A possible reason for the recent weakness in EBOS and Spark share prices

If you have a KiwiSaver account, there is a high chance that the MSCI All Country World Index (ACWI) has a bearing on the composition of your global equity exposure. It might be that your KiwiSaver provider takes a passive approach to allocating your savings, in that case there is a high chance that the ACWI determines exactly which global shares you own and in what proportion.

On the other hand, you might be using a fund manager that adopts a more active approach to security selection, in that case they may be taking active positions against the ACWI, in which case the ACWI has a lesser effect on what global equities you own but it may still play a part in how that manager positions their global equity portfolio. This situation is not unique to New Zealanders, savers across the globe have exposure to the ACWI which means that according to MSCI that, at the end of 2023, USD $4.6 trillion was benchmarked to the ACWI, either through passive or active investing. So, sort of a big deal.

That in turn means that being a member of the ACWI has some bearing on the ownership of the shares of a company. Simply put, going into the ACWI is good for a share price, going out is bad for a share price. It’s a supply and demand situation. I won’t dwell on this point as it means that the share market is not fully efficient. The share price of a listed company should solely be determined by the intrinsic value of that business not by it being a member of an index, even a very important index. But let’s move on.

There are countless ways of investing out there, such as value, growth, GARP, blend, as well as arbitrage hedge funds. The latter is the one that is of most interest in this article. Arbitrage hedge funds are looking to extract a buck in a low-risk way from some of the share markets more blatant mispricing’s. The somewhat obvious tautology of a blatant mispricing that it can’t, or at least shouldn’t, be a large mispricing. A classic example of an arbitrage trade is a dual listed company, for example one that is listed in New Zealand and Australia, that is trading at a different price to the price it is trading in the other country. When this happens, it creates a very low risk opportunity for an investor to trade in both markets and pocket the difference as a profit. The only problem is that the profit is generally small from this type of activity. But investors have a happy knack of finding a solution to most hurdles to a generous return. In this case the solution is leverage, borrow money to do the small trade many, many times, which can ultimately turn the small profit into a big one.

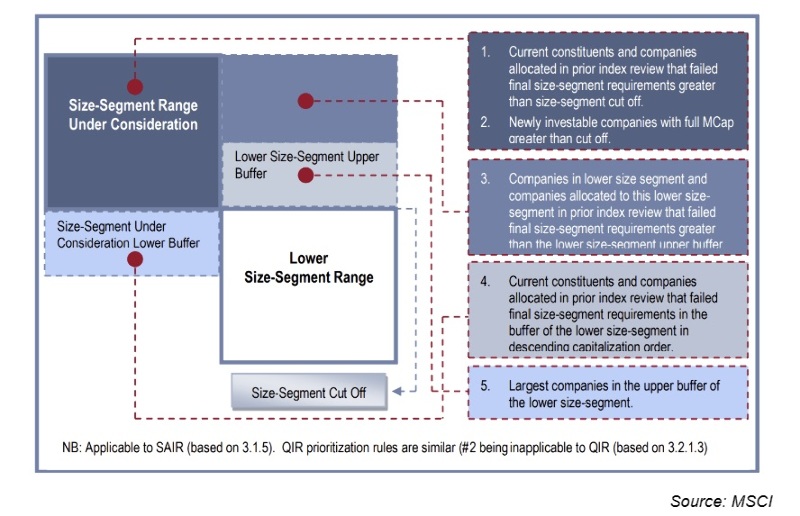

Another trade that arbitrage hedge funds can look for, is companies that are destined to be added or removed from an important index, such as the ACWI. It would be easier on both the writer and the reader of this article to take it as read that the rules that govern the composition of the ACWI are complicated. Feel free to download the 206-page pdf here if you don’t believe me - Index methodology - MSCI But if you are prepared to learn all the rules by heart you can be one of the first to figure out companies that are likely to be added or removed from the index, step forward the arbitrage hedge fund.

The afore mentioned complexity is in large measure down to some of the goals of a good index creating a need to manage levels of conflict. Targeting an index that is investable, representative, low turnover, diverse and trackable requires compromises which creates complexity. One result of this complexity is a situation that is playing out right now in the New Zealand share market. New Zealand has six companies that are members of the ACWI. One of them is EBOS Group but perhaps not for much longer.

Due to the recent drop in the share price of Spark, another of the current members, New Zealand may only be entitled to have five members of the ACWI going forward. And the casualty of that change would be EBOS as the smallest of the current six. As mentioned before being a member of the ACWI is a pretty big deal and so is no longer being a member. Broker Forsyth Barr estimate that being removed from the ACWI could trigger passive investors to sell 9.7 million shares of EBOS on the day it exits the ACWI, which represents over 13 weeks of normal daily trading in EBOS[1]. The supply and demand dynamic is pointing to potential EBOS share price weakness due to the sheer volume of potential index related selling.

Chart of EBOS recent share price action Source: Bloomberg

In the chart above you can clearly see that the daily volume, the bars below the price chart, gets larger in early March but are still multiples smaller than the required 9.7 million shares. At the same time the EBOS share price weakens coming from close to $38 down to closer to $34. Talk of a possible exit from the ACWI could well be having an impact on the EBOS share price. Remember though it is the Spark share price that ultimately determines if EBOS stays or goes.

The chart above shows that the Spark share price has also been weak in recent times. Forsyth Barr estimated that a Spark share price of below $4.80 between the 17th and 30th of April would likely trigger the EBOS exit from the ACWI. Funnily enough the Spark share price does indeed slump below that level during that period. We cannot know for sure but if you were running an arbitrage hedge fund a possible trade would be to short sell EBOS now in the expectation of buying it back cheaper when the 9.7 million of index selling hits the market. But to make sure EBOS does leave the index, the arbitrage hedge fund also sells shares in Spark to contribute towards a weaker share price. This is obviously pure speculation on my behalf but it’s a big coincidence. But it will certainly be fascinating to see what happens to EBOS and Spark share prices in May especially if EBOS is indeed removed from the all-important ACWI. Time will probably tell whether or not arbitrage hedge funds were active in our share market over this period.

5 topics