Antares' seven-step process powering Dividend Builder

Funds management requires balance, between process and independent thinking. These two dimensions are not particularly compatible on the face of it but, if done right, can lead to outstanding results.

Consistency and discipline create flexibility. If you have a proven process that is robust and repeatable, that frees you up to challenge the status quo by thinking differently to take advantage of opportunities that may be missed by the market.

As style-agnostic, bottom-up stockpickers, the Antares team gain deep insight into the companies in which they invest (or decide not to invest) via a systematic process that includes rigorous ESG and sustainability research.

In creating and adhering to a winning process, the team can pursue the other element, independent thinking.

The Antares culture is one of curiosity and resilience. The goal is to challenge inherited wisdom, rather than accept it.

In this edition of Fund in Focus we explain the Antares seven-step process, with a particular focus on the Dividend Builder portfolio, which aims to deliver income and capital growth in a tax-effective manner – making it ideal for almost any Australian equities portfolio.

Edited transcript below

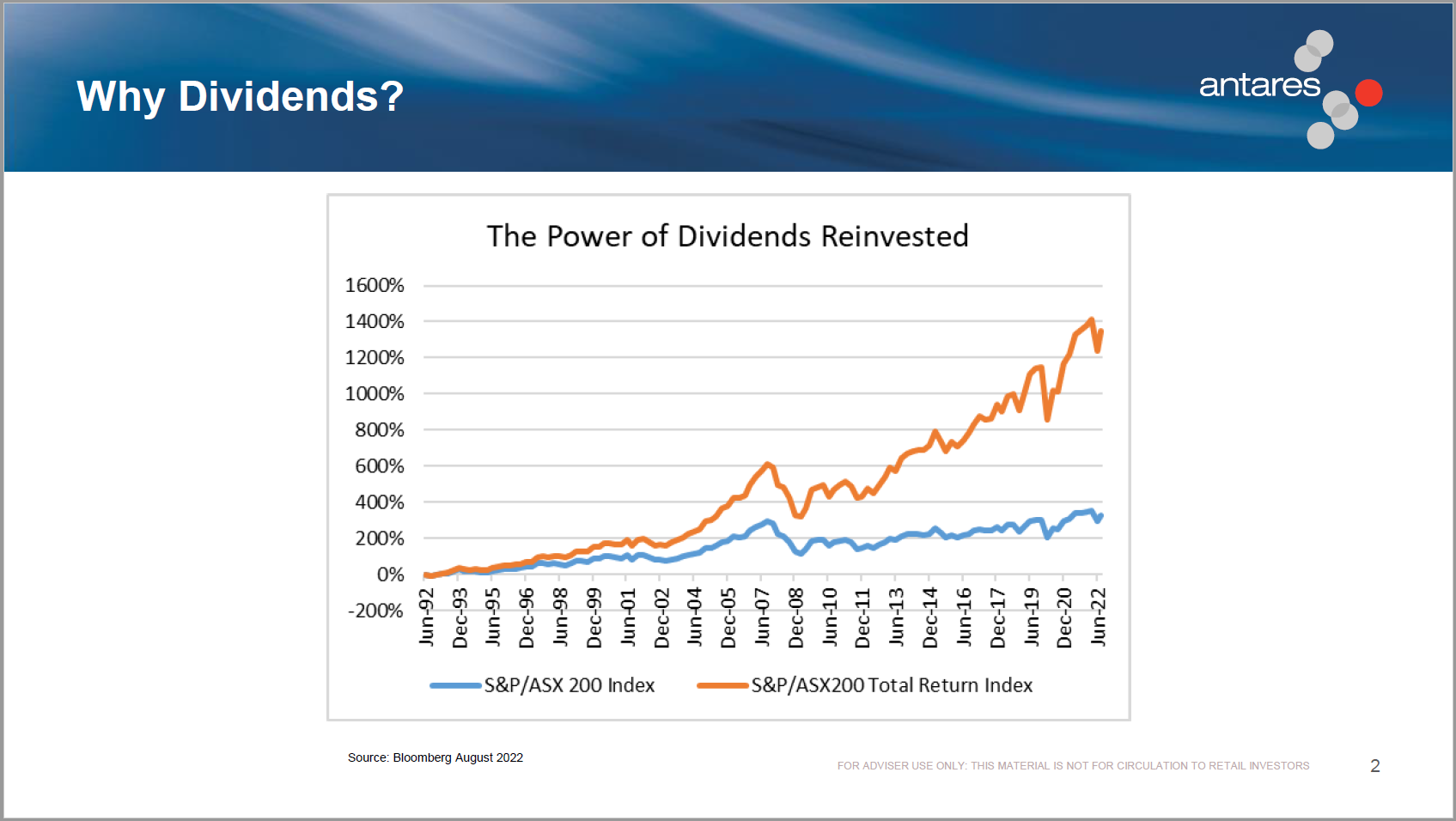

Hi, I'm Andrew Hamilton. I'm here today to talk to you about Antares Equities, and specifically our Dividend Builder strategy, both managed fund and SMA. Firstly, why dividends? Why Equity income? This chart shows it very powerfully.

This data is from Bloomberg as far back as we could find it for the ASX 200, back to 1992. The blue line is the return of the S&P ASX 200 index. That has returned almost 400% since 1992. The orange line is the S&P ASX 200 total return index. What that means is all of the dividends are added back and reinvested.

We know the power of income in building wealth.

The same is true with shares. The orange line which is the total return index, has returned just south of 1400% for the same period. That's pretty powerful.

Why Antares?

We're bottom-up stock pickers, we're style agnostic. That means we're not value managers, we're not growth managers, et cetera. We seek to outperform at all phases of the market cycle, rather than just in specific times within a market phase.

As bottom-up stock pickers, obviously we believe strongly in fundamental bottom-up stock research, and we have a 25 year track record managing only Australian equities. I've been with the firm for 22 of those 25 years.

