A is for ambition: Apple and Amazon bet big on the future

The recent Apple and Amazon results showed one key thing; these tech giants are laying down markers for how they see the next stage of tech evolution unfolding and staking out positions to profit from it. Looming large in this evolution is Ai [Apple Intelligence], with Apple looking to leverage capabilities across what is an enormous ecosystem of 2.2 billion active devices while Amazon is focusing on pushing Ai applications across their cloud and consumer business. The recent results also provided key insights into shorter-term business performance.

Apple (NASDAQ: AAPL)

- EPS: $1.40 vs. $1.35 estimated

- Revenue: $85.78 billion vs. $84.53 billion estimated

- Gross margin: 46.3% vs. 46.1% estimated

- Guidance: OPEX of between $14.2 billion and $14.4 billion in the current quarter, Gross margins of between 45.5% and 46.5%.

Estimates were provided by LSEG and compiled by CNBC.

The key takeaway

While the gains from the release of “Apple Intelligence” will be significant, they will take time. This was evidenced by the fact that despite this recent result coming in ahead of expectations, it was coupled with a guide for the coming quarter that was mildly below what the market was looking for (Apple guided to revenue growth of low-to-mid single digits vs a market that was expecting +7%).

This makes sense as “Apple Intelligence” has only just rolled out in the US in recent weeks, and will not become available in the UK, Australia, Canada and New Zealand until December 2024. Other geographies will follow throughout 2025. Most importantly, it is also December 2024 before we see a meaningful expansion of the AI features including the long-awaited ChatGPT integration. As such, the powerful iPhone upgrade cycle that we expect to come with “Apple Intelligence” is likely to be a slow burn, with momentum building through 2025 and into 2026.

What impressed and what disappointed

The ability of Apple to turn a benign demand environment into double-digit EPS growth is impressive. Product growth has been tepid but the higher growth services business, margin expansion and a buy-back continue to drive EPS growth above 10%.

While we appreciate that Apple Intelligence will take time, the pace of the roll-out driving the weaker-than-expected outlook for 4Q (which is their biggest quarter of the year) was mildly disappointing. However, Apple tends to focus on quality rather than speed, so we do think that their ability to monetise Ai across an installed base of 2.2 billion active devices is a compelling, multi-year opportunity.

