Asian infrastructure - Trip insights with 4D Infrastructure (part 3)

This is part three in a four-part series from our recent trip through Asia. Parts one and two are available below:

Utilities

Chinese gas utilities

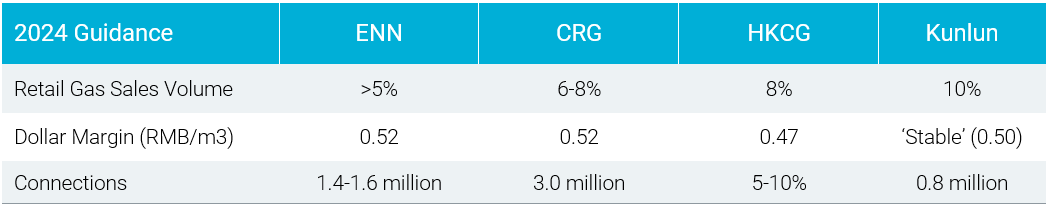

The market has always been focused on the sector tripod, being; (i) gas sales volumes growth, (ii) dollar margin, and (iii) new connections.

Source: Company

*China Gas Holdings (CGH) excluded. Not comparable due to its fiscal year ending 31 March, nor has the Company provided any FY25 guidance to-date

1. Gas volumes: 2023 gas volumes fell flat after a reopening that never materialised, causing operators to revise their guidance downward or predict declines in volume. For 2024, city-gate operators remain somewhat cautious, providing volume growth guidance ranging from 5-10%. This reflects a conservative outlook amid market uncertainties. Among the major city-gate operators, ENN Energy (ENN) is expected to benefit from an increase in gas volume from high-end manufacturing and renewable sectors, while China Resource Gas (CR Gas), TownGas China (HKCG), and China Gas Holdings (CGH) foresee robust commercial demand and growing household consumption. Despite the short-term uncertainty, management believe the long-term prospects for robust gas demand growth remain intact. This is underpinned by continuous recovery in macroeconomic conditions, China's dual carbon policy, ongoing industrial coal-to-gas conversion, industrial upgrades, and increased urbanisation. The Central Government projects that domestic gas demand will reach approximately 600-700 billion cubic meters (bcm) by 2030, up from around 395 bcm at present. This projection implies a compound annual growth rate (CAGR) of 6-9% over the coming years. Given this outlook, city-gate gas operators have set goals to maintain volume growth at or above the industry average and we got comfort from conversations thereon with messaging similar across the sector.

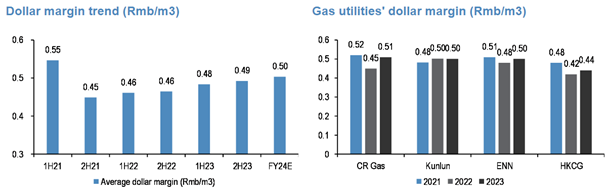

2. Dollar margins[1]: High global gas prices, combined with constraints on passing through procurement costs to residential customers, have resulted in dollar margins for city-gate gas operators being squeezed. Margins have dropped from the previous levels of RMB0.55-0.60 per cubic meter (cbm) to RMB0.45-0.50/cbm in 2023. However, ongoing policy reforms aim to address this issue by creating a framework that allows a more direct and timelier pass-through of increased costs to residential customers. Going forward, many operators anticipate sequential improvements and for dollar margins to stabilise at a normalised level of around RMB0~0.55cbm, depending on the customer mix. The exact margin will depend on factors such as the ratio of residential to commercial and industrial customers, the degree of pass-through allowed, and other cost control measures.

Source: Companies’ Results Presentation (FY/Interim 2021-23), J.P. Morgan calculations. Note: Average of CR Gas, ENN, HKCG, Kunlun

