An unusual recession for the Aussie consumer

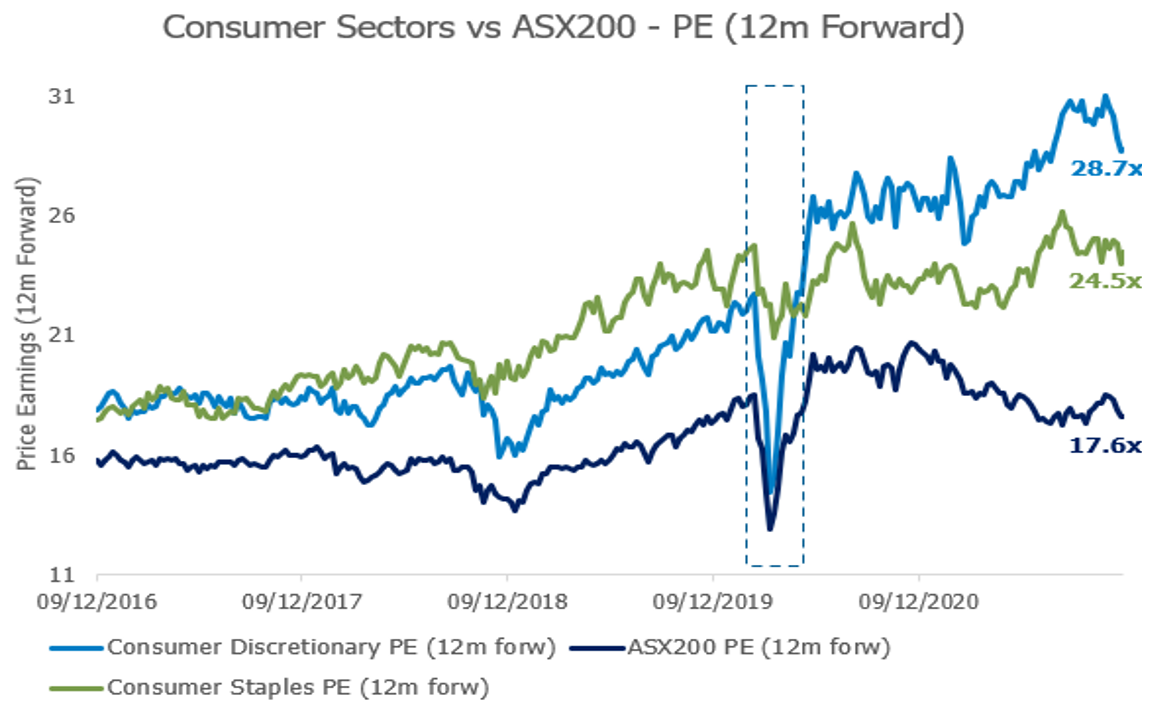

There are two types of consumer companies: staples and discretionary. Staples deal in goods that we need every day, generally companies like supermarkets or food and beverage manufacturers.

Consumer discretionary companies deal in products and services that are not as urgently needed, that consumers aren’t forced to buy on a regular basis, whose purchase can be delayed if required. These tend to be retailers of household goods like furniture and electronics, media and gambling companies, and some services such as education and childcare. Discretionary companies are generally quite at risk during recessions.