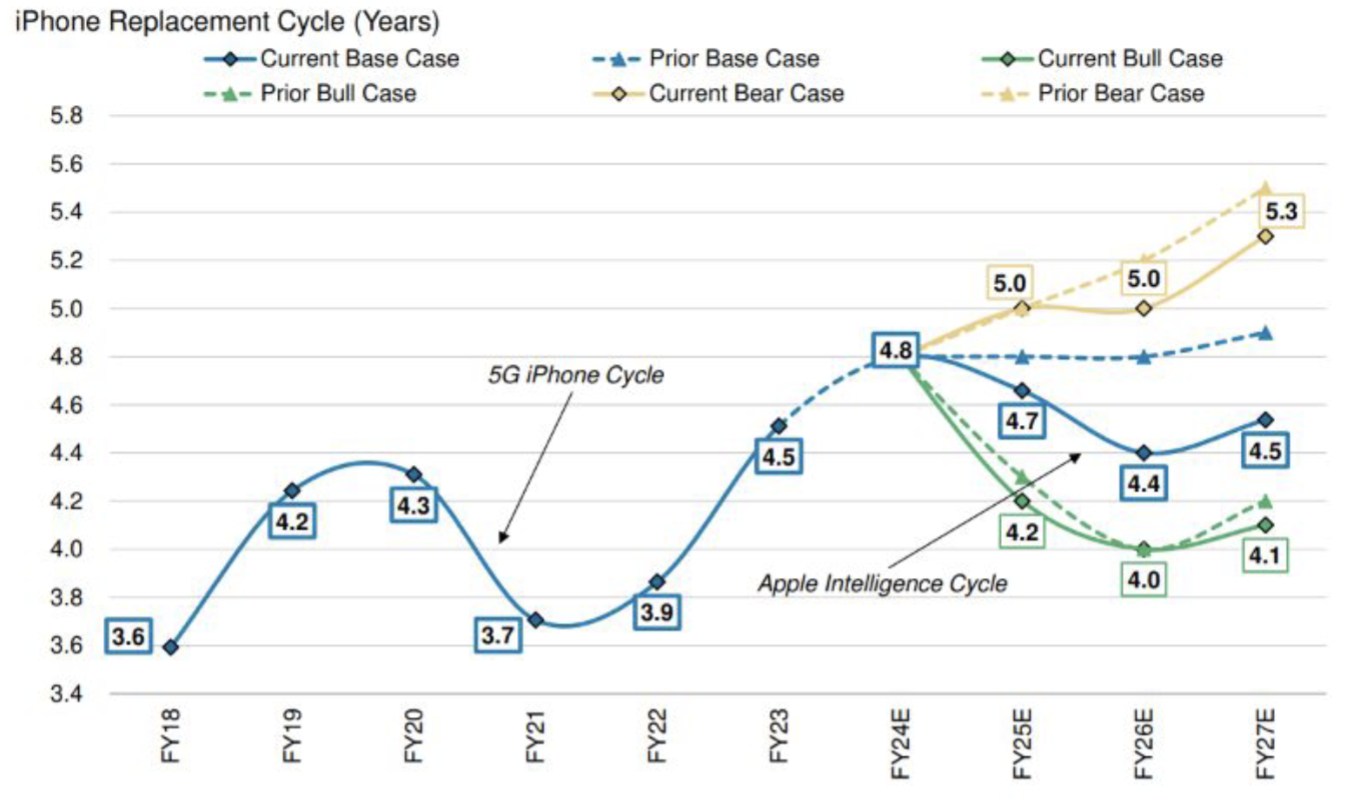

The next phase for Apple is all about an iPhone replacement cycle coupled with an expansion of associated Services revenue. The chart below shows what happened the last time a compelling technology shift occurred, with 5G driving a compression in this replacement cycle. Since the most recent trough in FY21, replacement cycles have shifted out by more than 12 months. A compression of this replacement cycle back towards four years will drive circa 10% EPS upgrades.

Risks

There are a few key risks facing Apple in the coming years. Key among these are:

- What if “Apple Intelligence” is a flop? This would undercut the investment thesis of a compelling technology shift driving customers to upgrade their phones, as well as reduce the ability of Apple to further monetise Ai capabilities through their Services business

- What about if Apple loses search payments from Google? The current DOJ case against Google has the potential to eliminate the $20-$25 billion of high-margin revenue that Google pays Apple to be the default search engine through Safari. While Apple will find a structure to replace at least some of this revenue, it is a potential drag in the short term

- Will the phone lose primacy as the key device state? Over the longer term, there is a risk that a different form factor supplants the phone as the dominant device. Meta is pushing down the glasses route and seems to be well ahead currently, but Apple also appears to be on the “visual” path, with the “Vision Pro” potentially just the first step towards a glasses device for Apple.

Buy Hold Sell

BUY: Apple’s ability to monetise its enormous consumer ecosystem is almost unrivalled. They will find a structure through which to monetise Ai, both through device sales and more importantly through an expansion of Ai-related services offerings. There is no company better placed to be the window into Ai for the average consumer.

Amazon (NASDAQ: AMZN)

- Earnings: $1.43 vs $1.14 per share expected by LSEG

- Revenue: $158.88 billion vs $157.2 billion expected by LSEG

- Amazon Web Services: $27.4 billion vs. $27.5 billion expected, according to StreetAccount

- Advertising: $14.3 billion vs. $14.3 billion expected, according to StreetAccount

Estimates were provided by LSEG and compiled by CNBC.

