A definitive guide to ASX uranium stocks: The top 5

In a previous article, I discussed the dynamics of the uranium market, breaking down the key factors driving supply and demand. On the back of that piece, I thought it would be worthwhile investigating companies listed on the ASX with a major focus on uranium and therefore, which have the most to benefit from the recent surge in uranium prices.

As I delved deeper into the ASX-listed uranium sector, it became clear that one article on Aussie uranium-stocks wouldn't be enough! So, I've decided to break up my coverage into a mini-series which I hope will eventually serve as a definitive guide to ASX uranium stocks.

I’m kicking off today at the very top with Australia’s five biggest uranium companies by market capitalisation. In future editions, I’ll work my way down to the minnows which are still very much at the exploration stage.

They don't call it the 'Big' Australian for nothing: BHP

Boss Energy (ASX: BOE), Paladin Energy (ASX: PDN), and Deep Yellow (ASX: DYL) tend to garner most of the attention in the ASX-listed uranium space. Certainly, we've seen decent spurts in the stock prices of each of these companies recently as the uranium spot price has pushed through US$75/lb.

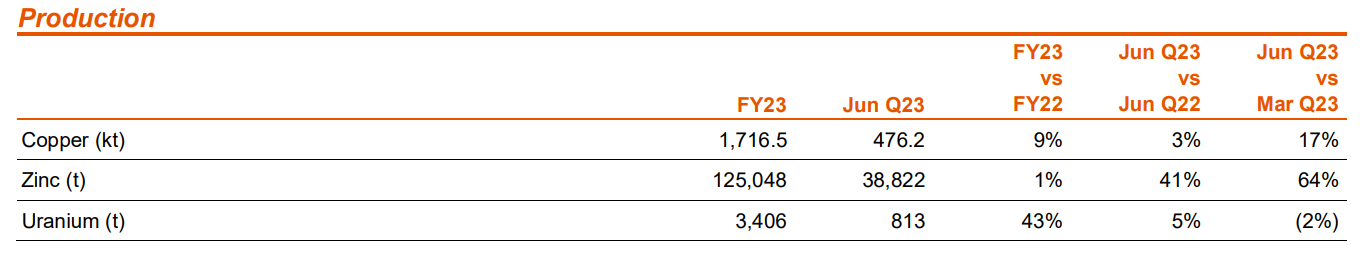

But, to borrow a phrase from Master Yoda, "There is another". In terms of ASX-listed uranium production, there's BHP (ASX: BHP), then there's daylight (lots of it), and then there's everyone else. In FY23, the Big Australian produced 3,406 tonnes of uranium (7.5 Mlbs) from its Olympic Dam mine in South Australia, up an impressive 43% year on year.

This means BHP now accounts for just under 7% of world uranium production, making it a globally significant producer. (Kazakhstan's Kazatomprom is the world's largest producer with around two-fifths of global production, and Canada's Cameco is second largest with around 14% of global production).

To put BHP's production into further perspective, the ASX-listed uranium pure-play closest to producing any uranium is Boss Energy, and it hopes to be producing around one-third of BHP's current production within the next three-years.

But, if you're a uranium bull ("U-Bull"), you can't really draw a line between BHP's substantial position in the global uranium supply chain and your desire to snag a 100-bagger in the uranium bull market.

This is because, in terms of profitability, BHP is primarily an iron ore and copper company. Based on BHP's FY23 results, iron ore accounted for 46% of its underlying EBITDA and copper contributed 30%.

However, there's a big asterisk on the 30% stat for copper. My best research suggests it’s here that BHP folds in its uranium profitability contribution. I failed to determine just how much of BHP's profit comes directly from uranium (insert PR-based conspiracy theory here), but I note two data points from the World Nuclear Association and the Australian Government, which suggest 20-25% of Olympic Dam's revenue comes from uranium.

Back-of-the-envelope maths suggests uranium could add roughly 6-8% to BHP's bottom line. Hardly big enough to move the dial on BHP's share price, especially compared to the daily ebb-and-flow iron ore and copper prices tend to have on its narrative.

But, BHP does have considerable potential to capitalise on uranium if it wants to. According to the Australian Government report mentioned above, Olympic Dam contains "26% of the world's low-cost uranium resources and is the world's largest uranium deposit".

As far as I can tell, BHP isn't particularly motivated to make a major pivot towards uranium production to take advantage of the recent spike in the spot price. According to comments by company officials, BHP's uranium production is merely a by-product of Olympic Dam's copper production.

This doesn't mean management is ignorant of the opportunities higher uranium prices present. On this point, I'd keep an eye out for any news related to a potential upgrade of the Olympic Dam smelter, which could grow copper output by more than 50%.

BHP would love to get this over the line, and the economics of the upgrade are certainly looking better given uranium's recent price run. The approval for the upgrade is still awaiting a final investment decision, but if it gets the green light, expect BHP's uranium production to get a major boost as well.

I say this not to highlight BHP as an investing opportunity for U-Bulls, quite the opposite actually. One must consider the massive impact such a development could have on global uranium supply, and therefore on the uranium price.

Now to those without a backup plan...

Some may argue BHP is somewhat redundant in the “definitive guide” of ASX uranium companies. I agree it will be difficult to ascertain just how much of an impact any potential increase in the uranium price will have on BHP’s stock price - but it is just too big a global player to ignore.

If you’re a U-bull, just knowing about the potential impact the Olympic Dam smelter upgrade could have on the uranium price is worth the pixels I’ve devoted to BHP in this guide. Next, I’ll move on to what I call the uranium “pure plays”. These are the stocks listed on the ASX for which there is no iron ore or copper backup plan - uranium is all they do!

The interloper: NexGen Energy

NexGen Energy (ASX:NXG) is listed on the ASX, but apart from its Aussie CEO Leigh Curyer, it's very much a Canadian company (FYI, NexGen's shares are also listed on the Toronto Stock Exchange and the New York Stock Exchange under the symbol NXE).

