Affluence's go anywhere fund offers 7.5% income and no headaches

Aussie shares and their fully franked dividends are a staple diet for many Australian investors; however, fixed income has traditionally played second fiddle in portfolios. The barriers to entry range from a lack of understanding through to an inability to access specific asset classes and more recently the simple fact that yields were unattractive.

Many of these barriers are breaking down as higher interest rates and a burgeoning fixed-income market present new opportunities across asset classes, offering diversification and income to a portfolio. However, knowing where to invest and how to manage fixed income assets remains a hurdle for many investors. That’s one problem Affluence Funds Management’s Daryl Wilson is tackling with the Affluence Income Trust.

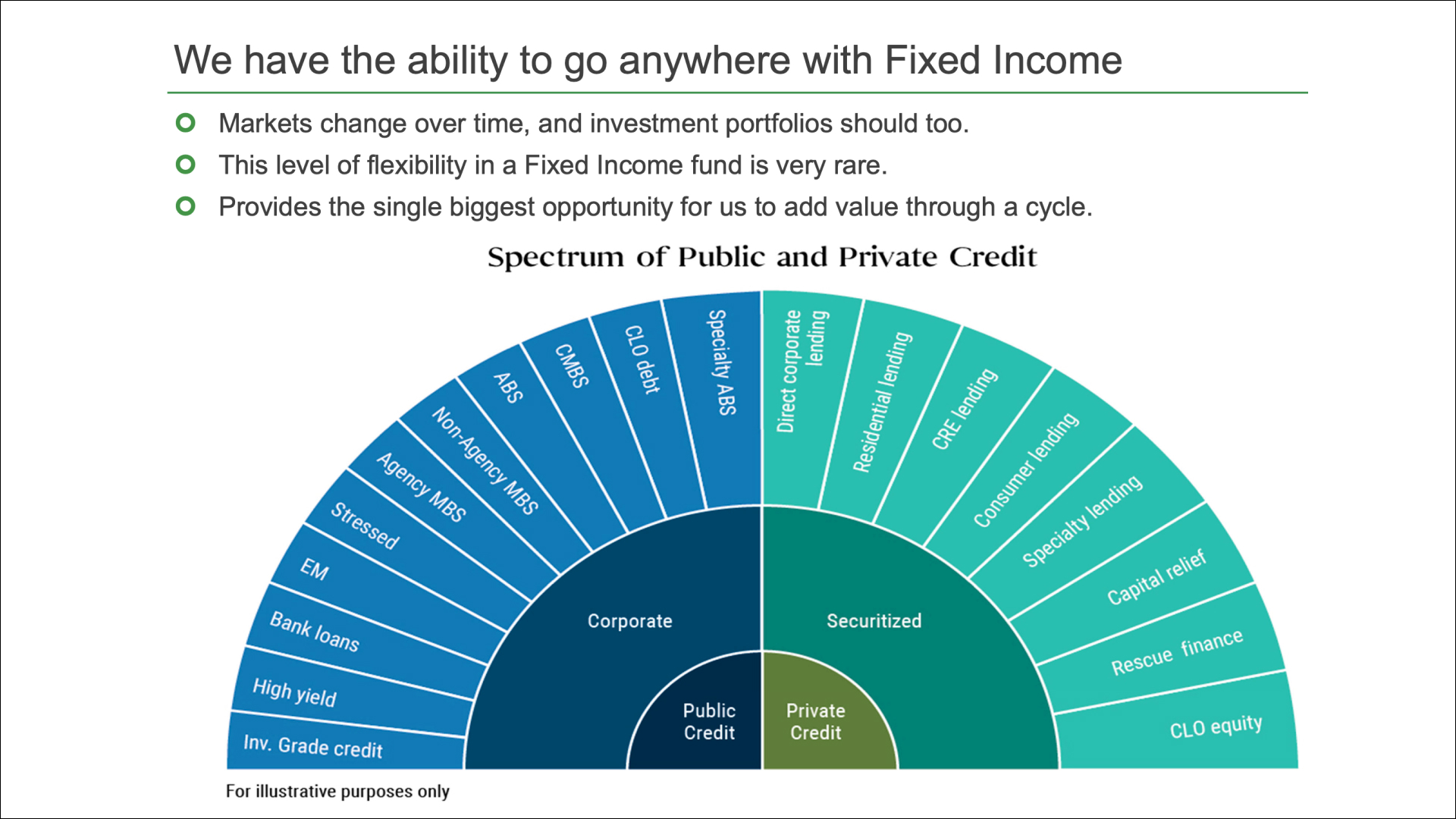

Affluence has adopted a fund-of-funds structure, allowing them to effectively ‘go anywhere’ across the spectrum of fixed income asset classes depending on where the best opportunities exist. The Affluence Income Trust is currently paying investors 7.5% per annum, and Wilson says these returns can be delivered without taking excessive risk.

“From 2014, when we started Affluence, until early 2022, we had very little fixed income in any of our portfolios. The pitiful yields just weren’t attractive. Now it’s different. Returns of 6-8% are achievable comfortably, provided you do your homework well,” he said.

In this Q&A, Wilson explains why he remains cautious about markets and where he sees opportunities. He also introduces the Affluence Income Trust and what makes it unique for investors seeking fixed income exposure.

In February this year you outlined a cautious view on markets and the challenge facing central banks. Are these views current, how are you seeing things right now?

Certainly, we believe that getting inflation sustainably back inside the RBA’s range of 2-3% will be a challenge. Which means that without some genuine economic pain, it will be hard for interest rates to fall meaningfully.

There’s a tug of war going on between the RBA and the State and Federal Governments. Our central bank is trying to gently slow things down to get inflation under control. But Governments are working against that objective right now by handing out extra cash and spending like drunken sailors. The losers, unfortunately, are the lower socio-economic cohort, because higher inflation and higher interest rates are hurting them the most.

