A guide to making sustainable and repeatable profits from takeovers

We make 61% of our money from takeovers where there are two or more bids.

How companies react to takeover offers is peak governance in our minds.

It many cases it will be a Board’s last act as the governors of the company; in the words of Jim Jeffries “there’s not a lot of wiggle room” to stuff it up when it comes to the fortunes of its shareholders.

I’ve been there many times as an advisor. I’ve also been there as a target a couple of times. Believe me, it’s all hands on deck……….cancel the holiday!

War rooms are commissioned.

If you are going to be bought you want to make sure you maximise the value for everyone.

BLOCK THE FIRST BALL.

I’m colloquialising here but if a target’s board doesn’t say something along the lines of one of the following, they are a great risk of negating their fiduciary duties:

- Thanks but it’s not enough

- Something, something, something, in absence of a higher offer we recommend.

When we read the first one, we are the first to say ‘hear, hear’!

Often the 2nd statement above is a follow on from the first one. Usually months apart - after a 2nd or 3rd offer has been extracted.

In the world of free markets multiple bids is governance in action and the great thing about public markets is you can get a seat at that auction without owning the whole asset.

ONE BIDDER SUCCESSFUL AUCTION

Even if there is only one bidder, it’s still an auction. If there ends up being a two or more bids the ‘winner’ of this auction is ultimately coerced to bid against themselves to meet the ‘reserve’, so to speak. It’s our duty to be part of this process to make sure that we receive top compensation for our investors/all non-bidder shareholders.

It not only satisfies our purpose but it also makes us feel good to know that thousands of shareholders benefit from prising out acceptable value. I use the word acceptable because I’m yet to discover the definition of true or correct value!

Now we wouldn’t blindly invest in 100% of takeovers in Australia with the expectation that there’s either a bidding war or the first bid isn’t the last bid because the pay-offs for the successful ones are not symmetrical with the losses for the unsuccessful ones (the Voldemort of Merger Arbitrage – ‘reversion to the undisturbed price’). That strategy would be no better than the old throwing darts at the cat litter pages in the middle of the AFR (or probably worse actually).

Ultimately Governance is manifested in the phrase ‘in (or not in) the best interest of shareholders’.

DON’T SELL YOURSELF SHORT

Let’s look at some recent quotes from the boards of targets:

Boral (ASX: BLD)

“We have carefully evaluated the SGH Offer and recommend that shareholders should REJECT the SGH Offer as it undervalues Boral.”

Tick. ALL YEE PAY HEED TO OUR CAPS TOO.

What happened?

Despite Seven saying that their bid was Best and Final (which is quite contentious in itself as under Australian takeover law once a bidder has declared their offer ‘best and final’, they can’t increase it) the independent directors and a group of shareholders, including us obviously, held the line and squeezed out a better deal from Seven with the release of franking credits.

That additional benefit and a better deal makes a big difference to us as merger arbitrageurs and our clients.

Namoi Cotton (ASX: NAM)

“If LDC [Louis Dreyfus Company] provides a binding proposal consistent with the terms of the NBIO and, subject to entry into a binding SIA in a form acceptable to Namoi, each member of the Board of Namoi (other than Sarah Scales who is abstaining) intends to recommend that Namoi shareholders vote in favour of the potential transaction, in the absence of a superior proposal and subject to an independent expert concluding, and continuing to conclude, that the potential transaction is in the best interests of Namoi shareholders.”

What happened?

BIDDING WAR.

We are now up to 5 bids in the ‘war’ for Namoi Cotton, with the stock trading at 71c.

OreCorp (ASX: ORR)

“The OreCorp Board has unanimously approved the transaction [a bid by Silvercorp] and recommends that all OreCorp shareholders vote in favour of the Scheme at the meeting of shareholders of OreCorp, in the absence of a Superior Proposal and subject to the independent expert to be appointed by OreCorp concluding (and continuing to conclude) that the Scheme is in the best interests of OreCorp shareholders.”

What happened?

Wind was caught in the chilly streets of Silvercorp’s hometown of Vancouver that horses were riding over the hill.

Perseus of Subiaco was a-coming.