The key takeaway

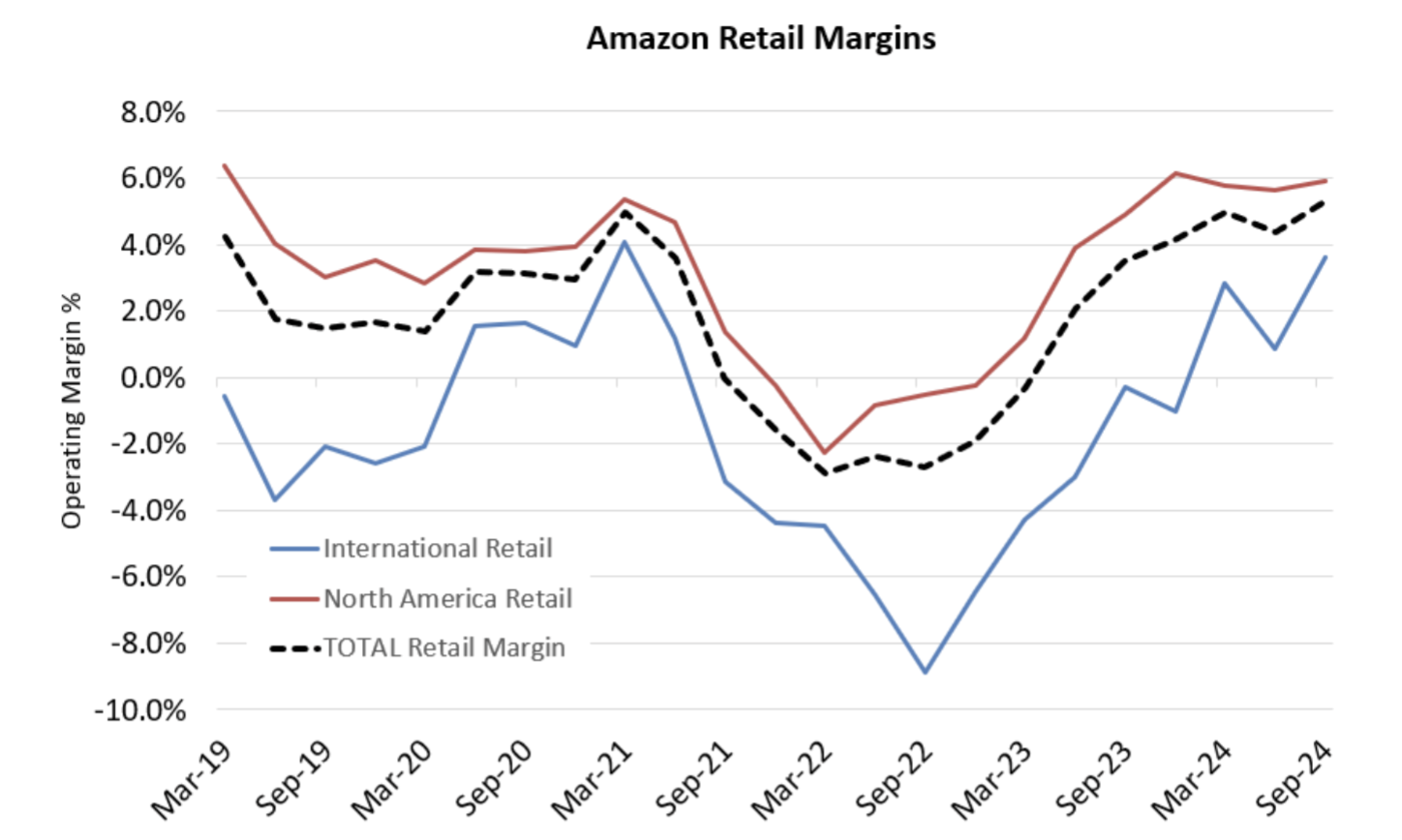

Margins, margins, margins. Given the scale of the Amazon business, a mild shift in margin outcomes can drive enormous gains in operating income and EPS. Amazon spooked the market during their 2Q24 results which showed margins for their core retail business to be weaker than expected, which was blamed on everything from product mix (more lower priced “everyday essentials” in baskets) to building extra satellites for their broadband business.

However, come the 3Q24 result last week, all was forgotten as Amazon blew those margin expectations (that they ironically had guided to themselves) out of the water. So the question becomes, will this margin expansion continue?

What impressed and disappointed

The margin outcome in the core retail business was impressive, particularly in the International segment. Despite pressures from the mix and what appears to be heightened competition from legacy retailers (eg Walmart) and Chinese players (Temu, Shein), Amazon generated solid topline growth and exceptional margins. The Amazon cloud business AWS also showed a continuing re-acceleration driven in part by Ai.

While it may seem unusual to have any source of disappointment in an exceptionally strong result, the variability of the margin outcomes compared to what management expected could indicate a lack of visibility. While a “miss vs expectations” is very happily received when it is an upside surprise, it does raise some concerns that perhaps next time the “surprise” could be the other way.

Given the scale of the retail business, a shift in margin expectations has a material impact on earnings. A circa 100bps improvement in retail margins versus current expectations for CY25 would drive a 7% beat in Amazon's operating income.