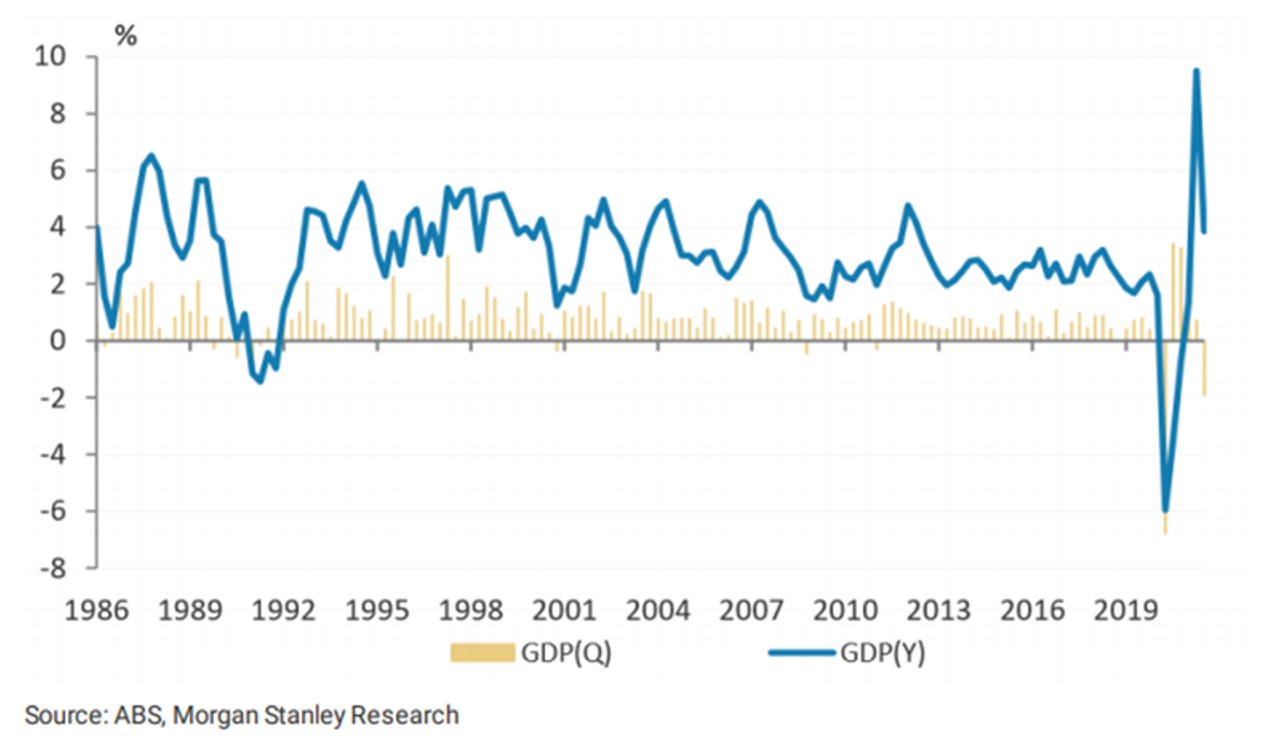

The most commonly accepted definition of a recession is two consecutive quarters of negative economic growth, and on that basis last year saw Australia’s first recession since the early 1990s. Recessions usually last for a year or two and are typically very bad for discretionary companies. Unemployment skyrockets, peoples’ disposable income is crimped substantially, as is their ability to spend on discretionary items. You still need to buy toilet paper (lots of it, apparently) and pay your utilities, so income is directed towards the essentials. The new lounge or TV can be put off for a while.

Consumer staples are more resilient during recessions than consumer discretionary stocks

Source: Bloomberg

This time it’s different

This time it was different. Last year’s was a very unusual recession. For a start, it was extremely brief. It was caused by the closure of the country by government decree in the early stages of COVID, not by economic excesses that needed to be cleaned out, which is usually the cause. In the March quarter of 2020 the economy shrank by 0.5% and was followed by a huge 4.9% contraction in the June quarter. The recovery, however, was just as sharp.

By the end of June 2021 we had recovered all of that contraction although the Delta lockdowns in NSW and Victoria in the September 2021 quarter sent it back down again, recording a 1.9% drop. The current (December 2021) quarter is hard to call — we don’t think we are currently in another recession, although we won’t know until the number comes out at the end of February. But it really doesn’t matter much if it is or not: unless there is a new set of lockdowns or some other exogenous shock, the economy should be back towards normal in 2022.

Australian GDP — the third quarter was more resilient than expected, despite lockdowns