To what extent do you think investors have become complacent about some of these risks?

Well, it's fair to say that interest rate expectations have adjusted a fair bit since the start of the year, so perhaps market consensus is now closer to reality. And I think while the ASX200 is slightly overvalued, it’s not outrageous.

The main risk we see is that the RBA’s hand is forced, and they do have to raise rates further to knock inflation down. That ups the recession chances quite a lot. It’s not priced in, but it’s also probably a year or more away if it happens. So, we’re positioning our portfolios with that in mind.

Despite these cautious views you’ve identified opportunities across asset classes from small caps to fixed income. What are the factors that make fixed income so compelling?

The good news for us is that our investment universe is basically unlimited. We have a value bias and we’re finding pockets of value across almost all asset classes at the moment.

In fixed income, because base rates are back up to more normal long term averages, there are decent returns available again. From 2014 when we started Affluence, until early 2022, we had very little fixed income in any of our portfolios. The pitiful yields just weren’t attractive. Now it’s different. Returns of 6-8% are achievable comfortably, provided you do your homework well.

Do you see this as a moment in time or an enduring opportunity?

It feels like the adjustment that happened in 2022 was a major structural shift. Prior to that, we saw 30-40 years of declining interest rates, culminating in negative yields for many high quality bonds.

We launched a fixed income fund last year because we believe this ‘return to normality’ will persist for some time.

I suspect we are now in an environment that is more in keeping with historical norms, where the RBA cash rate fluctuates between 3-5%, other than during periods of recession.

The Affluence Income Trust was launched in July 2023, what are the objectives and what do you think is unique about the Trust?

We’ve got three broad goals for the Fund. First, we’re looking to provide a decent level of income. So, we’re targeting to pay monthly distributions 3% per annum above the RBA Cash Rate. Right now, the Fund is paying 7.5% per annum, which is slightly ahead of our target.

