A global broker at an attractive price

Kasa Investment Partners

IB’s main value proposition is to execute trades in financial markets such as equities, options and foreign exchange. It needs four basic competencies to do this: legal and compliance, technology, marketing and customer service. The bases by which players compete in this market are:

- price (execution, commission, interest rates);

- service (such as platform, advice, white-glove); and

- range (including markets, instruments).

Most of you are familiar with full-service brokers such as Goldman Sachs, Morgan Stanley and Macquarie Bank. These players primarily compete on range and service, offering a myriad of financial services including broking, advisory and investment banking.

You may also have heard of discount brokers such as Robinhood, Schwab, and Commsec. These players focus on price, targeting retail customers.

There is a series of brokers with a niche strategy; Tiger, for example, targets Chinese speaking investors, while Bell Potter focuses on Australian investors, and so on.

Interactive Brokers doesn’t compete directly with any of these groups of brokers. It has carved out a niche for itself, which it dominates with no clear direct competitor. To understand why we need to look at how it evolved.

Thomas Peterffy, IB’s founder, Chairman and largest shareholder, is a technologist through and through. In 1977 he purchased a seat on the American Stock Exchange, and helped develop the first electronic platform for securities. IB’s platform was originally built to carry out the company’s internal trading requirements. It was then made available to external customers, professional traders that needed best execution, low fees & charges, low margin loan rates and high rates on idle cash.

Some of these clients moved on to create hedge funds, asking IB to build trading tools for them. Others pooled their resources to form proprietary trading groups, making money by using the sophisticated features IB had created for the hedge funds. Yet another group of clients went into the money management business by forming Investment Advisory firms. This group needed different account structures, automated portfolio building, and allocation and rebalancing tools which IB built for them.

Many of the original clients were international arbitrageurs, and so the platform naturally expanded to other markets. IB then white-labled the platform to brokers who did not want the legal and technological challenges of creating global execution capabilities. These brokers directed their efforts to marketing, client servicing and other layers of value.