Investment philosophy

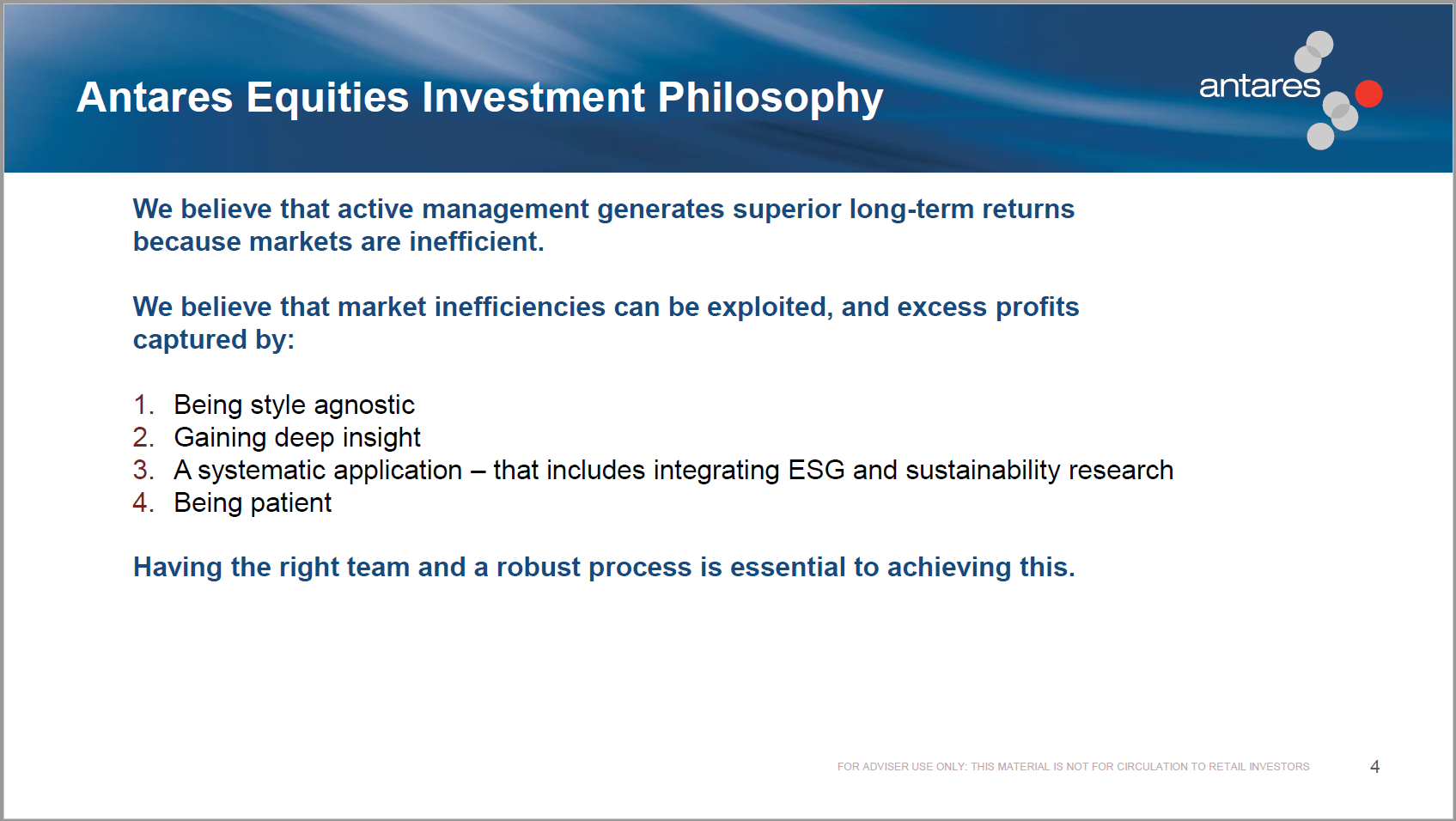

As active managers, we believe the market is inefficient, but how do we seek to exploit those inefficiencies? As I mentioned, we're style agnostic, so we're not wedded to particular types of stocks in which we invest.

Bottom-up stock picking means we seek to gain deep insight into the companies which we can and do invest in. But in order to do it well, we need a systematic application of that process.

That includes rigorous environmental, social, and governance (ESG) research, as well as sustainability research. We see those two things as complimentary, but slightly different. Active management also requires being patient. To do all of that and do it well, we have to have the right team and we have to have that robust, repeatable process.

Our investment team has 10 members: one specialist dealer who executes all of our transactions, the rest of us are all stock research people. We all have stock research responsibilities. Three of us manage portfolios.

Our culture is to be curious, to be resilient.

The team is a diverse one, not just diverse in traditional ways of thinking about diversity, but critically for us, diverse in terms of the way different members think. We need to make sure that people's thinking challenges the status quo and challenges inherited wisdom.

