Are we there yet?

Key Points:

• Whether the market has troughed or will make new lows depends on whether the Fed is able to achieve a moderation in inflation without too much economic pain.

• Decomposing inflation into its underlying drivers suggests that this is unlikely.

• In a hard landing scenario, equity markets typically bottom once inflation has peaked, there has been significant monetary easing and there are signs of improvement in economic data.

• In this drawdown, the economic pain hasn’t even really begun yet, inflation has barely peaked, and the Fed is till hiking rates, suggesting there is a long period of continued weak markets ahead of us.

Please Stop the Ride, I Want to Get Off

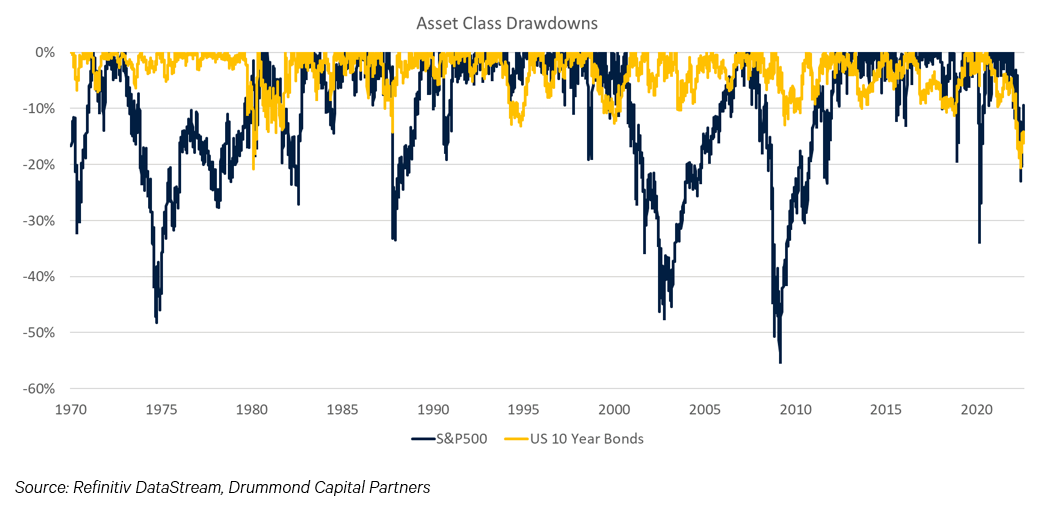

Global markets have been weak for all of 2022 so far. US equities and longer dated bonds have both fallen around 20% as at the time of writing. For US bonds, this represents the largest sell-off in more than 50 years. For US equities, this is the 9th largest sell-off since the Great Depression, only eclipsed by major recessions, the Tech Bubble and the Black Monday period. Since 1900, the average size of a bear market sell-off has been around 35% and the average length of a bear market has been around 16 months. At 20% down and 10 months in, can we assume we are about halfway done? In this month’s Insight, we outline what we think the catalysts will be for the bear market to be over. This will largely depend on whether the Fed is able to achieve a moderation in inflation without too much economic pain.

A Soft-Landing Pivot Party

What are the prospects for a moderation in inflation without a recession? This would allow the Fed to achieve its soft landing and put a floor under markets. Below, we split inflation into four key components from which we can draw out some conclusions.

Durable goods (cars, televisions etc) - Durable goods inflation has already moderated substantially, reflecting improved supply chains and restocked retail inventories. However, for CPI to “normalise”, we would want this component to again start falling and this may not be possible with the geopolitical split between China and the US and the subsequent reshoring of manufacturing.

Non-durable goods (fuel, food etc) - Structural underinvestment in commodity production over the past decade suggests that even with a resolution to the Ukraine conflict, non-durable goods prices will remain elevated. Note much of this component is excluded from the core inflation calculation anyway.

Rent (rent and owner’ equivalent rents) – Strong growth in rent costs reflects the still strong labour market and the impact of falling average household size post Covid, which saw many people move out of share houses or move into dwellings with a spare room/office. CPI rents will likely continue to rise for quite some time given the large gap between growth in listed rents and CPI rents.