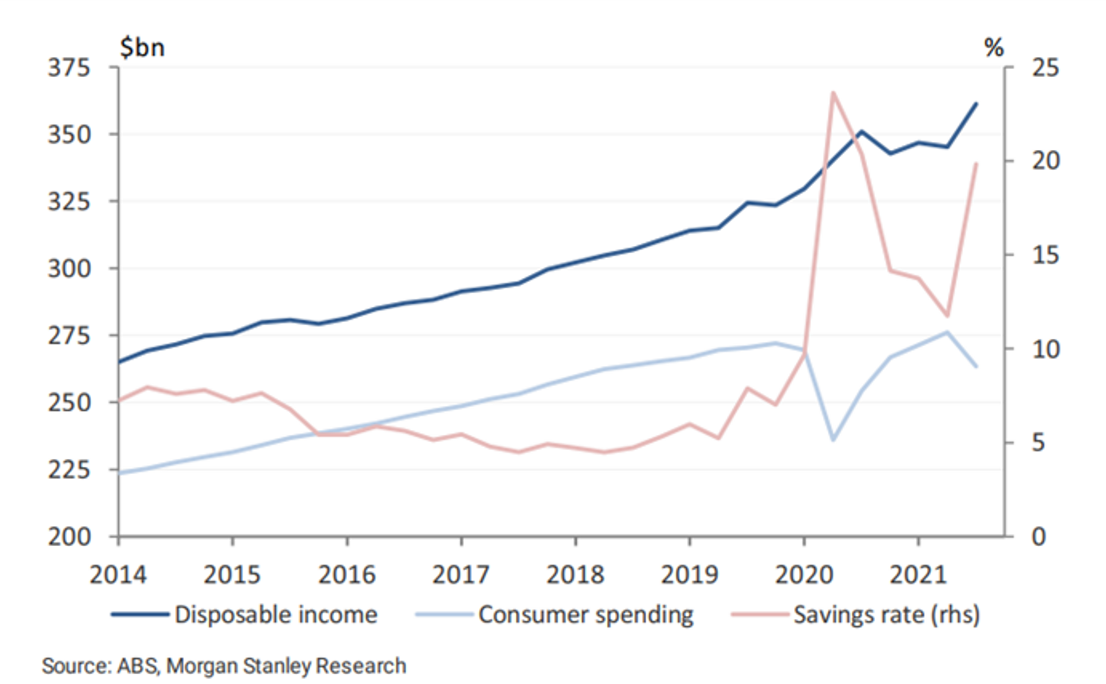

This time it was different too because the widespread damage to consumers typically wrought by recessions didn’t happen. The government took the GFC strategy and turned it up to 11. During COVID the amount of government stimulus was immense, many times that of 2008-09. It was directed at companies, to keep a lid on unemployment, and to individuals who had lost income. It wasn’t particularly efficient but it was effective in helping the economy rebound.

Some people and companies actually ended up in a better financial position than they would have been. Those on unemployment benefits also received larger payments for a period. As a result, rather than consumer discretionary companies doing it tough, some of them did very well indeed. Many people who were all of a sudden unable to take expensive holidays had extra income to spend on that new lounge or TV or car. Sellers of such things made a motza, on top of which, many received JobKeeper funds.

It was interesting to see how companies dealt with JobKeeper. Alphinity did not receive, nor did we seek, any government support through COVID: we didn’t need it. We were proud of one of the consumer discretionary companies in our portfolios, Super Retail Group (ASX:SUL), which operates several retail formats, including Supercheap Auto, BCF, Macpac, and Rebel Sport. It initially accepted JobKeeper funds but ended up doing very well from the unexpected consumer environment. It was the first company to make the principled decision to return unneeded JobKeeper payments to the government and started a minor trend. Some retailers did it voluntarily, some were eventually shamed into it, while others have resolutely held onto the money.

Where to now?

But that is the past: where to from here? It is inevitable that some of those gains will be given back. Few retailers could book a one-off 20% or 30% increase in sales and keep growing from that new base. The timing is uncertain however, and while the COVID disruption went on for much longer than anyone thought it would at the start — ourselves included — some things are going to apply in the current financial year which could lead to the consumer staying strong for some time:

- High vaccination rates and boosters reduce the risk of further lockdowns, Omicron permitting

- Personal balance sheets are in very good shape. People collectively have the ability to spend massively when the opportunity presents itself

- Unemployment is also in pretty good shape. Many were surprised that unemployment didn’t skyrocket during this most recent spate of lockdowns — in fact it kept falling — but that is just because of all the government support given to people who lost work and didn’t need to search for a job.

Australian consumers — in a strong position with post-lockdown savings

The market is very aware of the likely one-off nature of many of the gains last year and has been reluctant to capitalise them into company valuations. There is currently a very wide dispersion between the top quartile of discretionary retailers with high valuations and the bottom quartile with the lowest valuations.

A number of those in the bottom look really “cheap” on current earnings — i.e. they are on a low multiple of earnings relative to the rest of the market — but the market expects them to earn less next year than this. If the environment turns out not to be as bad, as has been progressively happening this year, there is the potential for earnings upgrades.

The market is generally pretty good at working things out directionally but less good at accurately estimating the precision of the moves. For instance, pre-COVID the market estimated that Super Retail Group would earn about $1 a share next financial year (2022-23). When COVID hit, the market took the very bearish view that the company would only earn about 60c per share in 2022-23. As the real environment panned out to be better and the company kept reporting strong operating conditions, there has been a string of earnings upgrades and the market is now looking for about 90c per share: less than at the start of last year but a full 50% above the panic-stations level.

Super Retail Group — earnings surprises drive earnings upgrades

Source: Bloomberg

Our experience is that a company’s share price is primarily driven by rising or falling expectations of future earnings. This worked neatly in the case of Super Retail Group: its share price fell sharply during the initial panic (from $10 to $4); we established a position not long after that. The shares have since recovered that and more, trading above $12 at the time of writing. Even at those levels, in our view, the company — as well as some others in the consumer discretionary sector — does not look expensive, especially when you consider that the earnings the market even now expects appear readily achievable and will likely be exceeded. If that is the case, its share price prospects will likely also be good.

In summary, there are still opportunities to invest in consumer discretionary companies even in the current uncertain environment and our process has proved to be effective in finding them. You can’t just look at them as a homogeneous group, however. Each individual company has a different earnings cycle and great care needs to be taken to find the right ones.

Learn more

As a specialist, active, core equities investment manager, our aim is simple and effective: to identify opportunities across market cycles and invest in quality, undervalued companies with underestimated forward earnings expectations. Never miss an insight by clicking the follow button below.

2 topics

1 stock mentioned