An ASX-listed property stock with a long growth runway

Three decades of declining interest rates were a boon for the listed real estate sector in Australia. Capitalisation rates used to determine commercial property valuations declined in tandem with the RBA Cash Rate Target to create a significant tailwind for the sector. Now that tailwind has become a headwind. Interest rates have risen significantly, posing a risk to asset valuations.

With the ASX-listed REIT Index 25% off its 2022 high, the challenges to real estate from higher interest rates, continued shifts towards work-from-home, significant new office supply, trends in e-commerce and the rising cost of debt funding are being reflected in lower listed asset prices.

While we acknowledge these challenges, the collective decline in A-REIT share prices has generated a few attractive investment opportunities. In this wire, we look at one such opportunity - HomeCo Daily Needs REIT (ASX: HDN).

Overview

In late 2016 David Di Pilla led the acquisition of a selection of ex-Masters property assets from Woolworths, with the objective of repositioning and re-leasing the assets. Other investors included the Chemist Warehouse Group, Spotlight Group, Primewest (now part of Centuria) and various senior UBS executives.

In 2019 “HomeCo”, later renamed “HMC Capital” (HMC), listed on the ASX. HMC then spun out 17 of these ex-Masters assets in 2020 as HDN. This portfolio came with a very active management team. The HMC management team has had no material executive turnover since IPO and are significant shareholders in HMC, which has a 14% shareholding in HDN.

HDN merged with Aventus Group in 2022 to create the bulk of the current portfolio. Aventus, which had listed in 2015, was a portfolio of 20 Large Format Retail (LFR) centres, assembled over two decades by Australian retail industry veteran Brett Blundy and CEO Darren Holland.

Strong Core Portfolio

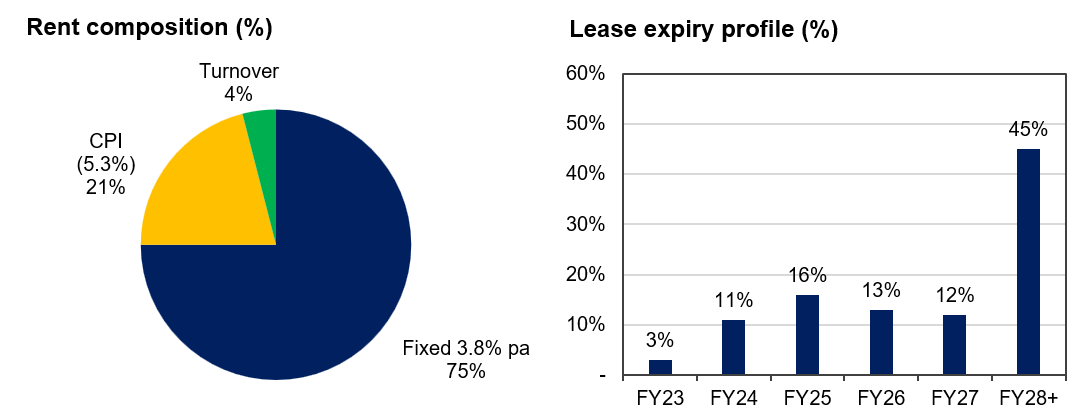

Today, HDN comprises a national portfolio of 53 properties. The portfolio is greater than 99% leased, with over 99% rent collection, a 4.6 year weighted average lease expiry and unusually low tenant incentives of 5.3% as at the most recent update in February 2023. The portfolio is focused within high population growth metropolitan catchments and is over 83% leased to large national tenants. Rental growth is comprised of a mix of fixed, CPI-linked and turnover-linked arrangements. Rental growth is currently 3.8% as of December 2022.

Source: Company Disclosures

Given HDN’s exposure to household goods, many investors view the portfolio as having highly cyclical characteristics. However, its tenants are predominantly large, well-funded and highly profitable retailers who we think are low covenant risk, high quality operators.

