Are Pilbara Minerals shares a buy? Brokers weigh in on June quarter results

ASX-listed mining companies are required to report their quarterly production and activities by the end of the month following quarter-end. This means June quarter reports are currently dropping.

The June quarter report tends to be viewed by investors as particularly important, as it is the final piece of the puzzle analysts require to solidify their views on a company’s full year performance.

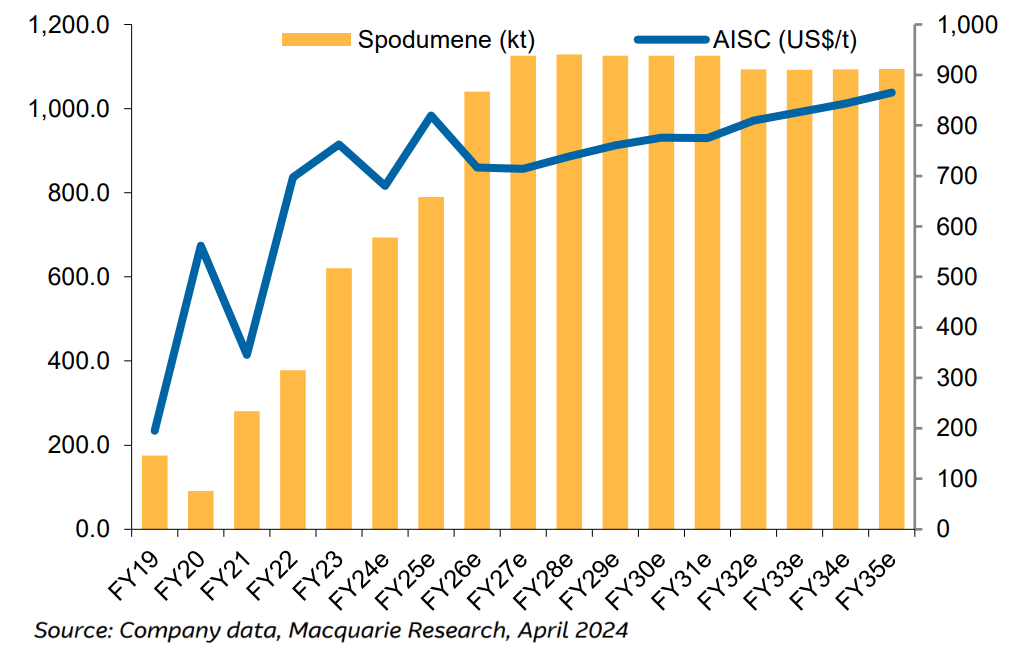

Pilbara Minerals (ASX: PLS) released its June quarter production and activities report Wednesday. It showed stronger performance with respect to production at its Pilgangoora operation, with record spodumene production of 226kt, up 26% on the March quarter.

Other impressive metrics included a 58% increase in quarterly revenues, a 12% reduction in quarterly unit operating costs, and a slight (+4%) increase in the realised price of its products. Pilbara management also saw fit to issue guidance for FY25 – usually a good sign a company has clarity across its operations.