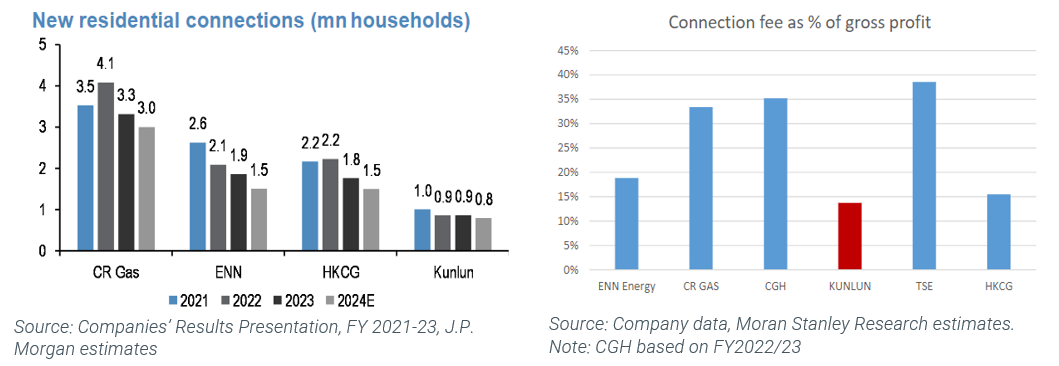

3. Connections: Connections, both for new and existing dwellings, have historically been the priority of the sector given the segment’s superior margins. The recent downturn in China's property market weighed on connections, as new connections in general contracted by 10-20% in FY23, reducing the segment's contribution to overall earnings. In 2024, new connections remain modest, with gas names guiding flat to 20% YoY declines, but positively benefiting from improving margins. Most operators expect to maintain a steady level of connections in the next few years, before a gradual decline thereafter. Even prior to the recent property market woes, our forecasts indicated a similar trend; the current circumstances have merely accelerated the timeline. Additionally, we do not model additional concession wins, only increased household penetration with the incumbent operating footprint.

Management teams were unified in their strategic focus on maximising value from incumbent operations rather than aggressively pursuing new concessions. This shift in approach underscores the significant potential for growth and profitability by enhancing current assets and expanding services within existing operations. By leveraging existing customer relationships and infrastructure, they can maximise value of their assets and open new revenue streams. We think this is an important and much needed sector transition. Key strategies include:

- Increasing customer penetration: Targeting higher penetration rates among both residential and commercial & industrial (C&I) customers in existing jurisdictions offers a way to grow revenue without the need for extensive new infrastructure. This can involve outreach efforts, promotional activities, and incentive programs.

- Increasing usage per customer: Encouraging existing customers to increase their gas usage can be achieved through targeted marketing, discounts, and providing solutions that meet specific customer needs. By understanding customer behaviours and preferences, operators can design campaigns that stimulate demand.

- Expanding dollar margins: The pass-through framework allows operators to adjust prices in response to cost changes, providing an opportunity to maintain or improve dollar margins. Additionally, exploring operational efficiencies and cost-reduction measures can further contribute to profitability.

- Offering Integrated Energy (IE) and Value-Added Services (VAS): These services encompass a wide range of activities, from energy management and equipment maintenance to broader energy consulting services. By expanding these offerings, operators can diversify their revenue sources and strengthen customer relationships. Some operators believe that the earnings contribution from these activities could eventually rival that of their core gas sales business.

Thai electricity utilities

The Thai electric utilities typically operate across three segments. Independent Power Producer (IPP), Small Power Producer (SPP), and/or Very Small Power Producer (VSPP).

In the latter half of 2023, utilities with large SPP portfolio exposure de-rated due to the Energy Regulatory Commission (ERC) freezing the energy tariff adjustment and concerns of potential incremental tariff cuts (having lowered the band of electricity tariffs by ~10% for the May – August 2023 period). This action, intended to lower energy costs and stimulate the Thai economy, led to margin squeezes as rising procurement costs could not be passed on to end-users. Regulatory focus on consumers came at the expense of the operators. Consequently, the Energy Generating Authority of Thailand (EGAT), a state-owned agency and the largest power producer and wholesaler in Thailand, incurred an additional ~Bt110bn in debt, putting its credit ratings in jeopardy. The sector has seen some reprieve through declining prices (gas and coal), along with a recent ~5% upward tariff revision in January 2024. Whilst declining gas and coal prices aid in margin expansion, the utilities are unlikely to retain this benefit for long given the Move Forward Party’s emphasis on energy policy measures, which could see a tariff cut follow to reflect the declining procurement costs. Some utilities are attempting to expedite the margin recovery through portfolio optimising and contract structures, particularly by increasing gas-linked tariffs with industrial customers. The failure of the regulatory construct/contract structure with little judicial recourse has long been a concern for us with the sector, and a reason we are not invested despite the opportunity underpinned by the country’s evolution.

Thailand’s latest iteration of its Power Development Plan (PDP, 2020) has set a net zero greenhouse gas emissions target for 2065 and carbon neutrality for 2050. Whilst this underpins the need for new renewable capacity over the long-term, the SPP and IPP markets are presently oversupplied and many of the utilities are uncertain as to whether they can successfully renew/replace capacity as contracts expire. This has increased the competition in domestic renewable energy bidding processes and pushed utilities to seek opportunities abroad to supplement growth and insulate from potential non-renewals of capacity. GPSC highlighted its ongoing investment in Avaada Energy Private Limited (AEPL), a renewables platform in India, and an offshore windfarm in Taiwan. BGRIM plans to pursue new greenfield and brownfield projects in countries such as Malaysia, Philippines, Cambodia, Vietnam, South Korea and Japan. BGRIM are currently constructing the Nakwol 1&2 offshore wind projects in South Korea which have a combined capacity of 740 MW (363 Mwe). Whilst these overseas investments signify a strategic shift, the utilities remain focused within the energy sector, with strict investment criteria requiring ’double-digit’ equity IRR returns.