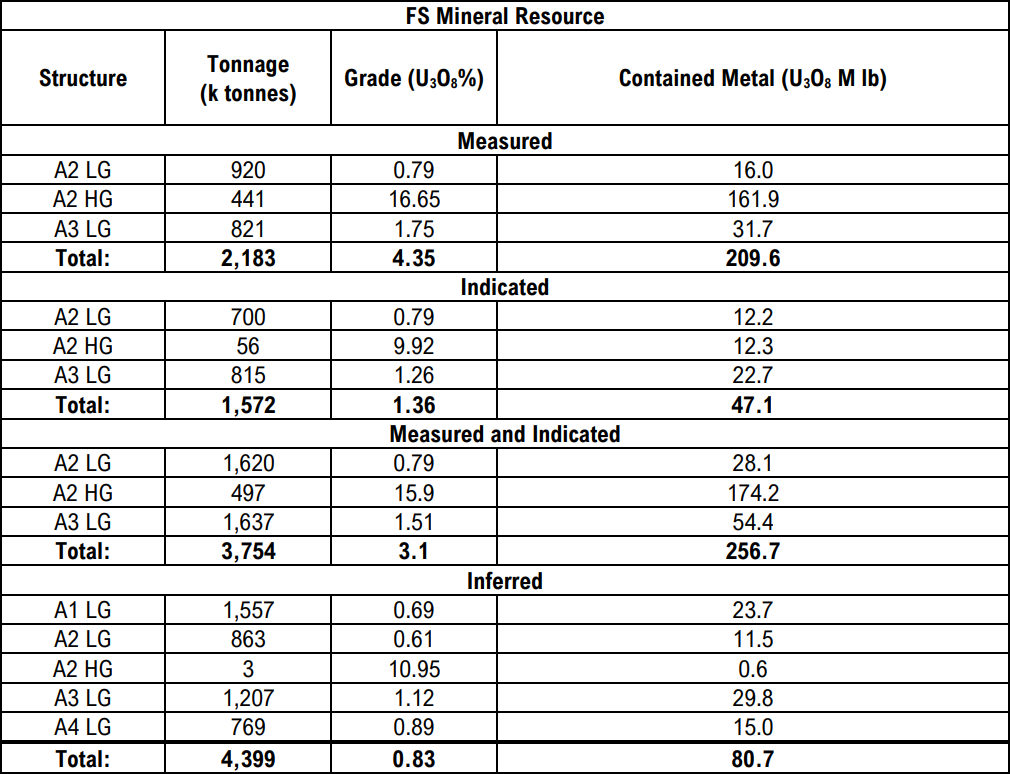

NexGen is focused on developing its 100% owned Rook I Project which is located in the southwestern Athabasca Basin of Saskatchewan, Canada. Rook I is part of NexGen's broader Arrow Deposit, which has Measured and Indicated Mineral Resources totalling 3.75 million tonnes ("Mt") at a grading of 3.10% U3O8, containing 257 million pounds ("Mlb") U3O8. You can add in another 80.7 Mlbs of Inferred Resources at 0.83% U3O8.

In June, NexGen obtained the necessary environmental and social approvals for a mine at Rook I, and it's presently upgrading and constructing infrastructure to support increased activities ahead of the mine's construction. FEED studies are ongoing, with a view to progressing to detailed engineering and procurement phases.

Read the last paragraph as: "Give-or-take minimum 12-months before official mine construction commences, and at least 24-30 months from first production".

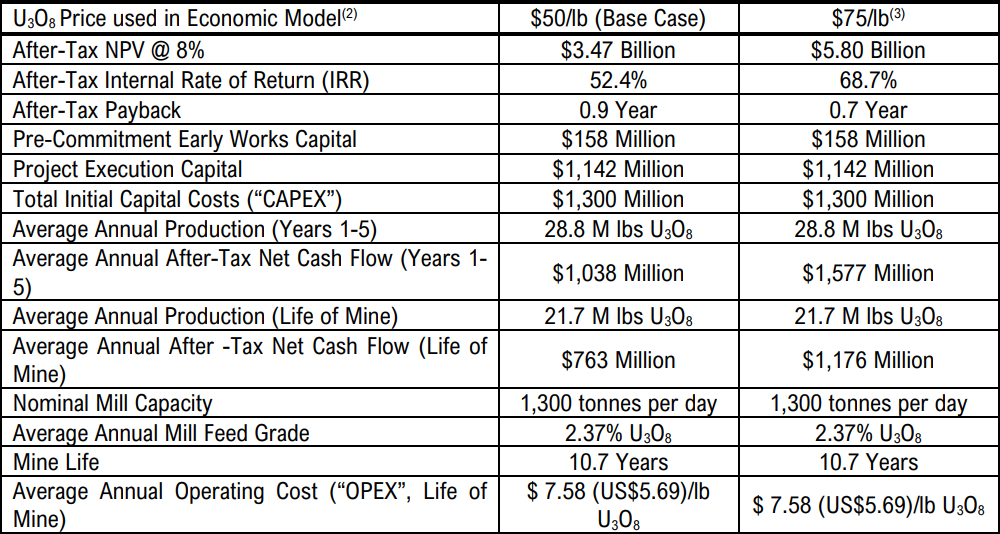

Based upon NexGen's 2021 Feasibility Study (equates to a DFS or BFS), it expects Rook I to produce 29 million pounds U3O8 per annum in the first five-years of its eleven-year forecast mine life. All-in-sustaining cost ("AISC"), which is a common measure of operational production costs used to compare mining companies, is a world-class US$7.58/lb.

These metrics will make Rook I one of the largest and lowest-cost uranium mines in the world this decade.

