Answering the internet's most common ETF questions

Around 51% of Australians (or 10.2 million people) hold investments outside their homes and superannuation, according to the ASX. Of these investors, around 20% (or 2 million people) use exchange-traded funds (or ETFs) - up from 15% in 2020.

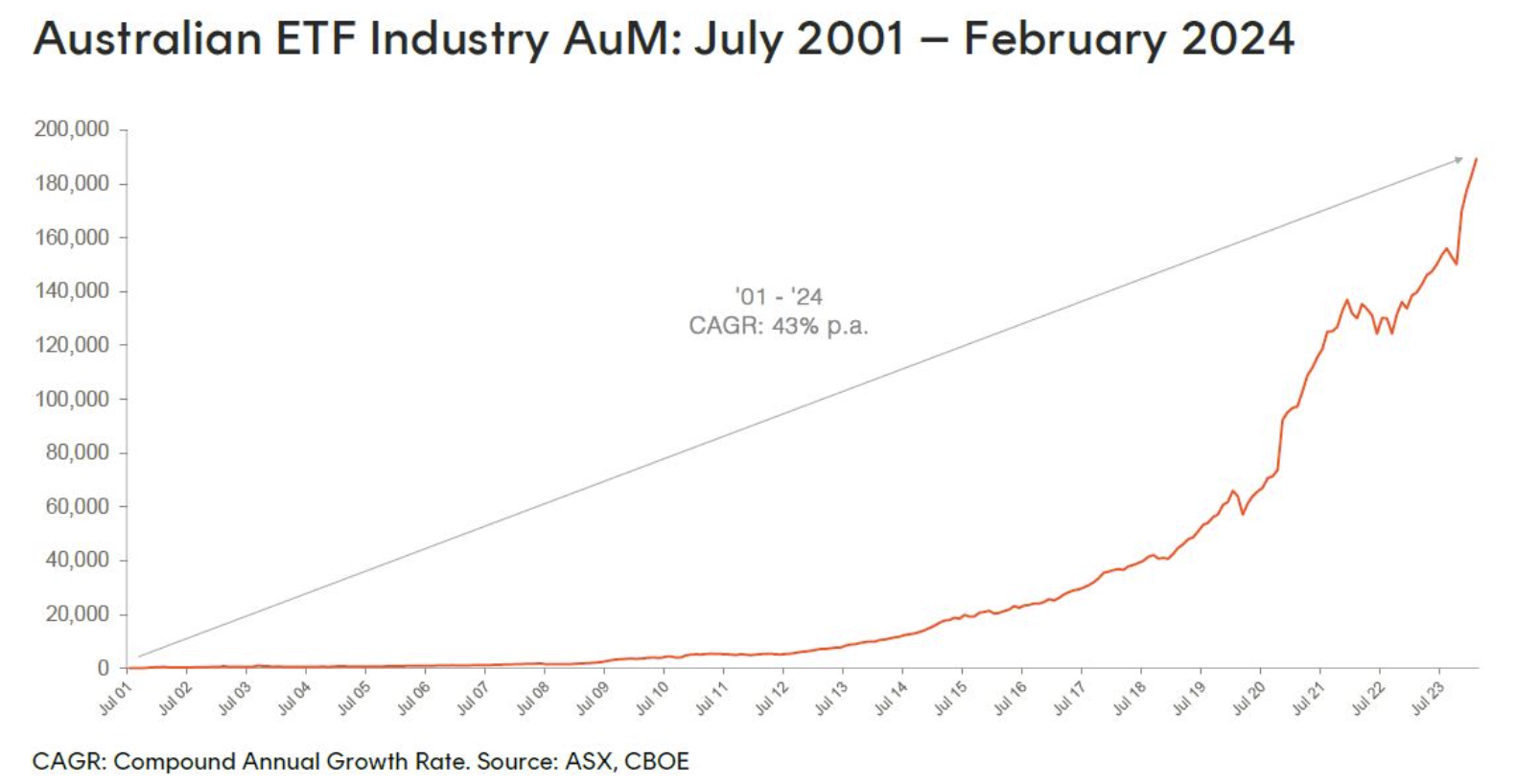

Investor interest in low-cost, liquid and diversified ETFs has seen assets under management in the industry explode over the last decade, with its market cap now reaching close to $190 billion. In fact, in the last 12 months alone, the market cap of the Australian ETF industry has surged 35.5% (or by $49.6 billion).