Despite these near-term challenges, the utilities are optimistic about electricity demand in Thailand, expecting a sustained annual growth rate of 3-5%.

Ports

Maritime trade outlook

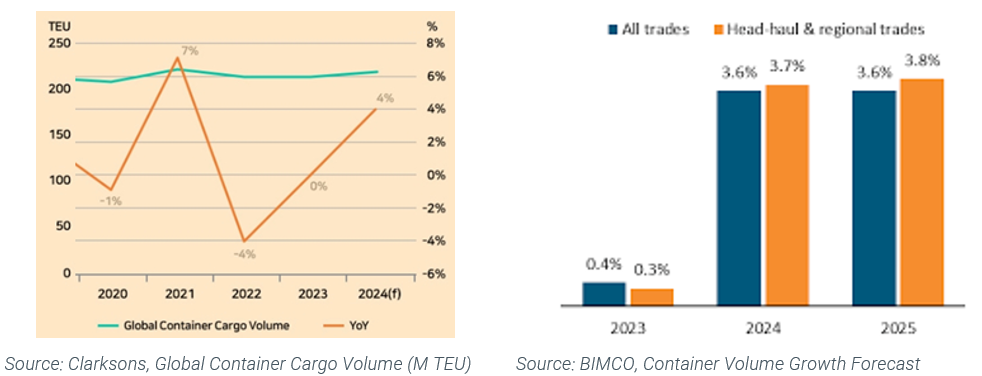

In 2023, the container market grew a modest 0.2%. Compared to 2019, before the pandemic, the market has seen an overall growth of 1.5%. Despite fluctuations in various economic indicators, global container volume growth has shown resilience. According to data from BIMCO and Clarksons, global container volume is forecast to grow by 3-4% in 2024, while Maritime Strategies International predicts a slightly more optimistic growth rate of 4.5%.

Port operators in the region had a similar outlook, but alluded to upside-risk. China Merchants Port (CMP) recorded a 10% increase in container throughput across its global terminal network for the first two months of 2024 but affirmed ‘flattish’ full-year growth guidance due to a low base effect in the first half and a cautious outlook for the latter half of the year. Specifically, they expect domestic throughput growth of 1-2% and throughput at its overseas terminals to grow slightly higher at 2-3%. COSCO Shipping Ports (COSCO) are slightly more optimistic, guiding to ‘mid-single digit’ growth. Westports (WPRTS), a key transshipment port located along the Asia-Europe and intra-Asian shipping lanes within the Strait of Malacca, has guided for ‘low single-digit’ container volume growth. Longer-term, they expect container volume growth to stabilize around 2-3% per annum suggesting limited organic growth opportunities.