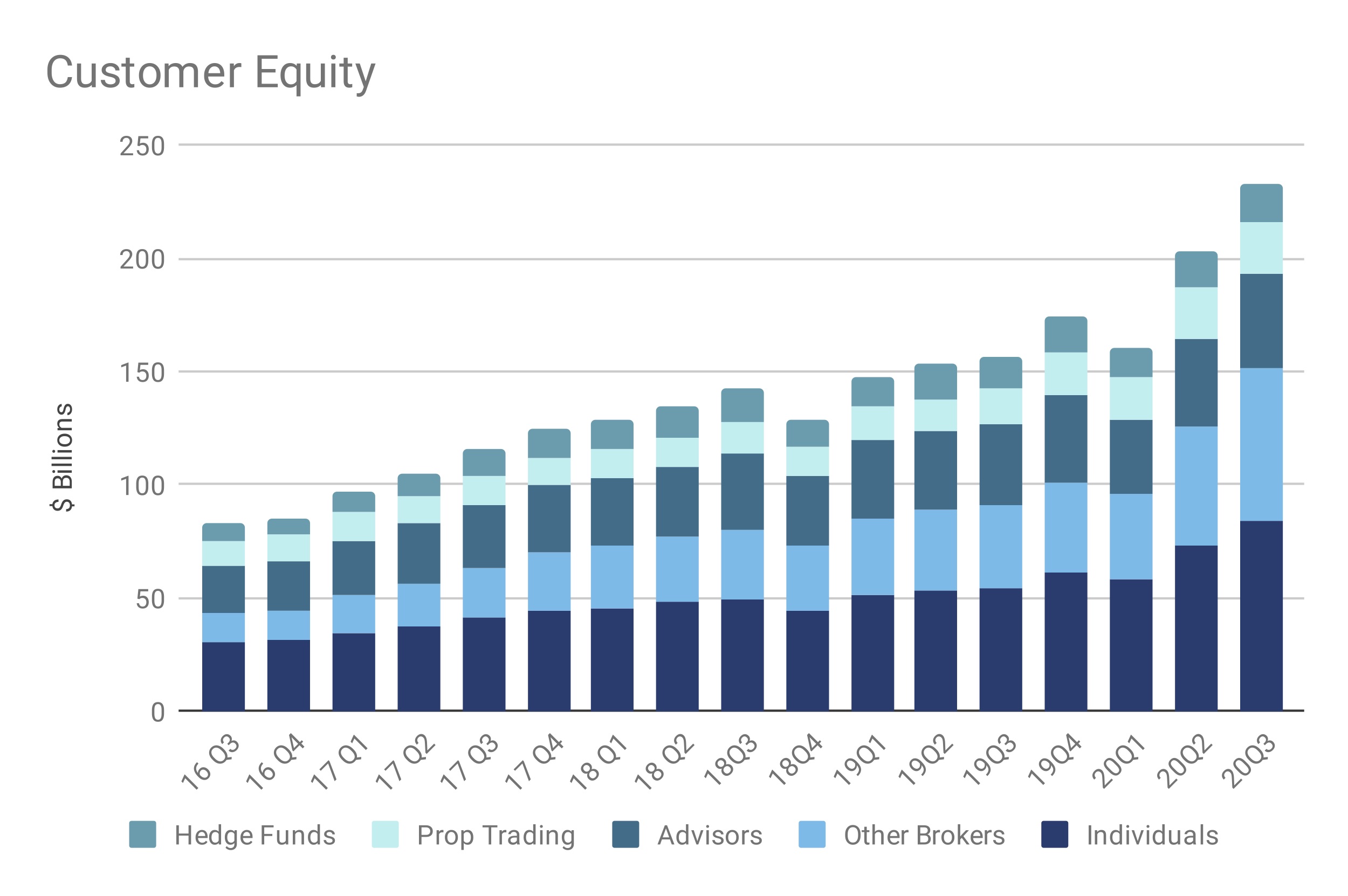

By starting out serving the needs of professional traders, IB ended with a different value proposition to other brokers. Minimal resources are directed to marketing and customer service. Instead, it sits as a horizontal technology layer that investors can either access directly, through hedge funds, advisors or other brokers. The platform has been optimised for price, speed, size, product diversity and trading tools. As a result, IB has ended up serving the most lucrative market segment: sophisticated investors and institutions that require minimal marketing to win over (around ⅓ of new accounts are via referrals), have low servicing needs, high account balances and high trading activity.

Economic Moat

Over the years I have come across global players such as Aldi, IKEA and McDonald’s that enter new markets and sooner or later dominate their target segment. Industries with these characteristics are conducive to this: 1) a sizable price sensitive segment; 2) scale economies that travel across borders; 3) a business model which reinvests scale benefits into price. Here are some sources of IB’s economic moat:

First and foremost, the majority of IB’s costs are fixed in nature; that is, they don’t vary with changes in revenues. Targeting the price sensitive sector, IB has created the virtuous price cycle ↓price, ↑volume, ↓cost per trade, ↓price. Trading US stocks on average cost 1bps on IB vs 31bps on Commsec. Even trading Australian stocks is cheaper on IB (8bps) than on Commsec (12bps). There has been a shift to zero commissions in the US which I’ll come to later in the note.

Second, as trading volumes rise, they are able to achieve better rebates from exchanges and high frequency traders which they share with clients in the form of lower fees / better execution – this is what attracts the prop traders. While hard to measure and compare, this can be an even greater cost to the investor than the trading commissions.

Third, there are economies of scope. When new markets/products are added to the platform, existing investors benefit from having a wider universe in which to invest. This means the larger the offering, the more attractive it becomes.

Fourth, IB reinvests incremental revenue into developing software that it provides free to all clients. If Kasa were to leave IB, for example, you (as an investment partner) would need to pay an additional fee to the new provider for the use of their platform. So, IB offers lower trade commissions, better execution, a large and growing investment universe and at no additional charge provides a managed account structure, tools for trading multiple accounts, reporting (not easy given the diversity of the investment universe), and fee calculation & facilitation.

Fifth, the ability to automatically liquidate positions and the price-focused approach has led to margin lending rates well below any other player. In Australia, the rate is even lower than mortgage rates - an $1m loan, for example, is currently priced at 1.2%. Investors have the added benefit of being able to secure the loan cross market with ease as IB uses a single account approach and takes care of the legal and technological issues.

Sixth, IB has a simple automated process for investors to make stock available for borrowing, earning a yield in the process. Given the size of their business, this means they are often able to offer a deeper pool of stocks available to be shorted and at more attractive rates than competitors. This is particularly attractive for players wishing to short stocks.

