An undervalued miner with a critical advantage

Tyndall AM

The concentration of supply of critical minerals related to decarbonisation is an issue that has been highlighted by major Western economies as a risk to securing the materials needed to meet climate goals.

The US Government acknowledged its concerns about this supply chain risk within the recently passed Inflation Reduction Act. Among other issues, this Act outlines potential tax credits for electric vehicle purchases if certain conditions have been met, including that no critical mineral used in the vehicle is sourced from a “foreign entity of concern”.

A key resource sector holding in both the Tyndall Australian Share Wholesale Fund and the Tyndall Australian Share Income Fund is Iluka Resources (ASX: ILU). This company is one of the few miners globally whose products are all considered of high strategic importance. These products include zircon, titanium, and a growing position in rare earths.

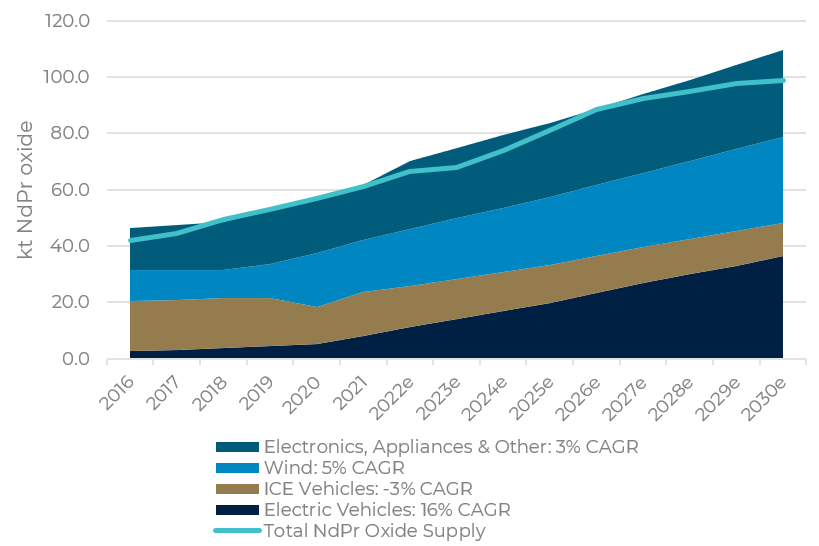

While rare earths are ubiquitous in our daily lives – they are critical inputs for electronic devices, glass, specialty steel alloys and emission control systems in internal combustion engines – it is the development of permanent magnets that enable lighter and more energy-efficient motors which place rare earths on a substantial growth trajectory to meet the world’s climate goals.

Figure 1: Rare earths – as Neodymium-Praseodymium Oxide (NdPr) demand – EV’s and wind to drive total demand growth of 6% CAGR to 2030

Source: Barrenjoey, Tyndall AM

The supply dynamics of key materials needed for decarbonisation are already well understood given they are part of our most consumed metals, including copper and nickel. Others, which form an integral part of the road to electrification, are coming from an almost insignificant demand base relative to their outlook. This includes materials such as lithium, cobalt and rare earths.

China’s control of these materials needed to transition away from fossil fuels is extraordinary, dwarfing even that of OPEC’s control of global oil markets. China controls 80% of battery raw material refining, 80% of solar panel manufacturing and 60% of wind turbine installations.

Notably, while the level of market share is high for these manufactured products necessary in the energy transition, China does not dominate the supply of the raw materials needed to produce them. This provides global consumers with the opportunity to support new entrants to these markets to mitigate the risk around supply chains. However, rare earths are an exception.

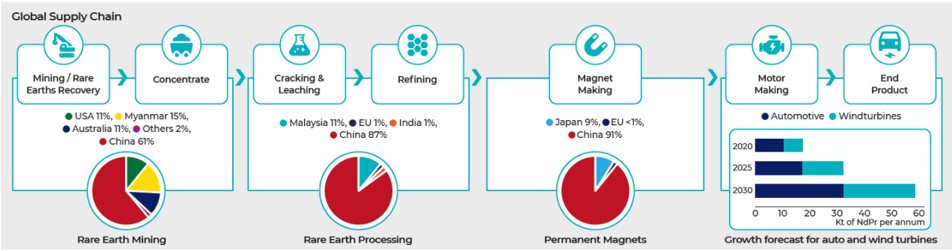

Figure 2: Rare Earths global supply chain

China controls almost 90% of rare earth processing and over 60% of rare earth mining. This number could be considered closer to 75% when including Myanmar volumes which are generally trucked across the border, implying an element of control over these mines by the Chinese.

