Actively managed small caps are a core portfolio holding

Flinders Investment Partners

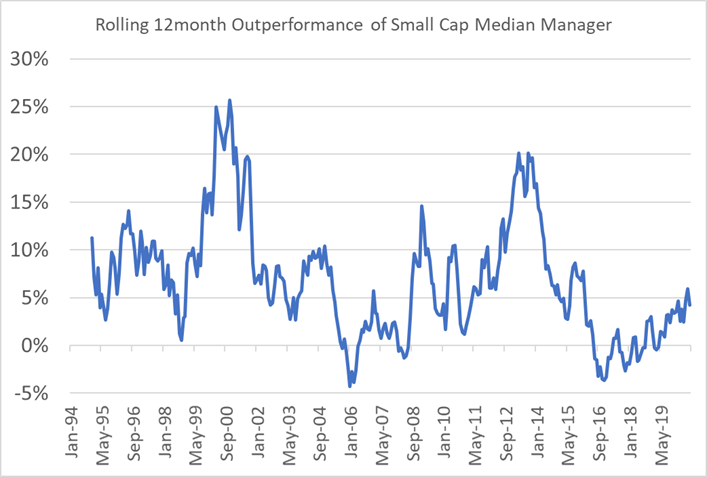

We have chosen the 5-year anniversary of the Flinders Emerging Companies Fund to review the performance of active managers in the Australian Small Cap sector. It is important to note that historically, active management has consistently delivered outperformance against the S&P/ASX Small Ordinaries Index as illustrated in Chart 1, a time series of rolling 12 month outperformance* of the median small cap manager.

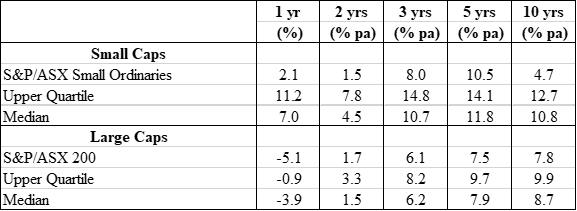

The last five years has actually been one of the tougher periods for the active small cap manager (a period that has coincided with a lower than usual level of cross-sectional volatility, which measures the spread of stock returns. See our earlier note here). Despite this, the median manager has still outperformed the benchmark (11.8% p.a. vs 10.5% p.a., Table 1). Importantly, the asset class continues to provide vast opportunity to deliver returns for investors.

Chart 1. Outperformance of the median small companies’ manager (rolling 12 months)

Source: Mercer, Flinders Investment Partners

When comparing across asset classes, while the Small Ordinaries Index has outperformed the ASX 200 benchmark in the last five years, it has underperformed over the last 10 years (Table 1). Interestingly, the median small cap manager has outperformed both benchmarks, as well as the top quartile large cap (Australian Equities) manager over the 10-year period. In fact, the median small cap manager exceeded the return of both indices over all periods, including the top quartile active manager in large caps.

Table 1. Australian Small Company and Australian Equity Manager performance (to August 2020)