Given more investors are using ETFs than ever before, Livewire decided it would be worthwhile to go back to basics, reaching out to two ETF aficionados for their top tricks and tips on investing in these listed vehicles.

In this episode, Shaw and Partners' Adam Dawes and DP Wealth Advisory's Andrew Wielandt answer the internet's most common questions on ETFs. Plus, they also each name the one ETF they believe "rules them all".

Note: This episode was filmed on Wednesday 13 March 2024. You can watch the video, listen to the podcast or read an edited transcript below.

Other ways to listen:

Edited Transcript

What is an ETF?

Adam Dawes: An ETF is an exchange-traded fund. Basically, an ETF is a basket of shares that have been put together. So you buy one share and you get a basket of those shares. So, they are great for diversification, great for getting access to international markets, and it's a way to fill out your portfolio. So an ETF is a great vehicle for investors to get diversification.How do you compare ETFs?

Ally Selby: There are hundreds of ETFs available on the ASX. How do investors compare them?

Andrew Wielandt: There's a whole range of ways you can do it. Further to Adam's point, it's around diversification and asset allocations. You might say, "I want some Australian shares or international shares or bonds or fixed interest or property," or whatever the case may be. So if you use that as your first lens, then your second lens might be, do I want to be passive? Do I want to follow an index? Or do I want to be active and use factors, like income, growth, momentum, etc, to further diversify my portfolio?Ally Selby: How would you compare similar ETFs though?

Andrew Wielandt: So part of it could be around cost if we're talking passive. If we're talking active though, there are other factors you should be considering. What rules do they use? What other factors are in play? Who are the managers involved? So it's not a simple answer, but a very blunt way of looking at it would be cost.Are ETFs safer than stocks?

Ally Selby: Okay. I really like this next question. Adam, are ETFs safer than stocks?

Adam Dawes: Yes and no. Is that a good answer for you? The first answer is yes, because they are more diversified. So you're not just in one stock. Now, if your whole portfolio was in Commonwealth Bank, well, you would have done very well. But if your whole portfolio was in another stock that hasn't done very well, it would fall. In an ETF, you've got a basket of goods. So your diversification and your risk are reduced. That's the yes.The no is that they're all in shares. So no matter where you go, if markets are falling, your ETF will fall as well. And especially with a lot of these thematic ETFs, so in other words, if it's in copper or uranium, all of those kinds of things, if that sector does badly, the ETF will do badly as well. So I don't know if I answered that, but there you go. Yes, they are safe. Yes.

Ally Selby: They're not all in shares though. Some more active ETFs are in fixed income-like products.Adam Dawes: Bonds. Yep, absolutely. But most of them are all in that listed space. But, you're right, there are other ones with bonds and things like that.

Are there any downsides to investing in ETFs?

Ally Selby: Okay. Over to you, Andrew. Are there any downsides to ETFs?Andrew Wielandt: Ally, that's a tough question to ask an ETF whisperer, as I've been called previously.

Adam Dawes: Very proudly called.Andrew Wielandt: Thank you. Merchandise coming soon for those playing at home. I think you've just got to be careful of these thematic ETFs, and Adam just touched on a couple of them before. The uranium ETF has just shot the lights out over the last 12 months. It's up about 55%. But over the last month or so, it's down about 9%. So these thematic ETFs tend to have a bit of a life of their own, and when people love them, they're on fire. But when people don't like them, people dislike them with a passion. So I think it's really just making sure you have that balanced portfolio and saying, if I have a thematic ETF, at what point, if people are no longer engaged with that ETF, do I get out? So that's probably more in that active space.

When it comes to passive, you're just buying markets, and we know that by buying markets, there's a 77% chance over 15 years that you'll actually perform in line with the market relative to someone trying to beat the market. So if you're taking a passive approach, long-term, you should be okay, but it's these active ones that you need to be a little bit more cautious on.

How much and how often should I invest in ETFs?

Adam Dawes: A great way for a young person to get started is to get some ETFs instead of trying to pick single stocks and understand what's going on, so you get that basket. So really it comes down to how much brokerage you're paying compared to that. And there's obviously cheap brokerage these days, so everyone should be putting $200 to $300 a month in. And for a young person over a 30-year lifespan, that compounding is amazing. Plus, then reinvesting those dividends as well, I think that's absolutely fantastic. So I don't think there's a real minimum as such. Maximum, the sky's the limit with market makers in there. But on the minimum side, I think for younger people, it's a great way to get your portfolio started.

