An Aussie microcap that's a “smart” way to play the UK re-opening

In a world of earnings uncertainty, particularly for businesses who benefited from a pull forward of demand during Covid, investors are pivoting to “recovery” stocks whose earnings were impacted through the pandemic and will benefit from a normalisation in coming years. While many of the obvious names are already priced for earnings normalisation, one stock appears to have been forgotten and represents great value for “smart” investors!

Smart Parking (ASX: SPZ)

Smart Parking (SPZ) is a global provider of technology, hardware and software for parking solutions. Their technology consists of automatic number plate recognition, digital signage, in-ground sensors and software that allows for control and analytics. SPZ’s target customers are private parking lots such as shopping centres, hospitals, airports, universities and hotels.

The Technology segment, likely familiar to shoppers, highlights empty car parks in busy locations with green and red lights. While a nice contributor which has recently turned profitable, the driver of the business is the Parking Management segment which issues parking breach notices (PBN’s) on behalf of customers. Yes, that’s right, SPZ is a listed parking cop!

Parking Management

In the most recent half, Parking Management recorded $15.5m of the company’s $17.3m total revenue and will continue to be the main driver of the business moving forward. The segment is almost entirely based in the UK, with some recent incursions into New Zealand, Australia and soon Germany. Geographical expansion is limited by regulation, most importantly whether SPZ can access personal information to issue a PBN based on licence plate data.

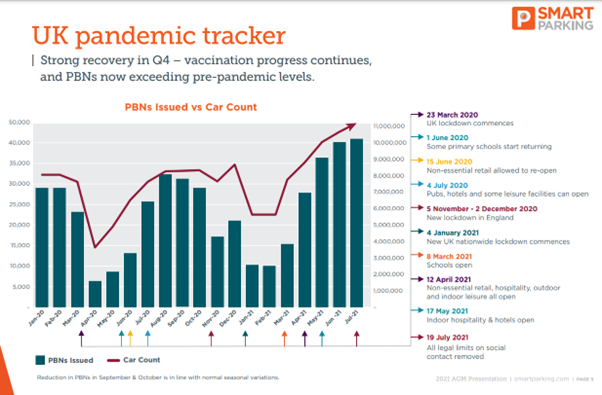

The Parking Management segment was heavily impacted through the pandemic as lockdowns meant less cars on the road and less PBN’s issued. The company was transparent on the slowdown, showing the impact as well as the recovery out of Covid. See the image below, taken from the 2021 AGM:

