A new lease on life for this property stock?

In the latest iteration of the Firetrail Analyst Series we dive into an Australian company which we think offers compelling long-term value: Lendlease Group (ASX:LLC).

There's no doubt that Lendlease shareholders have endured volatility and pain over the years. The company has been a tale of two halves: a booming integrated property business and a loss-making engineering contractor.

While its stock price is down ~35% and hasn't recovered much since the COVID crash, we think Lendlease has strong turnaround potential as it prepares to exit its engineering business and focus on its very attractive pipeline of real estate developments.

Here, Blake Henricks expands on why a re-rating may be looming for Lendlease, just like the time when Woolworths exited Masters and Wesfarmers jettisoned Bunnings UK to focus on their respective core businesses.

Watch the video

Read the Q&A

What's the investment thesis behind Lendlease?

Lendlease is a development business, but what makes it different is it's integrated. So, what that means is Lendlease will go from sourcing a site, to creating a plan around that, creating an area where people want to work, live, shop, and then, once that's finished, either sell it or put it into the investment management business. So, it's really a life cycle business centred around property.

The reason we got interested in it was because Lendlease started losing a fair bit of money on engineering projects. Thankfully, we weren't invested through that period, but what it showed was that Lendlease was foraying into engineering projects, and if you think about tunnelling, think about large, one-off projects, that is engineering. It wasn't a good decision, they've probably lost close to $1 billion dollars of shareholders' money, but they've made a decision to exit that business.

And if you think throughout the history of investing, and you've even just seen in the last couple of years when Woolworths exited Masters, when Wesfarmers exited Bunnings UK, the market could focus on a really high performing core business, and we think that's what's hidden in Lendlease at the moment. We're getting closer to the engineering exit and that was really the opportunity.

What should investors pay attention to?

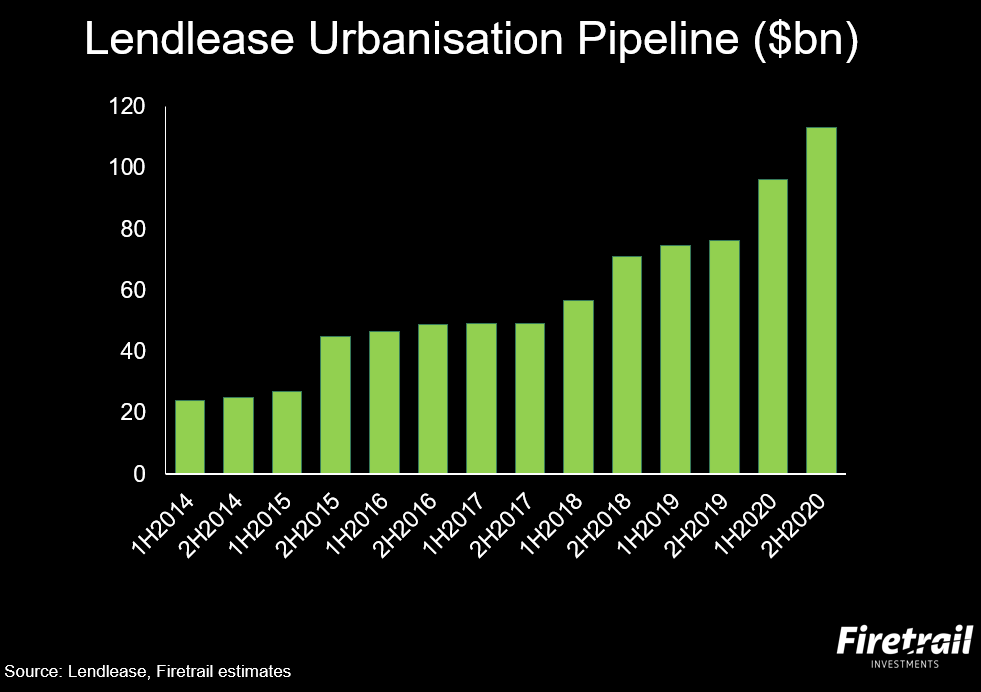

The key thing to watch is the development pipeline. Lendlease took on a strategy, going back 10 years ago, to focus on urbanisation. So picking off a handful of gateway cities, cities like Sydney, San Francisco, London, Milan, and said, "What we're really good at is just building really great places where people want to be live, shop, and work." And, that strategy has taken a long time to come to fruition, but it's coming to fruition right now (see chart below).

The current pipeline is $113 billion of development. In the last year alone, they've won $37 billion. And I think really the marquee project is the Google project. So, the Google project is 15,000 apartments. It's got over a $20 billion finished value, and it's representing almost 20% of the Lendlease development pipeline. Now, the reason that came to be was because the biggest loser out of the tech boom has been non-tech workers in San Francisco. The success of Google and others has sent prices of real estate up, they've sent rents up, and Google had a problem, and the problem was prices are too high, it's hurting diversity in the community.

Lendlease came in and said, "Well, let's do these 15,000 apartments. We'll do a mix of really nice places, but also some affordable places." And, what that's meant is they're solving a problem for Google, solving a problem for the community, and creating an opportunity for Lendlease's shareholders. This development pipeline is going to be realised over the next, at current run rates, 25 years, we think it could probably be sooner, through an acceleration of the development pipeline, but that's really what you're getting.