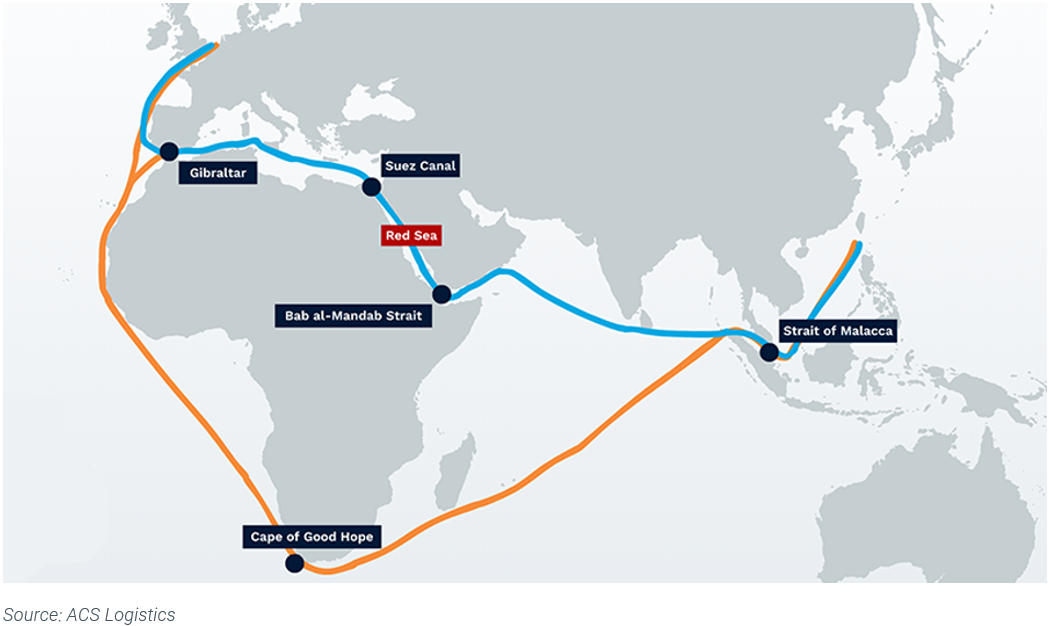

The Red Sea disruptions

Attacks on vessels in the Red Sea area have significantly disrupted traffic through the Suez Canal, the shortest maritime route between Asia and Europe and responsible for about 15% of global maritime trade volume. According to UN Global Platform and IMF PortWatch, trade through the Suez Canal in the first two months of 2024 dropped by 50% compared to the same period in 2023. Shippers have chosen to avoid the Suez Canal and reroute via the longer Cape of Good Hope, extending journey times by more than a week and adding over 3,500 nautical miles (6,500 kilometres) to their voyages. UBS estimates that this re-routing translates into a 20-30% increase in cost per container.

Port operators indicated that ocean carriers' networks are settling into a ‘new normal’. Despite the logistical challenges, they indicated that even if Suez Canal diversions persist, apart from longer voyage times, the frequency of ship calls are expected to be sustained.

Supply chain shifts

Supply chain shifts aren't new. They've been ongoing and driven by a range of factors including diversification, cost-cutting, tariffs, subsidies, geopolitical risk, lead times, and ESG considerations. The supply shock that started in China during the pandemic and the demand shock that followed only emphasised and accelerated efforts to reduce vulnerabilities in production strategies and supply chains. Companies are increasingly re-evaluating their approaches to address these risks and enhance resilience, focusing on regionalisation, reshoring, and multi-sourcing to create more robust and flexible supply networks.

CMP and COSCO have taken steps to mitigate risks associated with changing global trade dynamics by investing in global terminal networks. This approach allows them to capture shifting trade flows amid ongoing supply chain realignment. Both companies have expressed concerns about industrial migration and the ‘China +1’ strategy, which involves companies diversifying their manufacturing bases outside China. However, they are also looking to capitalise on these trends by investing in new terminals in regions expected to benefit from this shift. CMP and COSCO believe that the domestic impact of these changes can be mitigated by the Central Government's mandate on boosting high-end industrial goods production, allowing China to remain competitive while adapting to global supply chain shifts.

Port charges

Through and post the pandemic, container capacity shortages, terminal congestion, and global inflation combined to elevate shipping rates, boosting shippers’ profitability. These favourable conditions enabled most terminal operators to negotiate higher port charges. Shipping rates have since normalised, and further pressure is anticipated as global GDP decelerates and additional shipping capacity comes online, which could impact shipping profitability. This outlook could see terminal operators face greater resistance for future fee hikes.

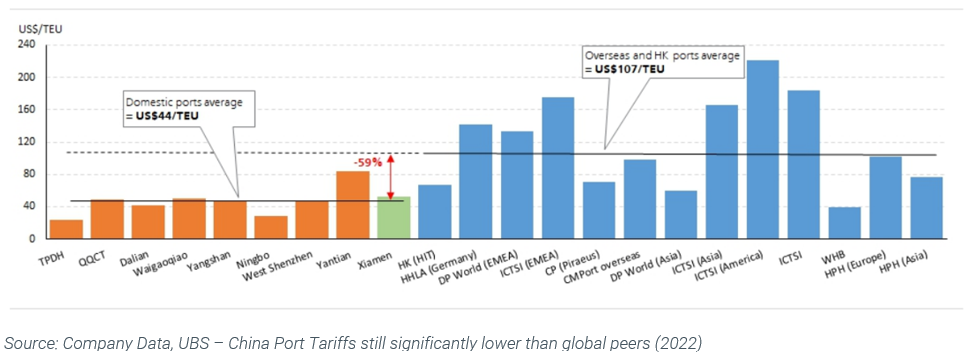

CMP and COSCO management expect benign tariff increases at domestic terminals of 1-2%, while aiming to implement inflation-like tariff increases at overseas terminals. Longer-term, we see a strong case for future tariff hikes at mainland China ports given the pricing disparity with global peers. Average revenue/TEU at mainland China ports in 2022 was US$44/TEU, while international ports were US$109/TEU. Notably, we do not factor domestic tariff increases into our assumptions, thus representing upside risk.

Source: Company Data, UBS – China Port Tariffs still significantly lower than global peers (2022)

Westports, on the other hand, operates under a different model. While the company negotiates directly with shippers, the Port Klang Authority sets maximum ceiling rates. WPRTS has commenced the process of requesting a container tariff revision, aiming for increases similar to the last review in 2019 (+30% for transshipment, +20% for Origin & Destination). The process is expected to take 1-2 years to complete and implement.

[1] Dollar margin represents the gross profit per unit of gas sold. It is calculated as the difference between the cost of purchasing the natural gas and the revenue gained from selling it at the city-gate.

3 topics