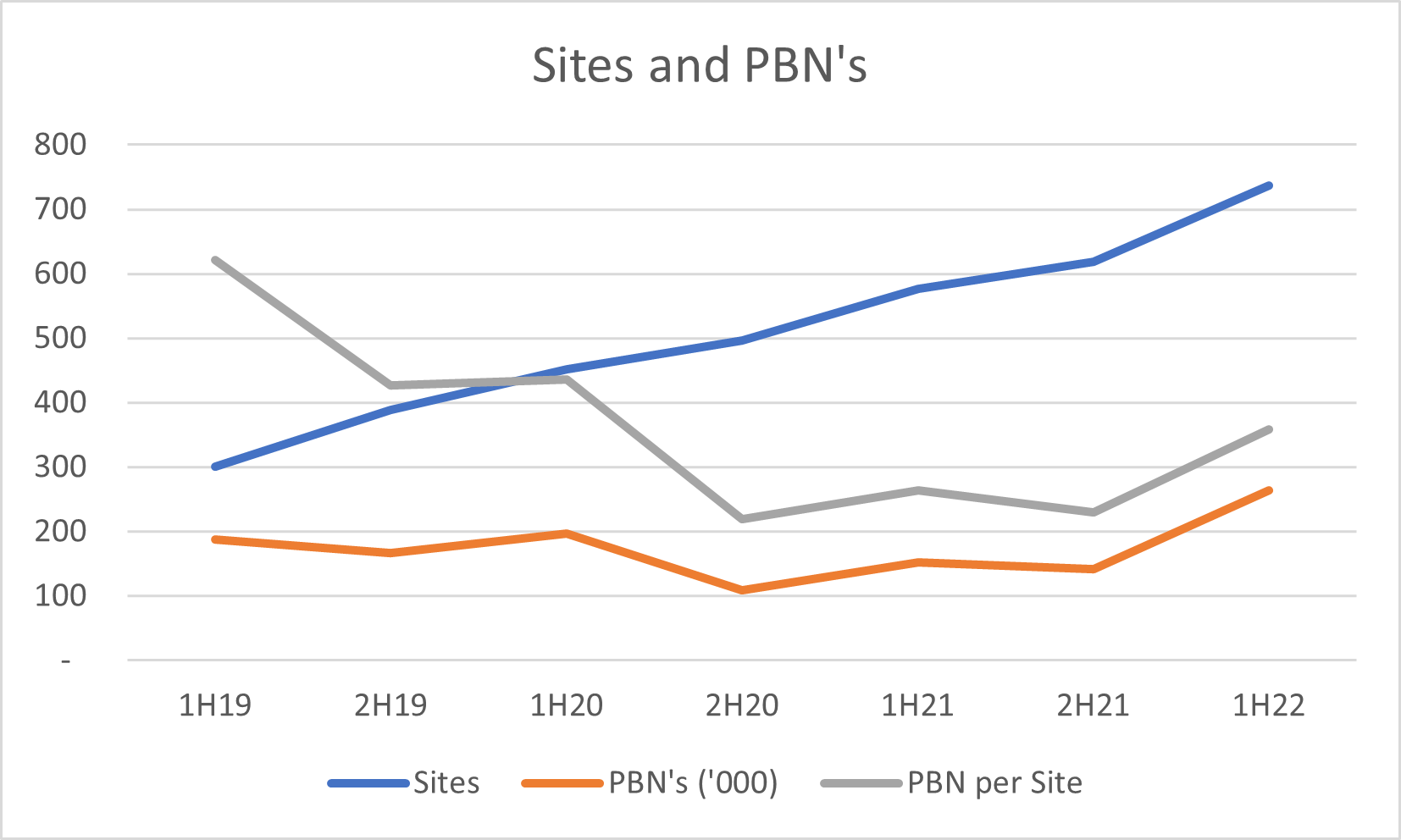

However, the company understates the recovery in this graph by using the absolute number of PBN’s issued. This number doesn’t consider the growth in the number of sites serviced by SPZ which grew nearly 50% over that period. I have graphed the relation between sites and PBN’s to show PBN per site remains below pre-Covid levels:

While the most recent half was a record for PBN’s issued, at a per site level of ~360 it remains below the pre-Covid levels of ~430 in 2H19 and 1H20. Admittedly it is difficult to gauge exactly where PBN’s per site normalises given a potential change in behaviour post-Covid and the economics of newer sites compared to older sites. Nonetheless there appears room for PBN growth even if the growth in sites slows down (which it is not expected to do with ambitious targets in the medium term).

Capital Light Growth

A listed parking cop is hardly the sexiest business model (and has genuine risks I will highlight later), however the economics may surprise you. Parking Management earned EBITDA margins of 37.5% in the recent half year result, a record margin despite the lower PBN’s per site. Impressively, EBITDA converts to cash with greater than 100% operating cashflow conversion. Growth is also capital light costing ~$15k to open a new site, with EBITDA payback in 7-9 months, and essentially no maintenance capital expenditure is required once cameras are installed.

The recovery from Covid has provided management with excess cash for growth. The UK business will continue to drive the top line (management targeting 200 new sites a year) and is self-funded, leaving excess cash to be used for overseas expansion. The 2021 AGM slides highlight management’s conviction (note, this is also before the company announced German expansion which may be a larger market than the UK):

Beyond greenfield expansion SPZ can also acquire smaller peers, especially those relying on manual issuance of PBN’s. The recent acquisition of NE Parking emphasises this perfectly with SPZ paying $517k for 517 sites, at a per site level a big acquisition given SPZ only had 772 sites prior to the acquisition. However, all the NE Parking sites are manually operated, and it is unknown how many sites are ideal for automated number plate recognition (ANPR). That said, SPZ paid $1.5m for the acquisition of 68 automated sites in 2021, meaning based on ~$15k average conversion cost they only need to convert 13% of the sites to achieve a similar outcome.

Unit Economics

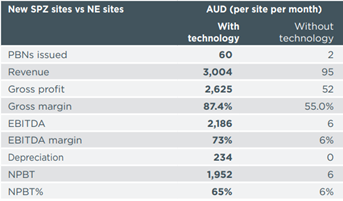

Following the NE Parking acquisition, SPZ management provided an illuminating look into the unit economics of an incremental ANPR site:

As expected, the unit economics are fantastic with 73% EBITDA margins. Looking at the most recent result there is about $11m in annualised overheads in the Parking Management segment, largely support and compliance related. SPZ also has an additional $2m in corporate costs and R&D.

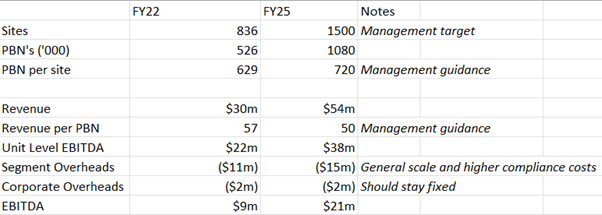

This gives us some inputs to see what the business may look like in 2025 if they can reach their target of 1500 sites under management:

On rough numbers, SPZ could earn $21m EBITDA in FY25 assuming they can maintain site unit economics and reach their 1500 target.

Risks

The main risk to SPZ is regulation, highlighted by the recently proposed UK Parking Code of Practice which would standardise compliance, appeals and most importantly, cap the fine amount of PBN’s. In most regions of the UK, it would effectively cut the fine amount of PBN’s in half from £100 to £50, which would have a dramatic effect on the unit economics listed above. Originally slated to take effect in December 2023, the Code has been withdrawn pending review of the fine caps, potentially a positive for SPZ and the industry.

Nonetheless, regulation risk remains high, and I suspect will always weigh on the valuation of SPZ.

Valuation

Smart Parking trades at a $63m market cap with $9m net cash in the bank leaving an enterprise value of $54m. The business trades on ~5x this current year’s EBITDA, but ~2x FY25 if growth targets are achieved. It is worth noting that transactions in parking management have occurred as high as 17x EBITDA (2018 Parking Eye transaction, UK’s largest provider bought by Macquarie Group) with others in low double digits. Smart Parking themselves knocked back a takeover approach from Parking Eye back in 2019 for 28c when the business was roughly half the size that it is today.

Nonetheless, the spectre of regulatory risk will hang over the valuation into the future, so despite the attractive economics of the business I don’t expect it to attract more than a 6-8x EBITDA multiple. That still represents fantastic upside from today’s level let alone if the business achieves its FY25 targets.

3 topics

1 stock mentioned