Arm, Instacart and Klaviyo IPOs: A new listings revival or dead cat bounce?

High-profile listings like chip designer Arm Holdings (NASDAQ: ARM) and grocery delivery app Instacart (NASDAQ: CART) have stoked hopes of a revival in the IPO market, where year-to-date volumes have been running close to decade lows.

But investors shouldn’t get too excited over a few chunky tech-oriented IPOs. And here’s why.

IPOs structured to pop

IPOs are getting a little more cheeky, opting for smaller offers and tight floats to give them the best chance of a pop on listing.

Arm floated approximately 9.3% of its outstanding shares, according to Renaissance Capital. Its IPO was also around 12 times oversubscribed.

By restricting supply, it pushes eager investors through a smaller door, effectively squeezing the share price higher.

Softbank was seen trying to align the stars for a perfect pop, with its bankers agreeing to price the stock at $51 instead of $52 to yield a bigger pop on its debut.

Arm was initially priced at $51 per share but opened at $56.10 and rallied 13.4% intraday to close at $63.59.

Short-lived gains

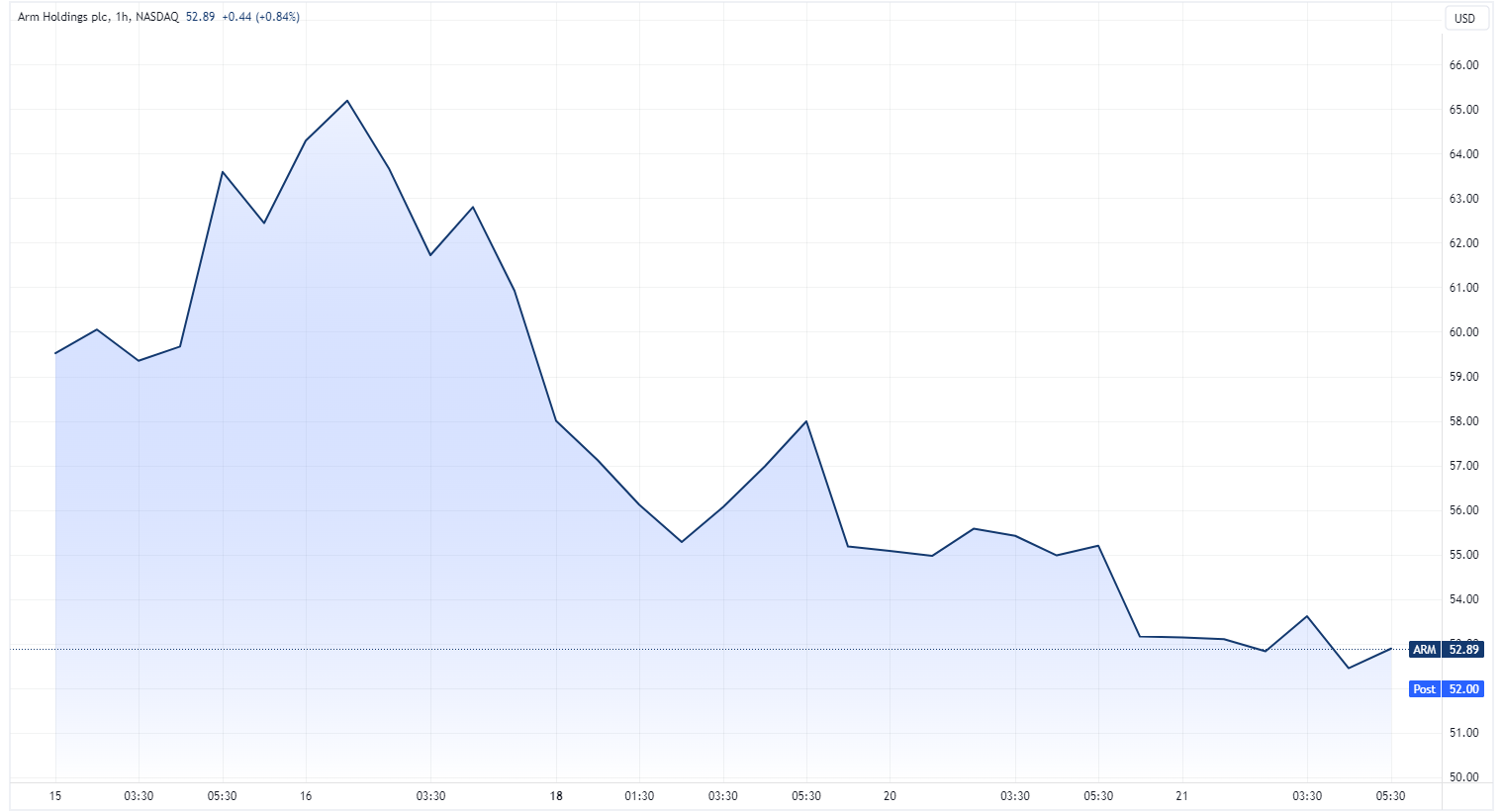

On the second day of trading, Arm shares briefly rallied 8.5% to $69.00 before finishing that session 4.5% lower at $60.75. And things only got worse from there.

- Monday, 18 September: -4.6% to $57.95

- Tuesday, 19 September: -4.9% to $55.17

- Wednesday, 20 September: -4.1% to $52.91

Arm has already undercut its debut price ($56.10) and trading just 3.6% above the IPO offer price of $51.

