Are we at big tech's turning point?

Under the pressure of rising interest rates, misses on earnings expectations and very full valuations, the Nasdaq closed at its 2022 low earlier this week. So have we finally reached the turning point for big tech earnings – and are we about to see a change in product offerings, management, marketing or all the above?

Before we get to the analysis, let's do a fast wrap of the numbers.

Big tech makes a big splash

Three months ago, Meta Platforms reported a quarterly result that shocked the market. After being priced for perfection throughout the pandemic, Facebook reported its first sequential decline in daily active users and weaker than expected revenue guidance. This quarter, active users rebounded slightly but revenues still missed the street's expectations. All in all, the bears still have this battle well and truly sewn up.

Even Google's parent company Alphabet could not quite pull out a beat to the street – with a hit at the revenue level but a slight miss on EPS. Not that it's fazed management, who also announced a $70B share buyback in the process. Talk about making hay while the sun (is still) shining!

Meanwhile, two days before its third-quarter earnings, Twitter dropped the bomb (and its poison pill) - paving the way for Tesla founder Elon Musk to acquire the company for US$44B. This week, the social media giant withdrew all guidance and previously announced buybacks – suggesting the era for public information will near its end much faster than first thought.

Microsoft squeaked out a beat, in large part due to the strength and loyalty of its corporate customers. Strong revenues were galvanised by strong demand for its cloud and work-from-home services.

The biggest splash of them all

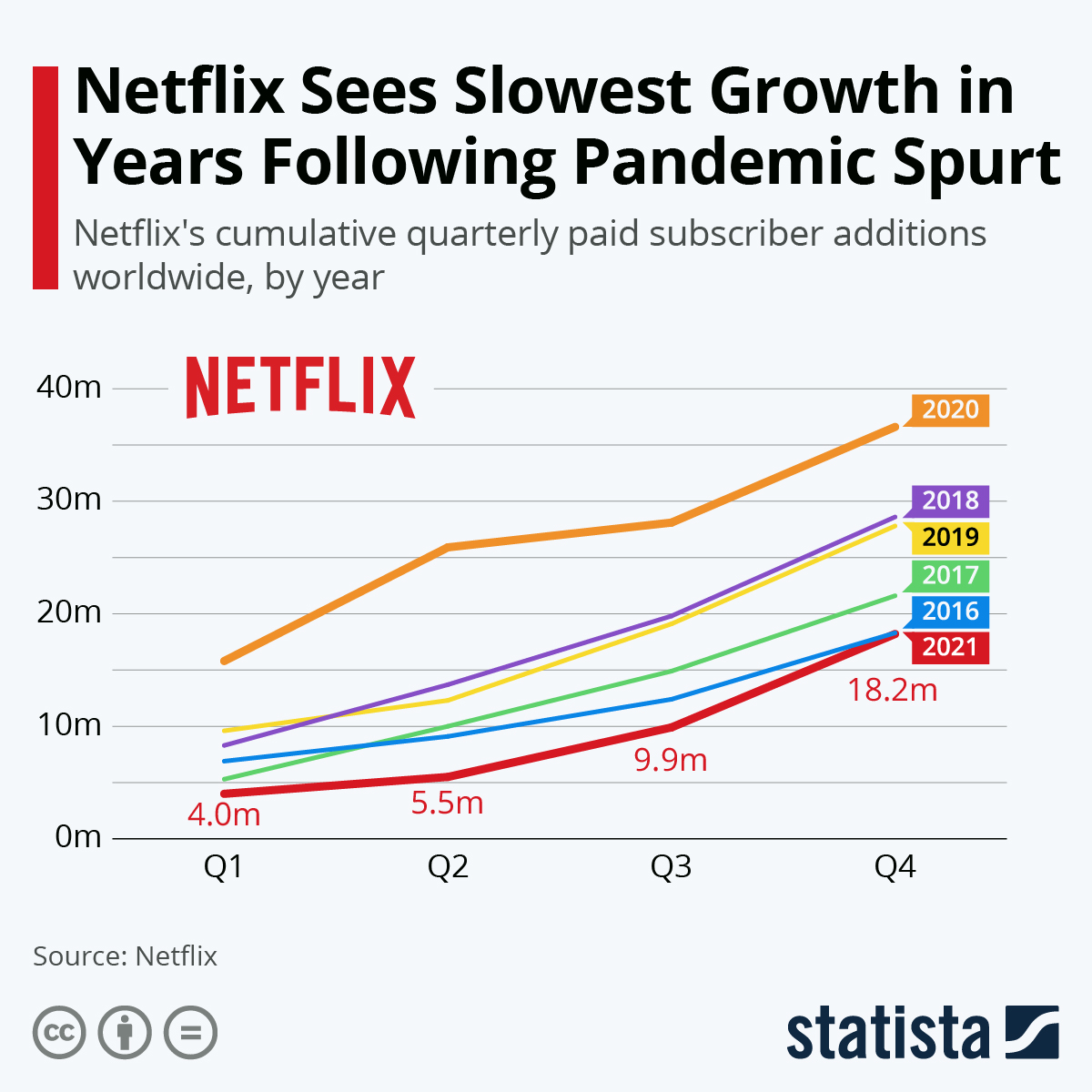

Last week, the sword fell on Netflix as the company announced its first paid subscriber decline for a quarter in more than a decade. Its outlook was also sour and investors wiped out 25% of the company's public value in the space of an hour.

Michael Pachter from Wedbush Securities was one of the few analysts who was bearish on Netflix upon its 2011 IPO. While he was proven wrong year after year, last week's result may prove that an "all-in" strategy is not always the best way to go.