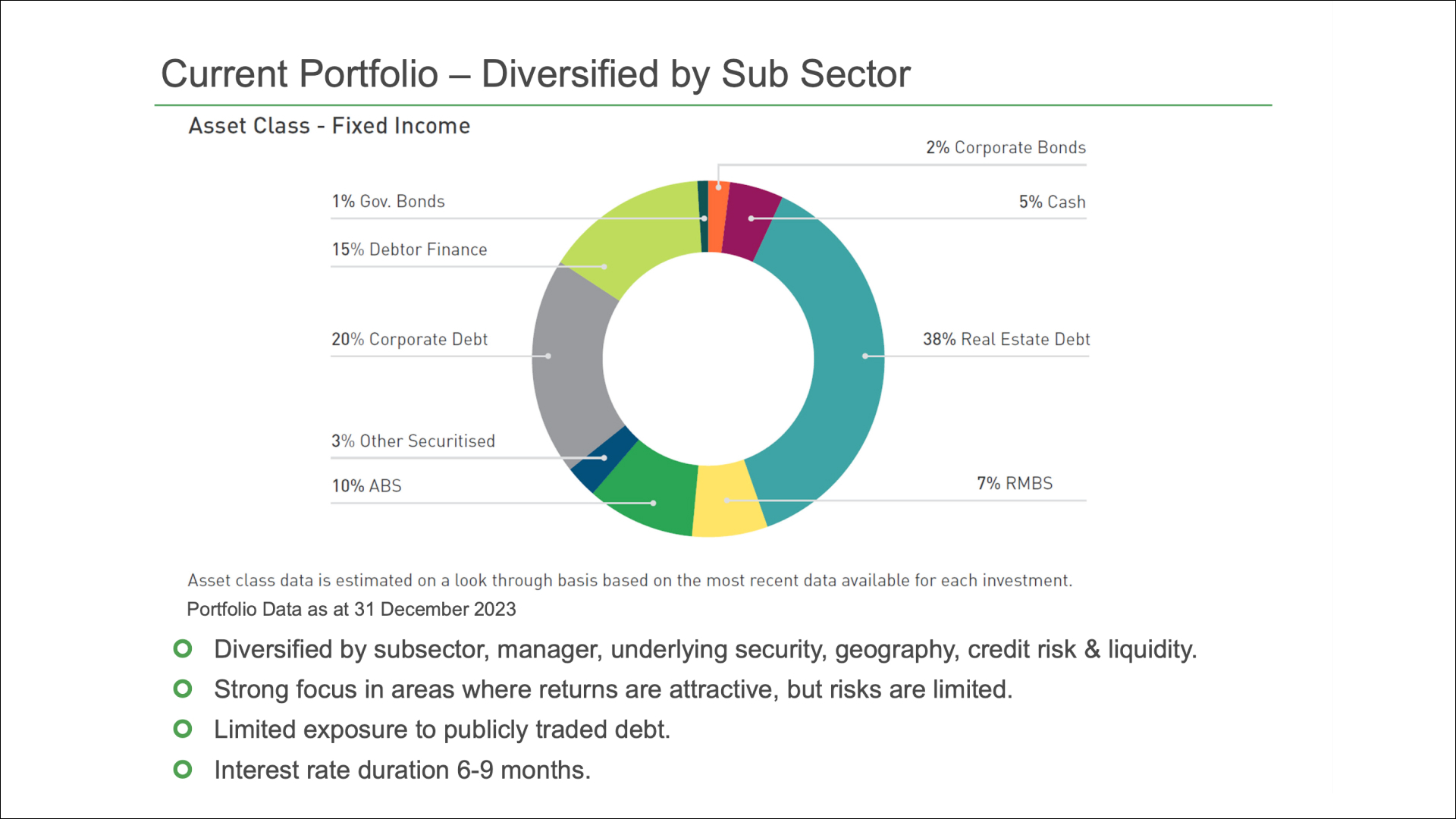

The second goal is a high degree of diversification within the Fixed Income space. This helps enormously with risk management. We want a broad mix of sub-sectors, underlying managers and investment strategies. We also want to maintain a reasonable level of liquidity. This gives us flexibility to adapt the portfolio as markets change, which is important.

The last objective is to maintain a relatively low risk profile. We want to preserve capital over three years and longer, after payment of distributions. This gives us flexibility to allow the unit price to move around a tiny bit in the short term, but to make sure we’re very focused on capital preservation in the medium and long term.

There’s a few things that make our Fund unique in Fixed Income. First, the extremely high level of diversification. Also, the flexibility to invest wherever we like within the Fixed Income space, rather than being constrained to one niche area, for example Government bonds or real estate debt.

