A Land of Contrast: 2018 Australian Economic Outlook

Quick Brown Fox

To understand where we are heading it is always important to look back at where we have come from. With that in mind, the Australian economy continued its uninterrupted twenty six year run of economic growth in 2017 delivering 2.8% year on year GDP growth through the September Quarter. In addition, jobs growth was strong and the unemployment rate declined over the course of the year from 5.8% to 5.4%. The RBA remained on hold the entire year with the Official Cash Rate at 1.5%. These are solid numbers and at a cursory glance most observers would say the Australian economy is in a healthy state. However, when we delve below the surface we see a land of contrast with signs of optimism in certain areas and potential weakness in others. Australia at this point of time is very much a land of contrasts.

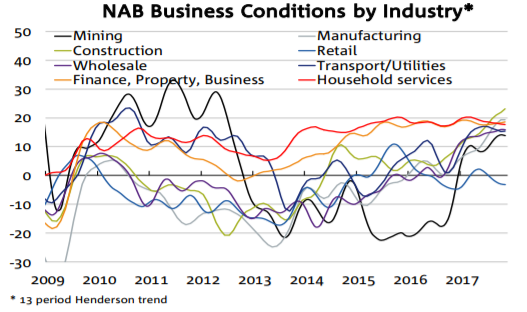

The biggest contrast in the Australian economy currently is the spread between business confidence and the lack of household spending. Business confidence hit record highs during 2017 whilst retail sales growth stalled. Business confidence has been partially driven by a rebound in Mining conditions as commodity prices have rebounded and the worst of the mining bust has been put behind us. Elsewhere we saw strong rises in Construction (more on this shortly) as well as Transport and Utilities. Retail is the sole industry reporting tough conditions.

Source: NAB

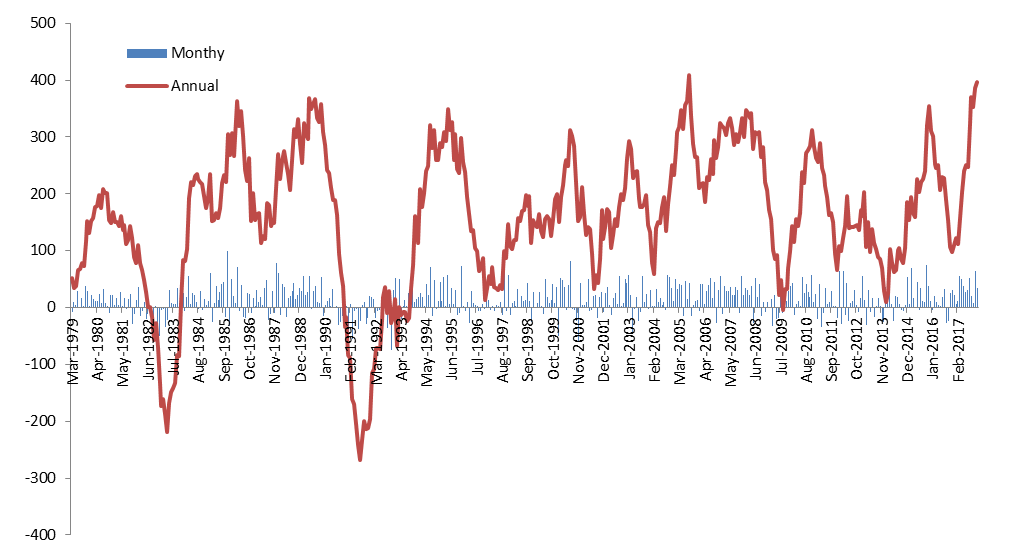

It may seem a little bit odd that retail conditions are weak given that business confidence is high and that has led to significant job gains over the last year. In fact, in the last calendar year the Australian economy created a record amount of jobs, 393k using the seasonally adjusted data. The chart below looks at the monthly annual job gains for the Australian economy going back to 1979.