The high level of market control exerted by China historically has allowed its government to manage rare earth prices to levels that have generally deterred international competition.

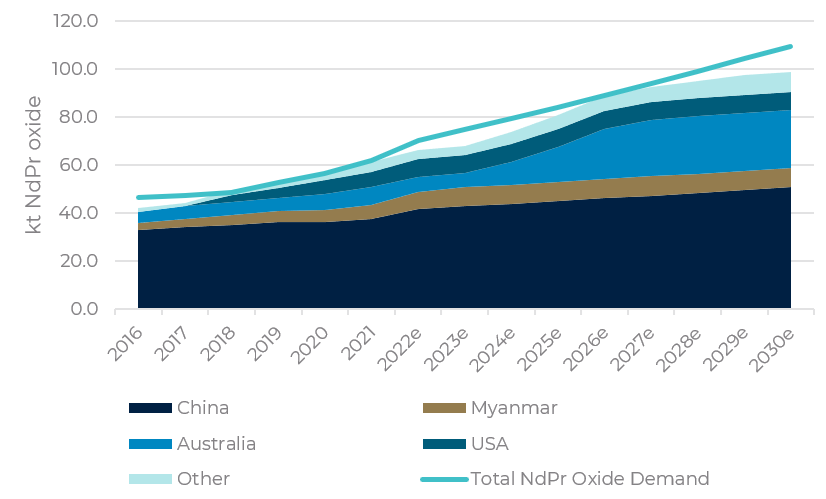

Figure 3: Rare Earths (as NdPr) supply by region – China expected to remain dominant, but significant growth forecast out of Australia

Source: Barrenjoey, Tyndall AM

Environmental risks to supply chains

China’s growth and dominance in rare earth mining and processing were driven by lax environmental standards which resulted in some exploitation of the country’s abundant resources. The Chinese Government’s credible environmental efforts saw the introduction of regulations to reduce environmental harm, including through forced industry consolidation to improve monitoring and the introduction of an export quota system to limit over-production.

While environmental standards have increased, China’s largest producers of rare earths still have low ESG scores. For example, China Northern rare earths is rated by Sustainalytics as “Severe Risk” and ranks the company second last out of the 14,647 stocks covered.

Myanmar’s nascent rare earth industry is facing substantial claims of environmental and social damage, with an Associated Press exposé highlighting substantial ecological harm and major negative impacts to Myanmar from mining practices.

The growing expectation amongst Western consumers for sustainable and ethically sourced materials will see an ongoing focus on the poor operational and environmental practices of Chinese and Myanmar producers. This, plus the geopolitical pressure to ensure the security of supply, creates an opportunity for producers in other jurisdictions to bring new supply to the market.

The Land of plenty

Australia can capitalise on this dynamic. It is already a key supplier of many critical minerals vital for decarbonisation, although current production is only a small fraction of the country’s demonstrated resource. This provides significant scope for growth.

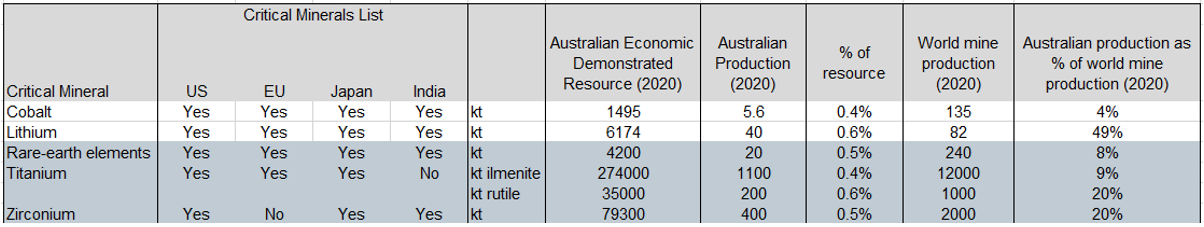

Iluka has the fortunate position of having all its products classified as ‘critical’. It is a major producer in its established markets – including a 30% share of the global supply of Zircon and a 10% share of the supply of high-grade Titanium feedstocks. While this is well understood by the equity market, we believe it is Iluka’s opportunity in rare earths that the market is yet to fully appreciate.

