An overlooked small cap agri stock

"When your competitors go one way, do you follow them, or do you go the other way?" That question was asked of a room of close to 100 financial advisers by keynote speaker Geoff Ramm at Centrepoint Alliance's annual conference last week. The focus at the time was effective marketing but resonated with this investment manager in a different context.

The stocks that contributed most to the performance of the Equitable Investors' Dragonfly Fund in the month of September were clear cases of neglect. Investors, on the whole, had turned their focus elsewhere.

An overlooked smallcap agri stock

Murray River Organics Group (ASX: MRG) was the strongest contributor to the Fund's returns. It is one of two companies Equitable Investors has taken an interest in that have been shunned for the cardinal sin of missing prospectus forecasts.

MRG's share price had flown as high as $1.32 in January 2017, shortly after its IPO. Then serial earnings downgrades resulted in the stock slumping as low as $0.27. Interest in the stock dried up. Its market cap is now just over $50 million and was about half that at its low point, with a $12 million capital raising assisting in the recent increase.

The institutional research arms of the major investment banks don't cover it (although boutique PAC Partners is one that does).

We've been attracted to MRG because, as a result of its neglect, it continues to trade at a discount to Net Tangible Assets, which are underpinned by farming assets in Sunraysia; and we believe MRG stands ready to deliver improved earnings should the weather conditions be more favourable in FY18.

Many more neglected small cap opportunities on the ASX

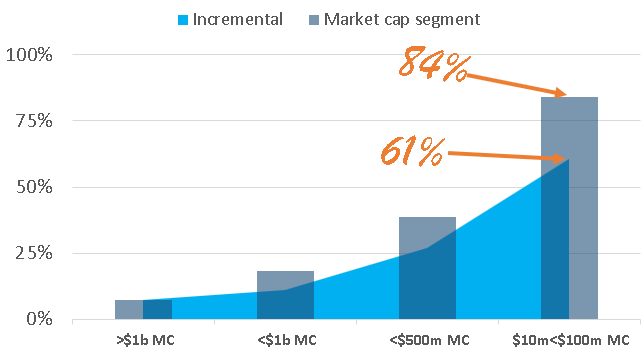

Stepping back to look at this specific story of neglect in context, a recent study by Equitable Investors found that only about eight percent of stocks listed on the ASX have a market capitalisation greater than $1 billion; while 70% of ASX listings have market caps of less than $100m.

Most of the total aggregate market capitalisation is captured by that eight percent minority. This is evident from free-float adjusted market capitalisation data for MSCI indices:

- MSCI Australia Large Cap Index had 30 constituents representing 70% of the market;

- MSCI Australia Small Cap Index had 151 constituents representing 14% of the market;

- MSCI Australian Micro Cap Index had 440 constituents representing 1% of the market.

If treated as a single stock, the MSCI Australian Micro Cap Index would have ranked about 9th in the Australian market by capitalisation (this was based on data available in August 2017).

This means investors with scale, such as large institutions, find it difficult to deploy capital with smaller stocks and, therefore, may not focus on this part of the market or may be absent from the market. It is argued that this could distort the cost of equity capital for small caps. It also means sell-side analysts are less likely to research small firms: their largest clients aren’t interested; lower volumes of share trading for small firms reduces the opportunity for their broker colleagues to generate trading revenue; and the typically size-based fees earned by their corporate advisory colleagues are less attractive.

Percentage of stocks by market cap segment that aren't researched

Source: Equitable Investors, Thomson Reuters

Studies have shown that stocks that are less researched deliver greater risk-adjusted returns than stocks receiving greater focus from analysts.

A 2008 paper by Australian academics Bertin, Michayluk and Prather, “Liquidity issues surrounding neglected firms”, considered neglect as either low analyst coverage or narrow dissemination of earnings announcements, and concluded based on data for 1,544 US firms that “neglected firms, by whatever neglect construct, are much less liquid than their counterparts, and thus the observed return premium is a logical result.”

2 stocks mentioned