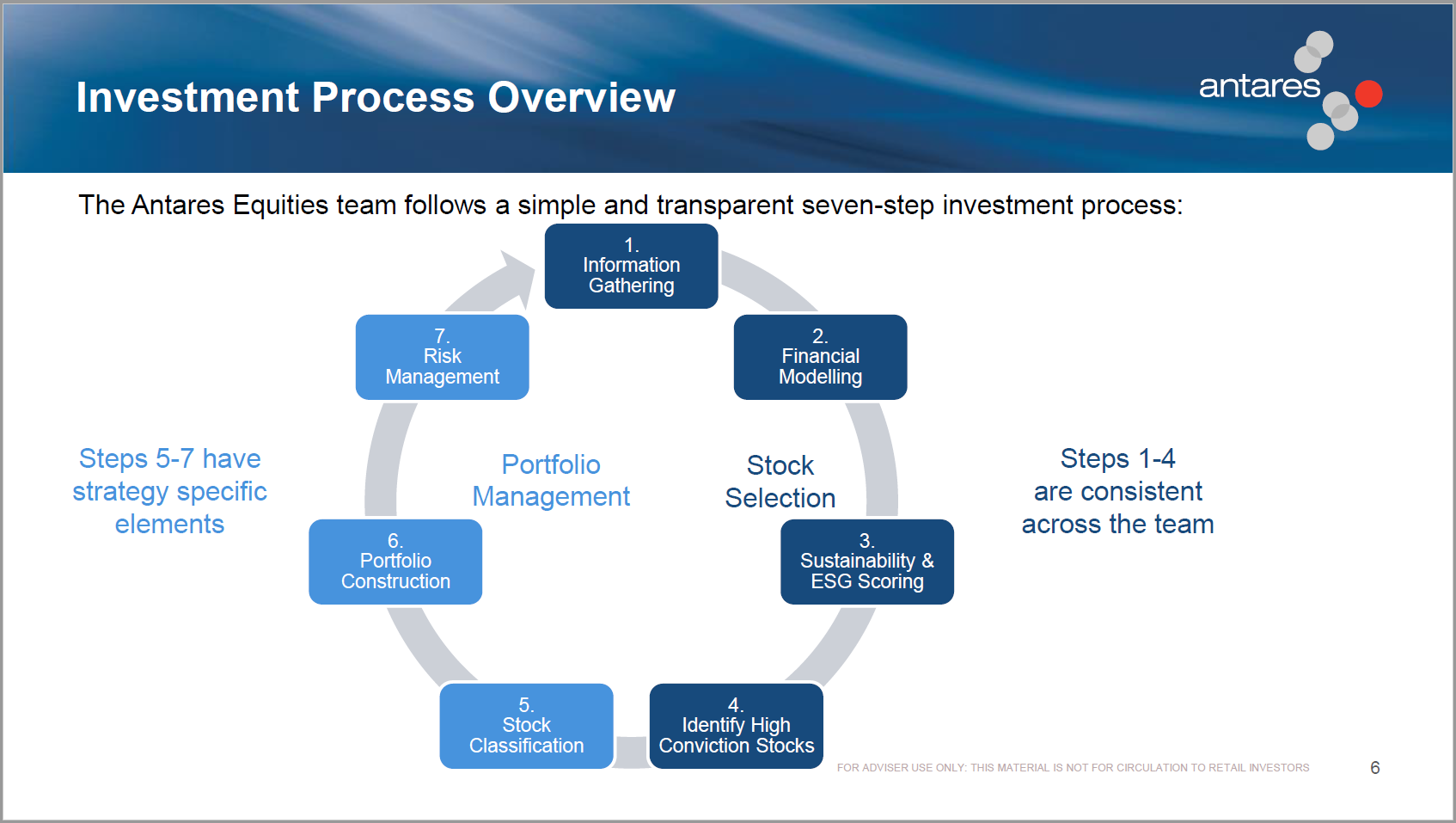

Our investment process is common across all of our portfolios, all of our strategies, through the first four steps of our seven-step process. That's all to do with the bottom-up research, ESG, sustainability and working out in which stocks we have high conviction. Steps five, six, and seven are different depending on the portfolio and have some slight nuances to suit each portfolio's objectives and risk tolerance.

Dividend Builder

The strategy is focused on delivering regular tax-effective income by investing in Australian equities.

The number one objective of the fund, the primary objective, is to deliver income greater than the benchmark. The secondary objective of the fund is to deliver moderate long-term capital growth. It is a highly concentrated large capitalization strategy.