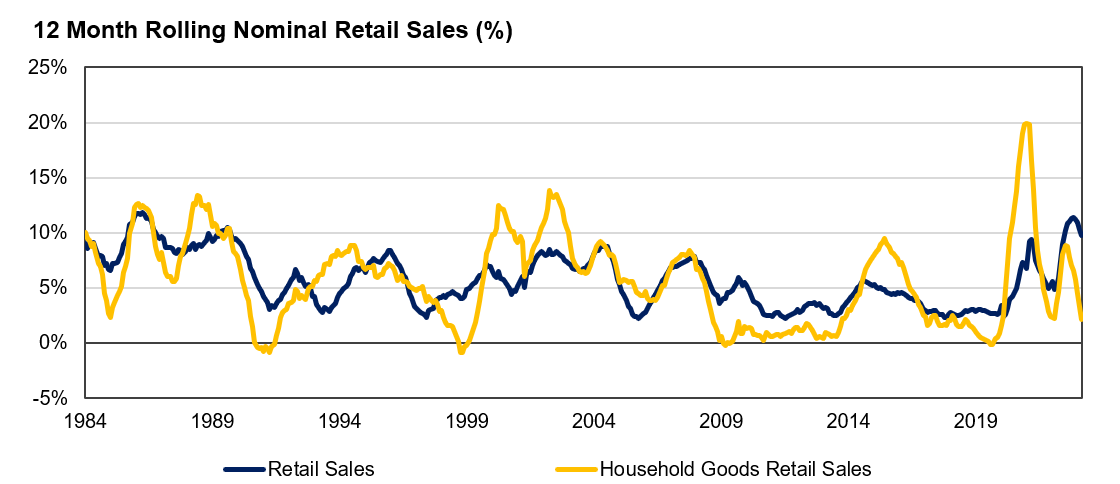

Further, the actual volatility of spending on household goods is, in our opinion, considerably less than perceived. Total nominal retail sales in Australia have never grown at less than 2.2%. Expenditure on household goods has only rarely and briefly gone negative year on year.

Source: ABS

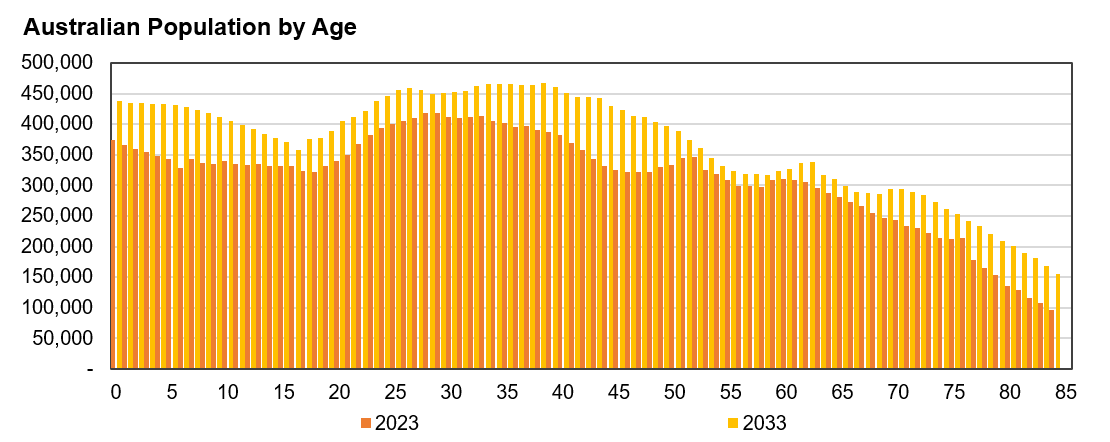

HDN, with a 79% metropolitan portfolio focused on high growth corridors, is a likely beneficiary of two mega trends: Australian population growth and increasing e-commerce. The Federal Government is forecasting Australia’s population to grow strongly in the coming decades, most of which is expected to be driven by strong net overseas migration.

