A turnaround for graphite is brewing: Which ASX miners should you be watching?

Graphite has a lot going for it – The commodity is the single largest component in lithium-ion batteries, there’s been a substantial under-investment in new supply and the market wants to shift away from the Chinese dominated supply chain. But despite all this, spot prices have more or less gone nowhere in the past decade.

2023 has proven to be a challenging year for ASX-listed graphite stocks including Syrah Resources (ASX: SYR), Talga Group (ASX: TLG) and Renascor Resources (ASX: RNU) – which are down a respective 56%, 8% and 14% year-to-date.

So what’s the play – Is now an opportune time to nibble on graphite stocks? Or is it time to hang up the gloves and admit that lithium is the better battery metal?

In this piece and with the help of Fat Tail Investments’ James Cooper, we take a look at how graphite’s performed so far this year, what the near term looks like and the state of play for ASX-listed graphite names.

The story so far: Weak macro, struggling prices

What makes graphite such a tricky sector is that:

- Prices are very opaque

- Most of its current demand comes from industrial sectors for applications such as furnaces, kilns and boilers.

“When people look at graphite as an investment idea, they tend to think about its role as an anode material for EV batteries. But right now, around a quarter of graphite supply goes into making anodes. It’s quite a small amount,” said Cooper.

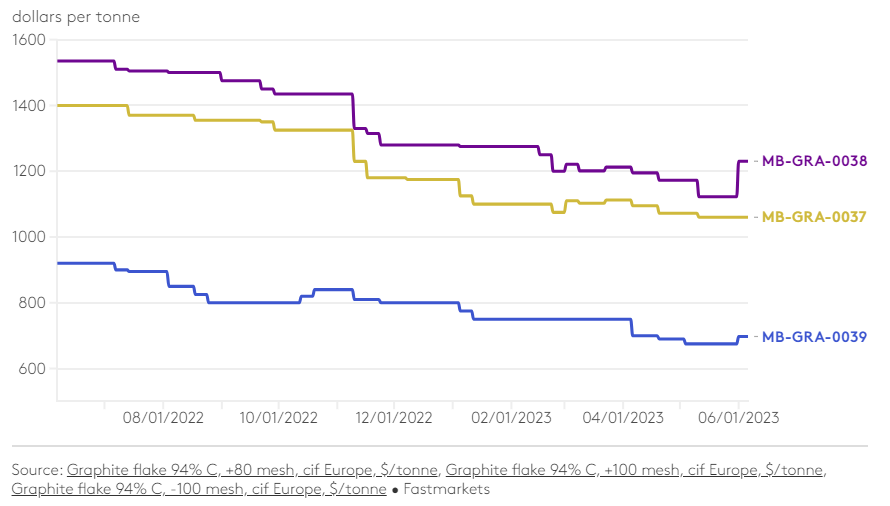

Graphite flake prices in China are down between 8-20% in the last twelve months, according to Fastmarkets. While prices in Europe are beginning to turn after a lengthy downward trend.

“Market sentiment remained bearish against the backdrop of sluggish demand in the downstream refractories and anode sectors,” the report said, which also provided commentary from various industry users:

- “There are only sporadic inquiries these days. And even if there is a deal, it is only for a small volume,” a trader in China said. “It is difficult to find any large orders under the current circumstances.”

- Elsewhere on the supply side, some producers have slowed or even temporarily halted their operations to keep prices from falling further, according to a second trader in China.

- “There has been a slowdown in the steel market, so we have not needed much material recently,” a consumer in Europe said. “We last bought in September and are only coming back to the market now.”

- “We really do not know if prices have bottomed out. It will depend on how demand evolves worldwide, and it will mainly depend on Chinese demand for spherical graphite,” a trader in Europe said.

Cooper also flagged synthetic graphite as another area that could be driving down graphite prices. Synthetic graphite is produced via a heat treatment process that causes carbon atoms to rearrange themselves into a crystalline structure that has higher conductivity, strength and purity than natural graphite.

“If energy prices are low, it makes synthetic graphite more viable. If energy prices rise, then we could actually see upward pressure in graphite prices because synthetic becomes less viable,” he said.

