Are disruptors the next generation of defensive stocks?

Capital Group

2020 has seen significant headwinds. Sectors that have traditionally been viewed as defensive are no longer considered safe-havens.

Energy is one example. This high yielding sector has been among the hardest hit during the COVID-19 pandemic and continues to see bouts of volatility amid supply and demand uncertainties.

In contrast, Amazon, which used to be regarded as a volatile tech stock in its early days, is one of several high growth companies that have matured into large diversified businesses and acted somewhat defensively as they benefited from stay-home policies.

These changes in the investment landscape have sparked a debate on what now constitutes a defensive stock.

Why invest in defensive equities?

Many investors use equities as a way to access strong returns. However, navigating the inevitable market declines and paying attention to the downside are important factors to consider when journeying towards long-term investment success.

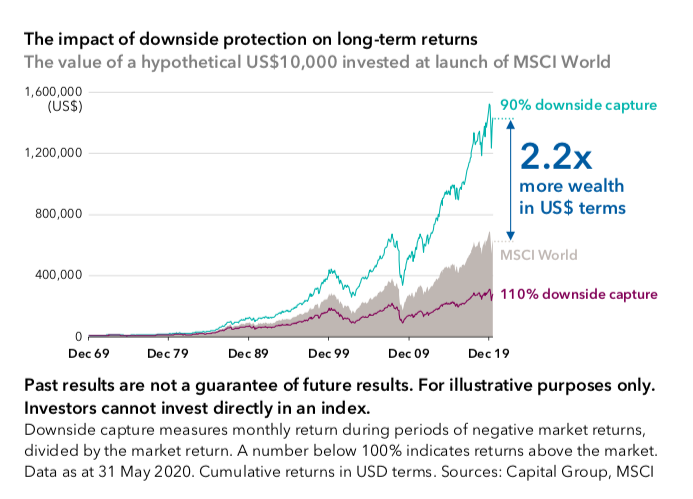

The example below shows how downside capture impacts returns by considering two portfolios that track the MSCI World Index. The portfolio that captures only 90% of the index return in months in which it was negative would have achieved a cumulative return of more than double the index since 31 December 1969. However, the portfolio that has a downside capture of 110% would have seen the wealth halve in value compared with the index’s returns.

Given the uncertainties ahead of us and the importance of protecting on the downside, it begs the question: Will the traditionally defensive sectors continue to serve investors well in the future? The answer to this may depend on the cause of the downturn.

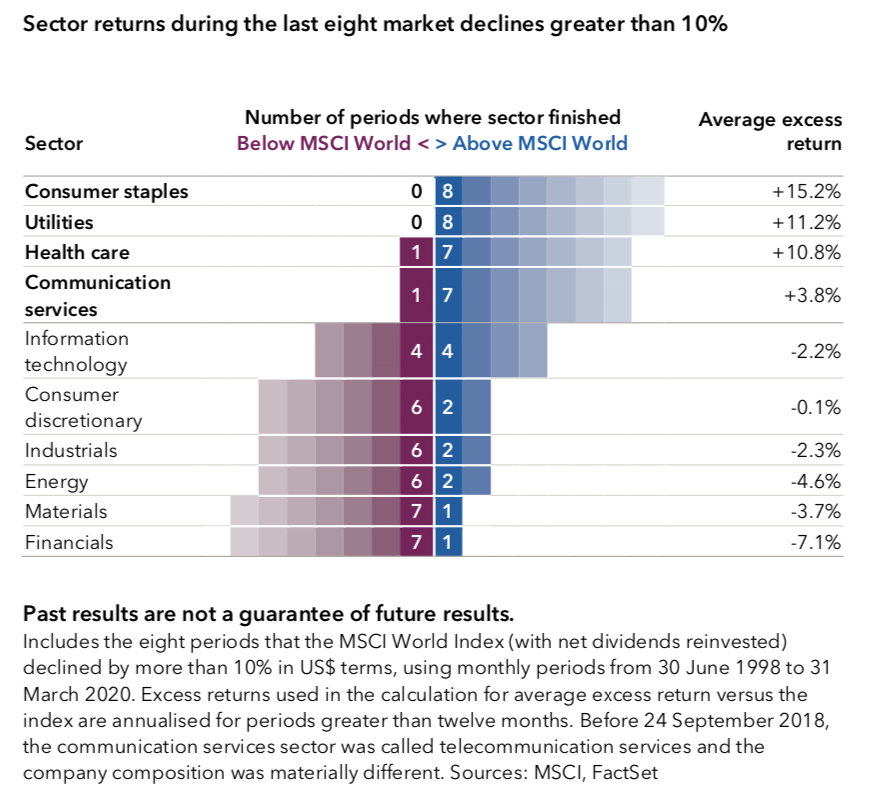

Looking at the last eight market declines of more than 10%, our analysis shows that sectors such as consumer staples, utilities, health care and communication services have held up relatively well against the overall market.

