Are central banks making markets more volatile?

For most of the post-GFC period, interest rates were so low you could feel the ground move. In the US, the Fed Funds rate's lower bound hit 0%, while in Australia, the now-famous 0.1% cash rate kept the economy stimulated (and depending on who you ask, over-stimulated). During this period, central bankers increased their communication frequency, giving us more guidance and more insights into their thinking.

While the move was (and still is) great for journalists and the investing public, it may have also helped increase confusion and volatility in financial markets.

Just think of all the times one sentence or even one word caused a violent jolt in the markets.

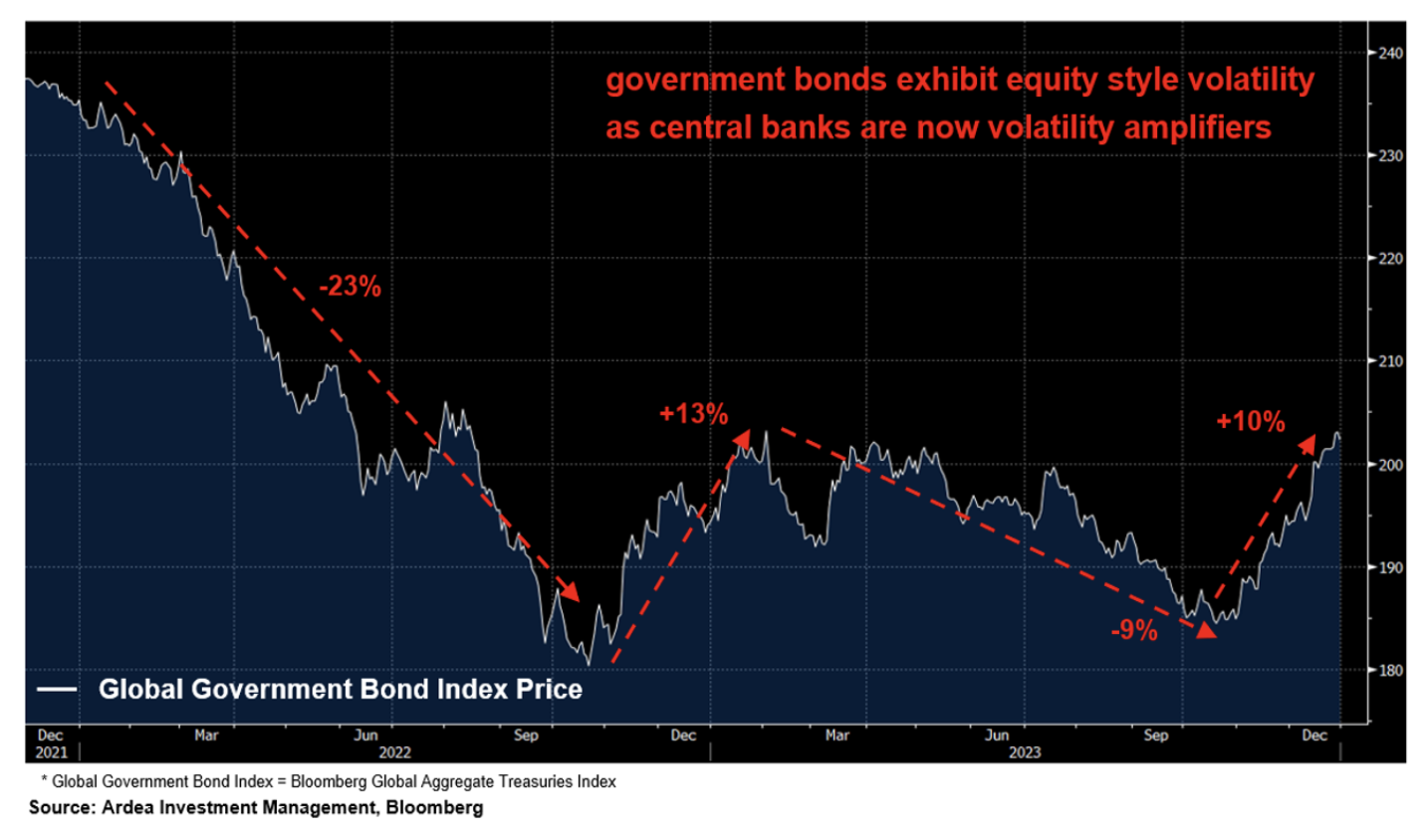

One of those who would agree with this sentiment is Gopi Karunakaran, co-chief investment officer at Ardea Investment Management. Not only does he agree with it, he also has the chart to prove it.

