A reimagining of global power, on the front line of the energy transition

The energy transition encompasses a reimagining of global energy production and consumption with the aim of reducing reliance on fossil fuels. As the CEO of Orsted (one of the world’s largest listed renewable energy infrastructure companies) recently stated:

“In a time of extreme heat in many places, it is painfully obvious that investments in transforming the worlds energy systems are more needed than ever.”

At the forefront of the energy transition is power generation, the largest source of carbon dioxide (CO2) emissions globally. Unlike hard-to-abate sectors (e.g., steel and cement) which face uncertainty in both technology and economics, the energy transition in power generation is in progress, is meaningful and is economically justifiable.

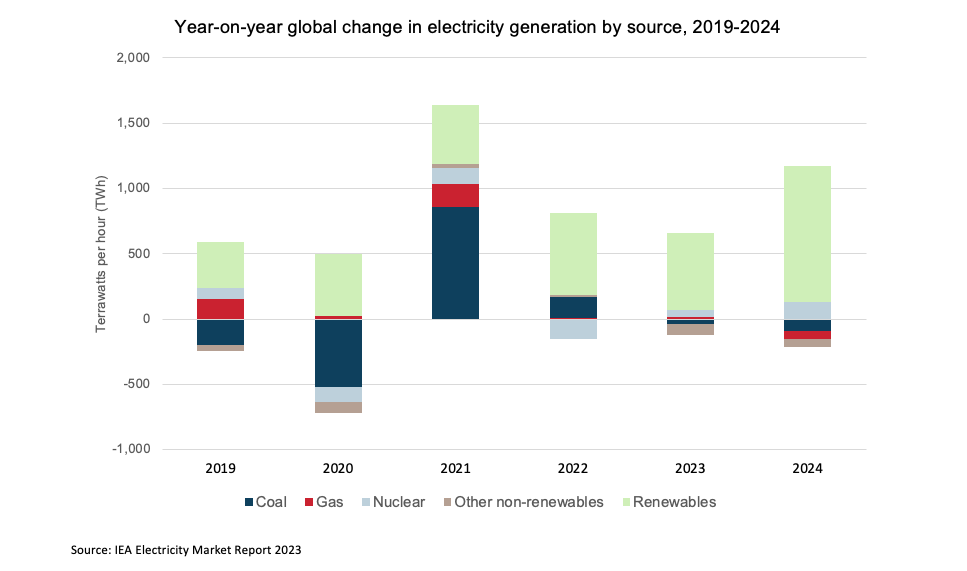

This can be highlighted by International Energy Agency’s (IEA) electricity market report update 2023. Looking at the year-on-year global change in electricity generation, in three of the last four years, renewable electricity generation has been the largest contributor to global electricity supply. Looking forward, this trend is set to continue, with only renewables and nuclear being net contributors to global electricity supply in 2023 and 2024.

Global Listed Infrastructure opportunity set in renewables

Global listed infrastructure provides arguably one of the best risk-adjusted ways to participate in the buildout of renewables, either directly through renewable developers or indirectly through utilities/electricity network operators.

While the risk and return characteristics of renewable developers and utilities are slightly different, both have infrastructure characteristics, namely: earnings are transparent and resilient, independent of economic cycle, typically inflation-linked, and long-dated. Let’s review the risk and return characteristics of each in turn.

Green shoots for improved return on capital for renewable developers

Starting with renewable developers, higher quality exemplars of the sector tend to focus on a build, own, and operate model. Renewable developers specialise in the planning, design, financing, construction, and operation of renewable energy such as hydro, biomass, geothermal, wind and solar.

Renewable energy assets are long-life assets, typically ~25-to-30+ years with return on capital being underpinned by contracts of similar duration (10-to-30 years), volume independent, and with pricing linked to inflation.

Governments around the world are increasingly incentivised to encourage renewable development due to the potential of green jobs that will be created through achieving clean energy policies as evidenced by US Inflation Reduction Act (IRA) and Europe’s Green Deal Industrial Plan.

Combined the US and EU clean energy policies allow for greater than US$1 trillion dollars in incentives and subsidies for clean energy investment.

Earlier this year, the US Energy Information Administration (EIA), the statistical and analytical agency within the US Department of Energy (DOE) analysed the impact of investment tax credits for clean energy alternatives highlighting two key conclusions:

- Economic cost of renewables (as measured by a levelised cost of electricity) will be well below alternative forms of energy (e.g., coal and natural gas);

- In 2030, electricity prices will be almost 10% lower than a no IRA scenario, positively impacting customer bills;

Because of this backdrop, it is anticipated demand for renewables will remain strong, allowing renewable developers to grow earnings strongly through the development of incremental capacity.