Finally, once a customer on-boards, they are generally reluctant to switch transferring assets and learn a new platform. As a result, churn rates are in the low single digits.

Growth

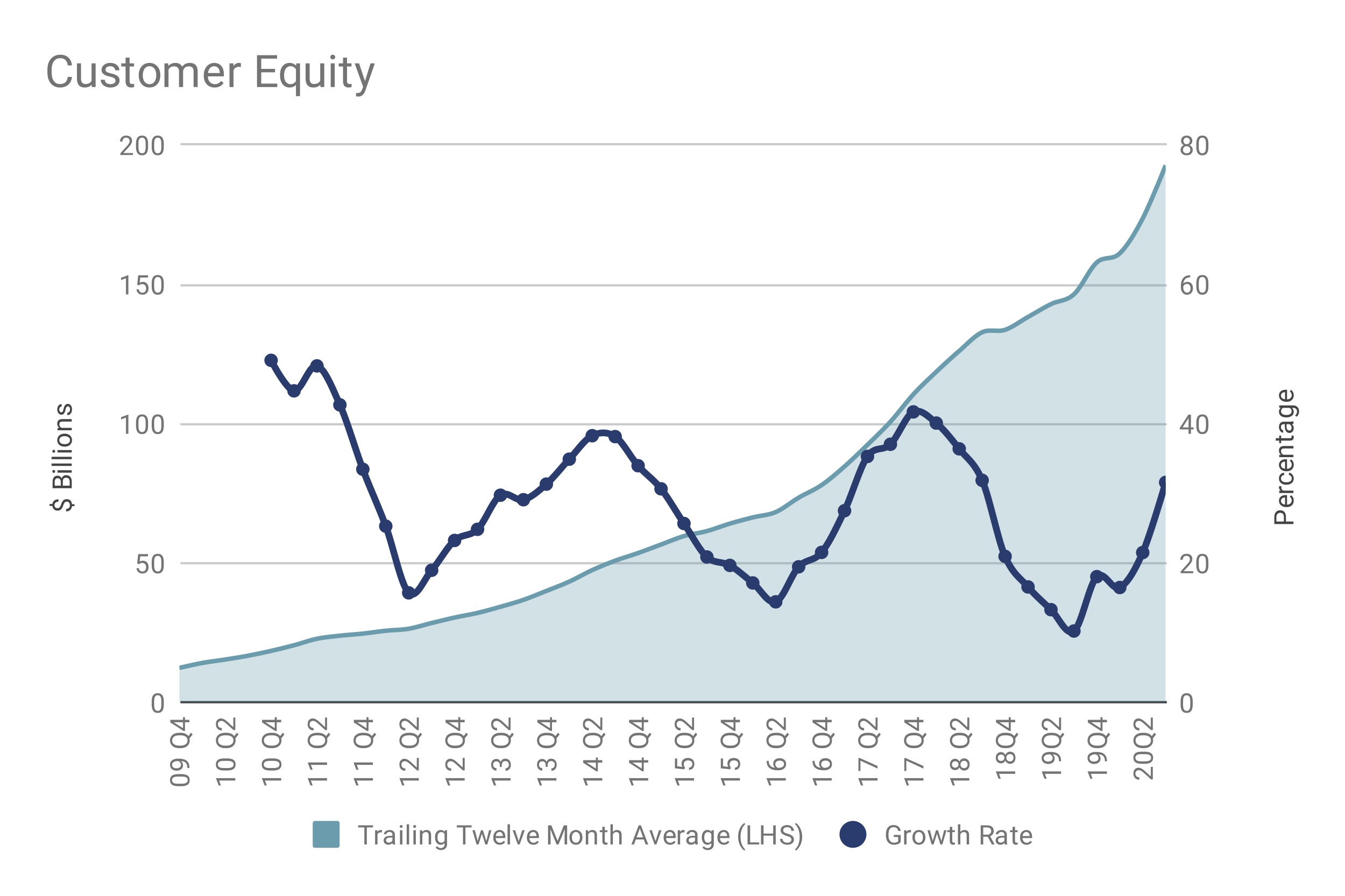

IB’s growth is underpinned by the virtuous cycle enabled by the economies of scale and scope, as well as the trend of financial market participation, particularly in non-English speaking and developing markets.