Graphite anode prices, both synthetic and natural, hit record highs in the first half of 2022 – When oil prices were trading as high as US$130 a barrel.

Where do we go from here?

Supply: China has the world’s largest graphite reserves but the majority of these reserves are low-grade, with flake sizes of less than 80 microns (not suitable for batteries and EVs). “A lot of areas in China have been shut down because of declining grades as well as strict environmental regulations,” said Cooper.

“But I don’t think we’re going to see an immediate cut in supply from China over the next 12 or so months.”

Demand: EVs only make up approximately 25% of current graphite demand. Which means two things:

- The graphite market is still heavily dominated by macro events

- This creates a massive runway for future uptake

Cooper referenced the research from Benchmark Minerals Intelligence, which suggests that global natural and synthetic graphite production needs to rise by 550% and 150% respectively by 2035 to meet “exceptional volumes of demand.”

But for now, graphite remains an industrial metal and given China’s subdued steelmaking and real estate industry – It’s got a bit of work cut out for it.

The state of play for ASX-listed graphite stocks

A few months ago, I wanted to provide a simple way for investors to see which ASX-listed graphite stock provided the best value for money based on 1) Market cap and 2) Mineral resource. You can read the full article here.

In summary:

- Names like Volt Resources (ASX: VRC), Syrah (ASX: SYR), Black Rock Mining (ASX: BKT), Ecograf (ASX: EGR) and Sovereign Metals (ASX: SVM) offered a better bang for buck

- Names like Talga (ASX: TLG), Renascor (ASX: RNU) and Quantum Graphite (ASX: QGL) were more expensive

- The ‘cheaper’ projects are all located in Africa while the more ‘expensive’ ones were all located in Australia or Europe

A tier-1 jurisdiction vs. Bigger resource

The data flags a bit of trade-off among ASX-listed graphite names. Should investors opt for those in tier 1 jurisdictions or those with a cheaper price tag and larger resource but based in Africa?

“Because graphite prices are still depressed, there’s not really any incentive to take on the extra risk of investing in Africa. Your focus should probably be on quality explorers and developers in stable jurisdictions,” said Cooper.

He also noted that the US Inflation Reduction Act – which offers partial tax breaks for critical minerals extracted or processed in countries with which the US has a free trade agreement – does not include Africa.

Stocks of interest: Syrah, Sovereign Metals & Renascor

Syrah is the largest ASX-listed graphite play and operates the Balama Graphite Operation in Mozambique. In late April, the company said it plans to “lower capacity utilisation to match periods of volatile customer demand and lower sales ordering,” which should not be surprising given the commentary from Fastmarkets.

“I don’t think there’s anything wrong with lowering output. It’s a strategic decision based on current prices. We saw a lot of uranium producers do the same thing five to six years ago during a trough in spot prices,” said Cooper.

In the context of longer-term fundamentals, “Syrah is one of the standouts because it’s a producer that’s outside of China, which is quite rare. If some geopolitical tensions between the West and China pick it, that could be a boost for companies like Syrah.”

As for where Syrah stands right now, “I would be a little hesitant still. I would be looking more into 2024 as a time where graphite demand could pick up,” said Cooper.

%20Share%20Price%20-%20Market%20Index.png)

As for interesting picks, Cooper brought Sovereign Metals to the table. The company operates the Kasiya Project in Malawi, which has the largest natural rutile deposit and one of the largest flake graphite deposits in the world.

“I think this [rutile] adds attraction because it has another element that’s not graphite, which I still see a bit of weakness over the next few months.”

%20Share%20Price%20-%20Market%20Index.png)

Processing graphite is typically quite polluting and damaging to the environment, which makes Renascor another interesting pick. The company is developing its Siviour Graphite Project in South Australia. Over the last five years, Renascor has developed a purification process that eliminates the use of hydrofluoric acid.

“I think this will appeal to the Tesla’s and the big EV manufacturers that they can advertise this to,” said Cooper.

This article was first published for Market Index on Tuesday, 13 June 2023.

4 topics

8 stocks mentioned

1 contributor mentioned