In terms of project economics, the feasibility study suggests Rook I has an After-Tax NPV of US$3.47 billion assuming a uranium price of US$50/lb, and US$5.8 billion assuming a uranium price of US$75/lb at an 8% discount rate. Keep in mind the current uranium spot price is around US$78/lb, and NexGen's market capitalisation is US$4.6 billion.

You can see the sensitivity to NexGen's valuation in these numbers. As an ultra-low cost producer, it has plenty to gain if prices keep pushing higher. Also, as it is largely a single-project company, the very basic rule of thumb of comparing market cap to NPV has some value. As we'll see, the next three companies are less amenable to this type of analysis.

Funding is an important piece of the puzzle when assessing any uranium development project. Without funding to construct and operate a mine, NPVs are worthless. On this point, NexGen appears to be largely there given it has lined up US$1 billion in non-binding debt financing and has around $270 million cash in the bank as at September 30 - compared to the US$1.3 billion capital cost to construct the mine.

Bigger picture, NexGen says it has also intersected numerous other mineralised zones on trend from Arrow along the Patterson Corridor at Rook I. This mineralisation will be subject to further exploration before its economic potential can be assessed. Importantly, NexGen has further exploration upside potential to complement its substantial medium-term production potential.

Voted most likely to succeed: Boss Energy

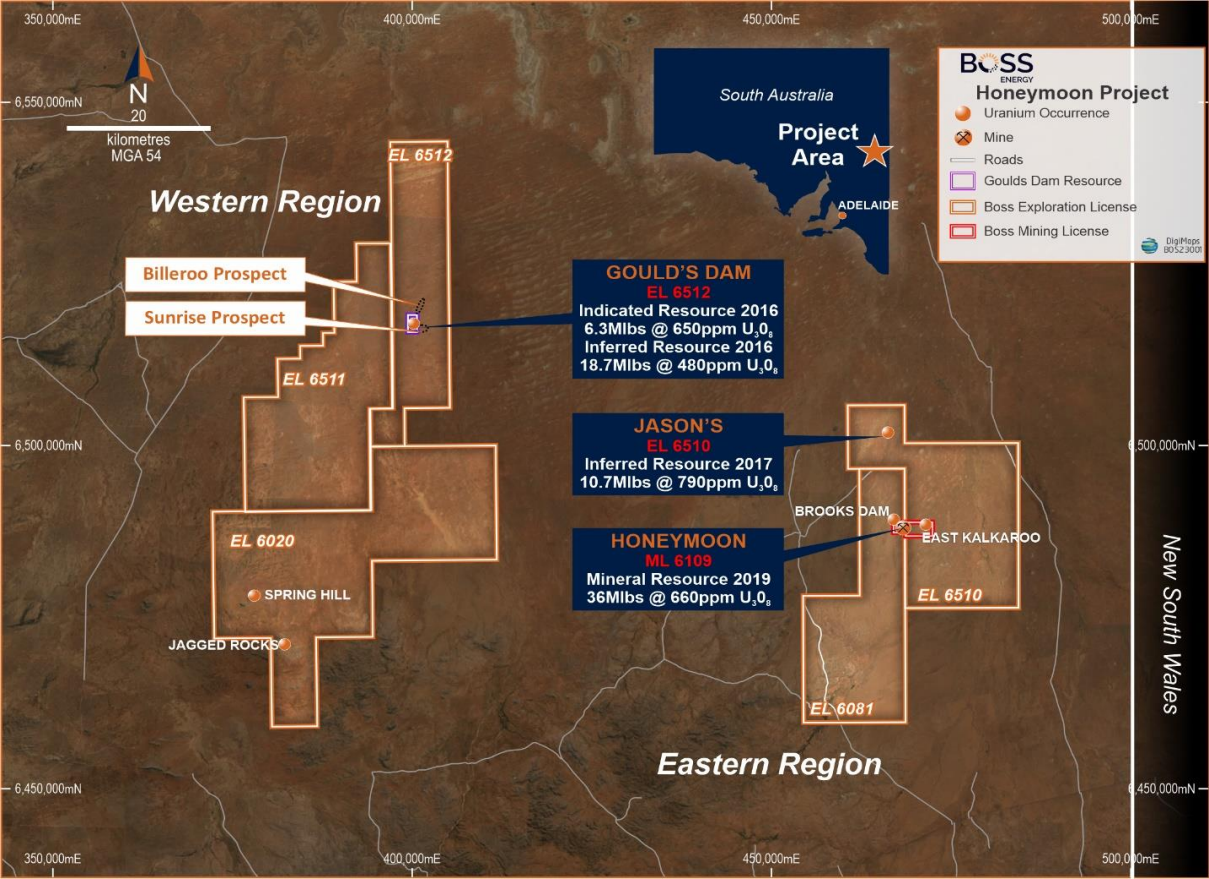

Boss Energy (ASX: BOE) is far closer to production than NexGen. In fact, mining operations have already started and first production is happening right about now. I am, of course, referring to Boss's Honeymoon mine in South Australia, located roughly 400 km south-east of BHP's Olympic Dam.

Honeymoon is a re-development / restart project, which means it was a producing mine in the past, but was closed due to low uranium prices in the wake of the Fukushima nuclear power plant disaster. Boss acquired the mine in 2015, and this quarter's production is the culmination of substantial investments of time and money by the company.

This is possibly the most attractive thing about Boss. We've seen how the last big thing, lithium, has followed the typical bust-boom-bust cycle in terms of commodity prices. Around the end of the last decade, underinvestment in lithium production, along with a boom in demand, caused a massive spike in lithium prices.

But, the oldest saying in markets is: Nothing fixes higher prices better than higher prices. When a commodity's price spikes, it tends to stimulate production of that commodity, plugging the demand-supply gap, and bringing prices back into check. Lithium mineral prices appear to have followed this very theme.

