Applause for a pause

It’s becoming extremely difficult to discern the likely action at each RBA meeting other than to say they are in the latter stage of the game. At this late stage of the cycle, the RBA is attempting to finesse what is already tight policy without risking an overshoot. The decision to pause is the RBA’s way of conveying that they are now reluctant hikers (again) and that the outlook is very data dependent.

The commentariat is ruminating over whether this is a ‘hawkish’ or ‘dovish’ pause. A pause is dovish by definition as it’s the central bank saying the balance of evidence has failed to justify tightening at that particular meeting and that an additional hurdle needs to be met in the future to change that stance. Those in the hawkish camp point to the outlook part of the statement made by Governor Lowe from the RBA’s recent monetary policy decision, which is largely unchanged from recent meetings and said…

”Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve.”

Leaving a ‘tightening bias” could be interpreted as ‘hawkish’ as the bias in the near term is rate hikes if there is a change. In addition, the decision to ‘pause’ in April deployed such language only to see the bank restart the hiking campaign in May.

So, what’s changed?

In our view, there is a clearer softening in their tone from recent meetings in emphasising that,

“Interest rates have been increased by 4 percentage points since May last year. The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so.”

Indeed. The incoming evidence continues to point to traction across the economy from tight policy impacting consumer demand significantly which is close to stall speed. In addition, we are now moving through the peak ‘fixed rate cliff’ as ~4-5% of all fixed-rate mortgages are resetting each month. We continue to believe the RBA could stop here and tighter policy would continue to ripple across the economy as rate hikes flow through.