But the picture is different if we examine the underlying industry and individual stock return differences. Utilities, for example, turned out to be one of the most volatile of all industries during the COVID-19 crisis, despite typically being regarded as a defensive sector. Furthermore, stocks in a supposedly defensive sector like consumer staples have varied greatly in volatility.

Case studies on market downturns such as the bursting of the dot-com bubble, the global financial crisis and the economic slowdown in China revealed a similar pattern of unexpected sectors emerging stronger despite not having a good track record of preserving value during weak market conditions.

The investment landscape became more uncertain when dividend-paying and value companies acted less defensively than expected during recent periods of market volatility. For instance, value stocks are no longer a straightforward, less- risky decision – looking back over the past 10 years, they have been more volatile compared to the broader market.(1) Dividend payers, on the other hand, are facing structural headwinds. Examples include oil companies facing a potential long-term decline in global oil demand, while telecoms are experiencing high capital expenditure requirements in their business.

These examples shed light on the importance of fundamental research into individual companies in order to identify the ones that can weather a downturn, rather than relying on a sector-level defensive strategy.

Redefining defensive stocks

As the traditional approach to defensive investing becomes less effective, what should we look for in a defensive company today? Defensive characteristics can include reduced economic sensitivity, perennial demand, stable and predictable earnings and pricing power. In addition, a different perspective on valuation may be required.

The current paradigm of rapid technological disruption has provided an environment where certain types of companies have not only provided attractive growth but at the same time demonstrated the defensive attributes outlined above.

So, where might investors find these new defensive investments? In our view, there are two general themes that are generating a new breed of defensive companies:

-

New technology, which drives secular growth, and

-

New business models, which drive lower cyclicality in earnings.

New technology

Starting with new technology – new defensive companies might, for example, provide new products or services that have relatively low market penetration, with strong potential for secular growth. This can provide a robust tailwind that can support growth even during economic downturns.

The emerging themes we have identified under new technology include:

-

Next-generation utilities: digital media and entertainment companies that are increasingly being consumed as a staple service by newer generations

-

Connectivity enablers: companies supplying the equipment and services necessary for the new age of connected devices and the Internet of Things (2)

-

E-commerce champions: companies providing the infrastructure that is enabling the rapid growth of e-commerce and digital payments

-

New energy: companies engaged in the generation and distribution of renewable energy

Next-generation utilities

A utility as we know it, is a company that provides electricity, water or gas. But today there is a new generation of utilities; these are new forms of digital entertainment that newer generations could consider a utility-like service.

