AGL Energy shares soar on bumper earnings and dividends, tightens guidance

Stalling electricity prices and soft forward curves (expected prices) have acted as a substantial drag on AGL Energy (ASX: AGL) shares, which have slumped around 35% since August 2023.

A forward curve represents the expected prices for electricity delivery at different points in the future and the rationale is pretty simple: Weaker future prices translate into lower earnings expectations in FY25 and particularly FY26, which has less hedging.

Today's first-half FY24 result has come out with better-than-expected earnings and dividends as well as a tightened full-year guidance towards the upper end of previous expectations.

First-half at a glance

- Underlying EBITDA of $1,074 million, up 78% year-on-year and above $961.5 million consensus (11.3% beat)

- Underlying net profit after tax of $399 million, up 359% and above $320 million consensus (13% beat)

- Interim dividend of 26 cents per share, based on a targeted 50% payout ratio of underlying net profit and above Macquarie estimates of 24 cents

- Full-year EBITDA guidance tightened to $2,025-2,175 million from the previous $1,875-2,175 million and above Macquarie estimates of $1,875-1,969 million (9.2% beat at midpoint)

- Full-year net profit after tax guidance tightened to $680-780 million from previous $580-780 million and above Macquarie estimates of $637 million (14.6% beat at midpoint)

The company said the narrowing of its FY24 guidance reflects the following drivers:

- Strong first half performance

- Impact of higher wholesale electricity pricing from prior periods, reflected in pricing outcomes and reset through contract positions

- Improved plant availability and flexibility of the asset fleet, including the commencement of operations of the Torrens Island and Broken Hill batteries

- The above points is expected to be partially offset by higher operating costs driven by inflation, variable customer costs and other investments.

AGL held a conference call to discuss the result at 11:00 am AEDT on Thursday.

A strong open

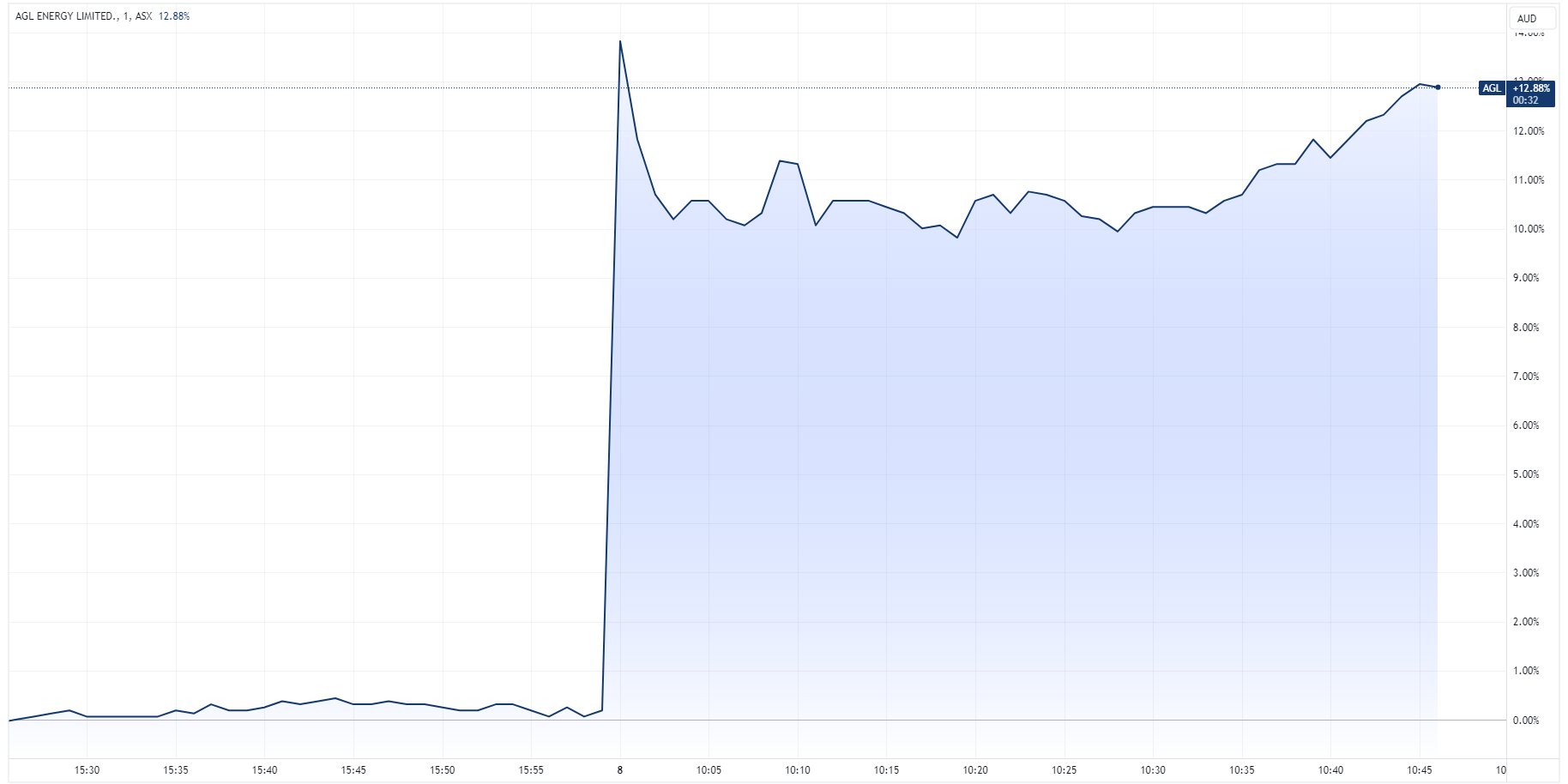

AGL shares opened 13.0% higher to $9.02, the gains eased to around 9.7% by 10:30 am AEDT and its currently trading back towards session highs.

Macquarie's thesis

The latest Macquarie note we have dates back to 1 February 2024. The analysts retained a Neutral rating with a $9.30 (from $10.89) target price.

"Forward curves since December have not improved with the summer surge not emerging. We anticipate this will limit trading opportunities in FY24 around additional unhedged base load power and the renewable portfolio," the analysts said.

"Without electricity prices rallying to long-term averages, AGL's earnings growth is negative through to FY26. Yield will provide some support in FY24 at current prices. Risk is government intervention keeps markets in over-supply."

The analysts expect FY25 net profit to fall to $479.8 million or a 34% drop compared to today's FY24 guidance (midpoint).

It's worth noting that this forecast will likely be revised given the stronger-than-expected result. But this should provide some perspective on why AGL shares have dwindled over the past six months.

%20Share%20Price%20-%20Market%20Index.png)

This article first appeared on Market Index.

2 topics

1 stock mentioned