Source: ABS

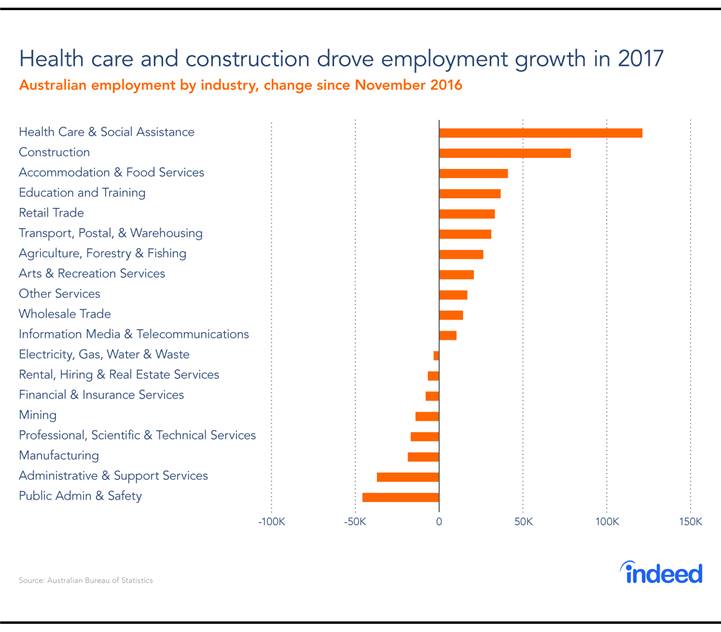

For those wondering where these jobs were created, the table below splits it via industry with the two key drivers being Healthcare and Construction. Healthcare is being supported by an ageing population and the National Disability Insurance Scheme whilst Construction has been driven firstly by residential construction and more recently by infrastructure spending.

Source: ABS

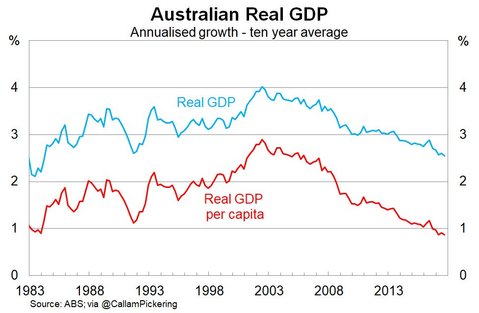

However, offsetting the record job growth is the fact the Australian population grew by 388k and immigration accounted for 245k of that increase. The reality is the primary driver of the Australian economy has been and continues to be population growth. If we look at the average GDP growth rate of the last 10 years (chart below) it currently stands at 2.5% per annum but in per capita terms it only registers 0.9%. In the last year, the headline number of 2.8% drops to 1.3% in per capita terms. One of the major reasons for this sluggish growth in our opinion has been the boom/bust nature of the economy in recent years (see here). The mining boom has been a significant drag on growth since 2012 however that drag is set to end. The residential construction boom which was kick-started by interest rate cuts has now started to slow and has detracted from GDP over the last three quarters. We expect this drag will continue in 2019.

Source: ABS

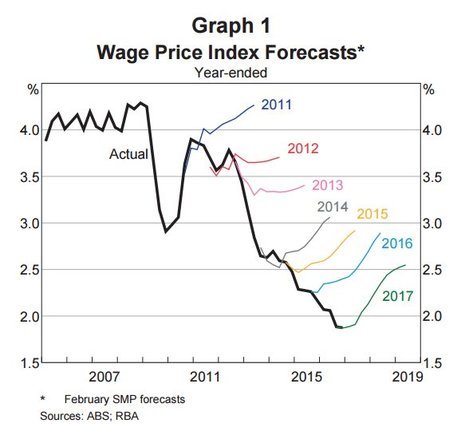

Jobs are growing but workers are not necessarily better off. Wage growth is stuck at all-time lows and despite the RBA and Treasury predicting improvements there are little signs of it yet. As can be seen below the RBA has been overly optimistic for some time with the coloured lines representing their forecasts each year.