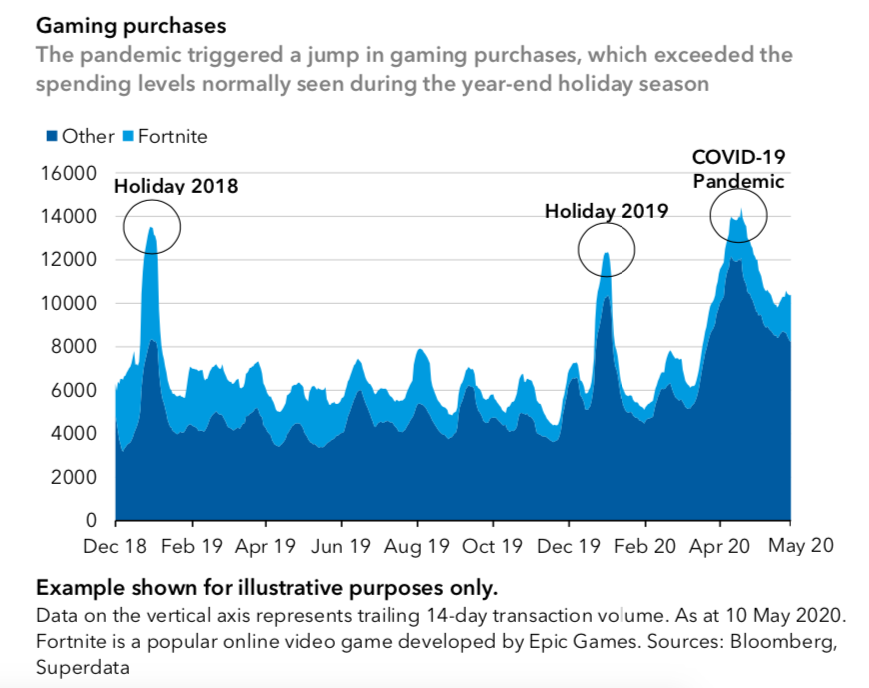

When it comes to entertainment, people often turn to activities they enjoyed as children or young adults. Millennials are the original digital natives and many in that generation play video games. During the coronavirus-induced lockdown, many millennials opted to spend time on video games rather than the television. The video game industry exhibiting resilience during the market downturn given the accelerated demand and adoption of online gaming.

Producing a successful video game is not an easy feat. One company that has done this well is Activision Blizzard, one of the world’s largest video game publishers that has developed dozens of popular titles such as Call of Duty, World of Warcraft and Overwatch. The company had over 400 million active users across its suite of multi-billion-dollar franchises as of end-2019.

Video streaming service providers like Netflix are another example of digital entertainment companies that have benefited from a surge in demand as a result of coronavirus measures.

The scale of video streaming services is a powerful force multiplier. Subscription fees can be used to pay for programming, which attracts more viewers, and a growing subscriber base, in turn, provides more funds that can be reinvested into ever bigger and more diverse programming.

This has been part of the Netflix strategy. The company constantly reinforces its offering with new content, bringing in megastars to helm prestige projects. With a paid subscriber base of close to 200 million (3) and growing, Netflix’s growth runway appears long given its current low market share of global broadband households.