Source: Mercer, Flinders Investment Partners

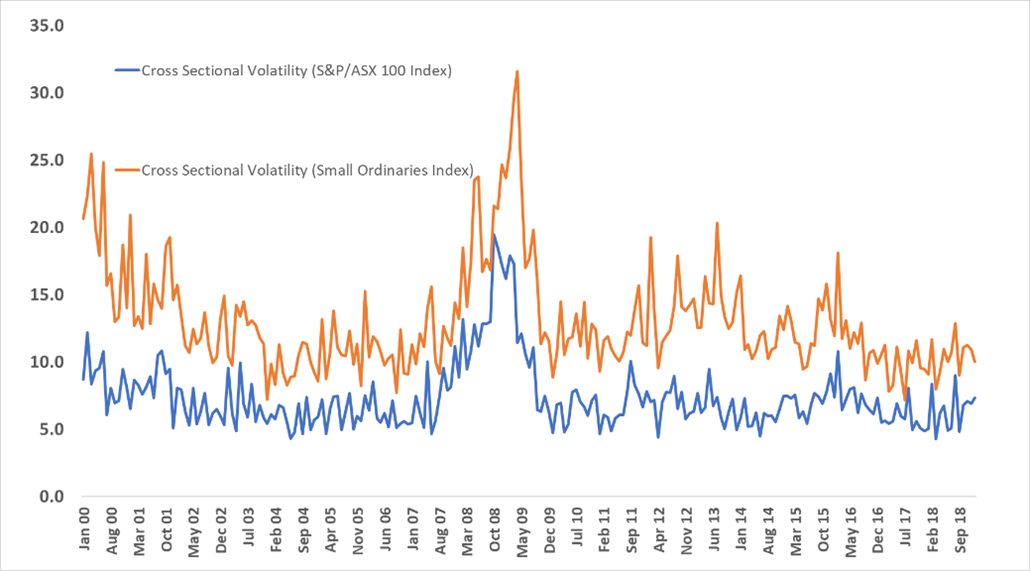

This outcome is not surprising. We have highlighted previously, that the cross-sectional volatility of the small companies sector is materially higher than the S&P/ASX 100 sector (which constitutes ~90% of the S&P/ASX 200 index, see Chart 2). The cross-sectional volatility represents (amongst other things) the opportunity set available to the investor. The higher the dispersion of returns, the higher the opportunity to add value. As the small cap asset class exhibits higher dispersion than large caps, there is the opportunity to provide higher returns.

Chart 2. Cross-sectional volatility for the S&P/ASX 100 (large caps) and the S&P/ASX Small Ordinaries (small caps) Indices

Source: Flinders Investment Partners

The debate about the level of small company exposure in a portfolio has typically revolved around an assessment of their characteristics relative to large caps. As demonstrated in Table 1, the average Australian Equites manager has delivered returns close to the benchmark (and probably under the benchmark, after fees). This cannot be said of the small cap sector, where the median manger return has consistently and materially exceeded the benchmark. Therefore, an asset allocation decision on the viability of a small cap allocation based purely on analysis of the benchmark returns, ignores the demonstrated alpha opportunity available for investors over time. Hence, a small cap exposure is core to any portfolio allocation to equities.

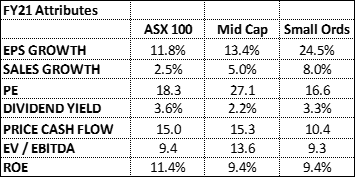

A final point on valuation. Markets have rallied strongly since the trough on 23 March 2020. Suffice to say, equities have re-rated aggressively. From this perspective, it is prudent to assess the current valuation and growth characteristics of the market segments to determine suitability for continued investment. Table 2 illustrates FY21 consensus expectations for large caps (S&P/ASX 100), mid caps (stock 51 to 100 within the S&P/ASX 100), and small caps (S&P/ASX Small Ordinaries i.e. stocks 101 to 300), based on FactSet consensus data. The key outcome here is the attractiveness of the small cap sector from both a growth perspective and from a valuation perspective. It is also important to note that the earnings growth illustrated below has been achieved off positive earnings growth for small caps in FY20, while large caps delivered negative growth in FY20.

Table 2. Market fundamental attributes

Source: FactSet, Flinders Investment Partners

Importantly, the opportunity set presented by the small cap sector allows the fund manager to demonstrate both their stock selection and portfolio construction skill. It is entirely possible to identify and construct a portfolio of high earnings growth companies with attractive valuation characteristics.

* performance data used in this report are before fees

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

Andrew is Founding Partner of the Flinders Emerging Companies Fund, which provides investors with an actively managed portfolio of listed small and emerging Australian companies, and is one of the top investment managers in the space.

Expertise

Andrew is Founding Partner of the Flinders Emerging Companies Fund, which provides investors with an actively managed portfolio of listed small and emerging Australian companies, and is one of the top investment managers in the space.