An opportunity to buy assets at a discount

Private equity secondaries, at their core, represent access to private equity — they offer buyers the opportunity to acquire seasoned private equity assets with demonstrated track records, while partaking in the future growth of those assets. For the sellers, secondaries are a liquidity solution that allow them to lock in gains and receive an expedited return of capital.

Secondaries continue to benefit from the growing size and need for liquidity in the primary private equity market and despite a record fundraising year in 2023, the supply of potential transactions is outpacing new capital raised.

As a result, we’re seeing a supply–demand imbalance that makes the secondary market attractive for both buyers and investors.

What follows offers the perspectives and observations from Ares dedicated Financial Advisor Solutions Team and was inspired by the questions we receive from private wealth investors about PE secondaries.

Why would someone sell good assets at a discount?

There are many motivations for investors who need liquidity and look to sell their private equity stakes:

- Rebalancing: This could be due to public market declines that push the private market allocation over the LP* [limited partner]’s investment policy statement.

- Liquidity: Private market distributions that LPs expected to gain have not materialised, while capital calls keep coming in and the LP needs the cash. Alternatively, private market distributions that LPs expected may not have materialised but LPs want to commit to the next vintage of funds** and need the cash. Both of these situations happened most recently in 2023.

- Portfolio organisation: “Cleaning up” older funds that are more than 10 years old and creating line-item proliferation in the LP’s portfolio.

- Idiosyncratic investor issues: This could include a crisis at the LP, the need to pay for large expenses or a change in the investment team approach.

In other words, the reason for a sale is almost never about the private equity assets; it’s about the seller.

Are the assets that LPs sell to secondary buyers of lesser quality?

Generally, LPs are incentivised to sell high-quality assets for which they can fetch higher prices. It’s typically easier to find willing buyers for good assets.

LPs also find it more palatable to sell a quality asset for 85 cents on the dollar that is up 2x rather than a struggling asset for 50 cents on the dollar that is showing a loss.