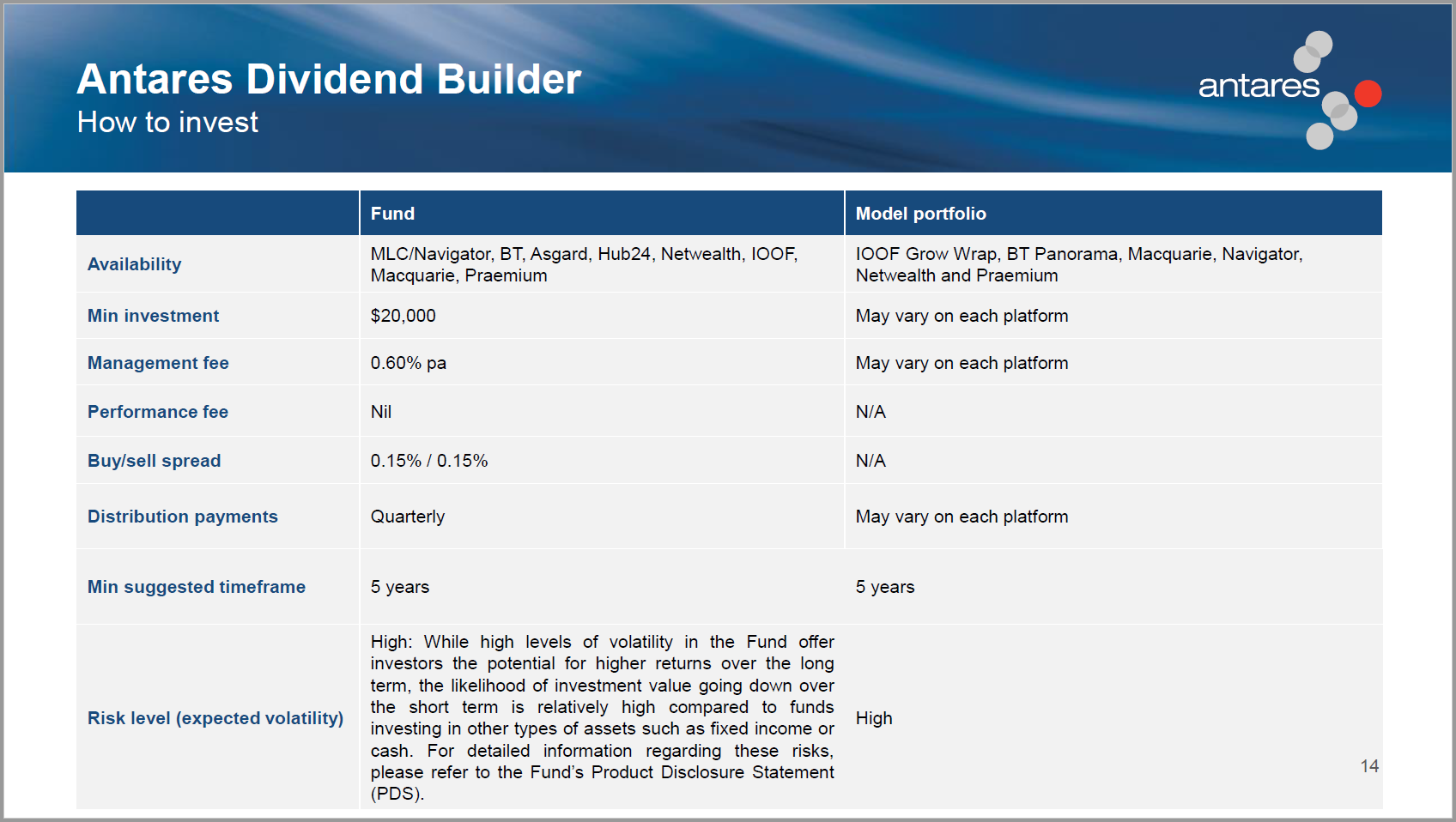

This fund is heavily focused on the top 100 stocks in Australia, that's where most of the yield is, but it's also concentrated. The maximum number of stocks we can own is 30. Typically, historically the fund has owned around 25 stocks. All of the dividends we look at, we look at grossed up for franking because franking credits have value to investors and the fund seeks to be low turnover, again, to maximise its tax efficiency. The fees are low.

I've been with the firm for 22 years. I've been a portfolio manager for 15 of those years. I took over managing the Dividend Builder strategy in October of 2021. But the fund itself has been around since 2005.

In Dividend Builder specifically, we believe in investing where we have insight. That suits the concentrated nature of the fund.

We prefer sustainable business models, sustainable earnings, sustainable cash flows, sustainable returns on capital, because we know that that is what leads to sustainable dividends.

We're passionate about the stocks in which we invest, but also about diversification. The portfolio needs to be diversified in order to consistently deliver, not just income, but total return. We manage risk constantly.

ESG and sustainability. We have a very long history of ESG and sustainability research at Antares Equities. We have a more than 15 year history of our ESG ratings - our traffic light rating system for every stock which we cover. More recently, we added our sustainability scores which are critical in our portfolio construction for all of our portfolios. This means ESG and sustainability are integrated, not just at the stock research level, but at the portfolio construction and risk management level.

Voting and engagement

We've required our analysts to vote on all proposals at AGMs and EGMS for more than 15 years. We conduct engagement away from the public gaze, not in the press, but directly with boards and with management.

