An explosive stock that has fresh ideas for boosting shareholder returns

Although tempting, we’ve resisted the urge to write about Australia’s banks that have been on a tear this year (and to which we are currently more underweight than we’ve ever been since the Allan Gray Australia Equity strategy’s inception almost 20 years ago). The same is true for Australia’s technology index, which has handsomely surpassed its late-2021 post-COVID-19 price peak.

At times, it feels like market participants are enjoying a white tablecloth dinner on top of an active volcano. To counter this, we have been surprised by the resilience of corporate earnings in the face of inflationary headwinds and a seemingly weak consumer. Let’s hope this continues!

For this Quarterly Commentary, instead of tabling an almost certainly incorrect economic forecast or outlook for corporate earnings, we’ve decided to opt for a deep dive into one of our portfolio holdings, Incitec Pivot (ASX: IPL). Writing about companies in which we invest is not only more comfortable for us (our happy place!), but it is also a topic where we feel we have about a 60% chance of being right (much better than almost certainly wrong and a surprisingly decent probability in the world of investing).

We first bought shares in Incitec Pivot, a chemical manufacturer and supplier, in 2019. At the time, the company had experienced difficulties due to low ammonia prices (a key driver of earnings across the various Incitec businesses). Poor decisions around capital spending in the decade before had resulted in a stretched balance sheet and pennywise but pound-foolish decisions had arguably affected reliability at a number of its manufacturing plants. The weather had also disrupted output at one plant.

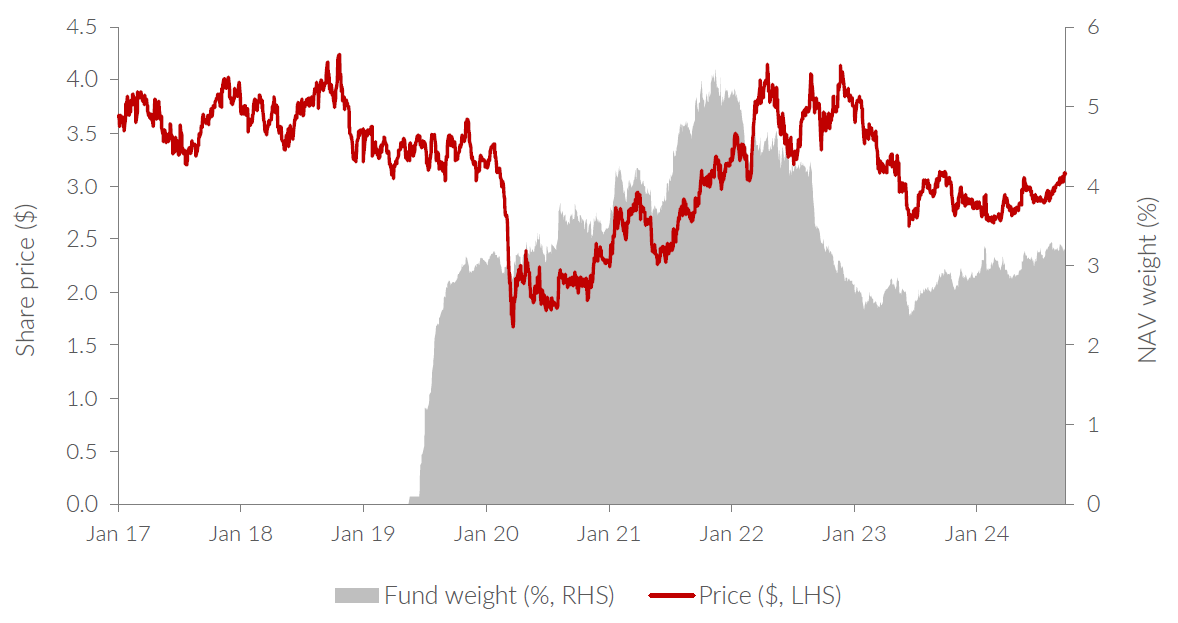

Since then, a deeply discounted capital raising during COVID-19 and the sale of Incitec’s US ammonia plant have resulted in a deleveraged balance sheet, even after a significant capital return. While the business has changed over the years, and so too have our holdings (as shown in Graph 1), we believe there is still sufficient value in the shares to warrant a position in the Allan Gray Australia Equity strategy portfolio.