Three months after its first offer, Silvercorp seemingly bid against itself and increased its cash portion of its offer for OreCorp by 27%.

Four days later Perseus announced they’d bought 19.9% of Orecorp.

Mmmmm, that ‘in absence of a superior offer’ wordage is about to come in handy.

Three months further on (29th Jan 2024) Perseus lobbed their competing takeover offer.

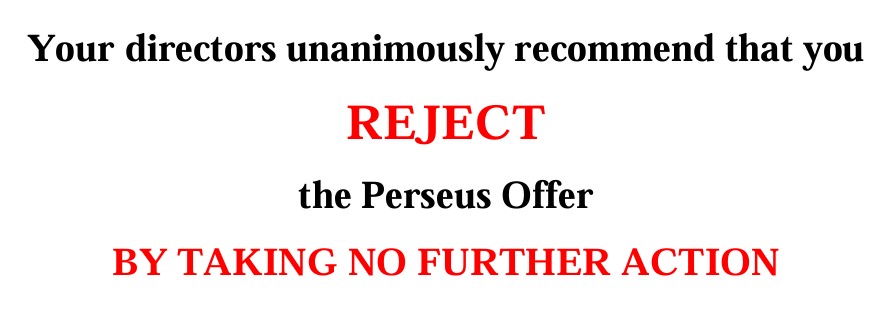

‘Your directors’ (the directors of the target, OreCorp) got busy:

Waters flow, rivers ebb, moves are made (including Perseus increasing their cash offer to A$0.575 in March 2024) and lo and behold five days after Perseus’ increased their offer the Board of OreCorp jumped ship and recommended Perseus’ amended proposal.

Anglo American

“The Board has considered the Proposal with its advisers and concluded that the Proposal significantly undervalues Anglo American and its future prospects.”

“The BHP proposal is opportunistic and fails to value Anglo American’s prospects, while significantly diluting the relative value upside participation of Anglo American’s shareholders relative to BHP’s shareholders. The proposed structure is also highly unattractive, creating substantial uncertainty and execution risk borne almost entirely by Anglo American, its shareholders and its other stakeholders.”

Tick

What happened?

BHP bid against itself and improved its offer from around $60 Billion to $64.4 Billion on Monday 13th of May.

Now Anglo is proposing value-creating restructures for itself. Who is the winner? So far, undoubtedly the Anglo American shareholders.

THERE ARE MORE WAYS TO BE AN ACTIVIST THAN WRITING A 7 PAGE OPEN LETTER

We don’t look to do things publicly but at the same time we’re not here to make friends.

While intimate knowledge of takeover law and corps law dictates our boundaries, we will often insert ourselves into corporate events (mainly takeovers) to maximise the transaction value.

That insertion may be by detailed communication with either the bidder or the target, their lawyers, financial advisors, other investors, or any combination of those stakeholders.

Often companies (particularly the smaller cap ones) are under-resourced or under-advised when it comes to takeovers. Helping and well-informed hands can maximise outcomes and turn big dollars.

INVESTING IN GOVERNANCE IS EASY, GENERATING EXCESS RETURNS FROM IT IS HARD

I’ve been around investment processes my whole professional career – either designing them or following them.

I’ve seen governance incorporated into investment processes but everything I’ve seen to date seems all very subjective.

It’s either he or she is a good CEO, or a bad CEO, and the management team is a good team or a bad team, or the CEO’s good but the bench is bad. These committees are effective, those ones aren't. Just seems like a cloudy Venn diagram and the process seems too often be a box ticking exercise more than it is a way to make money.

You can invest with ESG; however you can also invest in ESG. There are thousands of opportunities to invest in the E in ESG; there are less opportunities to invest in the S and even less in the G – in a really defined sense anyway.

Merger arbitrage is a great way, in our opinion, to make strong returns with low volatility low correlation and low drawdowns (on a portfolio basis), from what at the end of the day is the manifestation of corporate governance (whether you be the target or the acquirer).

Even bad governance can have a negative delta (which is good) in merger arbitrage as often the reason the takeover is on the cards is the management team of the acquirer thinks they can do a much better job than the target’s team – and they are prepared to pay up to get the chance.

Free…..markets!

5 topics

7 stocks mentioned