A gold medallist's winning path to investing

Just a few days after Australian sailors Matthew Belcher and Will Ryan scooped Australia’s 15th gold medal of the Tokyo Olympics, it's a fitting time to reflect on some of the parallels between the nautical sport and investing.

Especially given I recently had the good fortune to chat with Tom King, CIO at Nanuk Asset Management – who also won gold in the men’s 470 class, but at the Sydney 2000 Olympics 21 years ago.

Tom King (left) and his sailing partner Mark Turnbull on Sydney Harbour in 2000

Source: Supplied

And, when I asked King, a high achieving sportsman, with a background in engineering, what drew him to asset management he elaborates on the symmetries between sailing and investing straight away.

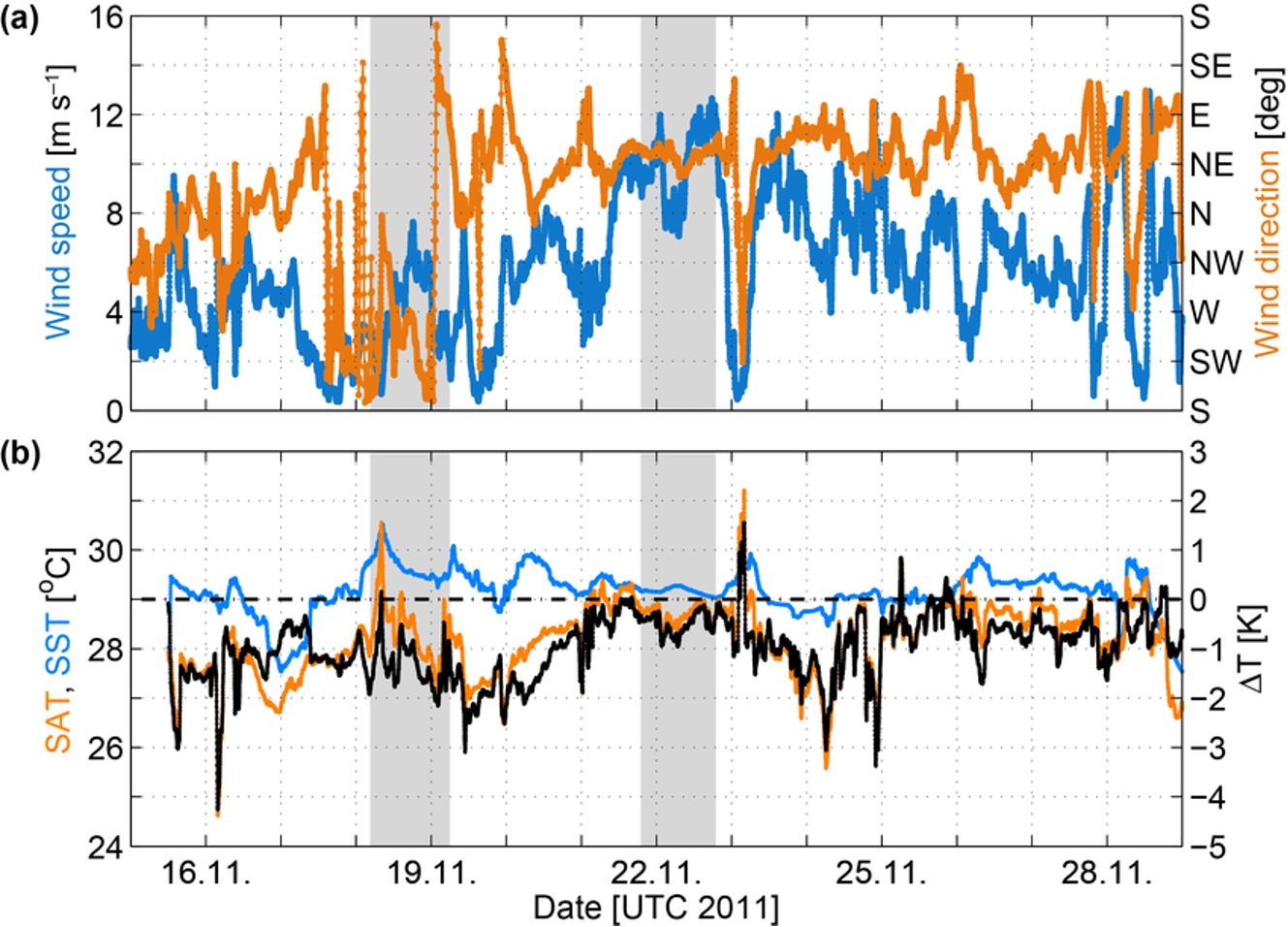

“If you’ve ever seen a chart of wind direction and wind speed, it looks remarkably like a chart of stock prices and volumes," King says.