Incitec Pivot has two main businesses today. One is an Australian and North American manufacturer and supplier of explosives used by the mining and quarry industries and operating under the Dyno Nobel brand. The other is a manufacturer and supplier of fertilisers with a strong market position in Australia. What unites the two businesses is their chemistry, as the products produced by Incitec Pivot in each division have a common nitrogen basis. However, it is worth looking at each of these businesses separately.

Graph 1 - Incitec Pivot’s share price and the Allan Gray Australia Equity Fund’s holdings

Source: Allan Gray Australia, 23 September 2024. The Allan Gray Australia Equity Fund is generally representative of the Equity strategy portfolio, which includes institutional mandates that use the same strategy.

Dyno Nobel explosives

Ammonium nitrate is the raw bulk material used in Dyno Nobel’s explosives. The process to make ammonium nitrate (NH4NO3) involves first making ammonia (NH3) from natural gas (mainly methane or CH4) and nitrogen (N2) from the air, and also making nitric acid (HNO3), which are then combined. Incitec Pivot makes ammonium nitrate in a few plants around the world:

- Moranbah is in the heart of Australia’s Bowen Basin, near metallurgical coal fields. This plant cost almost A$1 billion (b) to build in 2010-2011 and has a capacity of 330 kilotonnes (kt) per annum (p.a.).

- Cheyenne is in the US state of Wyoming and, together with a smaller plant in Louisiana, Missouri (LOMO), makes 800kt for the North American market. The LOMO plant buys its ammonia while Cheyenne is partially integrated back to gas (i.e. first manufactures its own ammonia). To be a successful manufacturer of ammonium nitrate, a company needs a low gas price (or a low ammonia price) and assets close to end-user demand. Incitec Pivot’s Moranbah plant is well-positioned relative to competitors on both fronts. This is also true at Cheyenne and LOMO, but with some risk around overall end-user demand for thermal coal.

On top of the manufacturing of bulk ammonium nitrate, Incitec Pivot has a number of other assets, from emulsion (formulations that improve the stability and in turn, safety, therefore allowing for easier transportation of explosives) plants to mobile processing units, that help deliver products to customer sites. These units are custom-made trucks that can cost several hundred thousand dollars apiece.

In Australia and North America, Dyno Nobel is a top-two market player in explosives. It is also expanding cautiously in other markets, organically in South America, and through an acquisition in Europe and Africa. The company believes these geographies will provide a runway for capital-light growth in the years ahead.

Fertilisers

The fertilisers business in Australia comprises primarily the Phosphate Hill diammonium phosphate manufacturing plant (and associated mine) and a distribution business with a strong market share.

This unit has had several challenges:

- Until the last couple of years, fertiliser prices had been very weak, depressing earnings at Phosphate Hill, a largely fixed-cost facility.

- Reliability issues at Phosphate Hill have further hurt earnings.

- Gas supply has been hit by lower-than-expected reserves at the field that supplies Phosphate Hill, requiring the company to buy more expensive gas elsewhere to keep the operations running.