In this wire, Karunakaran illuminates this theme and also shares what impact the increased volatility in bond markets has had on the Ardea team's investing strategy. Plus, we'll also discuss the Ardea approach to fixed-income trading - one that makes it the polar opposite of most of its competition.

Edited Transcript

Gopi, you work in an area of the market that used to be stable but has seen some remarkably volatile price action, that's the bond market.

Why are central banks "volatility amplifiers"?

Lee: You've said that central banks have become volatility amplifiers, they're almost encouraging it. Why do you say that?

Well, it starts with inflation. So if you think about most of the post-financial crisis era, so 2009 up until 2021, central banks have two policy objectives. One is supporting economic growth and one is price stability. Now, for most of that post-GFC period, those two objectives were broadly aligned in the same direction. Inflation was too low, what they did to spur inflation would also help growth. So it was an easier calculus.

Then inflation showed up, and now those two objectives are going in opposite directions. The things that they need to do to bring inflation back down, like tightening monetary policy, and stopping quantitative easing, those things can hurt the growth objectives.

So there's a much more two-way, tension, uncertainty, hence volatility, and that's why we have this view that they've changed from being suppressors to volatility amplifiers.

A turning point for bond prices and yields

Lee: Do you suspect we're now at a turning point for prices and yields?

Karunakaran: It depends. Well, the way I'll answer that is if you're asking about a turning point in the sense of direction, are yields going to go up or down from here? Honestly, I have no idea.

That is a very difficult call to make and frankly, we don't as an industry do a very good job of making that call.

Where I do think we can call it a turning point or regime shift is around volatility. So I think structurally we've shifted to a higher overall regime in bond markets. What that means is for any level of yield, whatever you think the yield is going to be, you should expect more price volatility around that level of yield. So if you think about it in risk-return terms, more price volatility risk for a given level of yield.

Lee: But is that a good or a bad thing for your investment strategy?

Lee: So in terms of that increased volatility then, what evidence do you have of volatility increasing in line with central bank speaking, I think you brought along a chart as well that we might as well explain that.

You can see on the chart some of the fluctuations we've seen over pretty short periods like over a month or so, or maybe three, four months. You're seeing 10% type moves, which is more equity-style volatility, but you're seeing in the bond market now.

What is the role of bond issuance?

Karunakaran: It's a big theme - even just in the context of when it started with COVID. When COVID happened, governments everywhere in the world engaged in huge fiscal stimulus. Of course, that all needs to be funded. And then the way that governments funded it is through issuing bonds.

Bond issuance has ramped up dramatically across pretty much every developed market, and that's happening at the same time that the biggest single buyers of government bonds, which are central banks are scaling back.

So you've got this massive demand-supply imbalance playing out through government bond markets everywhere.

Why that's relevant for us is that essentially what we do at Ardea is exploit market inefficiency and that inefficiency arises because of temporary demand-supply imbalances. So all these bonds coming to market are creating a lot of demand-supply imbalances, and that is causing what we call price dispersion.

Basically what that means is you see situations where two bonds in the same market, same issuer, quite similar to each other, are priced inconsistently with one another because of these demand-supply imbalances. And we can profit from that by essentially buying the cheap one, short the more expensive one and waiting for prices to realign.

The mispricing opportunity

Karunakaran: It's very active. So it's the polar opposite to a traditional buy-and-hold style bond approach. With that type of approach, most of your return is coming from just holding the bond and earning the income or the yield that you get from that bond.

For us, the income or yield is irrelevant to what we are doing. It's all about price movement. So all of our returns come from trading. So we're trading very frequently all day, every day, literally hundreds and hundreds of trades a week.

Lee: All right, some great insights there. Gopi Karunakaran, thank you for joining us for our day investment management and thank you for joining us. If you enjoyed that video, why don't you subscribe to the Livewire and Market Index websites as well as our YouTube channel! Thanks for watching.

1 topic

1 stock mentioned

2 funds mentioned

1 contributor mentioned