“And at a high level, the kind of sailing I was doing is a game of risk-return decision-making, played in a dynamic and very competitive environment against a large number of other competitors.”

The crossovers don’t end there, he explains, also pointing out that sailors operate in an environment where they have some understanding of why the wind behaves as it does and what it might do in the future.

But like gauging the weather conditions for sailing, investment forecasts are also imperfect, explains King.

“It can’t be predicted exactly. And that’s very similar to buying and selling stocks. And the skillset that I had in sailing has some relevance to what I do today.”

“The ability to make decisions in a complex and changing environment under significant pressure with incomplete information is a skill that was really important in sailing, and I consider very important in investing.”

Source: Supplied

As a side note, there's also plenty of boating terminology commonly used in everyday financial commentary. We often read or hear about market headwinds and tailwinds, or the need to navigate carefully through periods of volatility – often described as choppy waters.

Wind direction and wind speed

Source: Supplied

Having started his finance career in an equity analyst role with boutique Sydney-based firm Herschel Asset Management, King then moved to Rothschild Australia Asset Management. He worked as an analyst here before shifting into investment banking and briefly running Rothschild’s forestry-based managed investment scheme. This was followed by a three-year stint at the Packer family’s Consolidated Press Holdings, which until 2013 also owned Ellerston Capital.

“Unfortunately, when the financial crisis hit in 2008, the opportunity for me within CPH changed, and that coincided with conversations I’d been having with the founders of Nanuk, which in turn led to us setting up the business."

After his earlier stint in investment banking, King had decided his strong interest in helping to improve companies’ operating efficiency was best fulfilled within investment management. He saw further opportunity still within Nanuk, having also developed a fascination with wind energy – not only through his sailing pursuits but also his tertiary engineering studies in the 1990s.

Source: Supplied

An ESG-centric fund manager, the fund manager's flagship (there's another sailing reference) runs the Nanuk New World Fund - a long-only global equity fund that invests solely in stocks that meet stringent environmental sustainability criteria. Key themes reflected in its portfolio include:

- Clean energy,

- Energy efficiency,

- Agriculture,

- Water,

- Waste management,

- Recycling,

- Pollution control and

- Advanced manufacturing and materials.

Alongside these environmental sustainability principles, King and his team are also highly focused on equity valuations.

"I’m here because the founders of Nanuk and I saw what we believed would be an enduring and compelling investment opportunity in areas that are going to contribute to solving the world’s very significant environmental issues."

He regards New World as a relatively style-neutral fund that is particularly targeted at investors who use multiple fund managers to access global equities as part of a broader multi-asset portfolio.

“We focus on a specific set of industries and areas that are related to environmental sustainability and resource efficiency, and we do that entirely for investment reasons, but it brings with it a set of other attributes that people might be interested in," says King.

"The challenge for us is that, in the last couple of years, many people have started to subscribe to our world view and parts of our investment universe have become very expensive because of people throwing money into stocks involved in areas like renewable energy and electric vehicles"

Given the sky-high valuations in the broader EV space, with Tesla a primary example, King has chosen more selective exposures from up and down the supply chain.

As an example, Nanuk recently added Hyundai Mobis which provides the battery management systems and electric drivetrain modules for the EVs sold by Hyundai and Kia.

“We should see this otherwise pretty boring, low-multiple company start to grow in the coming years,” King says.

In response to this, King and his team have been trimming allocations to some of the pricier areas since the end of last year – which has helped the performance of the fund this year, having seen a significant correction in some areas since January.

Most exciting prospects

Some of the sub-themes within the broader decarbonisation theme he’s most excited about include sustainable agriculture and some niche technology areas with exposure to areas such as healthcare and the rapidly rising electric vehicle uptake.

A few stocks he calls out from his portfolio include:

- SIG Combibloc, a Swiss company that manufactures sustainable food and packaging solutions

- Nuance Communication: Recently bought by Microsoft, this US company develops voice recognition software for the delivery of online healthcare

- Garmin, a well-known manufacturer of wearable GPS devices.

The fund also holds a position in TomTom, a Dutch company known for its in-car navigation technology. Its mapping products are seeing particularly strong uptake by the manufacturers of EVs and vehicles with higher levels of autonomous technology, as well as being used by the likes Microsoft, Uber, and Apple.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

1 contributor mentioned