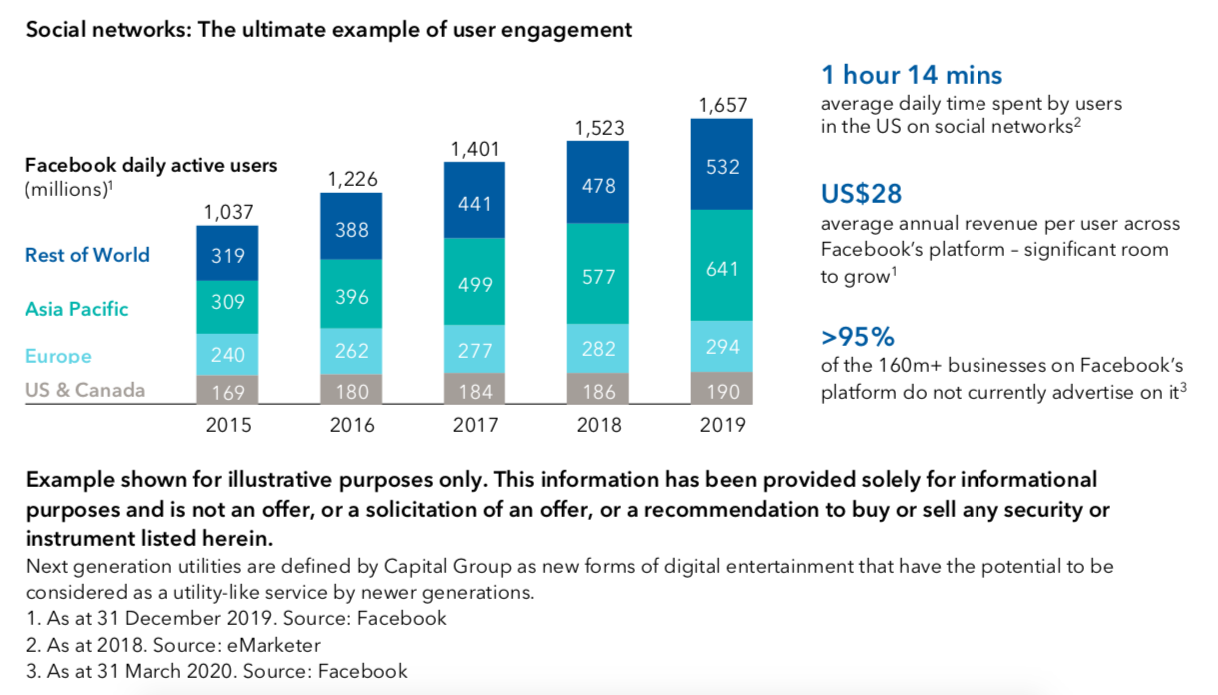

A third example of digital entertainment is social networking. Consumers tend to prefer social media sites that already have a large and growing user base. Outside of China, the company that holds a dominant position in the social media space is Facebook. The company’s key success comes from offering a valuable service of keeping people connected with their friends and loved ones.

Facebook has a favourable user base that continues to grow by the year. As of March 2020, more than 95% of its 160 million business users do not yet advertise on its platform. This represents a huge monetisation opportunity for the company.

All in all, video gaming, video streaming and social networking are among the least expensive forms of entertainment today, and in some cases, they are available for free. Demand for these services can be inelastic, just like traditional utilities.

Furthermore, the time spent on digital entertainment can be unlimited, compared to sporting events, which are often one-off or seasonal in nature.

New business models

New defensive companies also include those coming up with innovative strategies that can help boost resilience and reduce the cyclicality of their earnings.

The emerging themes we have identified here include:

-

Safe havens in financials: non-bank financials, such as exchanges and data providers, that are less exposed to economic conditions

-

Digital brands: companies embracing digital initiatives to help improve their brand value - an intangible asset that can boost resilience

-

Enterprise staples: software companies offering subscription pricing models to improve the adoption and accessibility of their products with business customers

-

Alternative health care: looking beyond traditional big pharmaceutical companies to identify interesting business models elsewhere within the sector

-

Safe havens in financials

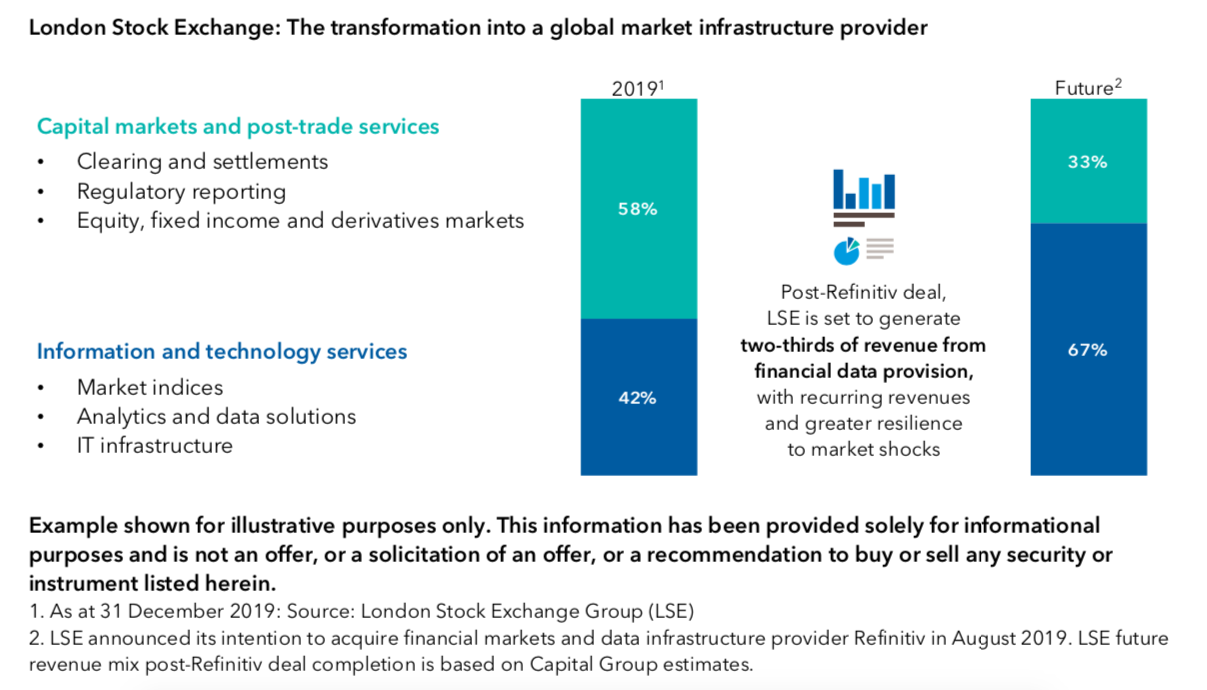

This is a cyclical sector, but there are select financial companies whose earnings are less dependent on financial or economic conditions. One such company is London Stock Exchange Group (LSE).