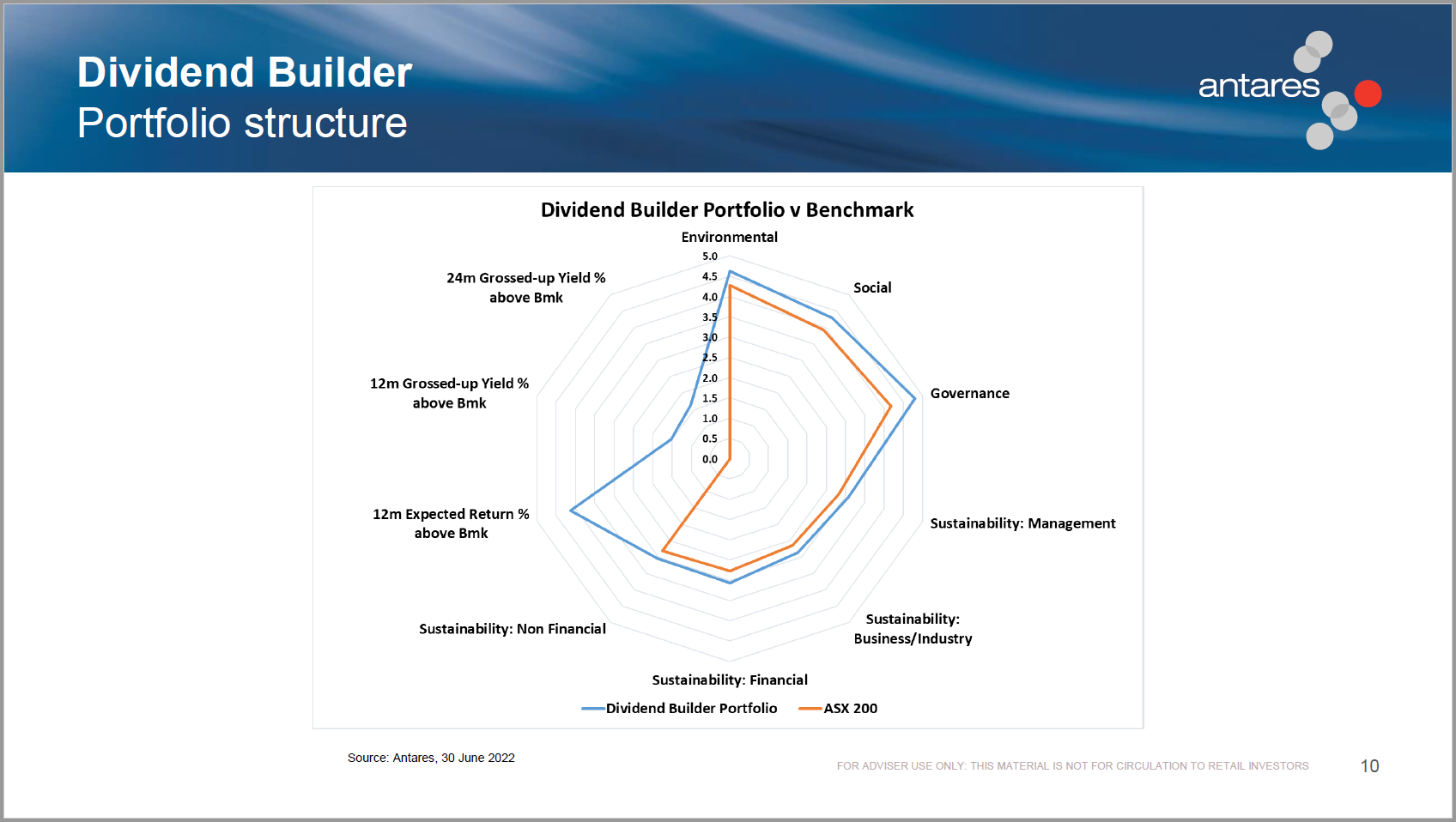

The structure of the Dividend Builder portfolio in a diagram. This is a snapshot that we look at as a portfolio management team to make sure that the portfolio is structured to deliver its objectives for our investors. The blue line on the diagram shows the score in each of these different parameters for the portfolio, and the orange line shows the score for each of these parameters for our benchmark. You can see the environmental, social, and governance ratings. Those are the scores from our internal proprietary ratings and the same for our four aspects of sustainability which are management, business and industry, financial and non-financial sustainability. We also have the 12 month expected return, the spread above the benchmark, the 12 month grossed up yield, the spread above the benchmark, and the same for the 24 month grossed up yield. So effectively the snapshot is a way that we can check visually to make sure that the portfolio is structured the way we want it to be.

