A September cut is back on the table

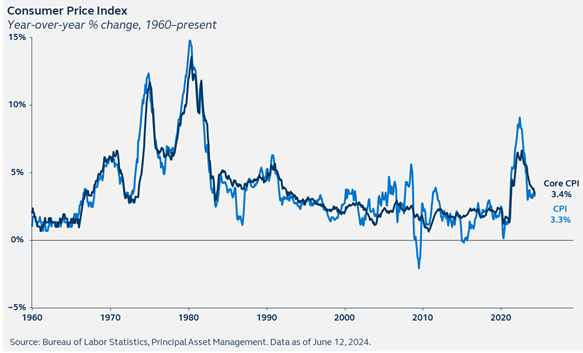

Today's CPI report came in softer than expected, delivering a positive sign that recent months of sticky inflation may have been just a bump in the road. Both headline and core inflation came in below consensus estimates in May, with core CPI rising just 0.2% month-on-month and headline CPI unchanged on the month. Today’s downside surprise is particularly welcome in light of last week’s blowout jobs report, and should go some way to easing fears that labor market strength may lead to renewed inflation strength. A September rate cut remains in the picture.

Report details:

• Headline CPI inflation eased from 0.3% in April to 0.0% in May, a significant milestone following many months of hot prints. This is the first time since July 2022 where there has been no change in monthly CPI. Core inflation slowed from 0.3% last month to 0.2% month-over-month, not only slower than the encouragingly low prints of late 2022, but the slowest pace since October 2023.

• Core goods continue to experience deflation, with prices declining marginally on the month. Core services prices rose just 0.2% on the month, the smallest increase since September 2021.

• Within core services, shelter remained a stubborn contributor to inflation, rising 0.4% for the fourth month in a row. Surveys continue to indicate an easing in these price pressures ahead, but it is taking a frustratingly long time to materialize.

• Removing shelter from the inflation numbers paints a much more positive picture. Core services ex-shelter— the Fed’s preferred CPI measure as it reflects the parts of the economy that monetary policy should clearly impact—was negative for the first time since 2021. However, it is worth noting that much of the slowdown in price pressures was in the airfares and auto insurance segment of CPI services— neither of which flow into the core PCE measure that the Fed targets.

Policy outlook

Last

week’s hotter than expected jobs report had raised significant market doubt

around the prospects of a September rate cut. Today’s inflation print appears

to have erased most of those doubts and the market is once again assigning some

probability to a September move. Even so, today is just one inflation number.

The Fed will need to see a series of soft inflation prints, as well as evidence

that the labor market is not restrengthening and risking an acceleration in

wage growth, before it can be sufficiently confident to ease. Fed Chair Jerome

Powell may have a spring in his step at today's FOMC press conference, but the

strength of last week's jobs report means that his tone should be one of

caution and balance.