Act in Haste, Repent at Leisure

From complacency to fear to excitement. Such is the journey of an investor. Right now investors with capital to deploy should not be afraid but excited – and of course patient.

In order to explain why, investors firstly need to hone in on what is actually important. There is an enormous amount of information circulating at present –a record amount. Investors need to turn down the volume on most of it and focus on the handful of things that are actually going to make a difference.

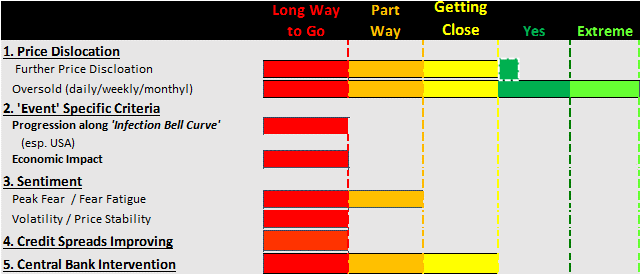

At Katana, we have over 70 macro factors that we consider during extreme market moves, but only a handful of these will drive the eventual outcome. In our earlier article Getting Perspective on Markets, we highlighted the 3 things that we are looking to see before increasing our exposure:

- Further price dislocation

- Progression along the ‘infections bell curve’.

- Fear fatigue / maximum bearishness

As the dislocation has unfolded, we’ve also added credit spreads, as there remains the very real danger that the credit markets may catch the Corona virus. Rounding out the list is Central Bank intervention, which is the swing factor.

The following points are clear at a glance:

- The market is heavily oversold, and prices have retraced enough such that if the crisis itself was more advanced, then now would be an opportune time to buy

- However, we are still in the earlier stages of this crisis as viewed through the lenses of both infections and the impact on the economy

- Accordingly, we have not reached the point of maximum fear, as the price volatility clearly demonstrates.

This makes it relatively clear that it would be premature to deploy further capital at this time. But perhaps more importantly, it also provides a clear pathway as to when that decision makes sense. In times of sensory overload, a clear, simple, objective strategy is our only hope of making the right decision at the right time.

Of course, this situation is fluid. And one of the most important points we made in our original piece, is that we have a new playbook and Central Banks are empowered and coordinated to act in a way we have not seen before. As we wrote last week, we will see ‘shock and awe followed by more shock and awe until the crisis is resolved’ In the past week we have indeed seen ‘shock and awe’ on an unprecedented scale. To be clear, this has not arrested the crisis as yet. But we should expect this to continue until it does.

The comment has been made repeatedly that Central Banks are running out of policy tools. I think this is off the mark. Governments will empower Central Banks with new and stronger tools. Consider for a moment what would happen if the US Congress empowered the US Fed to buy stocks in the market via say ETFs? This would seem a logical and realistic step under the current administration, and it could see the market rally 10%+ in a session.

Of course, ever burgeoning budget deficits, expanding Central Bank balance sheets and ‘creative’ new policy tools are not without consequences. But as has been the experience for the past decade, that will be tomorrow’s problem.

In the meantime, we must focus on probabilities not possibilities. For the time being we sit and wait. We wait for:

- infections to progress along the bell curve, esp. in the US

- the economic impact to be quantified and analysts downgrades to flow through and/or

- further Government and Central Bank intervention on a scale that turns the tide.

As one of the great pioneers of the markets in Jesse Livermore quipped nearly a century ago ‘I made the big money from sitting’. Sit we shall, but with a close eye on the above factors.

3 topics

.jpg)

.jpg)