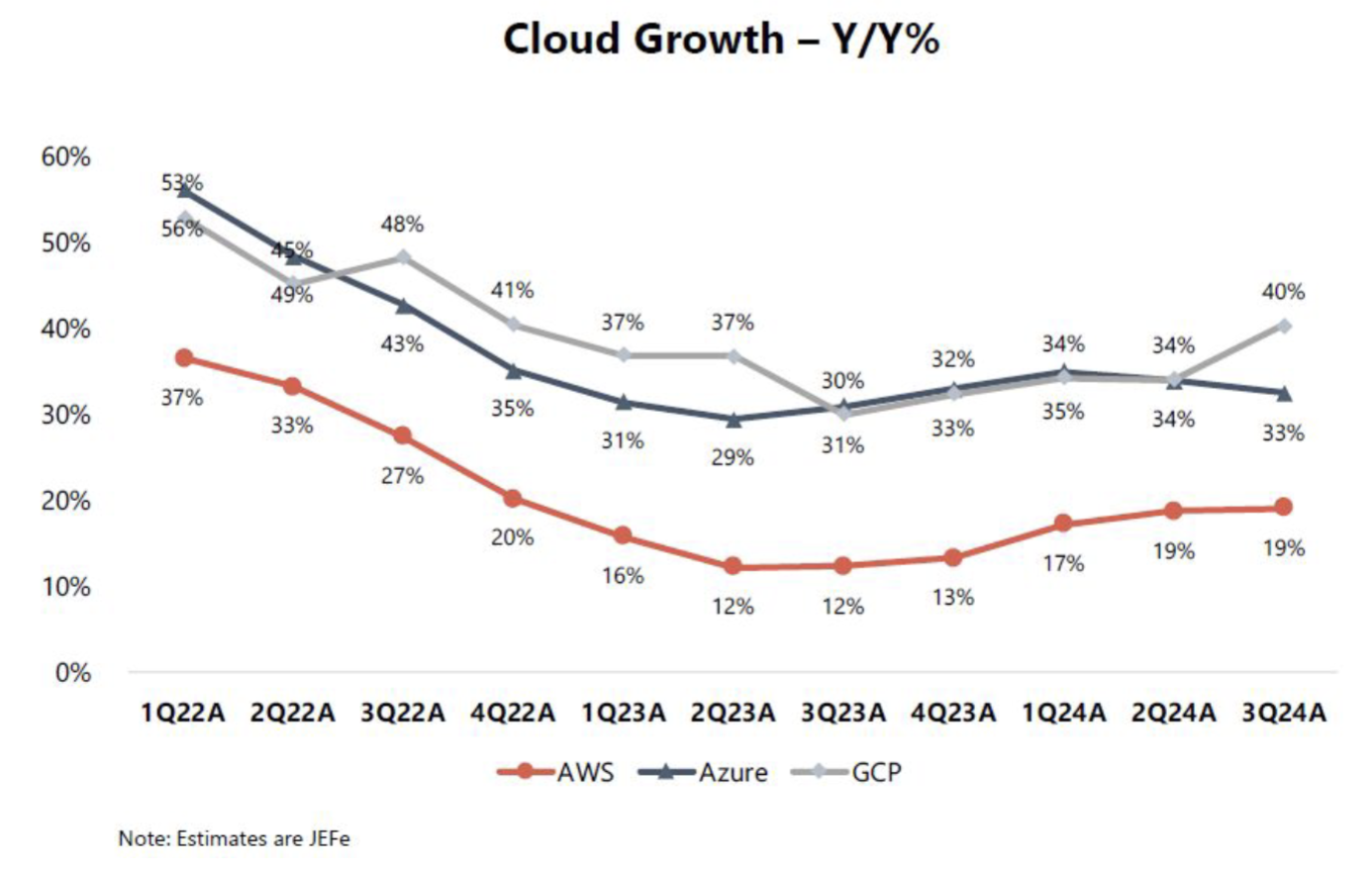

The other key chart is around cloud growth. A combination of the “law of large numbers” plus optimisations had driven compression in cloud growth rates across Amazon (AWS), Microsoft (Azure) and Google (GCP). However, the advent of Ai has driven a re-acceleration in cloud growth, which is impressive given the base of business is significantly larger.

Risks

For Amazon, risks are on a couple of key fronts:

- eCommerce competition: Amazon used to be almost the only game in town when it came to eComm. However, COVID saw a number of retailers reshape and improve their eComm offerings (facing an existential threat to your survival will do that). Now traditional retailers such as Walmart (who can combine grocery with general merchandise) are making some inroads, while platforms like Shopify can offer alternate paths to market. This is coupled with an increase in competitive intensity from Chinese platforms Temu and Shein.

- Cloud growth: while AWS has been performing well in recent quarters, they had initially slipped behind Azure in terms of Ai functionality. Given the sheer scale of the capex required to build out data centre capacity, continued success in cloud is critical to generate returns on this investment.

Buy Hold Sell

HOLD: While this earnings outcome for 3Q24 was extraordinary with revenue +1%, operating income +18%, and EPS +24% ahead of market expectations, the margin variability coupled with some consumer stress creates some potential visibility issues. Top-line growth is landing in line with market expectations so margins need to continue to do the heavy lifting for Amazon to continue to exceed market expectations in the future.

Historically, Amazon has been happy to plough expenses back into the business just as this profitability begins to emerge which accentuates this risk. However, Amazon's position is a powerful one, and the Amazon Prime offer is compelling, so if Amazon can demonstrate consistency of profitability improvement, the stock would shift to a BUY.

2 topics

3 stocks mentioned

2 funds mentioned