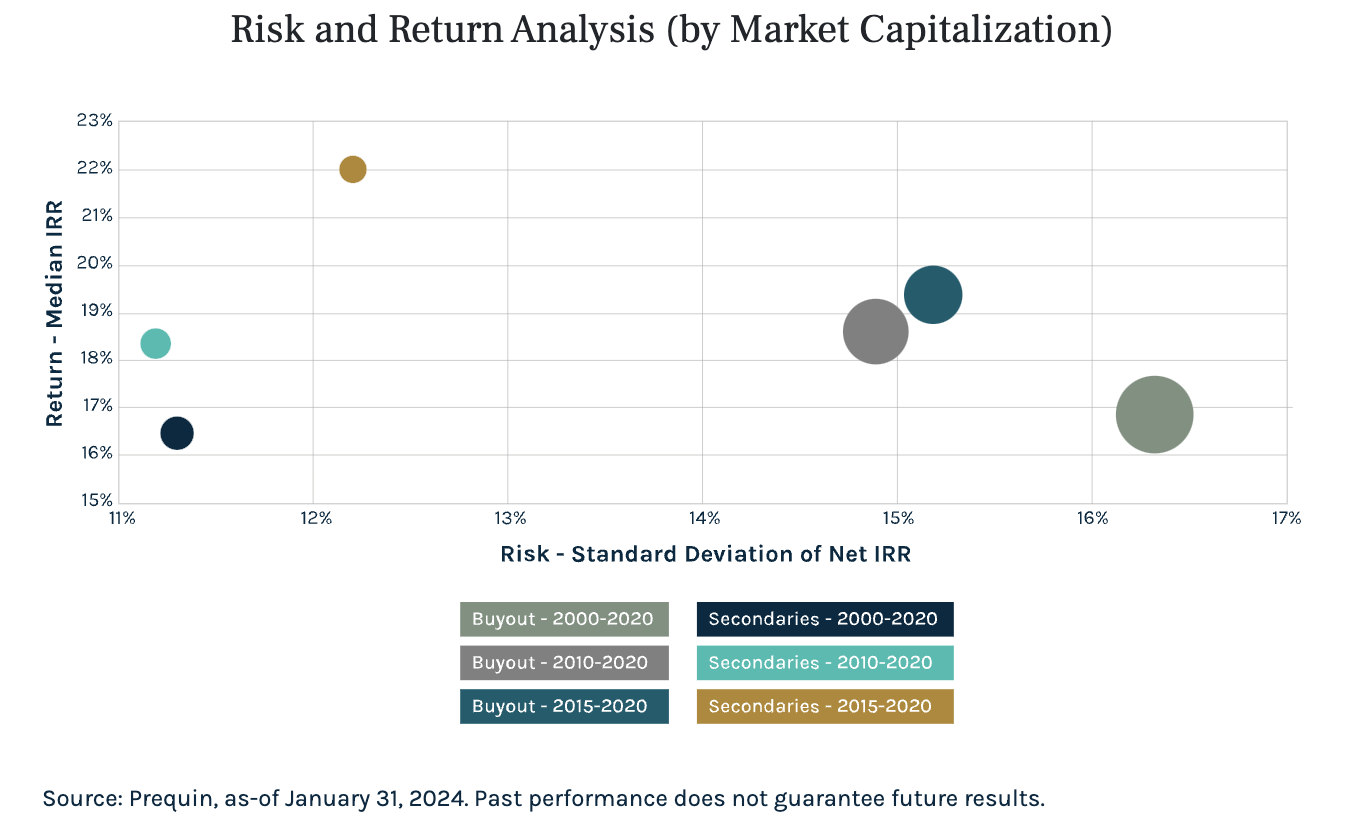

One way to see the proof of these incentives is to look at the chart below. Here, we demonstrate the returns of secondary investments versus regular primary private equity funds.

A few things become apparent in the chart:

- Given secondaries have had similar returns to primaries (as measured by net internal rate of return), it shows that secondaries are not buying lower-quality assets.

- Secondaries can frequently provide returns with less risk. In addition to the above reason, investors in secondaries often benefit from diversification and the fact you know what you are buying (as opposed to buying a blind pool of assets.)

- The data over the last 30 years shows that secondaries are a representative mix of all buyout private equity and are just as high in quality.

And speaking of secondaries...

How much secondary transaction volume can the markets handle?