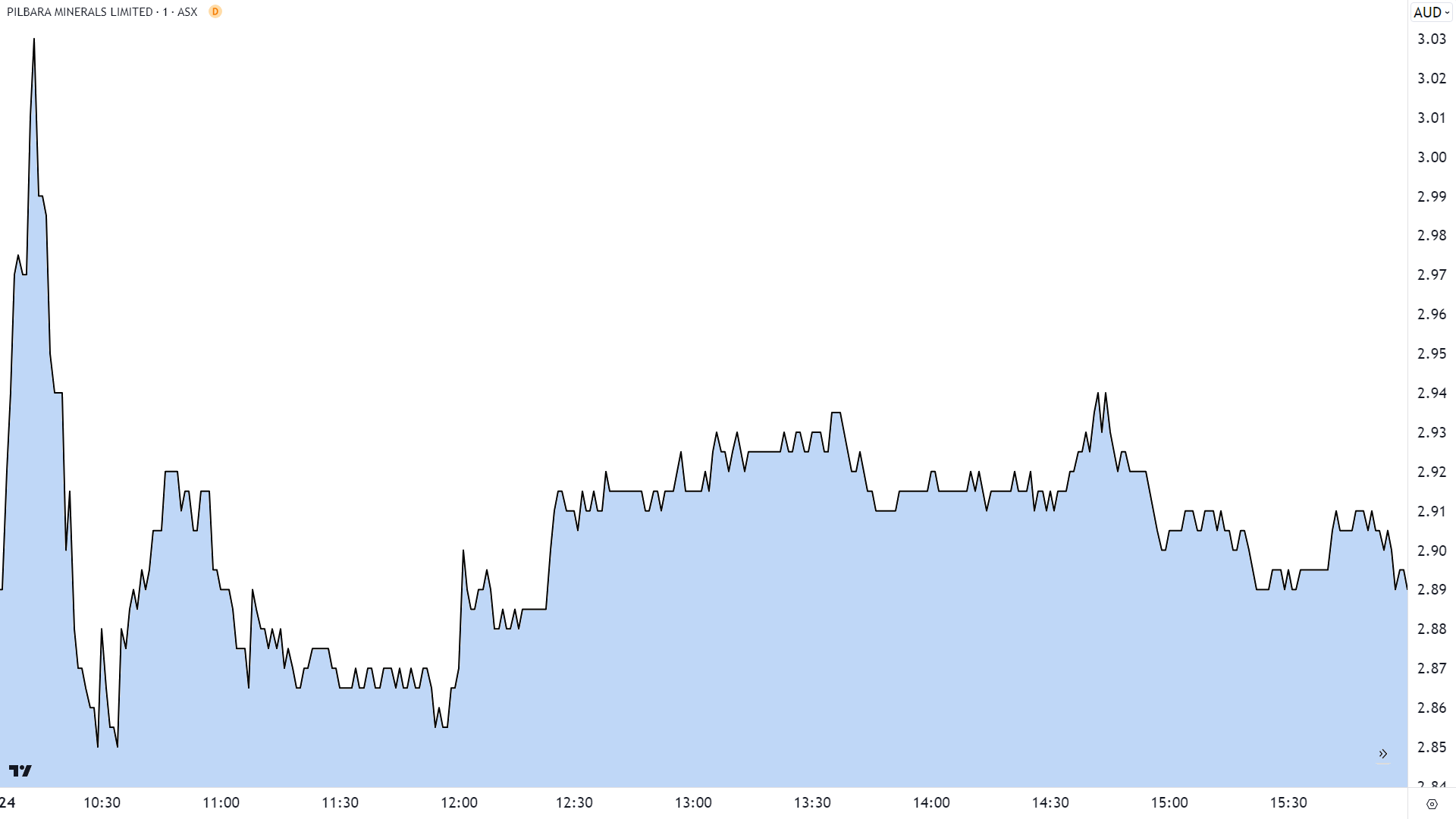

However, the share price response to the results was mixed. Initially, the price spiked nearly 5% to $3.03, only to swing to a loss at $2.85 shortly thereafter. Pilbara’s price did steady from there, even trading back in the black for much of the afternoon, before closing steady on the day at $2.89. A wild ride for no result!

This morning, when the stock opened it plunged to a low of $2.78, but it has since recovered to trade – you guessed it – roughly back to where it started. So, clearly, there’s some important information in the report that’s spiking both bullish and bearish views on the stock.

The result so far is an equilibrium. But undoubtedly Pilbara Minerals’ shareholders as well as those potentially looking to buy the beaten down miner want to know what the longer-term share price impact could be.

The big brokers have reviewed the news, and they’re ultimately the ones advising their institutional clients who are doing the buying and selling. So, let’s investigate the key findings in the latest research updates on Pilbara Minerals, and try to answer the question: Buy, Hold, or Sell?

Pilbara Minerals Broker Consensus vs June Quarter Update

%20Broker%20Consensus%20vs%20June%20Qtr%20Update.png)

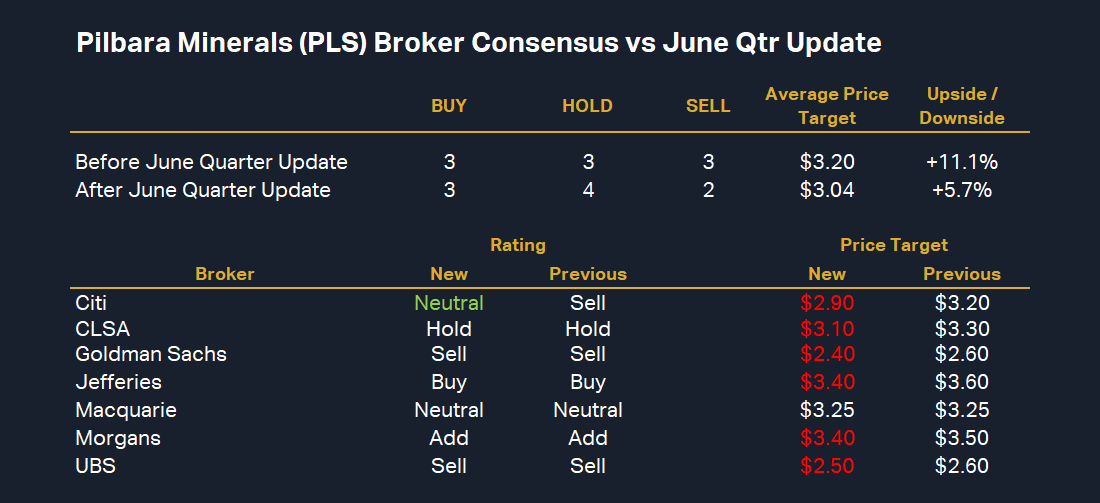

Let’s kick off with a summary of all the moves in broker ratings and price targets post report. The graphic above compares all the broker information we have on file going back three months to keep it current. We have filings for nine brokers in total, of which seven issued updates today regarding Pilbara Minerals’ June quarter report.