Whilst there are variations by visa class, the median age of migrants into Australia is in their late 20s. In addition, Australia’s large millennial cohort are increasingly moving into their mid-30s, an age when consumption of household goods increases, demonstrated by the fact that the average age of a first home buyer in Australia is approximately 36.

Source: ABS

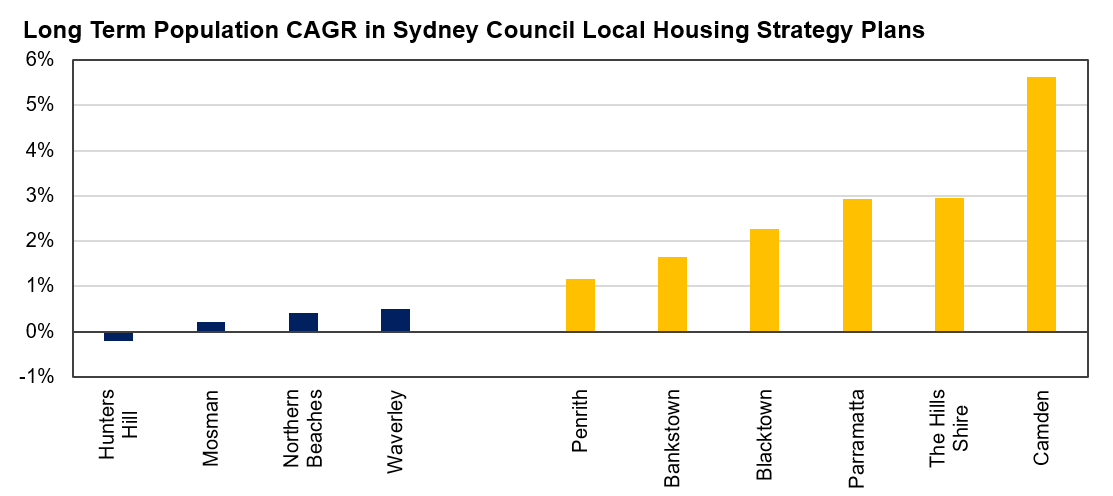

Given the extremely tight supply of housing in inner-metro locations, population growth is likely to be focused on the Greater Sydney, Melbourne and Brisbane metropolitan areas. HDN’s portfolio is well positioned, with the population growth in its catchments expected to grow by 1.9% per annum in the next 5 years, which compares favourably to the national average of 1.5%. With Australia’s recent immigration boom these figures may well prove conservative.

Source: Greater Sydney Councils’ Local Housing Strategies

HDN’s tenants are likely to be either beneficiaries of, or resilient to, greater e-commerce penetration. Health & Services providers are somewhat indifferent to e-commerce, given the full offering of a gym, childcare centre or primary healthcare provider is impossible to replicate online. Large format retail is similarly resilient, as non-entry level consumers generally want to touch and feel high value items like couches or mattresses before buying them.