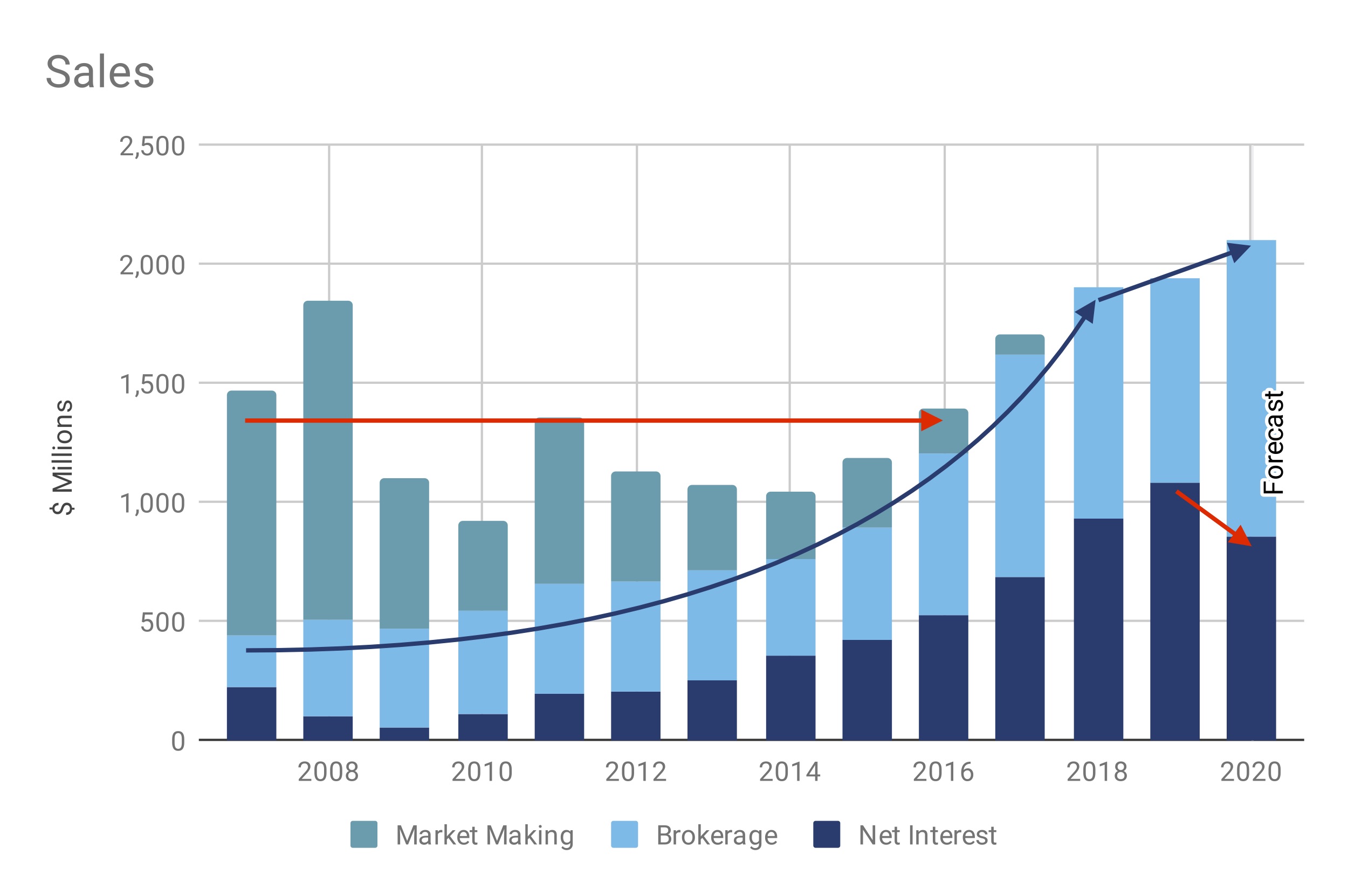

Historically, growth in customer equity has oscillated between 20% and 40% pa, with the pandemic driving recent growth towards the top of that range. This structural growth has not been easy for investors to identify, for two reasons. First, the demise of the market-making business was a major headwind in the first decade following IB’s listing. Second, interest income is sensitive to changes in rates. The tailwind of rising rates switched to a headwind in 2019, which then accelerated as the Fed responded to the pandemic. The commercial barrier to charging negative rates to customers has caused IB’s net interest margin to halve over the last twelve months.