By coming into production as you read this, Boss sits alongside other major global producers like Kazatomprom, Cameco, and BHP as being in the box seat to take advantage of a high current uranium spot price.

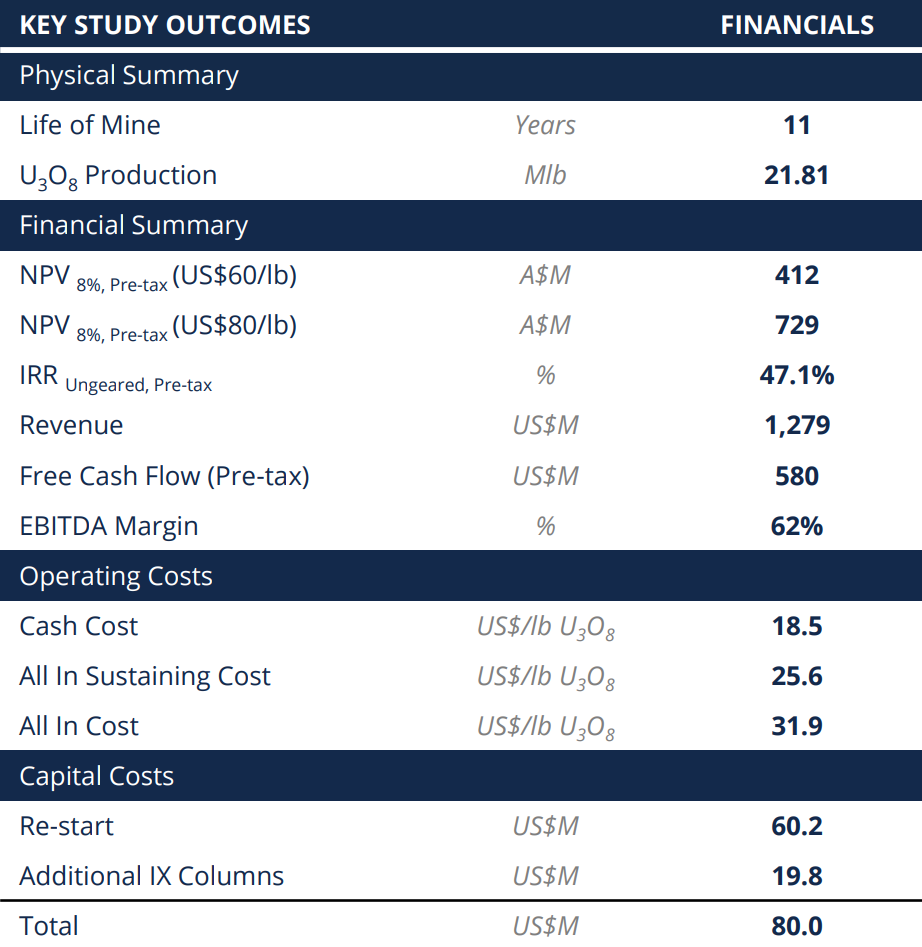

Boss aims to produce around 2.5 Mlbs U3O8 each year within the first three years of production for an 11-year mine life. AISC is expected to be around US$25.60/lb which is comparable to BHP's Olympic Dam production costs of around US$27/lb. These numbers suggest Honeymoon's production is a relative minnow compared to NexGen's 29 Mlbs p.a., but a not-too-modest one-third of BHP's 7.5 Mlbs p.a.

.png)

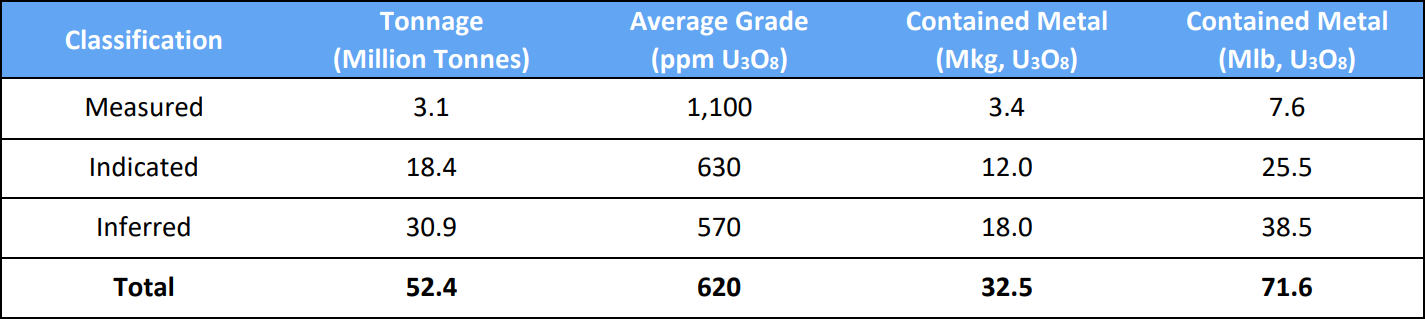

Comparing resources, Honeymoon is considerably smaller and lower grade than Rook I, hosting 33.1 Mlb U3O8 (Measured and Indicated) at an average grade of 738 parts per million (“ppm”) versus Rook I's 257 Mlb U3O8 at an average grade of 3100 ppm. If we add in Inferred Resources, Honeymoon’s got 38.5 Mlbs at 620 ppm U3O8 compared to Rook I’s 80.7 Mlbs at 0.83% U3O8.

DFS project economics data suggests Honeymoon has a NPV of $412 million at a uranium price of US$60/lb and $729 million at $80/lb, both assuming an 8% discount rate. Boss's current market capitalisation is $1.5 billion, and given like NexGen, Boss is also largely a one-project company, one could argue it is potentially more than fully valued. Either that, or investors are seeing extra value from somewhere else in the Boss Energy equation.