The second reason we really like Lendlease, is because of the management and the incentives and the discipline in capital. Lendlease has some really disciplined capital metrics. In development, they want to do a 10% to 13% return on invested capital, in investments, it's 8% to 11%. Management are heavily incentivised with long-term management targets, and what it creates is a culture of long-term shareholder-friendly value creation. Those two reasons, that big development pipeline, and also really strongly incentivised management make Lendlease very attractive.

What's the outlook from here?

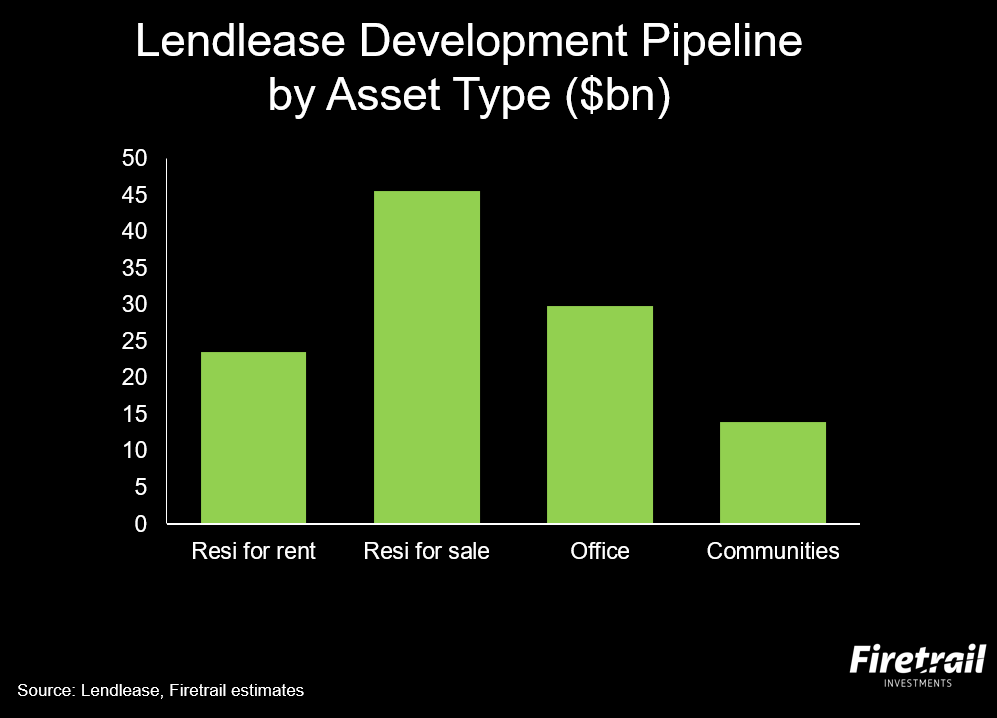

The outlook is really predicated on the development business. And so, if you look at the development pipeline, that $113 billion I was referring to earlier, you've got a part which is office, and a part which is residential.

If you look at the office side, they are in gateway cities, places where people want to work and live, so they're very well located. Right now though, with COVID, there's obviously a bit of a dampened demand and uncertainty about the future. One area where there's no uncertainty is on investor appetite. So, if you look at Lendlease, they've got 150 capital partners in the stable. Many of these partners have committed capital, they're very interested in allocating more capital to Lendlease projects, and I think over the medium term, even if office takes a little bit of a step back, many of their projects are very well located and are really quality assets. So, offices right now, maybe a little bit tough, but I think for a medium-term investor, that asset is very, very lucrative.

On the other side (see below), it's residential, and there are two parts of residential: for-sale and for-rent. If you look at for-sale, the marquee project at the moment is Barangaroo. You may have seen this, but they recently smashed all the records, they sold a $140 million penthouse at Barangaroo. It's smashed all the records for the highest selling price, the highest dollars per square metre. That's the for-sale part.

Resi-for-rent is probably where it's most interesting at the moment, it's one of the hottest asset classes around, the cap rates are very, very tight, and what they're doing there is converting sites owned by Lendlease and a partner, and then they're renting them out in totality. So, you've got a really diversified client base, which is individual tenants, and there is so much demand for this asset class.

If you look at the Google example, 15,000 apartments, probably around 70% of those are going to be Resi-for-rent. So, I think overall, the development pipeline is in an attractive space, and it's going to grow very well over the next, at the moment, 25 years. We do think they can accelerate some of that and that's really the opportunity.

What does the Lendlease of the future look like?

Lendlease in the future is going to be recognised as more of an investment manager. Now, this isn't going to be an overnight trend, but as that development pipeline converts into investment management, and that's the high multiple stuff, people don't love development, and I understand why, but as that office and residential and the Resi-for-rent move and transform into investment management, taking long-term, recurring fees, asset growth, rental growth, that's what people are going to see in the future.

And that's why this latent value in Lendlease is so attractive. With engineering as the headwind today, we do see that as moving to the side, and people being able to focus on a really great core business with massive growth potential in the future.

FOLLOW us to get first access to these reports

We hope you enjoyed this wire on Lendlease. If you'd like to receive our other exclusive reports first, hit FOLLOW below. For our previous insights, click here.

4 topics

1 stock mentioned

2 contributors mentioned