"I questioned Netflix’s international strategy, and am convinced I have been right from the beginning," Michael says. "They lose money internationally, because they are pricing constrained and because content costs are prohibitive. I based my downgrade on the company’s determination to grow at all costs, and that is what proved me right in the long run."

The competition was and still is a huge problem for the streaming giant. If you want an example of that, look at this chart.

It's not all bad news for those who are clinging on for dear life to Netflix. Michael says the next two years could prove to be vital for the company's fortunes.

"I think they can grow out of their problems, and if they take my advice from 2011 and stop trying to grow so fast, they should be able to command an above-market multiple," he says.

Yes, that's a minus in front of that number

The other biggest splash came late this week when Amazon shocked the market by reporting a heavy EPS loss (against Wall Street's estimates of a heavy EPS profit). Operating cash flow collapsed by more than 40% and its AWS (web services) platform growth fell behind Google and Microsoft. Its large stake in Tesla rival Rivian also hurt its bottom line given the latter estimates it will only produce a quarter of its promised total.

Regardless, Michael says the Jeff Bezos-founded company is a model for how to grow sustainably.

"They didn’t launch in 180 countries at once, like Netflix did. Prior to 2016, Amazon was in only 16 countries, and even now, I don’t think they are in more than 40 – 50. They are chasing consumers who have discretionary income, unlike Netflix," he says.

So the question is – has the data on consumer preferences, inflation, competition – and most importantly – valuation finally caught up with corporate balance sheets?

Platinum Asset Management – Alessandro Barbi

Platinum Asset Management's Alessandro Barbi was lucky enough never to be invested in Netflix – a move which he personally admits was due to a lack of conviction. Alex says we are at a turning point for big tech earnings as expectations for future metrics growth just don't add up with a global tightening cycle.

"If we have to discount these cash flows with interest rates, and interest rates go up, the value of future cash flows go up. Hence, the valuation of these companies get adjusted down," Alex says.

While every big tech stock has its own challenges, Netflix in particular cornered itself into what Alex describes as a "model building, high subscriber growth" approach. Others such as Alphabet and Microsoft are older and thus, have a more established advantage through consistent cash flow generation.

.jpg)

In contrast, Alex recently sold his stake in Apple due to smartphone growth and hardware innovation have stagnated. The case in point is reports that the Cupertino-based company will move to a subscription-based model for its phones and warranty programs, effectively making its customers pay to stay on rather than its traditional model. This model, Alex says, is "very ambitious."

"You're really looking for a loyal base, which no matter what will always want your phone coming out. may suggest that the company is implicitly telling you that the rate of innovation for the hardware is going down. If they can't entice you to buy new models upfront, or without forcing you to have a subscription, right?," Alex points out.

The biggest opportunities are no longer obvious

Alex says the biggest opportunities in global tech, post-earnings season will actually not be in the FAANG names. While he's holding onto Microsoft, Meta and Alphabet, Alex's most bullish position is now in names like Intel and semiconductor plays.

.jpg)

Intel beat on the top and bottom lines for the first quarter but is forecasting weak quarterly guidance. Part of that can be attributed to the global inventory challenges and partly because Apple decided to move to an in-house chip manufacturing process.

Intel CEO Pat Gelsinger told the earnings call that he expects the industry "will continue to see challenges until at least 2024 in areas like capacity and tool availability,”

"There's a lot of companies which people have never heard about in semiconductors outside of, say Intel which we invest in," Alex says. He also points to those stocks holding single-digit earnings multiples, making them even more attractive than the biggest names.

"It's companies making equipment for semiconductors for example, like applied material, or ASML," Alex notes – while highlighting Lam Research (NDAQ:LRCX) as a potential, long-term opportunity. Note he didn't mention Nvidia or Taiwan Semiconductor Manufacturing Company (TSMC) - that's fodder for another conversation at another time.

Montaka - Andrew Macken

Andrew says this earnings season highlighted the valuations of the winners and losers - namely, the losers have much more to run given their potential is not factored into its share prices.

"The market now appears to be appreciating more fully the long-term implications of the important differences between big tech companies," Andrew says.

"There appears to be a stark difference between the ugly-looking stock prices of many tech leaders and the results they have recently reported," he adds.

So what is good value in this very rich part of the market? As we flagged earlier in this piece, Microsoft edged out a beat to the street's estimates on revenue and EPS. It also happens to be Andrew's top pick.

"The quality of its cash flows and durability of its long-term growth are not being reflected in its stock price today," Andrew says.

In total contrast, one of Microsoft's biggest competitors in the work-from-home thematic is Andrew's sell. With Microsoft owning and distributing such properties as Skype and Teams, it should be no surprise that Andrew is not a fan of Zoom.

"On the sell side, watch out for enterprise ‘point solutions’. Zoom, while a great application, it’s very difficult for to compete with Microsoft Teams which Microsoft essentially gives away for free," Andrew points out.

Conclusion

During the first quarter, the bears certainly won the battle over big tech's share prices. While context is always key, it is worth pointing out that anyone who bought Netflix in 2018 has now lost almost all of their pandemic era gains. It all begs the question – if the best days are behind us for big tech's big gains, who has what it takes to stand out from the pack for the next cycle? It is the answer to that question that will ultimately turn heads.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And as an added bonus, Alex and I will be doing a follow up piece soon on all things semiconductors - how to invest in them and at what valuations. If you'd like to submit a question for that conversation, send it to us - content@livewiremarkets.com.

4 topics

2 contributors mentioned