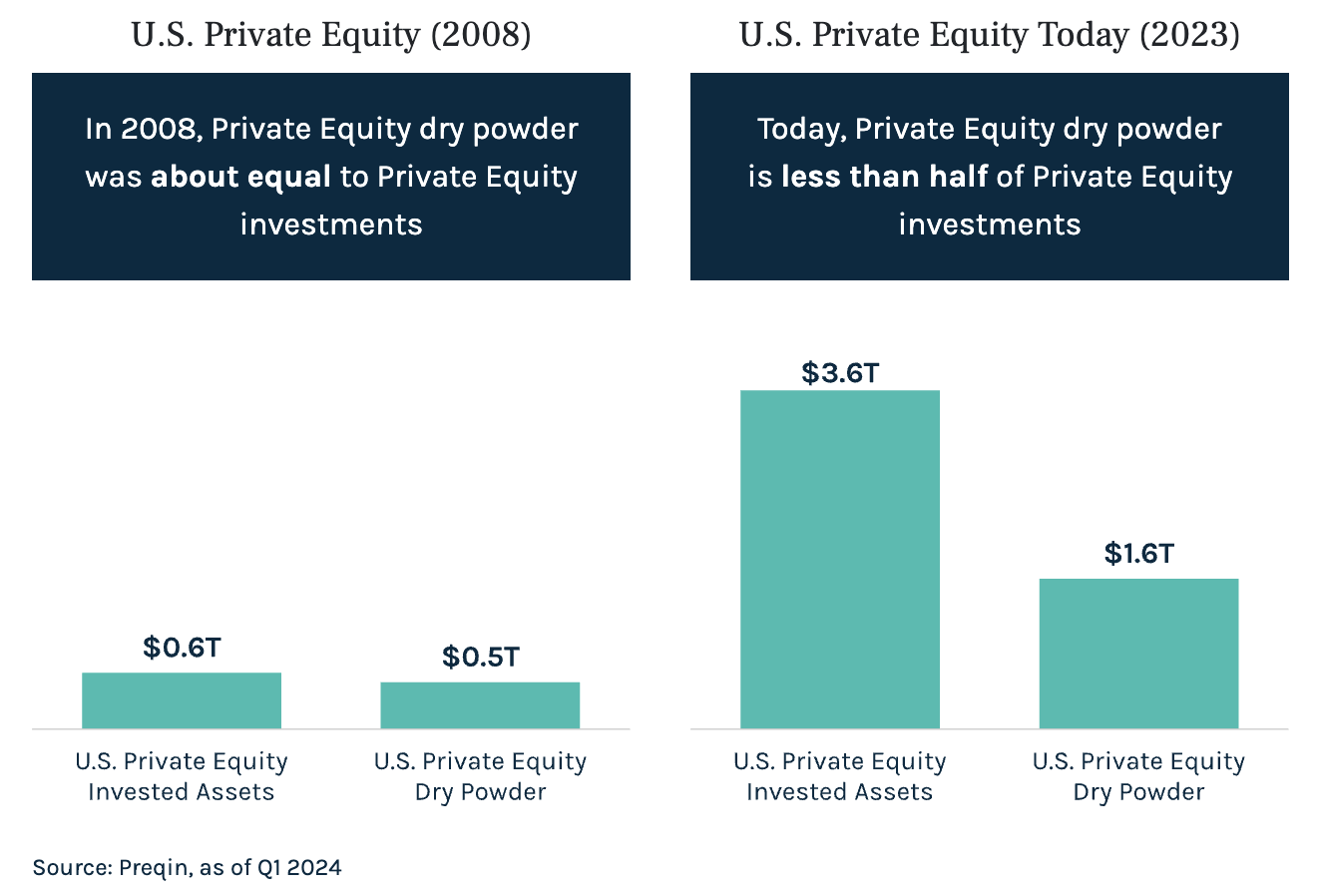

Private equity secondary transaction volume has traditionally fluctuated between 2% and 5% of total private equity invested assets. In 2023, we saw transaction volumes of just under 3% of invested assets. Having said this, we believe there are two main drivers poised to potentially grow that figure to 5% or higher.

Driver 1: The amount of private equity dry powder*** is at its lowest levels in the last 25 years on a relative basis when compared to the size of private equity invested assets (see the below chart).

While there are many ramifications of this trend, one consequence is fewer private equity dollars waiting to buy assets from other private equity managers. We believe this may increase demand growth in the private equity secondary market.

Driver 2: LPs in private equity funds are already struggling with low distributions from their private equity holdings as hold times have increased and exits have become harder to find.

In addition, the average ownership period of private equity assets has increased as private equity shops have moved away from financial engineering and toward operational value creation. This process often takes longer but may provide more durable returns.

GPs can hold assets for longer, while still meeting the distribution needs of their LPs, by leveraging continuation funds**** as they offer partial liquidity and the ability for GPs***** to maintain ownership of their best assets. GP-led secondaries are now roughly 50% of secondary volume.

As these two drivers converge, we believe secondary transaction volume will continue to grow, and we expect much of that growth to happen on the GP-led side of the private equity secondaries market.

Purpose-built solutions to make private markets accessible to investors

Ares is one of the largest and most experienced investors in acquiring secondary private fund ownership stakes in the alternative asset management industry. We seek to generate risk adjusted returns through leading industry analytics and research, robust deal origination, underwriting and portfolio management activities. Find out how to access this opportunity here.

GLOSSARY:

*LPs/Limited Partners: The investors who contribute capital and pay the management fees.

**Vintage: The term "vintage year" refers to the milestone year in which the first influx of investment capital is delivered to a project or company. Investors may cite the vintage year in order to gauge a potential return on investment.

***Dry Powder: Cash that’s been committed by investors but has yet to be allocated by investment managers to a specific investment.

****Continuation Funds: A vehicle designed to extend the holding period of one or more assets from an existing fund that has reached or is approaching the end of its lifecycle.

*****GPs/General Partners: The people in the firm who manage the fund and pick which investments they will include in their portfolios. GPs are also responsible for attaining capital commitments from investors.

4 topics

Mr. Benveniste is the Head of Australia for Ares Asia Wealth Management Solutions and acts as a client portfolio manager for Australian investors. Prior to joining Ares Australia Management in January 2020, Mr Benveniste spent six and a half...