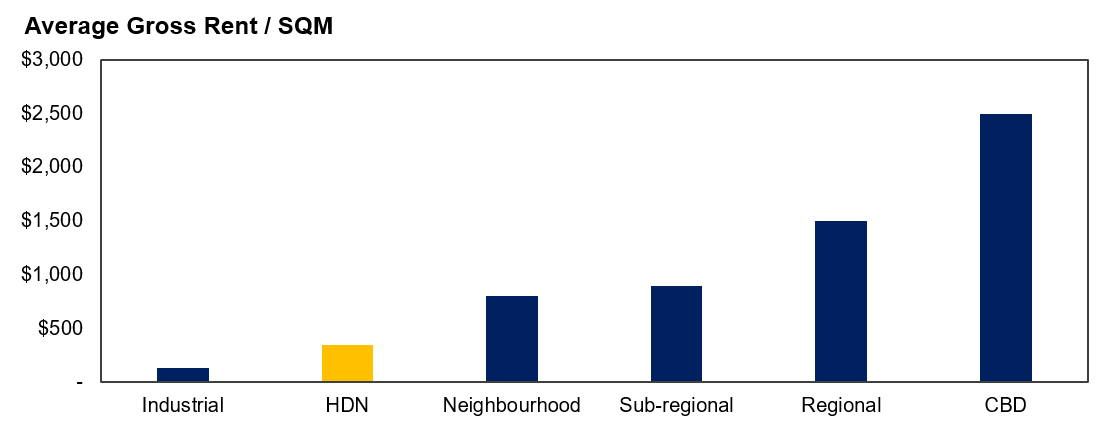

By contrast, neighbourhood tenants such as supermarkets, as well as some large format retail tenants, have customers that are increasingly demanding a seamless omni-channel retail experience with the option of fast delivery. To meet this consumer demand and fend off Amazon, these tenants need a portfolio of affordable and well-located sites, with integrated direct to boot facilities. HDN’s portfolio is increasingly being viewed as critical “last mile logistics” infrastructure, a vital complement to the industrial logistics warehouses of large Australian retailers. At approximately $350 per square metre, HDN’s starting rents are a fraction of other retail rents.

Source: Auscap estimates, Colliers, JLL

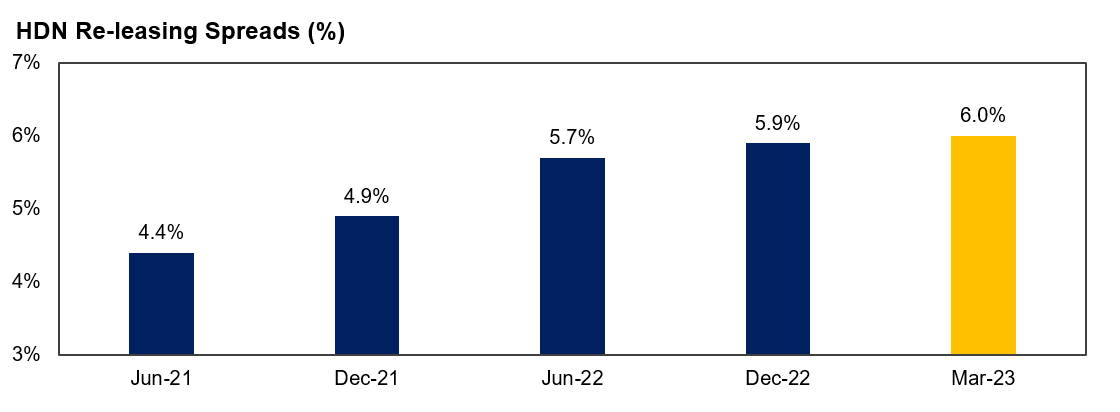

Evidence of the value offered in HDN’s portfolio is in its re-leasing spreads, being the growth in rent for new or re-signed leases. E-commerce, COVID-19, work from home and expensive rents have created a multi-year headwind for the rental growth of large retail malls. As a result, many retail A-REITs have experienced low or even negative re-leasing spreads in recent years. Yet HDN’s re-leasing spreads were north of 6% as of March 2023.

The significant positive re-leasing spread is quite distinct from its peers and suggests the sites are attractively priced and in demand from current and prospective tenants. These re-leasing spreads have been increasing in recent reporting periods. We expect HDN to have a long runway of sustainable rental growth.

Source: Company disclosures

Development Upside

Further, there is significant upside within the portfolio. Currently only 37% of HDN’s 2.5 million square metre land bank is being used as Gross Lettable Area (GLA), which provides management with a long runway of profitable development opportunities. These development opportunities are largely tenant-led low-risk initiatives such as adding complementary retailing or childcare pad sites.