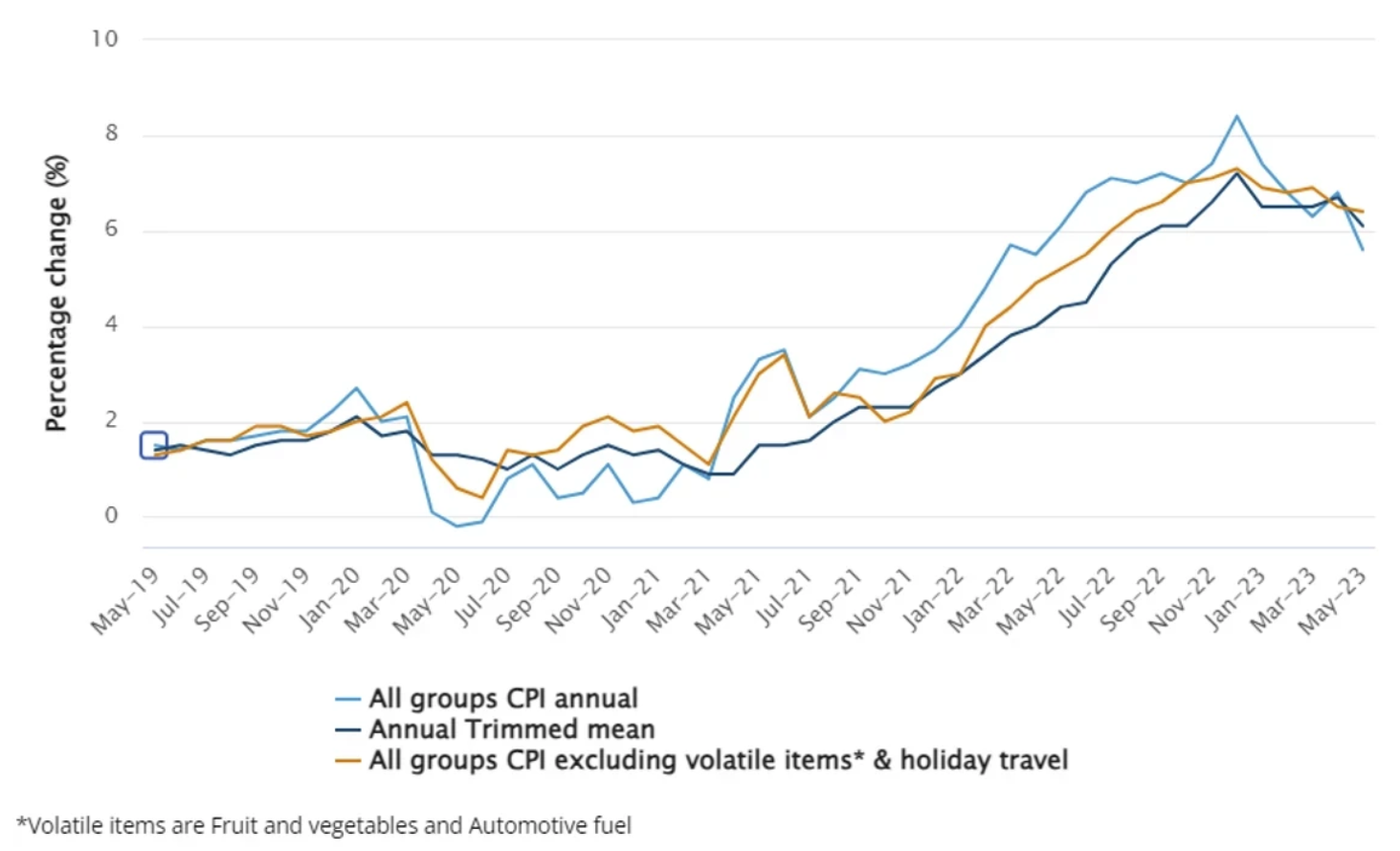

Significant in the RBA’s decision, of course, was the CPI data for May released in June. The headline number nosedived to 5.6% from the prior 6.8% (which was somewhat of an aberration) but as the chart below shows, headline CPI is now the lowest its been since April 22 and a far cry from the 8.4% peak in Dec 22. Core measures are trending lower too, albeit at a slower pace, although they were never going to do a bungee jump back to 2.5% absent a seismic macro shock. Consequently, all eyes will be on July 26 when the Q2 CPI numbers will be released. Note, despite the emphasis on core inflation for policy, in a high inflation environment headline inflation matters a lot as this is what drives inflation expectations and wage-setting behaviour. Getting the headline number down matters, so it’s worth noting that next week the monthly release of the U.S. CPI is expected to show YoY headline CPI close to 3%. Core will be higher, but this is a significant milestone and not to be underappreciated.

All groups Monthly CPI indicator, Australia, annual movement (%)

Source: Australian Bureau of Statistics

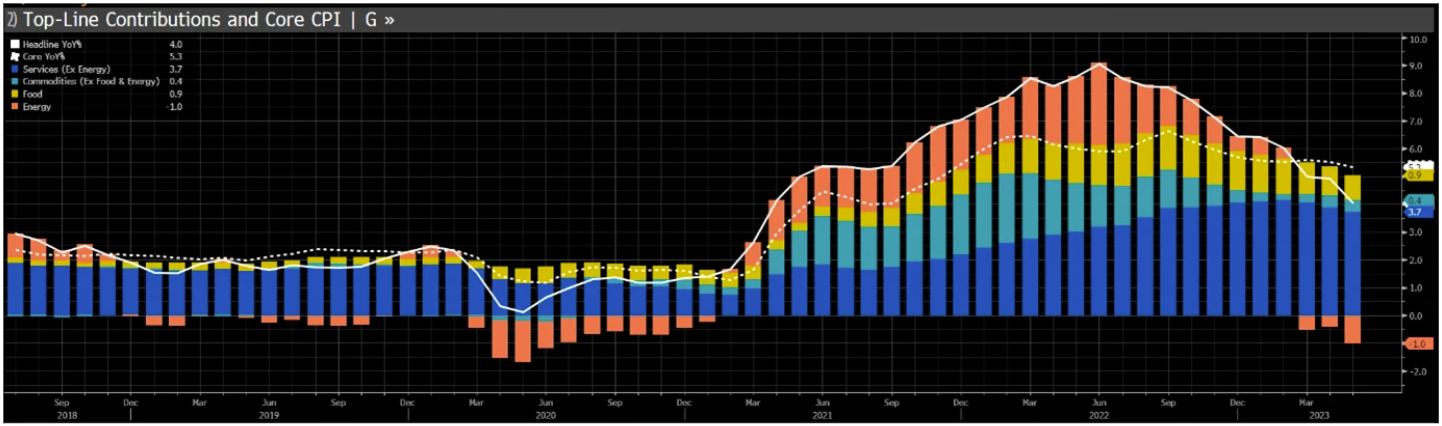

U.S. Annual Headline CPI Expected to Decline from 4% to 3% In July

Source: Bloomberg

Services CPI is the focus in this last-gasp inflation battle and as above this is decelerating at a slower pace. However, over the last 3 months, “supercore” U.S. CPI (excluding shelter, used cars and trucks) has been running at 2.3% annualised – the lowest since early 2021.

The RBA is looking for core inflation of ~1.1% QoQ/6% YoY in Q2. The first quarter CPI released in April was slightly below their expectations at 1.2@ QoQ but then they raised rates in May anyway. This time however with rate pain starting to seriously bubble to the surface we consider the RBA is likely to pause again if there is any downside to the release.

At the current eye-watering 4.1% level, which is very a restrictive cash rate, a further 25bps or even 50bps is not a game changer compared to the 400bps already metered out in just over 12 months. Further, the bond market has struggled to gain much confidence in the outlook and is priced for an additional 2 x 25bp hikes. From here, further hikes are increasingly bullish for bonds as it cements the downturn, which is already underway and heightens the already significant likelihood of overtightening and crushing the household sector.

What to do?

It remains the right stance to have some duration exposure at this late stage but reserve some capacity to add when the fog clears. Volatility has been uncomfortable. But to be short or materially underweight at this juncture would require a view that the RBA in fact has a lot more to do - another 100bp or so of hikes. The last twelve months have shown that you cannot dismiss a risk scenario but with inflation falling and the economy slowing rapidly this scenario is fairly unlikely. On the other hand, as reluctant as the market is to consider it, there is a possibility that the RBA might be done. We are beholden to July data to argue that case so it’s too early but don’t rule it out.

Buying high-quality investment-grade bonds in the area of 6%+ has been our preferred focus. These provide a strong cushion to upside surprises from the RBA in terms of terminal cash and upside in the scenario that we are indeed (dare we suggest) truly in the latter stages of the hiking cycle.

.png)

1 fund mentioned

.jpg)

.jpg)