Clues to where this extra value might lie include Boss's 1.25 million pound uranium stockpile which the company purchased in February 2021 at US$30/lb. This was a strategic decision to help manage off-take flexibility in Honeymoon's early stages of production, but also in response to what management considered an undervalued spot price at the time. At the current spot price, Boss's stash is worth around $150 million.

It's also worth considering Boss has substantial scope to upgrade its resources at Honeymoon. Infill drilling is underway on two major satellite deposits within the Honeymoon project area (Gould's Dam and Jason's) to grow mine life and production rate. Boss believes Gould's Dam and Jason's could eventually increase production to over 3 Mlb p.a., or extend the mine life if the original production estimate is maintained.

Boss has an excellent track record of increasing the JORC Resource at Honeymoon, having expanded it over fourfold from 16.6 Mlbs to 71.7 Mlbs since the project was acquired. So perhaps some of the current market cap-to-Honeymoon-NPV-differential suggests further progress will be made here.

Boss also has cash and cash equivalents of $63 million and a fully cash-backed environmental bond of $8.9 million.

The perennial bridesmaid: Paladin Energy

Paladin Energy (ASX: PDN) owns a 75% stake in the Langer Heinrich mine in Namibia. The mine sits within a well-known uranium province which contains several producing and historically producing uranium mines. This means Langer Heinrich is close to the key infrastructure required to get production to market.

Investors pay a premium for companies whose projects are located within stable mining jurisdictions. Certainly, the three projects we've discussed so far: Olympic Dam and Honeymoon in South Australia, and Rook I in Canada, fall into this category.

We have seen several recent examples where governments have nationalised, or taken significant control of mineral assets (DRC, Zambia, and Argentina come to mind). Namibia is widely considered a "mining friendly" country. That said, in June, the Namibian Government banned the export of unprocessed critical minerals like lithium, cobalt, manganese, graphite, and rare earths.

Uranium wasn't included, and it remains one of the country's key exports. Still, investors should consider sovereign risk when assessing and comparing prospective mining projects.

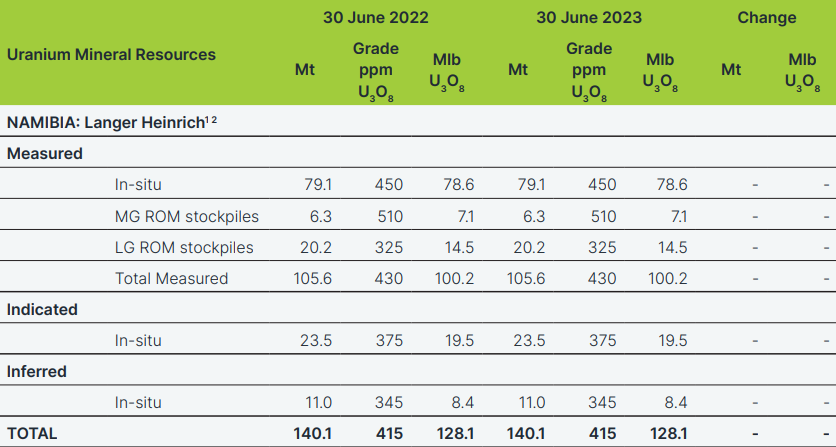

Like Boss's Honeymoon, Langer Heinrich was also a working mine. Paladin produced 43 Mlbs U3O8 between 2007 and 2018 when the mine was placed on care and maintenance due to the low uranium price. So, this is another re-development / restart project.

According to Paladin's most recent update, the Langer Heinrich restart is approximately 80% complete and first production is on track for the first quarter of 2024. Restart operations are progressing in line with the company's US$118m budget. Paladin is fully funded to production.

Langer Heinrich contains Measured and Indicated Resources of over 120 million pounds U3O8 at an average grade of 426 ppm U3O8. Approximately 22 Mlbs of this is ore in stockpiles which Paladin intends to process in the first year of Langer Heinrich's restart, before mining new ore in year two.