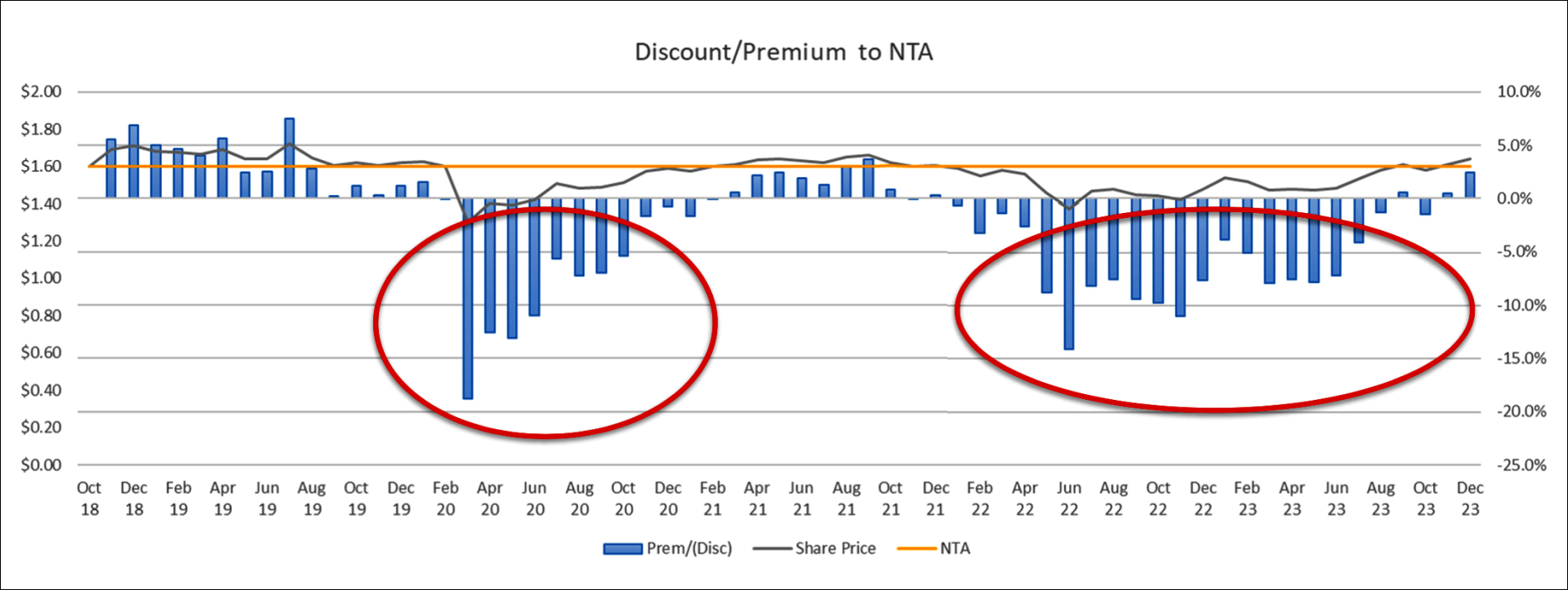

We can also add a lot of value at certain points in the cycle through what we call ‘discount capture’. That simply means buying fixed income investments below their par value and being able to profit from realising that full value over time.

Why did you choose to take the multi-manager approach?

We’ve taken this approach in all of our funds, and it’s served us very well over the years. We look to identify a range of high quality managers that we believe can outperform, and we allocate more capital to them when their investment universe looks attractively priced.

The managers we choose tend to have a few things in common. They usually specialise in a specific area or strategy, where they have a distinct advantage we can understand. This provides them with a better chance of outperforming. And they’re almost always boutique fund managers. To us, that means the investment team has substantial ownership of the management firm, and they invest a meaningful amount of their own capital into the investment funds they manage. This creates strong alignment of interest.

I’m oversimplifying the process a bit because there’s plenty of other factors we take into account when choosing managers. But a strong investment strategy and alignment of interest are probably the most important.

Can you use an example to illustrate your manager selection process and how it adds value?