Value

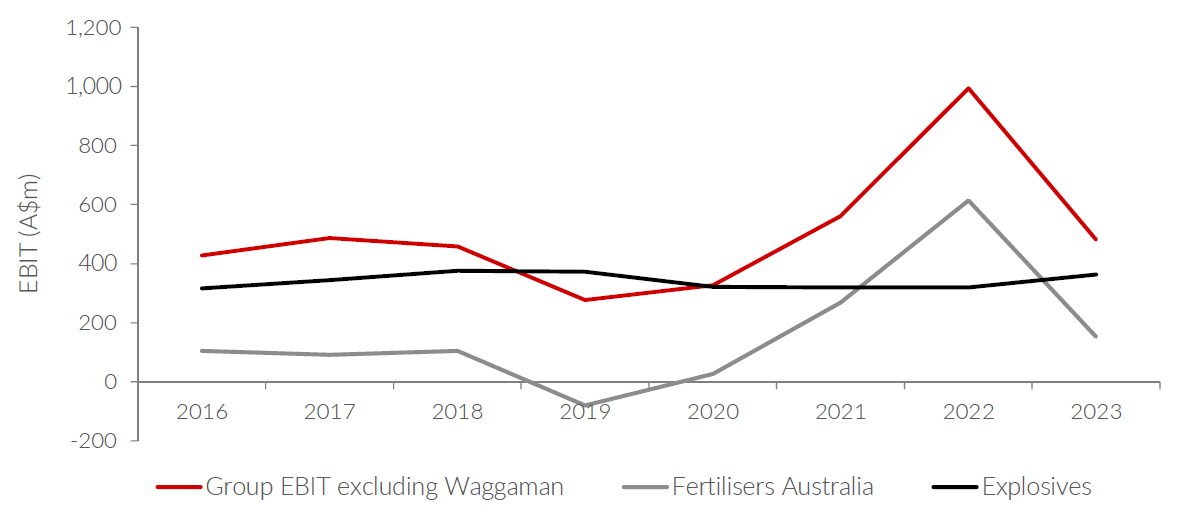

Incitec Pivot’s current market capitalisation is $5.8 billion, with a further $300 million in net debt for a total enterprise value of $6.1 billion. We can see from the earnings before interest and tax (EBIT) figures in Graph 2 that the two businesses have quite different characteristics:

- The explosives business has had a fairly steady earnings stream, with the dip in 2020 coming from losing an important contract and the rise more recently reflecting the partial restoration of margin as historical low-priced contracts are renegotiated. We believe there is a little more to play out here. Also, due to an arrangement to buy ammonia from the new owner of Waggaman (which Incitec Pivot recently sold), at zero cost (worth around $40 million p.a.), as well as contributions from the recently acquired Titanobel, the explosives business (net of corporate costs) should make $380-400 million of EBIT. It is worth noting that Incitec Pivot equity accounts after-tax profits of $60 million (earnings from associates reflected in the EBIT line on a post-tax basis), so to make this EBIT comparable to other companies would require us to add around $25 million for a total of $405-425 million of EBIT from this business.

- The fertilisers business is very volatile and is more directly driven by the price of ammonia relative to the price of gas. The period up to 2020 reflected some very low ammonia prices globally, while 2022 saw a big increase in that underlying price. It is hard to value this business. Replacement costs for the manufacturing plant on its own could be over $1 billion, but it is a very old, and relatively unreliable, plant, with a challenged gas supply, putting it in a third quartile, or even fourth quartile, position on the cost curve. It is quite likely that the lack of affordable gas into Phosphate Hill is terminal for that plant’s operations, though there may still be value in the phosphate rock mining activities that accompany the operation. On the other hand, the distribution business has made ~$50 million EBIT p.a. and continues to grow.

Graph 2 - Incitec Pivot’s segment EBIT

Source: Incitec Pivot company filings. 30 September 2024. Numbers don’t add because of corporate and other eliminations.

Based on this, the market is valuing Incitec Pivot on 12.8-13.4x its earnings before interest and tax that we could reasonably expect from explosives, Australian fertiliser distribution and corporate.

This is similar to the multiple that Orica (a close competitor) trades on, but is below the multiple the broader market excluding banks trades at. Importantly though, it assumes that no value is ascribed to Phosphate Hill, an asset we feel that shareholders are being paid to own, and no value for the surplus land at Gibson Island and other facilities. In its latest investor update, Incitec Pivot set even higher earnings targets for its explosives business by FY26.

What are the risks?

While the above seems relatively attractive, there are always risks in any investment and reasons that sellers might have for offering shares at these prices. There are shorter-term risks around Phosphate Hill’s reliability and its gas supply, which could even lead to losses at that manufacturing plant. And longer term there are risks around thermal coal in North America, with 20% of Dyno Nobel’s North American revenue exposed to thermal coal, the demand for which has been in long-term decline. There is a chance a more rapid decline in demand would make Dyno Nobel’s plants in North America far less profitable. This is at least partly tempered by critical mineral extraction becoming an ever deeper and lower-grade phenomenon which will require increasing amounts of explosives and, importantly, higher margin services.

It is hard to accurately predict Incitec Pivot’s future but, despite some potential future issues, we see Incitec Pivot shares offering reasonable value. With new management and a refreshed capital-allocation-focused board, some of that value may actually be realised for existing shareholders. It is currently a little over 3% of the Allan Gray Australia Equity strategy portfolio and may soon go by the name Dyno Nobel once again.

The above wire is an extract from Allan Gray Australia’s September 2024 Quarterly Commentary, which you can read in full here.

Learn more

Contrarian investing is not for everyone, however, there can be rewards for the patient investor who embraces Allan Gray’s approach. Visit the Allan Gray Australia Equity Fund profiles to find out more.

1 stock mentioned

2 funds mentioned