A rally is raging in this unloved sector, could this small cap be next?

Pinnacle, Perpetual, Platinum, Magellan, GQG and Regal Partners, the six firms most investors would think of when asked about investing in ASX-listed fund managers. Although, I’d argue that this has been a cluster of stocks that has been largely overlooked due to a string of high profile burnouts and generally poor sentiment towards active management.

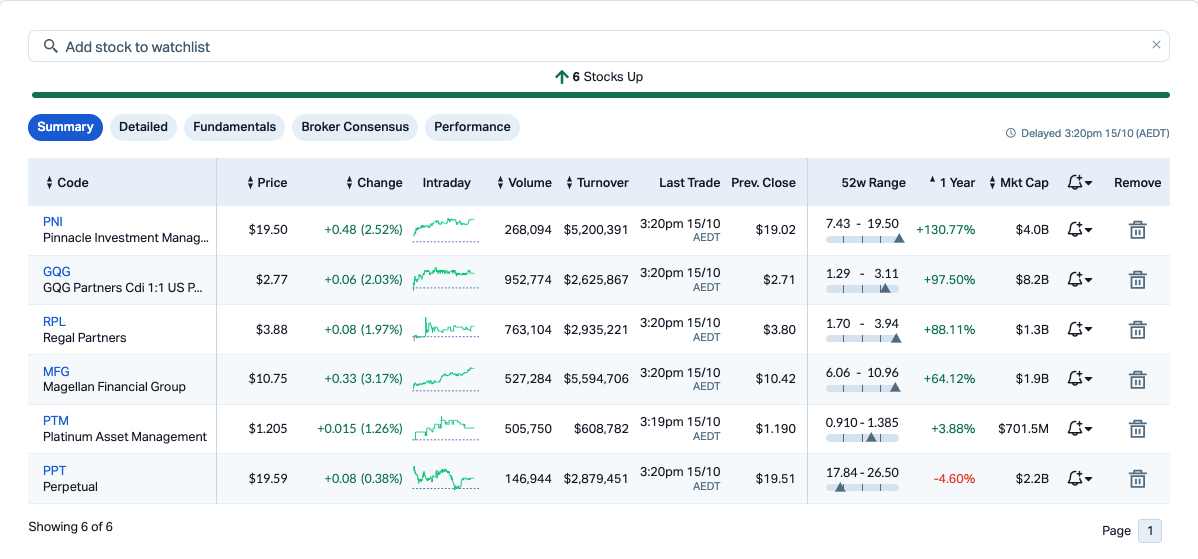

So, when I pulled up my watchlist, I was a little surprised to see bumper 12 month returns for four of the six names. Over the past 12 months you’re looking at an average return of 63%, Pinnacle is leading the pack, Perpetual and Platinum the laggards.

Sentiment looks to be improving after Calastone reported Q1 of 2024 as the worst on record for equity fund flows. Share prices are now reflecting optimism and some evidence to suggest that fund flows may have bottomed and to a larger extent the leverage these businesses have to rising markets.

A small cap moving up the ASX

Flying under the radar of these established brands is Navigator Global Investments (ASX:NGI), currently capped at $850 million and up 38% in 2024. Navigator owns minority equity stakes in 11 asset management businesses across a range of asset classes and geographies.

There are some similarities between Navigator and Pinnacle when it comes to equity stakes in multiple fund managers. However, Navigator takes a less operational involvement compared to Pinnacle, where back office and distribution have become a point of difference for the stock.

What is unique about Navigator is that it is entirely focused on alternative asset managers, a part of the market attracting a lot of interest from asset allocators ranging from sovereign wealth funds right down to wealth management firms and individual investors.

The stock caught the attention of small cap investor Adrian Ezquerro from Elvest who believes the Navigator has been put in the ‘too hard’ basket by brokers and fund managers due to a legacy agreement around fee revenue.

Ezquerro is far more optimistic and believes Navigator Global can exceed market expectations for earnings over the next three years.

“Elvest currently forecasts compound earnings growth of between 10-15% over the next three years (FY2024-FY2027), which compares to consensus at just 0.7%,” wrote Ezquerro.

New leadership

12 months ago Navigator announced that Stephen Darke, a 23 year veteran of Macquarie Group, would take over as the firm’s Chief Executive Officer. Darke has experience in the alternative investment space but importantly he is based in Sydney, enabling him to engage with local investors.

One trend that is playing out globally is the ‘democratisation’ of alternative asset classes and Darke expects this to continue gathering pace in Australia.

“There is an increasing acceptance by family office investors, wealth platforms that perhaps locking up your capital for a little bit longer can really allow you the opportunity to generate quality risk adjusted returns,” said Darke.

“You're seeing the development of products that are a bit more focused on retail investors, wholesale investors and high net worth investors. There's been innovation on that front. As a result the taps have opened a little bit more for access into Alternatives and I think that's going to continue at a very fast rate of knots.”

Notwithstanding this trend, my view is that there are still some meaningful barriers for investors looking to access Alternatives, not least of all the due diligence required to pick a decent manager.

So if you believe Alternatives are going to play a bigger role in portfolios but you're not sure how to access the opportunity then perhaps gaining exposure through a listed player is an option worth considering.

I was introduced to Stephen via the team at Elvest and I invited him as a guest in our Alternatives in Focus Series for 2024.

In the interview below, I ask Stephen about the trends he is seeing in Alternatives, what he looks for in a manager and his growth plans for Navigator Global.

Time codes

- 0:00 - Introduction

- 0:45 - About Navigator Global (ASX:NGI)

- 2:30 - Lessons from the GFC

- 3:37 - The strategies Navigator has partnered with

- 8:18 - Where is the growth in alternative assets?

- 11:09 - Offshore trends coming to Australia

- 13:30 - Top of the list growth opportunities for Navigator

- 16:06 - Growth outlook

1 stock mentioned