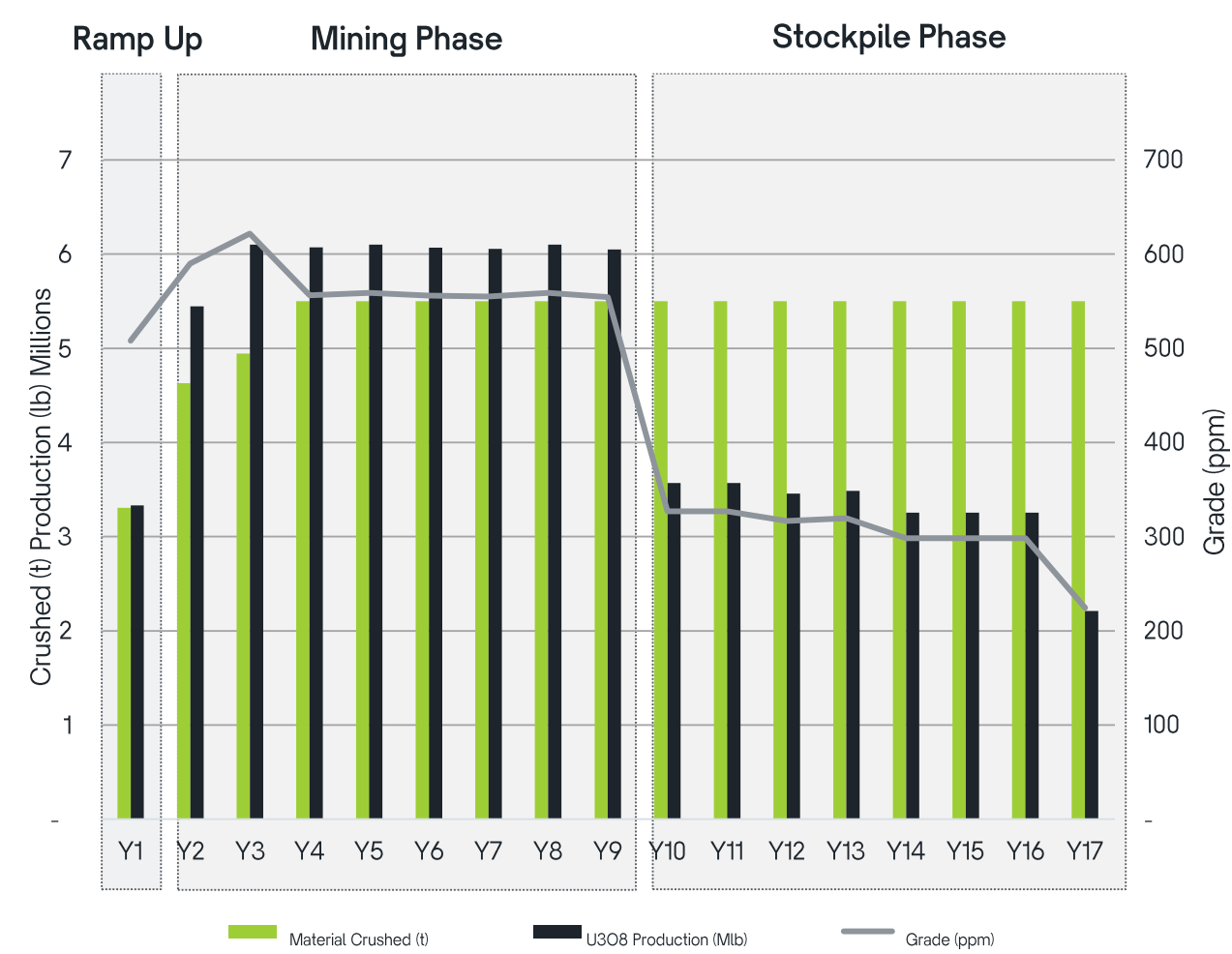

Paladin expects Langer Heinrich will produce 6 Mlb p.a. at peak production in seven years, and it should operate for 17 years at current resources. The life of mine AISC is US$27.40/lb (compared to BHP US$27/lb, Nexgen Energy US$7.58/lb, and Boss Energy US$25.68/lb).

In Langer Heinrich's first phase, Paladin forecasts it could account for as much as 4% of global uranium supply. Offtake agreements are in place for 48% of estimated production, while approximately 90% of the life of mine production remains exposed to market-related pricing (i.e., able to take advantage of a higher uranium price).

