An energy stock at “a hyper-compelling, rock-bottom valuation” (and 9 other stocks to watch)

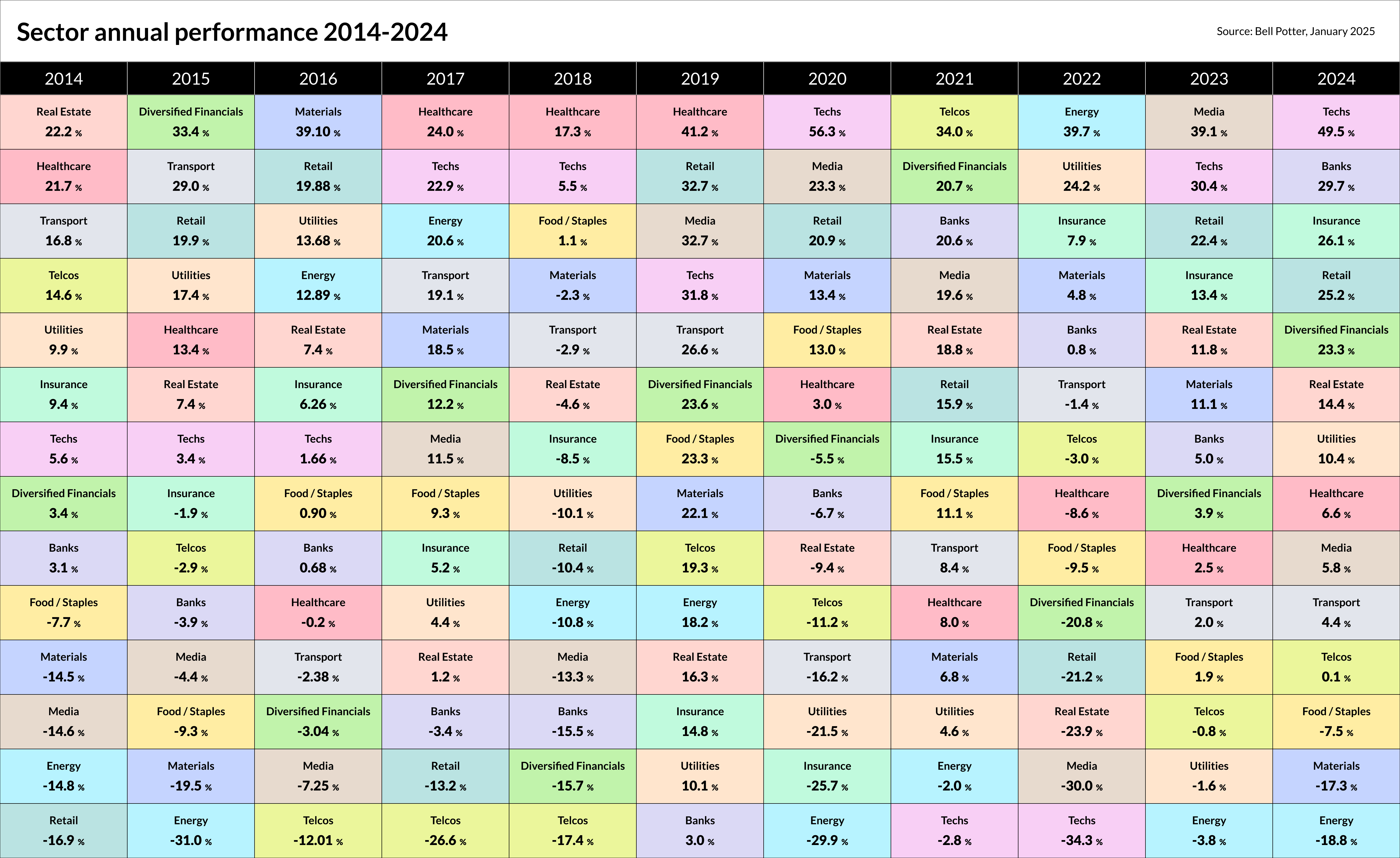

Amidst the celebration of record highs in 2024, it was easy to forget that good performance was not universal. Three sectors even ended the year in the red, with energy the worst-performing sector of the lot.

But, as we all know, past performance is not a reliable indicator of future performance. Yesterday’s winning sector could be today’s loser, and vice-versa.

Information technology may have been top of the pops for the past two years, but it was the worst performer of 2022, down 34%. Bet you all wish you bought in hard on the first day of trade in 2023!

Interestingly, that was also the year energy was on top, up 39.7%. We all know what happened after that.