Certainly. The Merricks Capital Partners Fund is one of the core investments in the Affluence Income Trust, with around a 10% portfolio allocation. Merricks Capital has been managing money for around 17 years. Most of their capital comes from large institutional clients, and they generally don’t offer investments to retail investors.

The Merricks Capital Partners Fund is a real estate debt fund. The Fund started in 2017 when the manager saw the opportunity to fill the gap in the market as banks reduced lending to the sector. They believed there was an opportunity to deliver outsized risk adjusted returns, and that has been the case for this fund so far.

The Fund has a couple of key features we quite like. They have developed a niche in lending to agricultural businesses. These are generally not small family farms, but rather large corporate conglomerates running highly sophisticated farming operations. The other feature of the Fund we like is that the manager runs a form of hedging across the portfolio. This has a small cost in most months but can provide extra returns when markets become volatile and credit spreads expand.

AIT can invest in a wide spectrum of fixed income asset classes. Where are you finding the most compelling opportunities right now?

The largest allocation is into the private credit space, via a few different underlying managers. There are plenty of exceptionally good credit teams out there. They are doing the job that banks used to do, before they were stifled by regulatory constraints and overzealous risk management.

These private credit teams have many years of experience, and they can assess opportunities quite quickly, which gives them a natural advantage over banks and other larger lenders. So, I would say on a risk-adjusted basis, that’s where many of the most attractive opportunities are.

Most underlying managers we use only accept funds from wholesale investors like us. Part of what we’re excited about with the Fund is that we’re giving retail investors access to a lot of these high quality teams that they probably couldn’t invest with directly. Not all the managers we use are wholesale only – there are some good retail managers as well. But having a wide open mandate means we can go wherever the best opportunities are.

What are you avoiding? Why?

I would say at the moment the most important thing is not to chase the highest returns. We believe if we can deliver 7-8% in this market with good risk management, that’s the sweet spot. If we can execute, then we can deliver returns close to long term equities average, but with much lower risk.

If you want to get 10%+ from Fixed Income now, you can find funds that are aiming to do that. For example, many of the higher returning Fixed Income funds are involved in property development lending. But in our view, the step up in risk in most cases isn’t worth it. So, we’ve much lower exposure to those types of strategies, using managers we trust to be very selective about the deals they do. There will be an opportunity to chase those higher returns, but this is not the time in the cycle to be doing it.

We’re also limiting ‘duration’, meaning most of the underlying loans we own through the Fund are floating rate. We enjoy the extra flexibility that brings, and we believe the higher for longer theme remains valid, as we’ve seen all year.

Another area we’re largely avoiding is publicly traded credit, particularly the medium to higher yield space. There is a lot of money chasing a return in this area right now. Margins have compressed, and little chance of default is priced in. If we saw a decent market correction, we could see some of these sectors fall by 5-20%, or even more, as the potential for defaults impacts pricing again.

Can you provide an example of a scenario that could precipitate a shift in the portfolio allocation and explain how this would benefit investors?

The most obvious example would be if we saw a decent market correction. What this has done in prior periods is that it has impacted the publicly traded credit markets quite hard. This creates a lot of opportunity because these markets can go from underestimating recession/default risk, to wildly overestimating it.

This gives us the opportunity to put our discount capture skills into play and allocate part of the portfolio to expert managers in that space. If we can buy investments at a discount when markets are overly pessimistic, then the Fund can profit from an eventual realisation of that investment closer to par value.

You have deep expertise on LITs and LICs - will AIT invest in these products?

We’re not currently invested in any LITs or LICs through this Fund. But there are around seven LITs that operate in the Fixed Income space.

In the past what has tended to happen is that if markets correct, they can trade below net asset backing. So again, this can provide us with some potentially very attractive discount opportunities.

We’ve successfully done this a few times over the years in our specialised LIC Fund, and it’s likely we would invest part of the Affluence Income Trust portfolio into a select basket of debt LITs is we see that type of opportunity again.

Where can investors get more information about the Fund?

More information is on the Affluence Income Trust page of our website, which can be found here. This includes the PDS, TMD, presentation and monthly Fund Reports.

You can also view the Livewire Fund Profile below.

1 fund mentioned

1 contributor mentioned