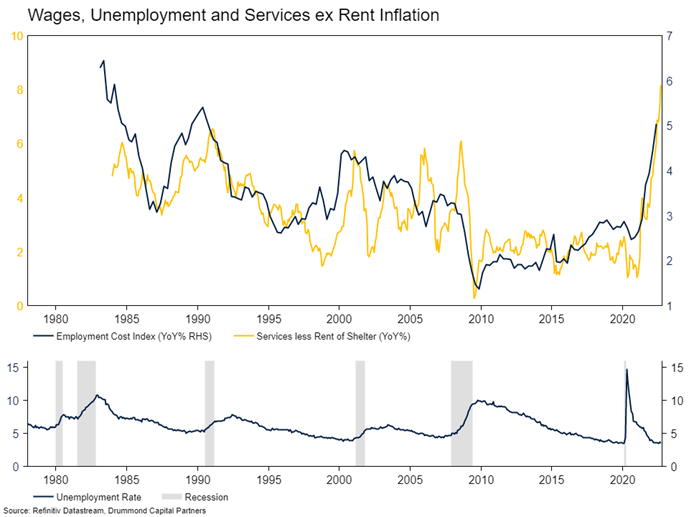

Services excluding rent – This is the most important component of the four as it is the most practical one for the Fed to target directly. Services inflation is unlikely to fall meaningfully until the unemployment rate rises given its strong relationship with wages growth see chart below).

For inflation to reach 3% by the end of next year (which, by the way, is still above the Fed’s target), a lot of things would have to go right. Assuming rent inflation stays elevated, goods prices would need to fall sharply (retailers would need to discount back towards pre-Covid price levels) and services ex-rent inflation would need to soften to around 3% annualised, a substantial moderation from here.

This all seems unlikely to us. We think a recession is necessary to generate enough labour market slack to depress wages growth and force larger household sizes (recently unemployed moving back in with parents or housemates) reducing rents. It’s not a pretty scenario, but it’s the one that normally plays out.

Market Troughs in Recessions

If the chances of inflation moderating on its own are thin, the most likely outcome is that inflation normalises via a recession – as has been the normal course of events through modern history. Below, we review six of these instances, including the path of some indicative macro variables, the Fed Funds Rate and the US equity market. In doing so, we can draw out any relevant parallels with the current period.

• Common to all instances has been an easing in the Fed Funds Rate in the months and quarters prior to the equity market troughing. This clearly stands in contrast to the current situation, with the Fed still expected to increase interest rates meaningfully in the next six months.

• In each of these periods except the Tech Bubble, the equity market troughs during the recession (the grey shaded area). This is consistent with the conventional wisdom that markets are forward looking and will begin to rally before there is an obvious floor from an economic data perspective. Again, with the US economy yet to formally enter a recession, this hurdle has not been met.

• Generally, inflation (top panel, grey line) is moderating prior to a market bottom. If inflation has not yet peaked, it moderates almost immediately following the market trough. Inflation in the US looks like it has peaked from a year over year perspective, but we have yet to see a material downswing.

• There is mixed data around the macro activity in the economy (ISM, housing starts, consumer confidence). Sometimes, an improvement in these variables in the aggregate tends to coincide with the end of a recession and beginning of the economic recovery. Given the US is yet to actually enter a recession, let alone exit one, it is too early to draw a parallel from these to the current environment.

Given the above, the key triggers we are looking for are:

• Economic data begins to show signs of improvement (or at least no longer deteriorating);

• Inflation has peaked and is trending lower; and

• Fed is actively easing policy in response to falling inflation and the recession.

Although we are nowhere close to meeting these conditions in the current episode, we can make some educated estimations about when they may come to pass given our forward view of the global economy.