The business model of a financial exchange involves facilitating public listings and the settlement of securities transactions, which can link its fortunes quite closely to financial market conditions. LSE, meanwhile, is transitioning from a financial exchange to a provider of broader market infrastructure services.

In August 2019, LSE announced its intention to acquire financial markets and data infrastructure provider Refinitiv. The deal, if it goes through, would boost the all-weather portion of its business, as its revenue streams would become more recurring than cyclical.

Enterprise staples

Software sits at the nexus of innovation and necessity. Boosted by advances in cloud technology, many software companies are embracing subscription-based business models to deliver products that in many cases are business-critical.

This shift in software delivery can benefit both suppliers and consumers since it results in lower revenue cyclicality and greater cost visibility. For example, cloud-based productivity application Microsoft 365 represents a switch to a subscription model that provides recurring and visible revenues for technology company Microsoft. Consumers, meanwhile, will no longer need to purchase multiple versions of Microsoft Office software to install the latest version. Durable demand and resilient economic models may also help select software companies weather future volatility.

Valuations of new defensives

Given their attractive characteristics, many new defensive companies have seen their valuations increase. These valuations have been driven largely by strong growth fundamentals including revenue growth, high margins, robust free cash flows and rising profits.

We believe that there are more meaningful and specific ways to value new defensive companies, based on their distinct characteristics and on an individual stock basis, rather than by focusing on simplistic valuation metrics like price-earnings ratio.

While headline multiples might appear expensive, the valuation premium is less significant when considering that:

-

Current multiples are far from the unjustified levels seen in the TMT (technology, media and telecoms) bubble

-

Market caps are generally in line with profit contributions

-

Valuations are often supported by strong earnings growth and are more justifiable within a medium- to long-term investment horizon

-

Return on invested capital may be a more useful indicator than earnings for growing companies

-

Low-interest rates can be supportive of sustainably higher equity market multiples for long-duration growth companies

To recap, companies in traditionally more stable industries have typically benefitted from lower valuations and therefore lower volatility. However, in today’s world, every industry is at risk of disruption so defensive investors are not necessarily safer parking their money in lower-valued, lower-growth sectors.

Regardless of economic or market conditions, our portfolio managers seek to protect and prudently grow client portfolios, with an emphasis on downside discipline in all environments.

It is our job as investors to identify companies that can provide downside protection in different types of markets. We do that with a long view, one company at a time.

Key takeaways

Downside protection can enhance long-term investment success.

A new breed of defensive equities is emerging that can be more effective in protecting on the downside than traditionally defensive equities, some of which are facing structural headwinds.

New defensive companies include those being driven by new technologies (e.g. next-generation utilities and connectivity enablers) and new business models (e.g. safe havens in financials and digital brands).

Build a defensive portfolio for the long-term

Capital Group believes in a smarter way of investing that combines individuality and teamwork into a tailored approach to help investors meet their goals. Find out more by clicking 'CONTACT' below.

Footnotes

- Data based on monthly periods for the 10 years from 30 April 2010 to 30 April 2020 using standard deviation as a measure of return dispersion. Indices used are MSCI World Value Index (with net dividends reinvested) and MSCI World Index (with net dividends reinvested) in US$ terms. Source: Morningstar Direct

- Refers to a network of physical objects or “things” embedded with technology to collect and transmit information.

-

As at 30 September 2020. Source: Netflix

2 topics

Matt Reynolds is an Investment Director at Capital Group. He has over 20 years of industry experience including head of Australian equities – core at Colonial First State Global Asset Management. He holds a bachelor's degree in Economics from The...

Expertise

Matt Reynolds is an Investment Director at Capital Group. He has over 20 years of industry experience including head of Australian equities – core at Colonial First State Global Asset Management. He holds a bachelor's degree in Economics from The...