While the lower rates are a current headwind, this is unlikely to continue, as central banks are reluctant to set negative rates. On the flip-side, should conditions change and rates rise, IB will be a beneficiary. This is important, as the single biggest macroeconomic risk to our portfolio, is rising rates and it is helpful to own businesses that will benefit in such an environment.

Risks

Zero Commissions: Robinhood is rapidly gaining traction in the market with its zero commission business model and simple UI. As we all know, there is no free lunch, especially in financial services. Robinhood’s monetisation model is centred around selling its customers’ order flow to high-frequency traders such as Citadel. These players then use this information to their advantage to make money.

This model has an inherent conflict, as Robinhood is incentivised to sell the order flow to the highest bidder, even though this might come at their clients’ expense. This conflict is well explained in Michael Lewis’ book Flash Boys. The US is the only country that allows the selling of the order book, possibly due to regulatory capture.

One of IB’s most important internal KPIs is the trade price they achieve for their clients (i.e. order execution). This may sometimes come from selling the orders to HFTs, in which case they pass through any revenues from such transactions back to the client.

IB’s clients are not attracted to the zero commission model because they are sophisticated enough to realise the cost of poor execution is higher than the benefit of the lower fees.

Many unsophisticated retailers don’t realise this, and so are attracted to the zero-commission model.

While IB is philosophically opposed to the Robinhood model, for commercial reasons it has responded by launching IB Lite, a zero commission offer that has less attractive execution and interest rates.

Robinhood is expanding outside of the US and at this stage, it is unclear how it will maintain a zero-commission model, given client orders can't be sold in other jurisdictions. Either way, Robinhood isn't living up to its namesake, as it is effectively stealing from the poor (or more accurately, the unsophisticated) to give to the rich.

The real risk to IB:

- Robinhood will iterate its model and start developing products and tools that appeal to IB’s core segment, and

- IB neglects its UI or is not able to iterate it due to legacy code.

Neither of these looks likely, but this is what I’ll be monitoring.

Minority shareholders: Around 80% of IB’s shares are held by management, with Thomas Peterffy still controlling the company. He may transfer value away from or act in ways that are not in the best interest of minority shareholders. This is unlikely as

- Peterffy has a track record of acting with integrity,

- the listed entity has been trading for over a decade with no evidence of this type of behaviour, and most importantly

- the listed entity’s purpose is to allow the trading of management shares at a market price with a slow but ongoing migration of control to it.

A related risk is that of Peterffy’s age, 75. He has run the business for decades and has a controlling nature, finding it difficult to let go of decisions. There is the risk of 1) poor decision making due to deteriorating mental capacity; and 2) the inability of the next generation of decision-makers to maintain IB’s trajectory.

Financial services business: Financial services is highly regulated and there may be changes that adversely affect the business. US regulators, for example, allow cash in one client’s account to be lent to another client in the form of margin loans, reducing IB’s capital requirements. A change in this regulation would be detrimental to IB, as it would need to increase the capital it holds.

The accounts of financial services businesses can be complex and opaque. Further, IB is involved in lending activities which can, and have resulted in, unexpected spikes in bad debts. There are many potential sources for risk here, ranging from errors in the codebase, unexpected large price movements, to poor customer risk assessment.

These risks are somewhat mitigated by a long operating track record, managements’ aversion to risk, the large gap between regulatory and actual capital held, the company’s assets being almost entirely liquid, the healthy profit margin and the integrity of the founder and Chairman.

Summary

Putting it all together, I see a strong business, with an attractive growth profile, run by great managers trading at a reasonable price. As with all our investments, IB is not without risk, weighing up the various factors, I judged 8% to be the appropriate portfolio allocation.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

After an extensive career across RBA, Ausbil & Fidelity, Ali founded Kasa Investment Partners to solve the agency problems within the investment industry and derive a more direct relationship between the portfolio manager and the investor.

Expertise

After an extensive career across RBA, Ausbil & Fidelity, Ali founded Kasa Investment Partners to solve the agency problems within the investment industry and derive a more direct relationship between the portfolio manager and the investor.