A Value Investor's Perspective on Digital Disruption

“Digital disruption” has been a catch-cry for new technology companies that are challenging established and traditional business models. Investors often think of digital disruption as the world of growth and momentum investing, of companies in exciting developing industries and of the lofty valuations these businesses frequently attract.

It is not seen as the realm of the value manager, who relies on traditional valuation techniques and would see valuations justified on the basis of a “revenue multiple” or with reference to “total addressable market” as bearing striking similarity to the “revenue to eyeballs” metrics used in the heady days of the dot-com boom. However, a grasp of the “digital disruption” concept is crucial for a traditional value investor.

Understanding broadly how disruption works, what opportunities there are to take advantage of any disruption that is taking place and what makes an incumbent business model defensible in such circumstances are all critical elements in managing an investment portfolio and any risks to a portfolio from potential disruption.

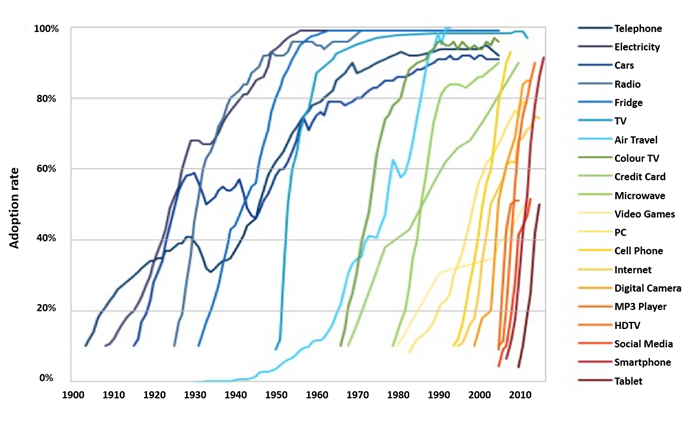

As part of our investment process we assess the likelihood of potential disruption to the businesses we invest in. Businesses get sold off heavily on the fear of disruption for the simple reason that, in today’s world, new technology can displace traditional business models in very short time frames. In fact, as demonstrated by the chart below, the speed with which new technologies are adopted en masse has shortened considerably over the last century.

US Technology Adoption Rates, 1900 to Present

Source: BlackRock, Asymco, Tony Seba

The adoption of new technologies is not linear but instead typically follows an “S-Curve”. This is because early iterations of new technologies are often not sufficiently compelling, cheap or scalable to drive mass market adoption and initially there might be a lack of supporting infrastructure. Over time successful products reach a tipping point after which uptake increases exponentially. The tablets we now frequently use can be traced back to the Linus Write-Top of 1987, the GRiDPad of 1989 and Apple’s own Newton MessagePad in 1993. But for a variety of reasons widespread adoption of tablets did not occur until decades later. With accelerated technological growth and more efficient supply chains, S-Curves have steepened.

It is worth noting that insiders in incumbent companies often have a poor record of predicting the success of disruptive threats. Former Microsoft CEO Steve Ballmer infamously predicted in 2007 that “there’s no chance that the iPhone is going to get any significant market share”. Similarly, former Blockbuster CEO Jim Keyes concluded in 2007 that Netflix was not “even on the radar screen in terms of competition”. Management complacency to disruptive threats can be a red flag.

However, investors also appear to have an observable bias in favour of assuming successful disruption. There are many times when investors assume that the incumbent will not succeed in repelling the threat, in transforming their own business and improving their competitive position. In the domestic market, there is an assumption that online retailers will disrupt their traditional bricks and mortar peers. Yet we find an increasing amount of evidence to suggest that, following significant investment into technology and online capability, many of the traditional retailers are leading the way in developing a strong digital offering as part of a powerful omnichannel strategy. The natural advantages of incumbency, including existing relationships with a large customer base and a wide product and service offering, can be ignored by investors. The presumption that these businesses will be displaced by disruption can present an opportunity, especially when a strong and growing business is sold down to highly attractive prices.

For the disruptors, it is worth noting that there is no guarantee that the company which invents a new technology will be the one to capture the value from the development. Facebook did not invent the social network. Alphabet (owner of Google) did not invent the search engine. But both have capitalised on these technological breakthroughs to become the leaders in their respective fields. Trying to pick an early winner amongst possible “disruptors” can be very difficult. Paying a lofty price based on the assumption that a company will emerge as the winner can be fraught with danger.

The success of a disruptor is also often reliant on the complacency of an incumbent. When incumbent management are focused on protecting their existing high margin business and short term profitability, at the expense of customer satisfaction and long term viability, they run the risk of destroying significant shareholder value. This happens despite incumbents often having far more resources to innovate than disruptors. As Harvard Business School Professor Clayton Christensen points out, disruptive innovation often comes down to “a marketing challenge, not a technological one.” For example, it is easy to forget that Kodak invented the digital camera in 1975.

As a value manager we would always be concerned about a management team that was dismissive of a viable threat to their business model. Conversely, where management teams are responsive and heavily investing to compete in a changing landscape, we find that the natural resource advantage of the existing players is often discounted more than it should be. Disruption is not a foregone conclusion. There are plenty of examples of incumbents thriving in the face of new competitive threats and potentially disruptive technologies. These are the companies that are investing for the future and adapting to a changing landscape. We are cognisant of disruption risk and always carefully consider whether an incumbent’s competitive advantage is sustainable prior to any investment. If our conclusion from this analysis is that market concerns of disruption risk are overstated, this may present us with an attractive opportunity to invest in a high-quality business at a discount to its intrinsic value.

Our value-based approach does also not preclude us from investing in attractively priced disruptors. There are occasional situations where the upside associated with successful disruption is not being considered or valued by the market. Or we might find an attractive investment in a company that offers a derivative exposure to a disruptive trend. As Mark Twain suggested “during the gold rush, it’s a good time to be in the pick and shovel business.”

We will continue to monitor disruption risk across our investments carefully to assess what implications there might be for incumbent businesses. We focus on an objective analysis of the market environment and the risks and opportunities for the companies involved. Indeed we currently have a number of investments in businesses where little value is being attributed to the fact that they are a key player in disrupting existing business models, which could create significant future value for shareholders. We will continue to look to take advantage of the range of opportunities presented by the inevitable digital disruption that is currently occurring and will occur into the future.

Tim Carleton is Principal and Portfolio Manager at Auscap Asset Management, a boutique Australian equities-focussed long/short investment manager. This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. A person should obtain and consider the Product Disclosure Statement before deciding whether to invest in any Auscap fund.