Figure 4: Key critical minerals on major economy lists and their Australian resource endowment

Source: Tyndall AM, Geoscience Australia

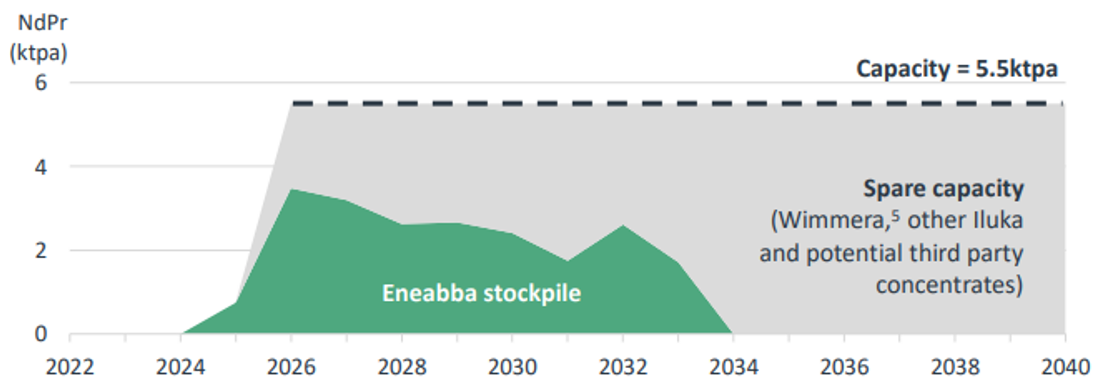

Iluka’s Eneabba project, located some 300km north of Perth in Western Australia, will be Iluka’s relatively low-risk entry into rare earth production. It is slated to produce 2.7mtpa NdPr initially, scaling up to 5.5mtpa in later stages which equates to 7% of forecast demand (for reference, Lynas rare earths currently produces 6ktpa NdPr).

Figure 5: Iluka’s illustrative rare earth (as NdPr) production profile from Eneabba and the expected total capacity of the operation

Source: Iluka Resources

While we usually have a healthy amount of scepticism when miners attempt to move beyond core competencies, the Eneabba project has several attributes that make it relatively low risk. These include:

- The utilisation of a considerable stockpile of rare earth-bearing monazite ore in place at Eneabba gathered from decades of mineral sands mining. This provides a known quantity, grade and mineralogy of material for processing in the initial years. This stockpile alone underpins the economics of the project, with further upside from additional mined deposits.

- Given the use of stockpiles in the initial phase, the environmental impact from mining is minimal as it uses a previously classified waste stream.

- The monazite has been previously treated by a French processor in La Rochelle (now owned by Solvay) in the 1980’s, meaning we know it can be done.

- Iluka engaged global French rare earth processing experts Carester early in the development process who are incentivised to see the project commissioned on time. Carester has first-hand experience in treating Iluka’s monazite ore during their time at the La Rochelle plant, with these same experts also bringing experience from other ex-China processing plants which provides a wealth of knowledge from years of troubleshooting.

- Iluka has secured almost all the upfront CAPEX from the Australian Government via a $1.25 billion non-recourse loan at market competitive rates and with a long tenor. The finance includes risk-sharing mechanisms to support the project in the face of potential technical, operating and/or market-based challenges.

While no new development is ever a lay-down misère, it is rare to find a development in the resources space with relatively low technical and financial risk to the operator. We believe the project could ultimately be worth in excess of $2 billion and account for almost half of Iluka’s value when factoring in contributions from other resources.

It is also rare to find a business fully exposed to key critical minerals at material levels of market share including elements so strategically important for decarbonisation.

Conclusion

As Western economies pivot to ensure supply security along entire decarbonisation supply chains, we expect the market’s appreciation of Iluka’s rare earth exposure will grow and add significant value to our investment. The US Inflation Reduction Act’s rules around critical mineral sourcing away from “foreign entities of concern” creates a strong rationale for Australian rare earths to attract a valuation premium. We expect this will be priced into Iluka over time.

Figure 6: NdPr price history (the key rare earth elements used in battery manufacture)

Source: Steelhome

Learn more

For more than 30 years, the Tyndall name in Australia has been synonymous with equity funds. We believe the best results in the future come from identifying value in the market today. To learn more, please visit our website.

4 topics

1 stock mentioned

Stefan has 13 years’ experience in equity analysis and a further 8 years within the Petroleum and Chemical industries, including oil refining and mining/steel services. Stefan has sector responsibilities for the Mining and Oil & Gas sectors.

Expertise

Stefan has 13 years’ experience in equity analysis and a further 8 years within the Petroleum and Chemical industries, including oil refining and mining/steel services. Stefan has sector responsibilities for the Mining and Oil & Gas sectors.