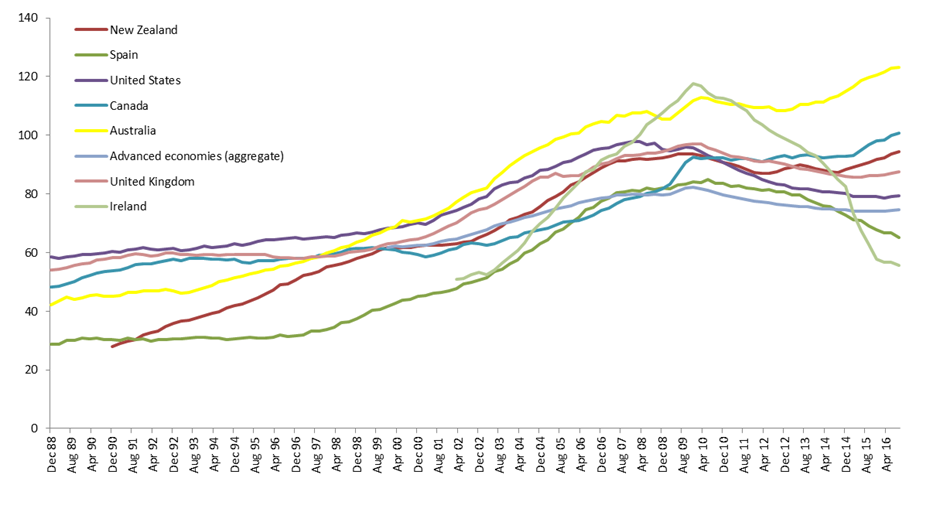

Low wage growth is the major problem for the RBA and the key reason why we can’t see them raising rates anytime soon. On the other side of the equation are the record levels of debt that Australian households are sitting on. Relative to GDP, Australia household debt stands second only to Switzerland on a global basis. Most developed economies have seen households de-lever since 2008 but not Australia. Household debt on its own doesn’t necessarily cause a problem but it does make our economy vulnerable. Adding to this vulnerability is the lack of wage growth meaning the income servicing the debt is not going up and hence adding more debt is unlikely. The change in debt influences GDP growth and if debt stops rising, GDP growth will likely stall.

Source: Bank of International Settlements

Low income growth and high debt is a toxic combination for households. Over recent years the RBA has papered over this problem via interest rate cuts but with those less likely going forward, the crunch is starting to appear. Hence the key risk we see for 2018 is the health of the Australian consumer.

2018 Key Risk: The Australian Consumer

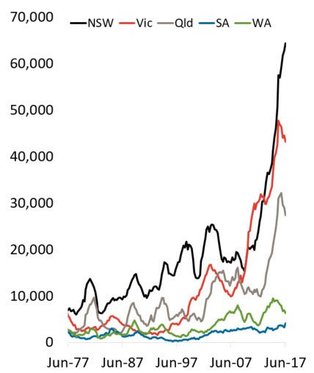

In the September GDP numbers, the contribution from Household consumption was the weakest since 2008. Retail sales have also been weak over the last half of the year (except for what appears to be an iPhone related November bounce) as households appear to have hit a brick wall. The chart below shows retail sales by state and we can see the decline has been led by the mining states with Western Australian and Queensland in negative territory whilst the other states are trending downwards as well after a strong bounce in 2012 as the interest rate cuts started.

Source: ABS

The key driver behind the recent declines was that on July 1 last year households were hit with two price increases. Firstly, the large amount of household debt got hit with APRA induced interest rate increases. These rate rises were for interest only and investor mortgages. This did see a significant amount of switching from Interest only to Principal and Interest but the overall impact remains capacity taken out of the household budget. Secondly, electricity prices went up 17% across the board. The combined impact is that heavily indebted households have less to spend. Whilst the media has focused on the entrance of Amazon to Australia, it is our opinion that the weakness in household balance sheets has been the major source of weakness for retail companies to date.

We do have to note thought that both of the price rises mentioned above are one off in nature. We do see households as the major risk to the Australian economy; however a stabilisation rather than a capitulation is the most likely scenario in the near term without further external cost increases.

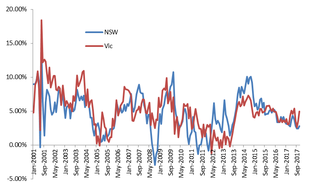

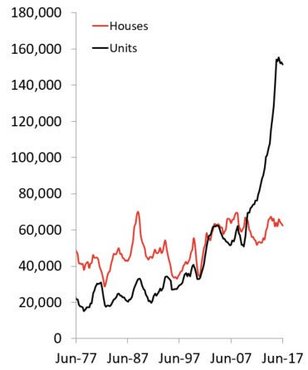

One of the important things to watch with regards to the Australian consumer will be the residential property market. The signs appear to be pointing a slowdown, the question is how big it will be? Whilst recent falls in prices are raising concerns about the wealth effect, we believe the more important aspect will be the drop in construction volume. For GDP and employment, it’s not prices that matter but instead the volume of construction (something we wrote extensively about in our Outlook last year, see here). With demand dropping we expect falls in construction to accelerate. The chart on the left below looks at Houses and Units currently under construction. The construction boom has been all about apartments and this is in the earlier stages of decline. Below, the chart on the right looks at current units under construction by state. Most states are in decline except for New South Wales although the leading indicators are that this will start to decline over the next 6-9 months. Victoria will be interesting to watch with a huge spike in apartment approvals over the last two months. Whilst we will see declines in construction across most regions, Victoria’s may get a second boom.