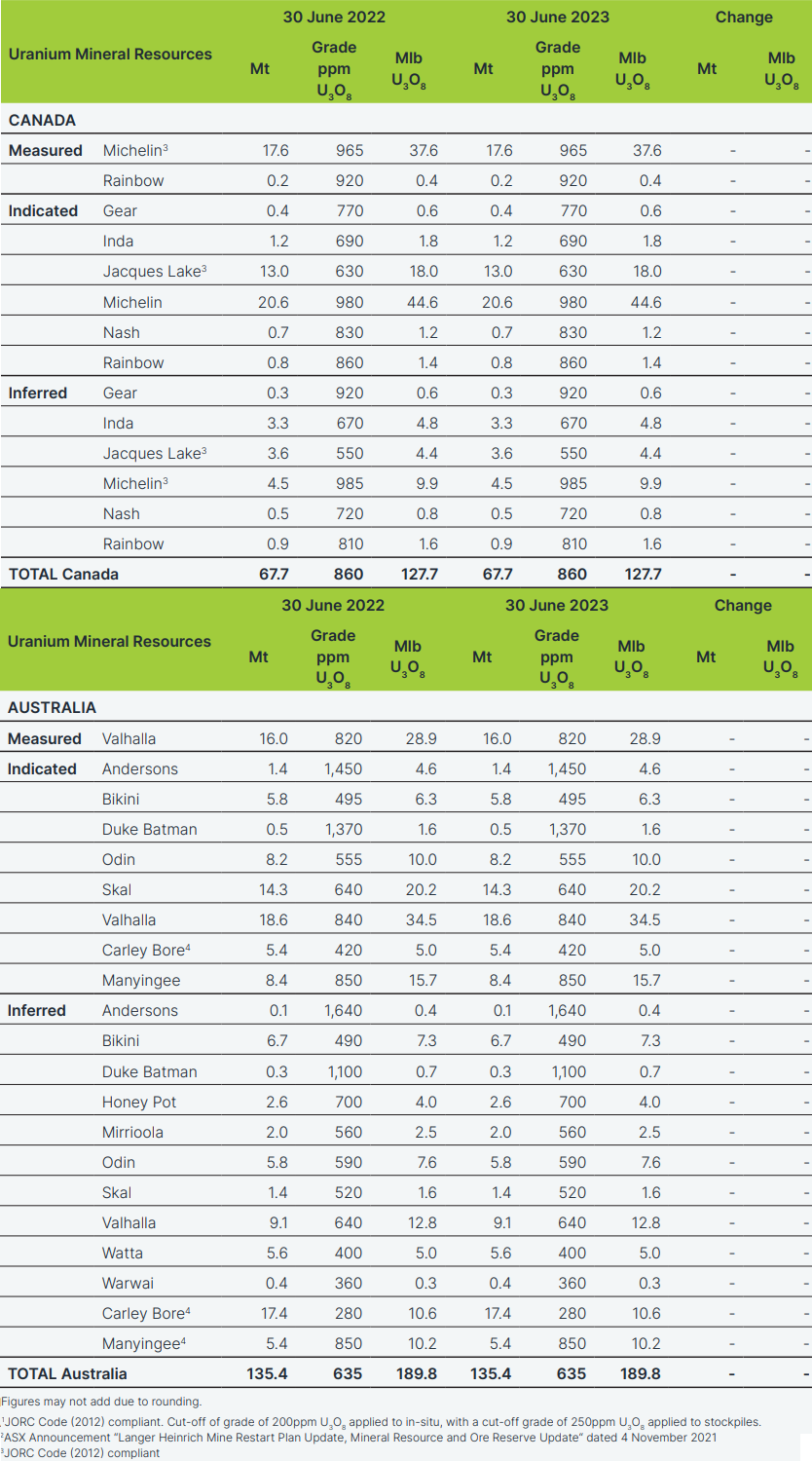

Paladin aims to expand the resource with exploration programs planned where mineralisation remains open. Further, beyond Paladin's Namibian operations, it also owns three other uranium exploration and development assets in Canada (Michelin), and in Australia (Mount Isa and Manyingee & Carley Bore). Paladin claims to have a globally substantial 445 Mlb U3O8 (Measured, Indicated, and Inferred) across its various projects.

I couldn’t find any recent data from Paladin on Langer Heinrich's NPV. A bankable feasibility study was completed in 2005 prior to first production in 2007. The mine operated for several years prior to being put on care and maintenance in 2018 - so that data is irrelevant.

I did find a Citi research report from 31 October which suggests Langer Heinrich's NPV is "$1.8 billion". Citi didn't state its assumptions for the uranium price, nor the discount rate they used in deriving this valuation, so you'll just have to assume they know what they're talking about.

I suggest it's a guide from a credible source, and my goal here is only to make a very broad comparison with Paladin's current market capitalisation of $3 billion. So make of that what you will! The company had US$100 million in the bank as of September 30.

Potential deep in the ground: Deep Yellow

Deep Yellow (ASX: DYL) is far earlier along the road to production than the first four we've looked at so far, but it does have what I could classify as two late-stage development projects.

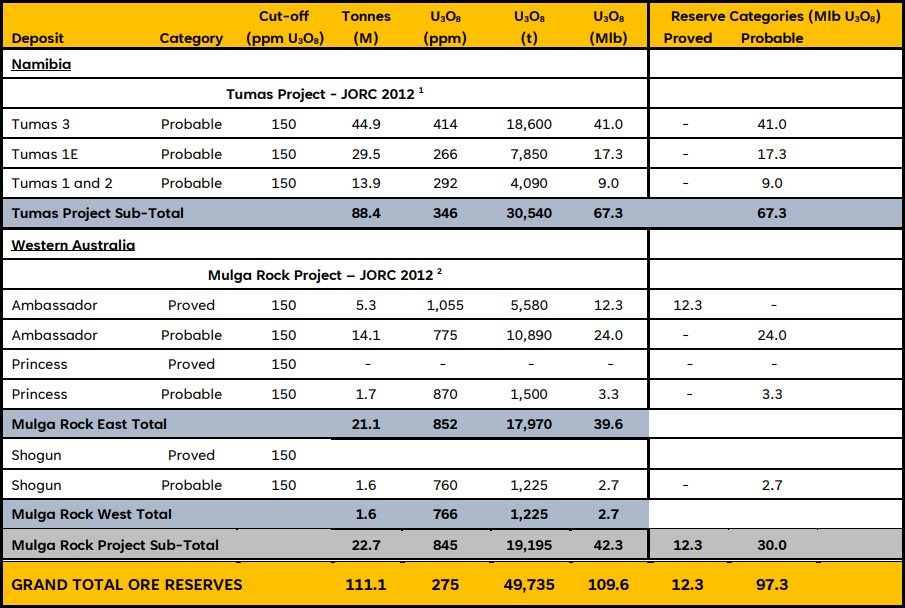

The Tumas project is located in Namibia and is the closest of Deep Yellow's projects to achieving production. In February, Deep Yellow tabled the Tumas's DFS which reported an ore Reserve of 67 Mlb U3O8 at an average grade of 345 ppm, as part of an Indicated and Inferred Resource of 114 Mlb U3O8 at an average grade of 263 ppm.

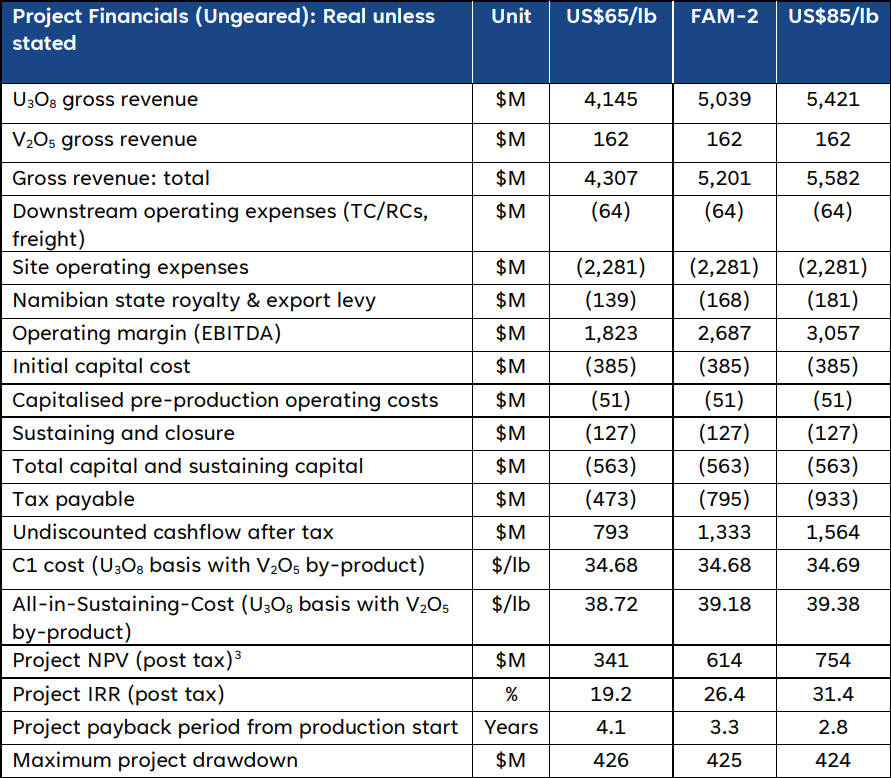

The goal at Tumas is to operate a 3.6 Mlb p.a. capacity mine with a life of 22 years at a life of mine AISC of US$38.72. Deep Yellow expects conversion of existing Resources could increase life of mine to 30 years, and exploration activities at Tumas to identify new resources continue.