Arm Holdings chart (Source: TradingView)

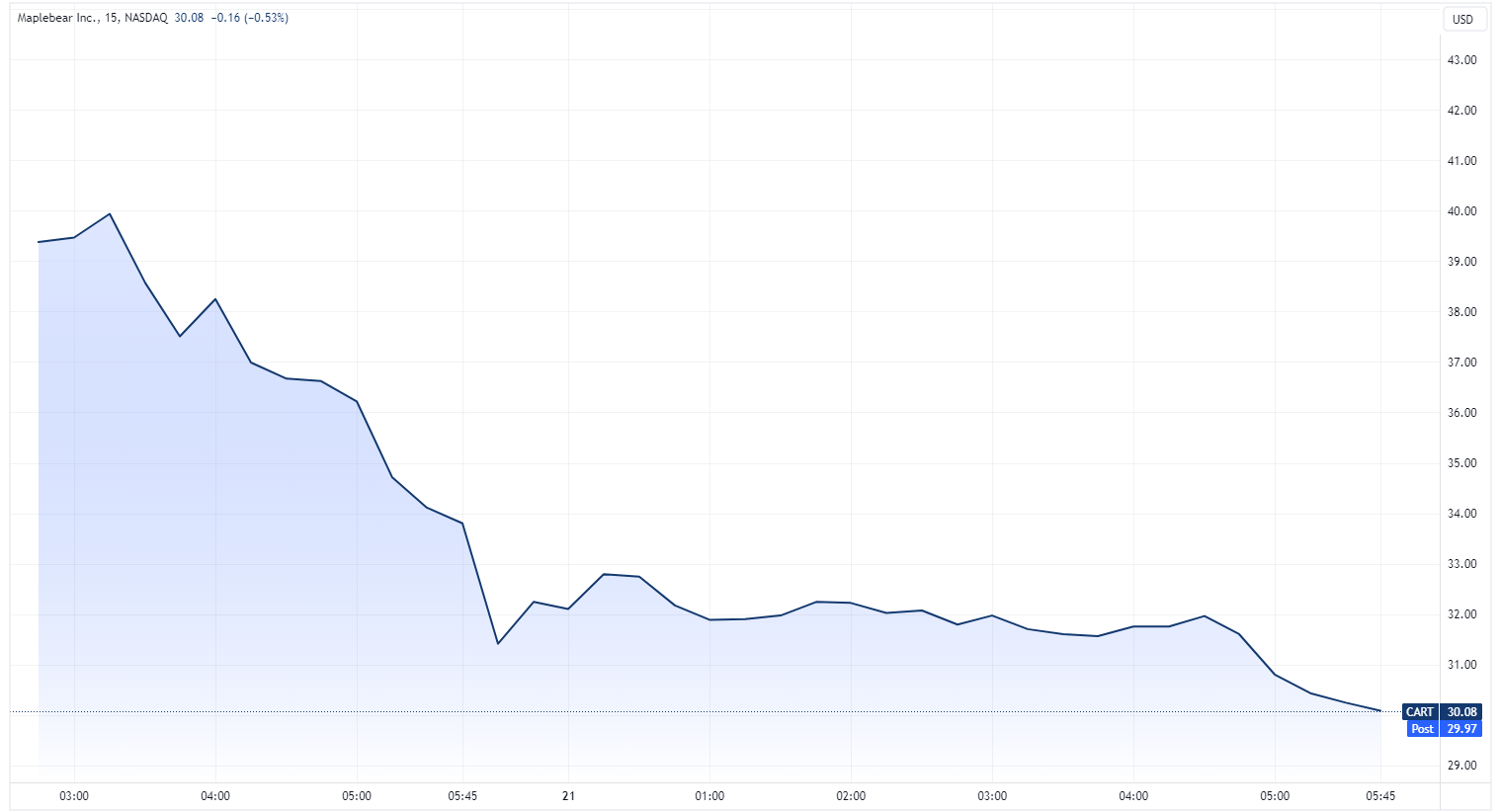

Instacart managed to do all the above in just two sessions – Soaring as much as 43% in early trade to $42.95 (from an IPO offer price of $30) but finished the session just 12.2% higher at $33.67.

On Wednesday, the stock fell 10.7% to close just 10 cents above its offer price.

Instacart chart (Source: TradingView)

So what does this tell you about investor sentiment? And how will this impact upcoming IPOs like email marketing firm Klayvio.

The oversubscribed IPOs suggests investors were keen to queue up at the starting line. But not so much the actual race. In fact, the fading price action suggests many have become net sellers.

Exit liquidity?

Are these IPOs trying to take advantage of the hype around things like Nvidia, ChatGPT and AI? Because so far, a chip designer, grocery delivery app and marketing automation platform sound like they have a lot in common.

Softbank acquired Arm for US$36 billion in 2016 and received a US$40 billion offer from Nvidia back in 2022 (which was scrapped due to regulatory opposition).

The company would’ve fetched a peak valuation of US$65 billion at US$63.59 per share.

Plenty of Instacart investors are sitting on considerable unrealised losses from 2020-21 funding rounds. The Wall Street Journal reports unrealised losses of roughly 73% from investment management and venture capital firms D1 Capital, Fidelity, Sequoia and T. Rowe Price (assuming they retained their stakes).

It’s nothing new

This fading price action isn’t exactly a new phenomenon, in fact, very few IPOs have been able to escape it.

Mediterranean restaurant chain Cava was one of the more high-profile IPOs before Arm. It soared as much as 117% in its market debut to $43.78 per share, up from its IPO price of $22.

The stock has almost halved from its peak of $57.11 in early August but still above the offer price.

This article was originally published on Market Index on Thursday, 21 September 2023.

3 topics