Source: CoreLogic

To a large extent these pictures explain what is happening in the employment numbers. Construction has added over 100k jobs in the last year and the New South Wales unemployment rate stands at 4.6% well below all of the other states which range from 5.5% to 6.6% (Western Australia having the highest). With a slowdown in residential property likely in the year, it will be very unlikely that the strong job growth from this year will be repeated. There is a large multiplier impact with regards to employment from construction with jobs ranging from design to approval to construction to selling the property (Real Estate Agents) and finally financing the property (Banks). Hence, residential property tends to be the biggest factor in the economic cycle as economist Edward E. Leemer posited in his paper “Housing IS the Business Cycle”.

For us, the retail and residential sectors remain difficult to invest in. There may be specific opportunities but “Green Shoots” remain a distant thought. In addition investors need to be cautious with 2nd order derivative plays such as the financial sector.

2018 Key Opportunity: Infrastructure

With a long period of monetary stimulus via Interest rate cuts and Quantitative Easing effectively having come to an end both globally and in Australia, we have started to see a shift to fiscal stimulus. In Australia this push is coming via state governments in New South Wales and Victoria. One of the positive side effects of the Residential property boom were record stamp duty receipts, this combined with asset sales has both state governments in a strong fiscal position.

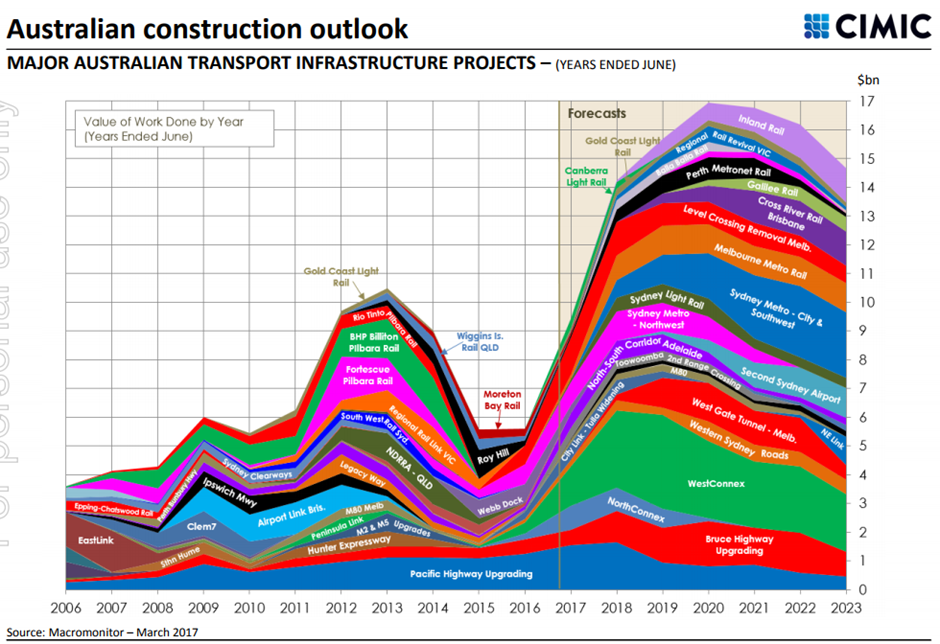

Governments with cash generally do not like to sit on it and as a result infrastructure work is set to boom. The chart below outlines the major projects planned over the coming years with a focus very much on road and rail along the East Coast. The amount spent on these major projects is set to double from FY17 levels through to FY20.

Source: Cimic

Over the course of last year we have added positions across companies focused across the likes of Bridge building, surveying and scaffolding. These companies tend to be leading players in niche industries and as a result are typically ignored by larger institutions. We have been able to acquire these positions at what we believe to be attractive valuations and all cases believe the prospect for earnings growth over the coming years.

Positioning for 2018

A year ago in our 2017 Outlook we wrote about the following about the Australian Information Technology sector:

"Whilst the banking sector is over-represented in Australia relative to global markets, the IT sector is severely under-represented at 1.4% versus 14.6% for the MSCI World. Given that relatively small size, it is a sector that is largely ignored by large institutional investors. This provides opportunities for those willing to investigate.

When we delve into the IT sector, we actually find a number of companies (primarily specialising in software) that are significant global players within a niche segment. These companies often exhibit many of the characteristics we look for in a quality company."

Sitting here today we feel vindicated. A number of the top performing stocks on the Australian market last year were in the IT space. Within our top five holdings at the start of last year were Gentrack which returned 85% for the year, Altium which returned 67% and Integrated Research which returned 42%.

Given these impressive gains it may not surprise you that we have moved to reduce our exposure and lock in profits over the course of the last year most notably in Altium and Integrated Research (we still hold positions in both but in a greatly reduced size). Whilst we believe in the long term future of the technology sector, we do note that valuations across parts of it are feeling very frothy. Early stage companies such as GetSwift (ASX:GSW) and Big Un (ASX:BIG) have seen significant rises. Speculation at the smaller end of town is well and truly alive, more often than not these fast paced gains in early stage companies reverse.

