A rosier outlook for private health insurers, says UBS

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

S&P 500 - 4,024 (2.62%)

NASDAQ – 12,601 (4.26%)

FTSE 100 - 7,348 (0.57%)

STOXX 600 – 428.12 (0.46%)

USD INDEX – 106.46

US10YR – 2.785%

WTI CRUDE - US$98.12/bbl

THE CALENDAR

The Chart

So, what’s the story?

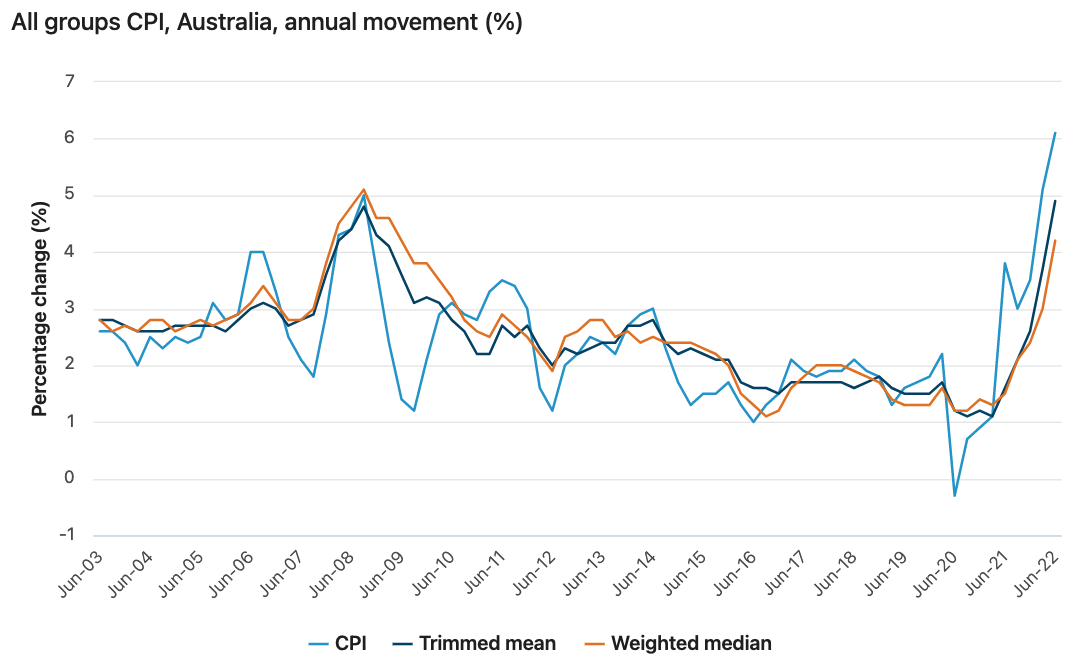

Annual consumer pricing index inflation increased to 6.1% in the June quarter, due to higher dwelling construction costs and automotive fuel prices. Annual trimmed mean inflation, which excludes large price rises and falls, increased to 4.9%, the highest since the ABS first published the series in 2003.

The higher prices of goods comprised 79% of the CPI for the most recent quarter, on the back of high freight costs, supply shortages, and ongoing strong demand.

The quarter also saw a historic rise in the price of new homes – the sharpest annual jump since the series started in the June quarter of 1999. These rises continue to be driven by high levels of building construction activity, combined with ongoing shortage of materials and labour.

The Stat

233%

March’s invasion of Ukraine by Russia, a major producer of high-grade nickel, saw the metal’s price more than double in just a few minutes – setting in motion global markets’ most recent short squeeze. Source: Janus Henderson on Livewire Markets: Anatomy of a short squeeze

STOCKS TO WATCH

Three highly diverse companies – in travel, technology and healthcare – hold Buy ratings in UBS’s latest report. Two of them, Corporate Travel Management (ASX: CTD) and Nitro Software (ASX: NTO) maintained their previous rating, despite having their price targets reduced. But health insurer Medibank Private (ASX: MPL) earned an upgrade from Neutral and saw its price target lifted by 16% to $3.90, from $3.35. Analyst Scott Russell cited MPL’s relatively stable revenues and predictable margins, improving claims trends assisted by Govt policy, and rising investment yields among its attractive attributes. “Whilst the stock doesn’t look cheap at around 20 times PE, we think these attributes are unique amongst financials and attractive at this point in the cycle,” he said.

THE QUOTE

“When you’re expecting a tonne of bricks to fall on your head and you only get 900 kilograms, HOORAY! The CPI was like that: not as bad as feared but still a shocker. Hitting the 2% to 3% inflation target seems a long way away. Inflation is a problem; the RBA needs to go 75bps next week.”

Economist Stephen Koukoulas, of Market Economics, on the latest quarterly inflation figure of 6.1% published by the ABS, which came in slightly below what many expected but is still troublingly high.

Today's report was written by Glenn Freeman

GET THE WRAP

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

3 stocks mentioned

1 contributor mentioned