Since listing, HDN has delivered an average return on its development cost exceeding 9%. At the 2021 merger announcement, HDN had identified a pipeline of greater than $300 million of development opportunities, which has since been expanded to over $600 million. We expect incremental development opportunities to remain a feature of HDN for many years to come.

Headwinds

HDN will be impacted by higher interest rates on borrowing costs. The move in HDN’s average borrowing rate from 1.44% in December 2022 to 2.75% in 2024 will temporarily offset the portfolio’s strong rental income growth, reducing HDN’s ability to grow its distribution in the near term.

We take some comfort from HDN’s 70% hedging across its drawn debt out to 2026 and current gearing at the lower end of its 30-40% target range. Further, senior management are incentivised through their remuneration to focus on growing both HDN’s Funds from Operations (FFO) and Distribution per Unit (DPU) over time.

Attractive Implied Valuation

HDN’s portfolio is currently valued at a capitalisation rate of 5.48%, following a modest negative revaluation in June. Interestingly, this negative revaluation was due to internal revaluations; independent valuers actually applied a small valuation increase to the circa 50% of the HDN portfolio they revalued.

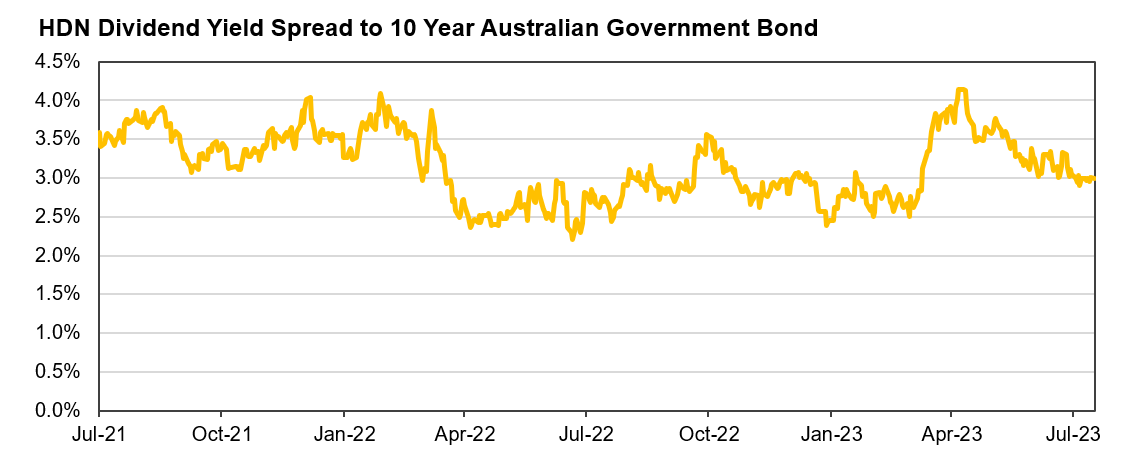

However, HDN is trading materially below this valuation at an implied capitalisation rate of 6.4% with a current dividend yield of circa 7%. The current dividend yield spread to the yield offered by the 10 year Australian Government Bond is approximately 3%, roughly in line with the average spread over the last few years, despite the dramatic increase in interest rates during this period.

Source: Auscap, Bloomberg

HDN provides investors with exposure to a high-quality portfolio of assets with a bright outlook for growth due to tenant demand and development opportunities. At a dividend yield of circa 7% and with sustainable growth anticipated, we view the total shareholder return as attractive given the risk profile.

We are also enthused by management’s growth initiatives and the potential for HDN to benefit from any future improvement in sentiment towards the listed real estate sector.

Learn more about Auscap Asset Management

I am the Deputy Portfolio Manager of the Auscap Long Short Australian Equities Fund which targets solid absolute risk-adjusted returns, looking to invest in companies that generate strong cash flows and are trading at attractive prices.

If you would like first access to my insights please click on my profile here and hit follow.

1 topic

1 stock mentioned

1 fund mentioned

1 contributor mentioned