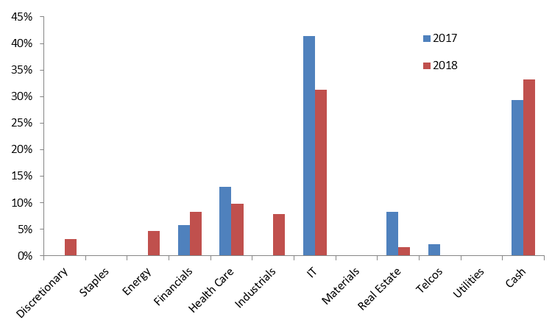

To illustrate the shift in the portfolio over the last 12 months, the chart below looks at the sector weightings today versus 12 months ago.

The major changes have been a reduction in the IT weighting from above 40% to 31% whilst introducing exposure in both Industrials and Energy. Not only have we increased the sector diversity in the portfolio over the last year, we have also increased the diversity by name with 21 companies now in the portfolio up from 17 a year ago.

The exposure within the Industrial sector is very much focused on the infrastructure theme focus above. The Energy exposure is based around special situations. There are signs that the Oil market globally has slowly come back into balance from oversupply. This has relieved pressure on a number of companies and created opportunities.

The first opportunity we came across was Beach Energy where we saw a company trading on a low multiple with a significant cash balance and an opportunity for M&A activity. Shortly after we established our position the company acquired Lattice Energy from Origin Energy to make it one of the largest suppliers of gas to the East Coast. Given the recent energy problems in Australia, this makes Beach in our opinion an asset with strategic importance.

The other opportunity we initiated a small position in was Horizon Oil. Horizon has solid production assets and a potentially significant LNG project but does have significant debt in the balance sheet. The company almost went bankrupt during the oil price fall but has now cut back on capital expenditure and at an oil price of $60 trades on around 4x Free Cash Flow.

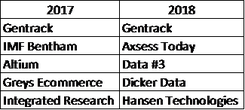

The other major shift in the portfolio can be seen through comparing our top five holdings to this time last year.

This time last year we were heavily invested in software companies (Gentrack, Altium and Integrated Research from above). Whilst on a Price to Earnings basis they weren’t the cheapest holdings, we believed the market was undervaluing their quality. Fast forward to today and we have vastly reduced our positions in Alitum and Integrated Research on valuation grounds. Our Technology position is focused on services companies trading on lower valuations (Data #3, Dicker Data and Melbourne IT) as well as software companies expanding their presence globally via acquisition (Gentrack, Hansen Technologies).

Overall, our portfolio is less concentrated and more diversified than last year. We like to buy quality companies but we like to buy them at the right price. Over the last year, quality companies have outperformed other factors and as a result we have reduced our exposure to a number of them. Whilst we have introduced a number of new positions over the last 12 months (11 in total), they are lower conviction positions and hence have a lower weighting in the portfolio. The resulting portfolio is a more diversified one.

Conclusions

As we written about previously, we expect a trend of increased infrastructure investment, lower residential investment and subdued household spending to continue (see here). In order to see the economy transition away from the mining boom, the Reserve Bank of Australia cut interest rates to spur economic transition. With the worst of the mining decline now behind us, the RBA is now reluctant for the interest rate cuts to continue (and at 1.5% there is a little scope for further cuts anyway). The interest rate cuts spurred a residential boom through both prices and (more importantly for the economy) construction.

Further interest rates cuts are most likely off the table now and that means no further boosts for the household. It also means house price growth will slow (and potentially reverse). With no sugar hits left for households, consumption is set to be weak and has been slowing for some time. This stagnation is the key risk in our opinion over the next 12 months.

Infrastructure investment is likely to take up some of the slack as the residential sector slows and we have rotated the portfolio towards this theme. However we do acknowledge that “Timing the cycle” is always difficult so whilst we do have an exposure to infrastructure, our major sector exposures continue to be Information Technology and Healthcare. These are two sectors that have structural tailwinds and contain quality niche companies that we believe will continue to perform strongly regardless of the economic cycle.

3 topics

Guy is the Chief Investment Officer at Quick Brown Fox Asset Management. Guy has over 13 years’ investment experience as an analyst and fund manager.

Expertise

Guy is the Chief Investment Officer at Quick Brown Fox Asset Management. Guy has over 13 years’ investment experience as an analyst and fund manager.