Casting your eyes back further, you might find healthcare as the standout sector between 2017-2019 or A-REITs when they were at the top of the pile 10 years ago.

Please click on the image below to zoom in.

The point is, could shopping in the worst performing sectors of the previous year be a good idea?

I spoke to Seneca Financial Solutions’ Luke Laretive about last year’s worst-performing sectors on the ASX and what he thought of them for 2025.

The biggest losers on the ASX – what happened?

Energy was down 18.83% for calendar year 2024. Oil prices were weak for much of the year, with OPEC extending production cuts. There are indications 2025 could be a better year, given recovering oil prices, and increasing demand for energy.

“I think the most interesting theme here is the decline of oil and gas companies in the energy sector, despite oil prices going up marginally over the last 12 months (NYMEX Light Crude +0.10% to 31 December 2024),” he says, highlighting Woodside Energy is down 14.5%, Karoon Energy down 29%, Beach down 10% and Santos down 6%.

“Some of these names have more systemic issues. I’d call out Woodside (ASX: WDS) specifically,” he adds.

The second worst performer on the ASX was the Materials sector.

The Chinese growth slowdown hit Australian materials in 2024, particularly affecting the demand for iron ore and coal. It was not the only area to be challenged, with weaker commodity prices across the board.

Lithium, a previous market darling, hit multi-year lows in 2024. Though there’s still hope for recovery as demand continues to rise for use in the energy transition and electric vehicles.

Laretive points out that 64% of the names in the sector outperformed.

“I’d argue it was more about what went down. A 51% decline in Mineral Resources (ASX: MIN) took circa $7 billion off its market cap and that matters more to the Materials Index than a 52% increase in West African Resources (ASX: WAF) which added circa $900 million to its market cap,” he says.

Consumer staples also ended the year in the red, down 7.5%. This may seem surprising given it’s a defensive sector that should be resilient to any slowdown in consumer spending.

In this instance, Laretive highlights there are only 11 companies in the ASX Consumer Staples sector.

“What happens to Woolies (ASX: WOW) and Coles (ASX: COL), at $37 billion and $25 billion market cap respectively, matters a whole lot more than Bega Cheese (ASX: BGA) at $1.7 billion,” Laretive says.

Both businesses have seen their share prices fluctuate off the back of ACCC allegations of price-gouging and subsequent court cases. That said, the supermarket duopoly continues to hold strong fundamentals and both rank as a BUY in Market Index’s Broker Consensus tool.

Turning fortunes for 2025: Is now the time to buy the worst-performing sectors?

Laretive is wary of buying anything on a sector scale.

“The devil (and the dough) is in the detail. The sectors don’t really tell you anything useful,” he says, cautioning investors to buy stocks based on their fundamentals rather than a broad sweep of a sector.

He has exposure to iron ore, coal, lithium, copper, gold, silver, oil & gas, exploration activity and royalties in his portfolio, along with industrial names servicing these activities already based on specific stock assessments.

That said, when it comes to resources or energy, “you need to invest counter-cyclically and be able to stomach short-term underperformance.”

“Over the last 12 months, you’ve seen a 30% drawdown in iron ore prices, a 15% decline in coal prices. Last time, these sorts of declines occurred, we saw a strong increase in prices over the following 12 or 24 months,” Laretive says.

He cautions that the key is identifying companies that have invested carefully during the hard times, and points to Stanmore Resources (ASX: SMR) or New Hope Group (ASX: NHC) as fitting the bill for the coal sector.

He does see a standout in the energy sector, too – Karoon Energy (ASX: KAR).

“Production has been a bit unreliable historically, but you are getting the stock at a hyper-compelling, rock-bottom valuation. For us, cash flow looks great, production stability is improving and it’s well supported by a buyback.”

The theme of 2025 for Energy and Materials and other opportunities

Laretive views mergers & acquisitions as the major theme for the first half of the year. He predicts Wildcat (ASX: WC8) in the lithium space and Antipa Minerals (ASX: AZY) in the gold space will attract some bids.

In keeping with Laretive’s focus on individual companies rather than sectors, he also sees earnings upside in the following mix of names for the coming year:

- Imdex (ASX: IMD)

- Origin Energy (ASX: ORG)

- AGL Energy (ASX: AGL)

- ALS (ASX: ALQ)

- XRF Scientific (ASX: XRF)

To buy or not to buy?

In short, buying just because something looks cheap is never a recommended course of action. But, if you can find some solid companies in a down-beaten sector, it could be worth further investigation.

3 topics

10 stocks mentioned

2 contributors mentioned