Inherently, however, there is higher risk associated with renewable developers compared to some other infrastructure asset classes because the return on capital can vary both lower and/or higher based on several variables. Return on capital can fluctuate based on cost of build, cost of finance), and technology risk (e.g., complexity/project management of deploying renewable energy). Acknowledging these considerations, since COVID-19, renewable developers have faced a negative feedback loop of increased inflation and supply chain disruptions and higher cost of financing which in turn, have reduced the risk and return payoff and by inference, valuations.

There are however some signs some of the headwinds renewable developers have been experiencing are dissipating given inflation attenuating, supply chain de-bottlenecking, and cost of finance moderating.

Encouragingly governments have acknowledged the increase in cost and accordingly have improved contract terms through improved taxation concessions, and pricing and inflation linkages. This bodes well for the sector and potentially allows for renewed investment opportunities.

But electricity networks remain the standout (risk/reward) winner of the energy transition

Utilities/electricity network operators are quasi-monopolies increasing regulated earnings through investment in the network.

New electricity supply (especially when it is renewables and distributed) requires significant upgrades to the ‘poles and wires’ of an electricity network, namely high voltage transmission lines and substations. Here in Australia, this need for investment into network grids is evidenced by state governments establishing renewable energy zones that attempt to coordinate incremental renewable capacity with new grid infrastructure.

The need for investment can be captured by the ratio of investment spent between renewables and networks. Global-listed electricity network owner Iberdrola (based out of Spain) recently highlighted:

“Based on either stated or announced climate policies from US and Europe, the ratio of investment between renewables and networks will increase from 0.7 currently to 1.0-to-1.2. That is, for every US$1 dollar spent on renewables US$1.00-to-US$1.20 will be spent on electricity networks.”

There is no transition to renewables without transmission.

It is anticipated utilities will undergo a multi-year, multi-decade upgrade cycle to facilitate electricity networks and grids to be able to allow more capacity, be more resilient, and handle more energy storage. This is beginning to be reflected in the data.

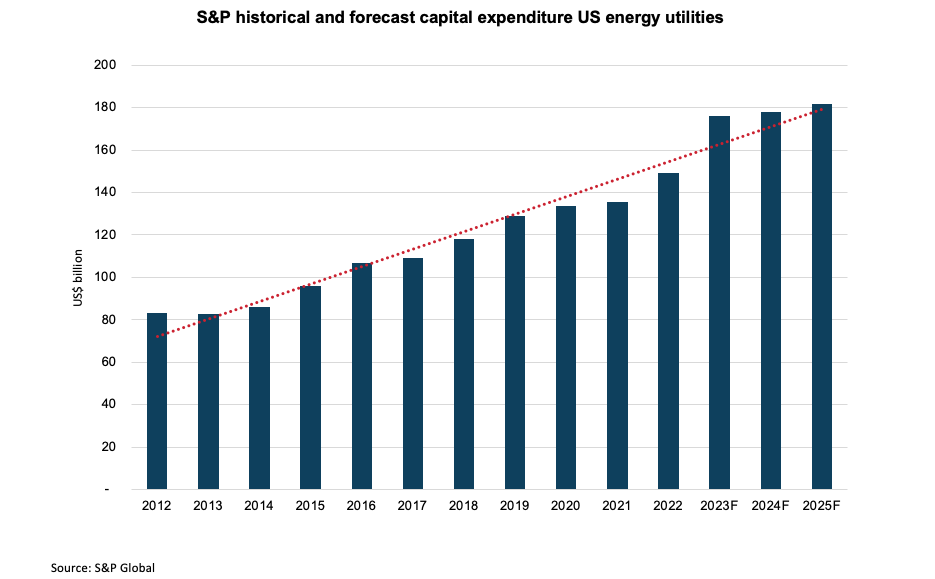

S&P has projected that the combined capital expenditure and earnings of US electric utilities from 2023 to 2025 will significantly surpass the trend. The appeal of this uptick in capital expenditure lies in the concomitant earnings growth and (regulated) return on capital. Thereby, with a higher level of confidence, investors can participate in the increasing need for clean alternative energy investment, as well as achieving appropriate returns.

Capitalise on structural change

A structural change is underway in the way energy is produced and consumed, with the buildout of renewable electricity on the front line, making Global Listed Infrastructure an excellent risk-adjusted sector to capitalise on this thematic, enabling access to high-quality global renewable developers and/or network operators.

Discover more about investing in Australian and Global Real Assets with Resolution Capital

1 topic

.jpeg)

.jpeg)