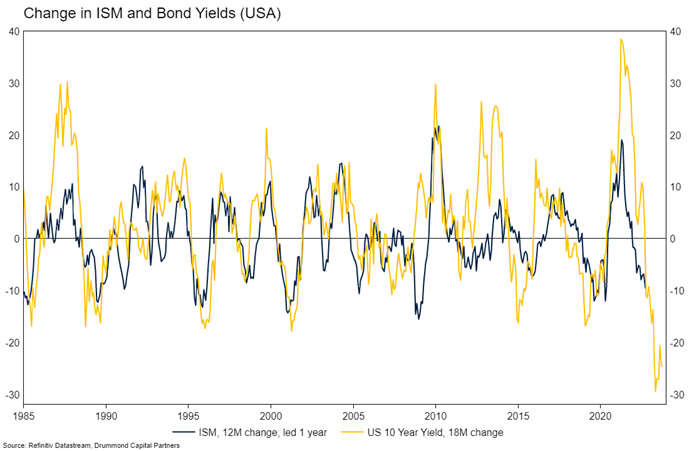

The most important consideration is when the recession is likely to begin. The Fed, by forecasting a rise in the unemployment rate from a low of 3.5% to 4.4% is implicitly acknowledging a recession. Since World War Two, there hasn’t been a single instance where the US unemployment rate has risen by more than 0.4 percentage points that hasn’t been immediately followed by a recession. Consensus forecasts have a similar profile for the unemployment rate in the US and imply economic growth is weakest in the first half of next year. There are signs the US economy is cooling. Job openings have fallen sharply. Business sentiment surveys have fallen a long way from the peak and while they remain expansionary, leading indicators suggest they should fall further over the coming year (see chart below, which implies and ISM reading of between 30 and 40 at some point in the next twelve months).

The above implies 2023 will be the year of the recession in the US, satisfying the first major condition. In four of the seven major recessions since 1970 (excluding Covid), the unemployment rate has increased by only 0.3% in the first six months of its increase – i.e. the initial rise in unemployment tends to be slow. As a result, we think services inflation will moderate only gradually. Despite this, the expected fall in goods prices should see overall inflation fall sharply through next year, satisfying the second condition. In terms of the Fed, we think they will begin to ease policy once they are confident inflation is under control. The Fed is unlikely to ease policy early into the rise in the unemployment rate as they will be concerned that inflation expectations will not properly anchor back towards their target range, and they will be focussed on causing a moderation in services inflation. However, sometime in the second half of the year or early 2024, once the unemployment rate has risen well above their forecasts and overall inflation is trending lower (though still likely above their target) they should feel like the inflation job is done and that they need to address the first part of their mandate – maximum employment. This will satisfy the third condition, allowing markets to trough sometime next year, more than likely from the middle of the year onwards.

Importantly, if we are wrong, and inflation moderates to target from here without a recession (the soft-landing scenario), equities have likely already bottomed. Evidence of this outcome would come in the form of sharply declining services inflation coincident with no great deterioration in the economy.

How Bad Does It Get?

Every market drawdown is unique, though there are clearly aspects which rhyme. Below, we summarise the major equity bear markets since the 1970s.

Comparing the current period to the instances in the table above, though US economy is not in recession, we think it will be by the time this is all said and done. The starting valuation for equities is elevated, but not as extreme as around the Tech Bubble or indeed even Covid (though valuations were much higher through 2021 prior to the start of the current correction). There are no obvious major macroeconomic imbalances in major developed economies at the moment. However, there are clearly deep problems in China, which is the world’s second largest economy. This still compares favourably to the Financial Crisis at least. Monetary policy now is being tightening more aggressively than in most previous periods, reflecting the largest mismatch between inflation and its target since the 1980s. We have yet to see major crisis fears. While this could still happen, the current drawdown feels relatively orderly outside of some issues around margining for liability driven investors in the UK.

Aggregating the above and aligning it with our forward view of the global economy, it seems unlikely this bear market will feature a total market decline towards the lower end of the range. However, a decline as great as the Financial Crisis also seems unlikely given the lack of systemic problems in the economy (outside of China). Something around the average seems most reasonable to us.

Portfolio Positioning

It is our expectation that the market will not bottom until inflation has peaked, the Fed is easing policy and economic data suggests the end of the recession is in sight. As a result, the portfolios remain very underweight equity exposure. This is likely to remain the case (notwithstanding shorter-term tactical changes to take advantage of oversold or overbought conditions) until either the Fed is cutting interest rates in the midst of the recession or services inflation moderates in earnest, increasing the probability of the soft-landing scenario.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics