An overlooked region that is set to explode

ASEAN (the Association of Southeast Asian Nations) is an attractive opportunity that is largely overlooked by global investors at the moment. In the second part of a series into why we are bullish on the emerging markets thematic, we deep dive into the key market catalysts accross South-East Asia.

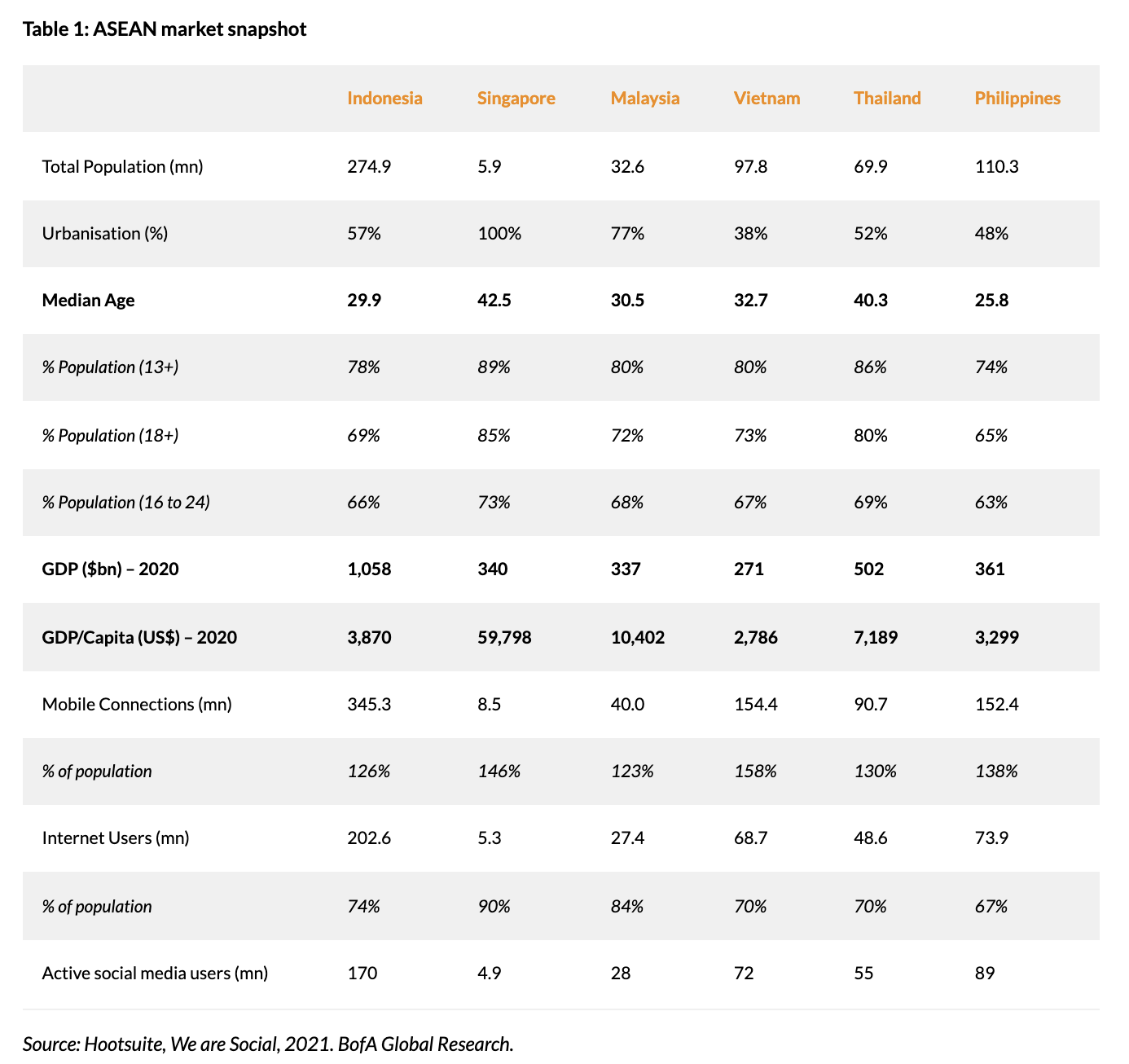

Regional demographics exhibit size and growth

South-East Asia has over 600 million people, or about 9% of the world’s population, and is growing fast. It encompasses countries that include Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam. Over a quarter of the region’s population is between 15 to 29 years old. The size of the middle class is growing, and demand for consumer goods such as electronics, cars, education, leisure, healthcare is rapidly increasing.

ASEAN is a region of different markets and varying levels of economic development. Diversity leads investors to a wide range of opportunities and having an appreciation of the local cultures and nuances is important in making the right investment decisions.

The drivers for growth include an abundant and young labour force, endowment of natural resources and rapid digitalisation.

Recently, the Regional Comprehensive Economic Partnership (RCEP) was developed to enhance trade cooperation between countries in Asia Pacific, including Australia, New Zealand, China, Japan, Korea and the 10 countries in ASEAN. RCEP is now the world’s largest trade block, accounting for a quarter of global trade.

At a time when Chinese labour costs are increasing due to rapid economic development, the young labour force in ASEAN countries will benefit from the migration of supply chains to the region. South-East Asian countries have also been increasing their share in global exports recently. Tariff cuts through RCEP are likely to boost regional trade over the next decade.

Countries such as Indonesia, who are key commodity-exporting nations, will benefit from a rise in energy prices. Indonesia is a major exporter of coal, still an essential fossil fuel required during the transition to clean energy, and of nickel, a key commodity required for electric vehicles. Such a rise would act to boost the Indonesian economy.

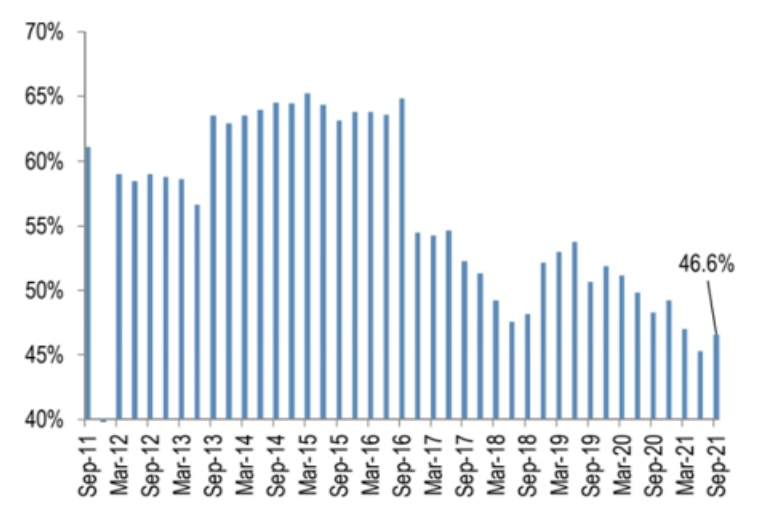

Despite favourable foreign investment laws in Indonesia, such as the Omnibus Law, foreign ownership of Indonesian equities is remarkably low and has contributed to the low valuations in the region. We think this could be on track to improve over the coming years, as market fundamentals improve.

Figure 1: Foreign ownership of equities in Indonesia

Source: J.P. Morgan

Digitalisation: The Next Growth Driver

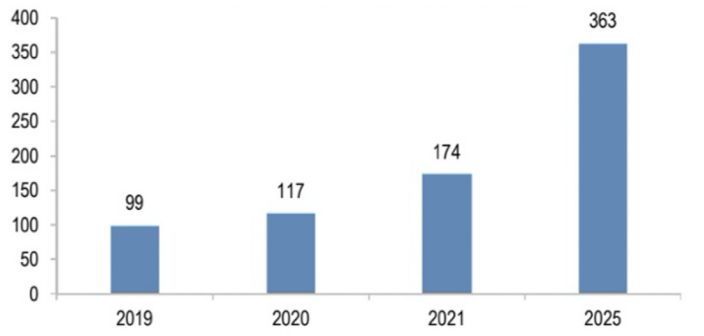

The internet economy size in ASEAN had grown to US$174bn in 2021 (+49% y/y), driven by e-commerce, transportation, food delivery, fintech, and online entertainment. Growth is expected to persist (at closer to ~20% clip in the coming five years). Similar to other regions, once people have a smartphone, the mobile internet ecosystem takes off.

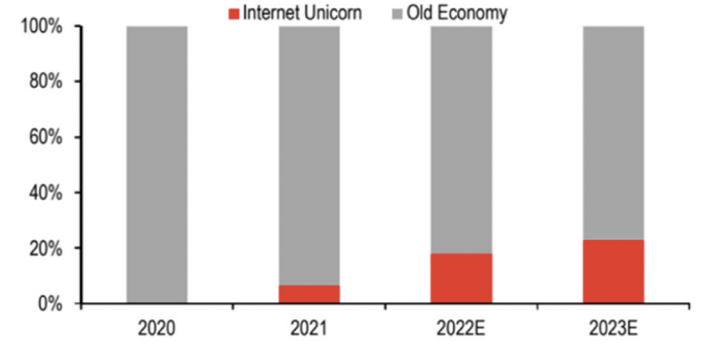

New economy names are starting to make an appearance in ASEAN countries. Many unicorns have grown to be dominant players in their respective domains and are now seeking to access public capital markets. Sea Ltd (a mobile gaming and e-commerce company) and Grab (ride-hailing) are already listed, garnering significant interest.

Figure 2: Internet sector could be more than 20% of MSCI ASEAN

Source: MSCI, Bloomberg, J.P. Morgan

Figure 3: ASEAN's Internet economy size (US$bn)

Source: Google, Bain and Temasek

The Inflection Time for ASEAN

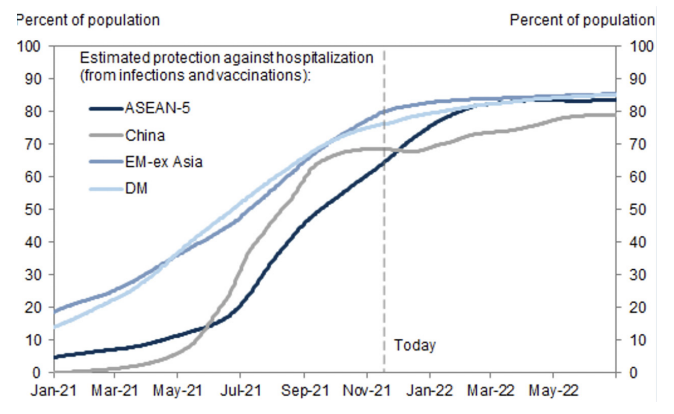

In the coming 6 months, the ASEAN economies are coming out of COVID lockdown. Vaccination rates have

climbed to developed world levels. The opening up of trade will lead to an improvement in activities. Omicron will

only be a speed bump to the overall recovery given the young population and experiences elsewhere in South

Africa, London and New York City.

Figure 4: We expect effective protection against COVID-19

hospitalisation in ASEAN to rise above 80% early next year

Source: Goldman Sachs Global Investment Research, Ourworldindata.com

Summary

There is a lot of growth ahead for ASEAN. A lot of the low-end manufacturing jobs have migrated to China after

China’s entry to the WTO. Rising Chinese wages have already led to reshoring of some parts of the supply chain

back to ASEAN where workers are abundant and young. The RCEP is enabling a smooth reconfiguration of the

global supply chain, and opening up the ASEAN countries to the huge export markets of China, Japan and Korea.

The income levels are low and will pick up. The young population is hooked into the internet and new industries

will be created, just like in other countries before them. This presents exciting opportunities for investors.

We are excited by the opportunity presented in the ASEAN region and continue to focus its on high-quality businesses for potential investment opportunities.

A detailed note on the opportunity in ASEAN is available in the PDF attached to this wire.

Make sure to check out the other parts of this collection:

- Part 1 - The compelling opportunity presented by China

- Part 3 - The valuation case for investing in Emerging Markets

Take advantage of the rapid growth in Asia and emerging markets

Lai's investment approach is to identify the immense changes taking place in Asia and other key emerging markets to find investment opportunities. To learn more, visit the Ox Capital website, or see the Fund Profile below.

5 topics

1 fund mentioned

.jpg)

.jpg)