforce. The key changes will improve the profitability of the sector as aged care residents begin to pay more for their care from 1 July 2025.

Our analysis suggests that these changes will increase funding for aged care operators by between $15-$30 per resident per day (depending on room price assumptions). These funding changes will be grandfathered-in and therefore earnings benefits for aged care operators should begin to be fully realised by the end of FY28.

Earnings Implications for REG and Will This New Funding Drive Bed Supply Growth:

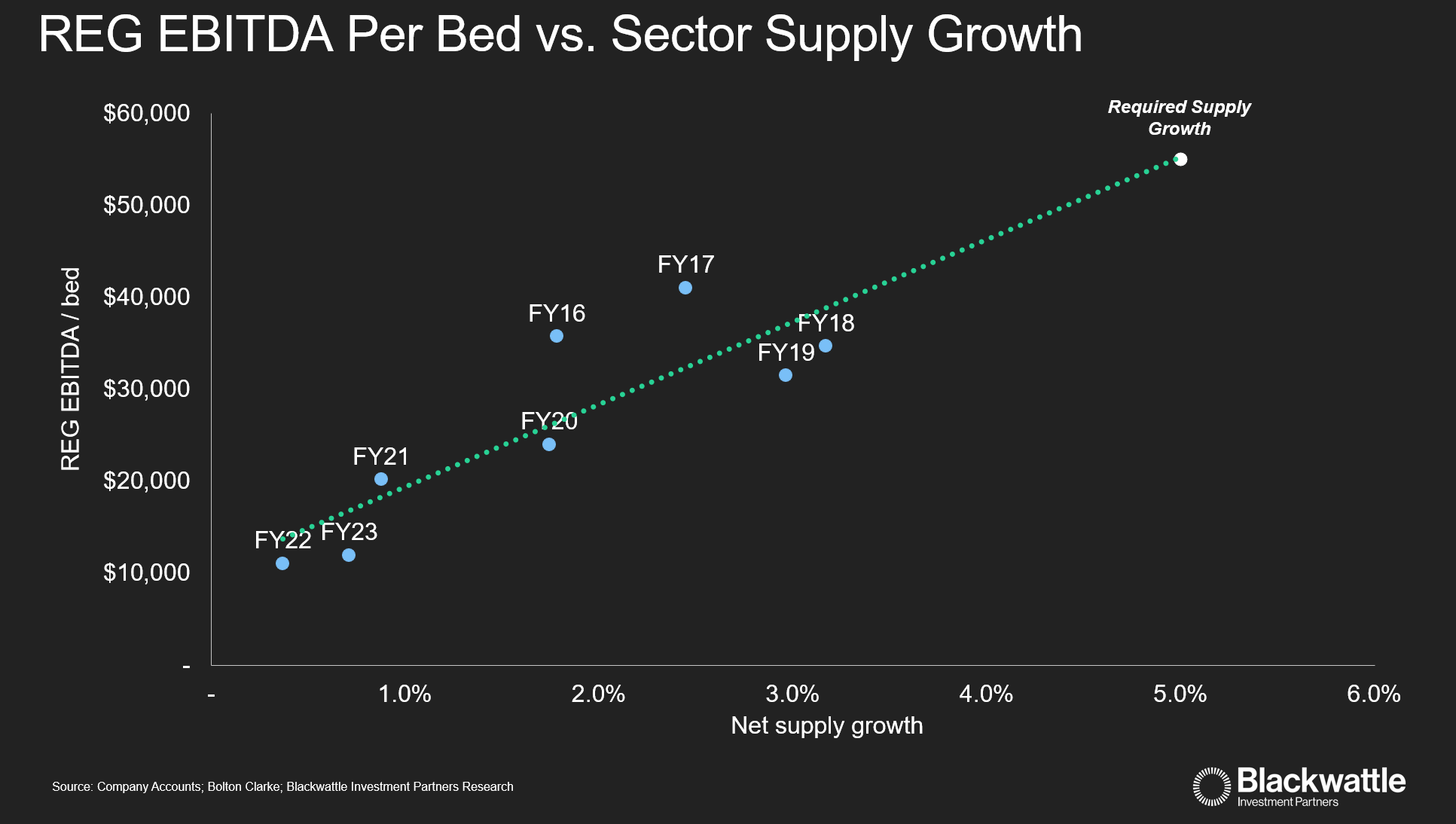

REG operates approximately 2.6 million occupied bed days per annum. A $1 per resident per day increase in funding – without associated costs – translates to an additional $2.6 million in EBITDA p.a. With an expected rise of $15-$30/day in funding, REG’s EBITDA could grow by as much as $40 million to $80 million by FY28 (assuming no occupancy uplift or changes to the accommodation supplement which is under review). This would increase REG’s EBITDA per bed p.a. from around $14,500 in FY24 to between $21,000 to $27,000 per bed in FY28.

However, the ultimate question remains: Will this announced increase in funding be enough to spur the required net new bed supply growth? Historical trends suggest it may not be enough. In FY17, REG's EBITDA per bed p.a. was around $41,000, yet sector net bed supply growth was still only approximately 3% p.a. To achieve the roughly 5% p.a. net bed supply growth that is needed and given construction costs have increased materially since FY17 (around $500,000 to build a new bed), we see the possibility that further increases in funding may still be required to meet the demand from Baby Boomers.

Conclusion:

The recent bipartisan support of the aged care reforms underscores a recognition from both sides of the government of the challenges that have faced the aged care sector in the past few years, and the need forincreased funding to stimulate bed supply growth. Although REG share price has r'sallied post the announced reforms, we continue to see upside for REG as the supportive regulatory environment and long-term demand trends bolster earnings.

5 topics

2 stocks mentioned