How long should I hold an ETF?

Ally Selby: How long should someone hold an ETF?Andrew Wielandt: Ally, how long is a piece of string? So again, this active versus passive frame. If I'm a passive investor, arguably forever, as I'm just buying a market or an asset class. It comes down to your circumstances. But if I'm in thematic land - again, coming back to that uranium example from before. Uranium spot prices have come off 10% over the last month. So it's time for me to get out. So if you have more passive, then it's longer term. If you're in thematic land, look at what's driving that thematic. For example, if the lithium price is off 80%, that's probably not helpful for lithium or battery technology ETFs, then you maybe need to have a shorter timeframe.

What happens if an ETF shuts down?

Ally Selby: Speaking of thematic ETS, or maybe the more poor-performing ones, what happens if an ETF shuts down?Adam Dawes: There are lots of ETFs that get released every year. Lots of big companies are releasing all of these ETFs, plus managed funds do that as well. More to the point, I think, is why do they cancel them? They cancel them because there's not enough volume going through and it does cost them money each month/year to have these ETFs listed on the ASX or anywhere. So it has to be a business decision, but it also has to be - like the thematic, it has to be right. So they do cancel these regularly. What happens is that you get the net asset value as of the date they're going to close it. So let's say June 30, you'll get the net asset value, the NAV of that ETF, you get that cash back, and then you can go ahead and do what you want. Whether you're at a loss or a profit, they will close it, give you your money back and you're done.

How are ETFs taxed?

Ally Selby: Okay, a little bit more of a difficult question now. How are ETFs taxed?Andrew Wielandt: I'm not an accountant, that's my disclaimer, but if you think about shares, it's pretty simple. You get a dividend and if and when you choose to sell them, there's either a capital gain or a capital loss. It's pretty simple. Similarly, with ETFs, if I sell them at a gain or a loss, that's one side of it. When it looks at the income though, different components are occurring within the income. So you were talking before about international - there might be some international income in there or if there's some Australian income or there'll be some franking credits, or if throughout the year the fund has actually been changing the mix within there, there might be a distribution of capital.

So there are a few more components, but don't stress. On your end-of-year statement from your ETF provider of choice, they'll actually tell you in box 12, put this and, in box 15, put that. So certainly keep your records. That's super important. There are a couple more moving parts, but it's not insurmountable.

What is the best ETF in Australia?

Adam Dawes: I am going to steal a bit of Andrew's thunder here, but it's the VanEck MSCI International Quality ETF (ASX: QUAL). This is the quality ETF. It is a fantastic ETF and gives you great international exposure. If you have a look at the chart, this thing's done absolutely fantastic and will continue to do amazing going forward. So it's one of our core staple ETFs in every client's portfolio, and I think everybody else should do the same.

Ally Selby: Andrew, over to you.

Andrew Wielandt: Mate, you're killing me. But just following on from Adam, obviously, it's QUAL, the one ETF to rule them all, but if we think about what the quality ETF holds, it's companies with a high return on shareholders' funds, steady to increasing revenue, and steady to decreasing debt. And Adam and I have been doing this game for a little while now. Hard to believe with the baby faces that we have. And it's very rare that you have companies go bad that exhibit those three characteristics. So that particular ETF holds 200 companies across a range of about 1500 across the world.To be a little bit different, so we're not matchy-matchy, the Vaneck MSCI International Quality (Hedged) ETF (ASX: QHAL) would be another one to think about. That's the hedge version. So one of the reasons why QUAL has done so well is because it's unhedged, and the Aussie dollar, which over the last 40 years has sat at around 74 US cents, is about 65-66 US cents at the moment. So, if and when the dollar does get its act back into gear and you'd expect that to be the case at some stage, then QHAL might be a way to protect yourself. Because if the dollar starts going up, QUAL will come under pressure. So perhaps the barbell, Adam, might be a little bit of QHAL and a little bit of QUAL, but the two together are a match made in heaven.

Ally Selby: Okay, well, I hope you enjoyed that episode of Buy Hold Sell as much as I did. If you did, why not give it a like? Remember to subscribe to our YouTube channel. We're adding so much great content just like this every single week.

5 topics

2 stocks mentioned

2 funds mentioned