It's also worth noting that Tumas contains a vanadium deposit, which will be mined simultaneously with its uranium for annual production of 1.15 Mlb V2O5. Order of magnitude, this will add about 4% to the Tumas bottom line.

Tumas's NPV is US$341 million (A$524 million) assuming a uranium price of US$65/lb, US$614 million (A$944 million) assuming a uranium price of US$77/lb, and US$754 million (A$1,160 million) assuming a uranium price of US$80/lb. Each calculation assumes a discount rate of 8% and conversions at $0.65 AUD/USD. These NPV scenarios compare with Deep Yellow's market capitalisation of $920 million.

The initial capex to get Tumas to production is US$372 million. Deep Yellow had $27 million cash in the bank as at September 30 and is burning around $15 million annually. This is important, because unlike NexGen, Boss Energy, and Paladin, Deep Yellow is not fully funded to production. At the current run rate, I suspect Deep Yellow will need to raise equity capital some time in late 2024 or very early 2025.

Along with FEED activities which are progressing, funding is the next box for Deep Yellow to tick. I'd expect to see an announcement on this in the next few months. It will likely be debt, but given cash burn to cash in the bank, and against the recent rally in Deep Yellow's stock price, there's a good chance of an equity capital raise in 2024. This could dilute current shareholders and possibly dip Deep Yellow’s stock price in the event a steep discount is applied to the new stock.

In terms of timing for financing and/or an equity capital raise, I suggest this might coincide with the Tumas FID which is slated for the first half of 2024. Looking further out, Deep Yellow has indicated production at Tumas could commence in 2026.

Deep Yellow's other major project is the Mulga Rock Project which is located 290 km by road from Kalgoorlie in Western Australia. This project is progressing toward a revised DFS which should commence in early 2024 and be completed by mid-2025. Current DFS estimates suggest Indicated and Inferred Resources of 90.1 Mlbs U308 at an average grade of 574 ppm. Deep Yellow envisages a 3.5 Mlb p.a. operation for a 15-year mine life. Exploration at Mulga Rocks is ongoing.

Deep Yellow also has another promising Namibian Uranium Province project called Omahola. It's relatively early stage compared to Tumas and Mulga Rocks, but historical exploration has identified a Measured, Indicated and Inferred Resource base of 125.3 Mlb U308 at 190 ppm. Exploration at Omahola is ongoing.

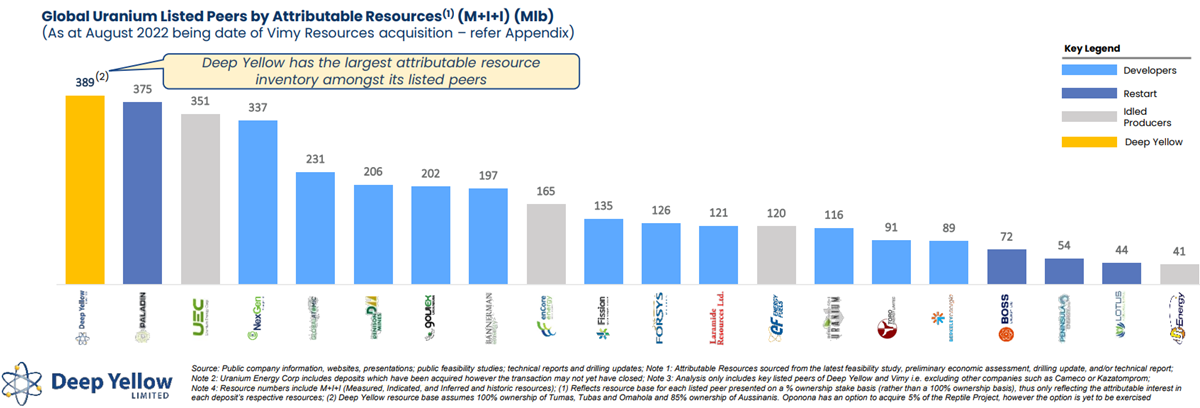

Possibly the key to understanding the value/lack thereof in Deep Yellow is what I call "pounds in the ground". The company claims to have 409 Mlbs of Measured, Indicated and Inferred uranium in the ground across its project, which according to Deep Yellow, is the "Largest uranium resource base of any ASX-listed company".

As long as I've been following Deep Yellow, it has promoted its pounds in the ground advantage over its rivals. This is usually done with a series of diagrams in their company presentations which compare their resources with other ASX-listed uranium plays.

My view is this data is kind of useless because pounds in the ground don't tell you anything about whether a company has any chance of extracting those pounds any time soon, or at anything that resembles favourable economics. I'll show you one of those cheeky diagrams here if only as a road map of where we're headed!

Next time…

That's it for now. So far, I've knocked off the Top 5 ASX Uranium Companies by market capitalisation, but also by production potential in the near term. Next time I'll commence a deep dive on the mid-and-smaller end of the ASX-listed U-Stocks spectrum, so stay tuned!

In the meantime, let me know in the comments below which ASX-listed exploration and development companies you'd like me to cover 👇

This content originally appeared on Market Index.

2 topics

5 stocks mentioned