Are cyclicals the new defensives?

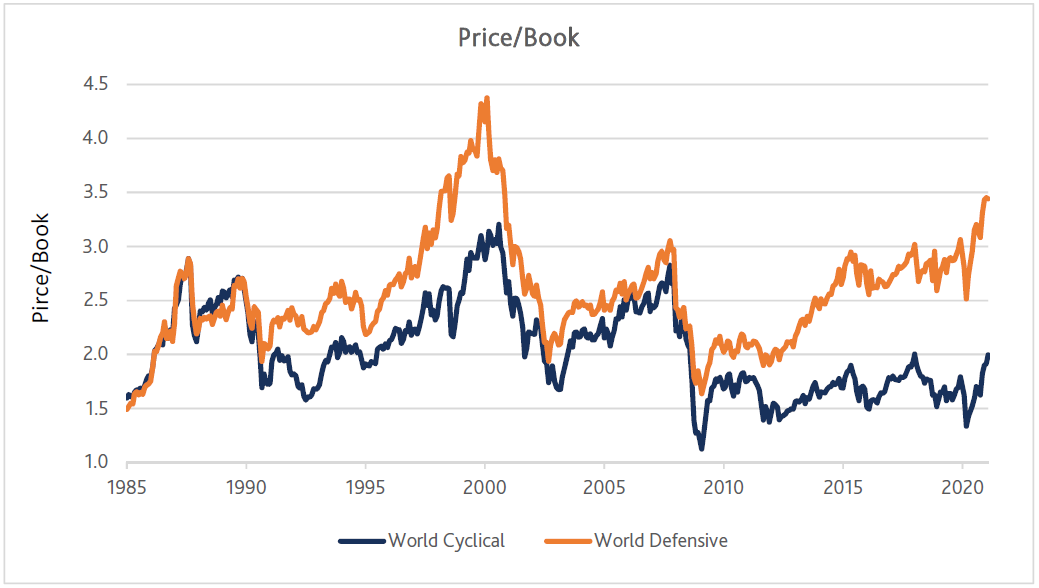

In the February 2021 monthly update for the Platinum International Fund, we noted that: “When we look at long term (i.e. 35 years) valuation analysis, relative to asset values, cyclical stocks still look cheaper than their averages, while defensives were only more expensive at the peak of the technology bubble.” This brief note expands on the detail in that valuation comment.

Over time, one simple valuation metric often used to identify stocks, sectors and countries that are out of favour or experiencing a temporary setback, is the Price-to-Book ratio (P/B). Mathematically, a P/B is equal to Price-to-Earnings (P/E) multiplied by Earnings-to-Book (or ROE). A low P/B can capture either a low valuation (on an earnings basis) and/or low returns on equity (coincident with cycle lows, or transient challenges) versus history.

Our quant analyst team has their own classification that we use for cyclical and defensive sectors, which is more granular than the Global Industry Classification Standard (GICS). We split 19 sectors into cyclicals or defensives and track them over time. Today, according to our analysis, around 55% of the global market’s capitalisation can be categorised as cyclicals and 45% as defensives.

We classify cyclicals to be: retail; autos; banks; property; commercial services; industrial services; industrials; process industries; energy; materials; and hardware. The balance of the market we call defensives and include precious metals; consumer staples; healthcare; insurance; infrastructure; content; software; and communications.

The Price/Book chart is key.

Source: FactSet Research Systems, Platinum Investment Management Limited.

If we compare the cyclicals in aggregate on a P/B basis, while they have experienced a sharp rebound from the lows of the COVID-19 sell-off, they are not expensive relative to historical levels, especially when considering today’s record-low bond yields, which are often used to justify the case for paying more for equities. While defensives, on the contrary, are higher than most of the last 35 years, excluding the technology bubble.

On a relative basis, the gap between the two groupings is close to its widest level of the last 35 years.

In simple terms, this suggests that investing in cyclicals still makes sense, particularly given our observations in the February 2021 Monthly Update that: “A change in the ‘real world’ is a move away from monetary policy to fiscal policy, after decades of restraint by governments. This favours real companies over virtual ones, at the margin. With data on the recovery stronger than anyone would have expected in April/May 2020, the market is warming to sectors that were out of favour.”

From a performance outcome perspective, over the long bull market from 2009-2020, the best periods for Platinum’s global equity strategy relative to market returns were in 2009, 2013 and 2017, which were coincident with the expansion of cyclical P/B multiples. This is a similar phenomenon to recent months. However, prior to the global financial crisis and especially from 2005-2008, cyclical areas, while performing well (particularly financials and resources), were less attractive and hence this relationship with our performance was not the same. In other words, Platinum’s global equity strategy has not simply been a play on cyclicals over time, but we have tended to invest well in cyclicals when they are cheap.

On the classification used by the quant team in assigning the 19 sectors and matching them to the portfolio on 26 February 2021, more than 75% of the long book was categorised as cyclical, with less than 25% in the defensive grouping, consistent with the discussion above and our views expressed over time about where there is value in the market.

To us, thinking about cyclicals (or economically sensitives) as the opportunity rather than the common short-hand of ‘value’ (versus ‘growth’) is more instructive and captures a better sense of market dynamics.

Bringing this back to themes in the portfolio and as the February 2021 Monthly Update notes: “The majority of the portfolio continues to be classified as belonging to the following thematics: Growth industrials, semiconductors, travel-related, Chinese consumer, healthcare, internet-related (though much reduced) and metals.”

Learn more

Stay up to date with all our views and analyses on global markets, industry trends, interesting stocks and the fundamentals of investing by hitting follow below.

3 topics