Performance

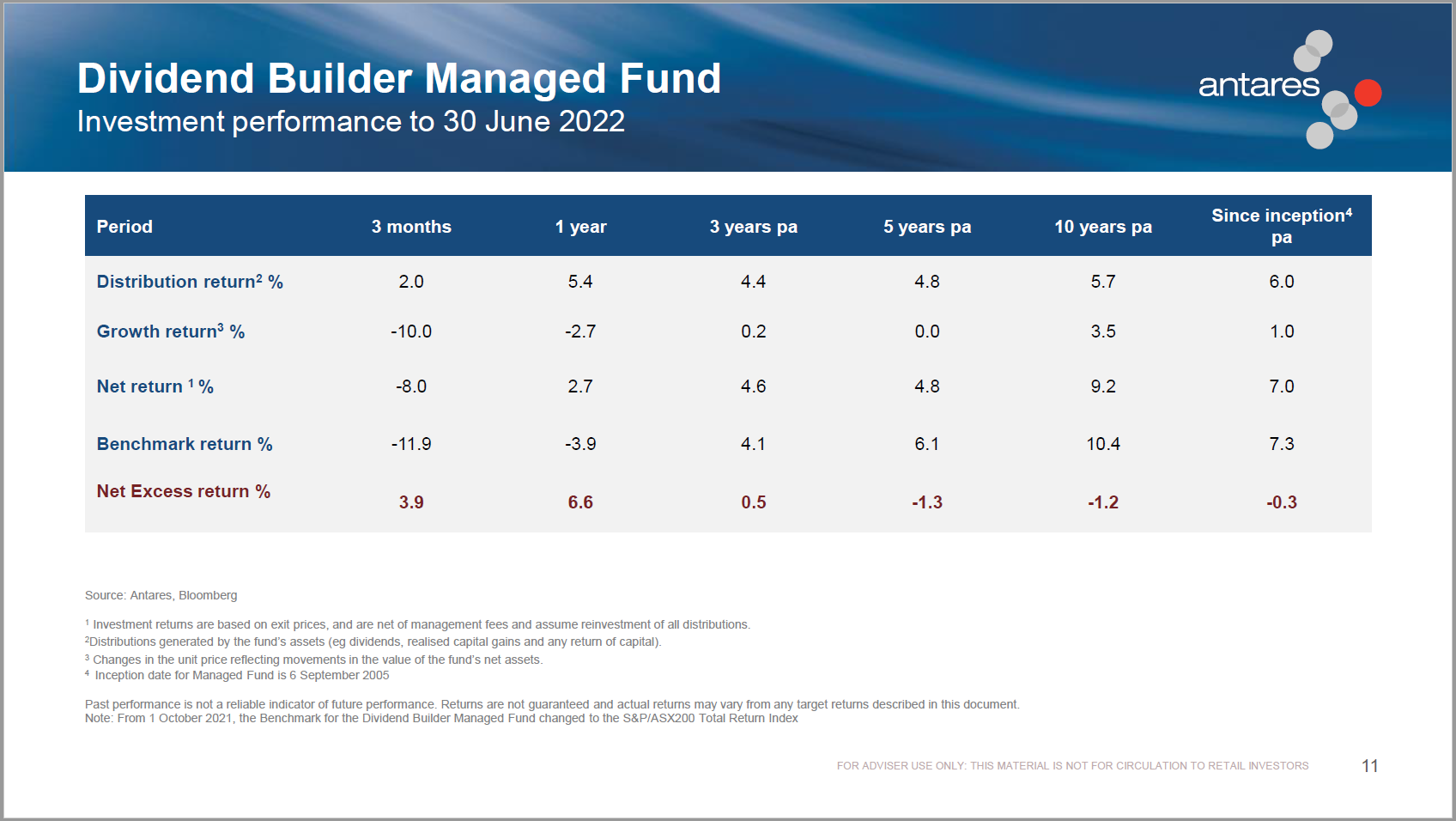

Dividend Builder delivered on its number one objective, to deliver income greater than the benchmark. With the transition in portfolio management, it's now also more heavily focused on total return.

We are passionate about continuing to deliver income, that number one objective of the fund. But we are equally passionate about delivering a total return, making sure that capital is preserved and grown through the medium to long term.

Because at the end of the day, the income that investors receive is not just yield, it derives from the amount of capital in the pool, the amount of capital that investors have in the fund.

We think Dividend Builder fits in almost any Australian equities portfolio. It's suitable for use as a core Australian equities holding. We think it's a good compliment to a passive Australian share portfolio. In terms of investor suitability, obviously it's suitable for investors who are seeking yield, seeking income, particularly tax effective income. And like most equity products, we think it's suitable for investors who really have a time horizon of five years and beyond.

In summary, Dividend Builder aims to deliver income and capital growth in a tax-effective manner. It's got a track record of longer than 15 years. It's managed by one of the most experienced teams in the Australian market, has a proven and repeatable investment process, and a very competitive fee structure. Dividend Builder is available on most platforms around Australia, which makes it easy to access.

If you'd like more information, then please look at our website, or give us a call on 1800 671 849. Thank you for listening.

Access to regular income and capital growth

The Antares Dividend Builder fund is an actively managed portfolio of high yielding equities listed (or expected to be listed) on the Australian share market which aims to deliver regular dividend income and moderate capital growth. For more information, please visit our website or fund profile below.

4 topics

1 fund mentioned