The only rating change came from Citi, who upgraded Pilbara Minerals from SELL to NEUTRAL. Ratings were near-perfectly split across buy, hold, and sell prior to the news, and now sit at 3 buy, 4 hold, and 2 sell.

There were several price target changes, all cuts. These cuts caused the average price target across the 9 brokers to decline by 16 cents or 5% to $3.04. This implies a modest 5.1% upside based on Wednesday’s closing price of $2.89.

The highest price target of $3.40 is held by Jefferies and Morgans, representing around 17% upside to Wednesday's close. The lowest price target of $2.40 is held by Goldman Sachs, representing around 17% downside to Wednesday’s close.

Clearly, from both the ratings and price targets, it’s clear Pilbara Minerals is a somewhat polarising stock. Putting aside the fact most brokers are now in the middle, there does still exist a few faithful and a few clear detractors.

I suggest, an approximate 5% upside in the consensus target, and an average rating only minutely better than HOLD is hardly a glowing endorsement. So, I suggest purely based on ratings and price targets we’ve answered the burning question of what the brokers think investors should do with the stock.

Let’s take a quick look at their commentaries to see if we can glean any further information as to what factors brokers think could swing the dial going forward (note SC stands for “spodumene concentrate”).

Citi

Upgrade to NEUTRAL from SELL | Price Target $2.90⬇️ from $3.20

“PLS ended June Quarter with a beat on all production metrics”

“Costs are a bit higher than we’d expected”

“Lithium fundamentals remain tough with Citi expecting prices to trend lower into year end. That said, spodumene pricing has been resilient”

“We’d also note compared to the start of the year, we don’t think consensus has as far to move down i.e. consensus SC pricing for next year is US$1,099/t vs Citi US$1,050/t”

“Given the short interest and under-performance YTD we think that it’s challenging to time a change in market sentiment, ie: supply cuts which could see asymmetric upside risk. We thus move to Neutral, from Sell”

Goldman Sachs

Retain SELL | Price Target $2.40⬇️ from $2.60

“While [production and] shipments were above expectations, this was largely offset by realised pricing of US$840/t (US$960/t SC6.0 CIF China) around 10% below expectations”

“Net cash declined to A$1.26 billion, (below GSe; from ~A$1.4 billion) despite an A$80 million inflow from a minority interest sale, leaving a return to dividends near-term unlikely”

“PLS remains at a premium to peers…1.05x NAV & pricing around US$1,175/t LT spodumene…peer average ~0.9x”

Macquarie

Retain NEUTRAL | Price Target $3.25

“June's exit production rate of 900ktpa and recovery of 72% were key positives, while FY25 guidance of 800-840kt has buffer for tie-ins.”

“PLS's A$1.6 billion cash balance provides significant headroom for PLS to navigate current market conditions, with dividends likely on hold for FY24.”

“PLS's realised price of US$840/dmt missed Visible Alpha (VA) consensus by 10% but was within 5% of our estimate. The company's updated pricing mechanism with two major offtake partners could move PLS's realisations closer to spot spodumene as early as 1Q FY25.”

“With its current cash position, questions may emerge on capital allocation versus growth.”

UBS

Retain SELL | Price Target $2.50⬇️ from $2.60

“Jun-Q spodumene production of 226kt beating expectations and the top-end of FY24 guidance (725kt vs 660-690kt)…However, a realised price of US$840/t was around 14% below our expectations on sales timing and reflecting the weak market conditions.”

“We have trimmed earnings on slightly higher costs and D&A which sees EPS -10%/-4%/-7% over FY25/26/27E and, after including more development capital, our NPV based price target is down 4% to A$2.50/sh.”

“Unlike PLS, we are concerned about the lack of cost support for prices and retain a Sell rating.”

“Markets appear well supplied with spot [prices] around US$900/t and no clear catalysts for a rebound, meaning risk remains to the downside in the short-term...the ramp up of African supply [will be] a key driver.”

This article first appeared on Market Index on Thursday 25 July 2024.

5 topics

1 stock mentioned