ASX 200 eases from all-time highs, Iron ore stocks falter + Gold stocks rip higher

The S&P/ASX 200 closed 10 points lower, down -0.13%.

ASX 200 Session Chart

Markets

- ASX 200 finished lower and near worst levels on Monday

- Materials and Healthcare stocks underperformed, with heavyweights like Fortescue (-3.2%), BHP (-1.5%), Rio Tinto (-1.1%) and CSL (-1.0%) weighing on the index

- Iron ore stocks struggled after Chinese iron ore futures slumped around 3.0%

- Lithium stocks faded early gains after Chinese lithium carbonate futures slumped from +5.2% to -0.9% in afternoon trade

- Real Estate stocks led to the upside after US treasury yields fell on weaker-than-expected manufacturing data (Australian yields also somewhat lower)

- Japanese giant makes $381m bid for Genex (The Australian)

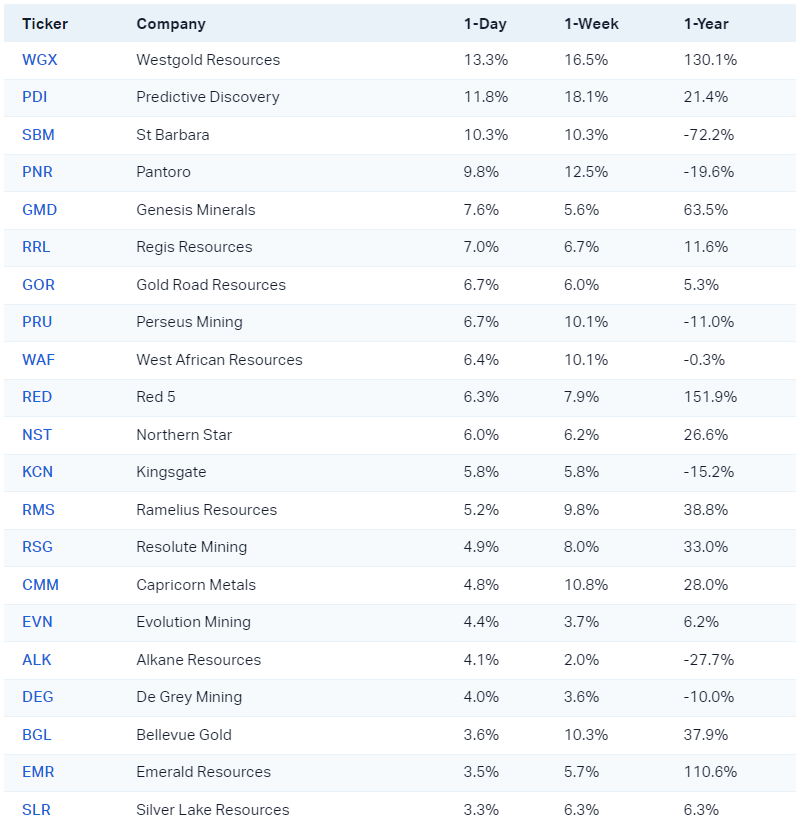

Gold Stocks Soar

Gold was all the rage today after prices for the commodity closed near record highs of US$2,080 an ounce last Friday and little changed on Monday. In Australian Dollar terms, prices are also sitting near record highs of A$3,191 an ounce. Here's a recap of how most gold-related names performed:

Westgold topped the one-day leaderboards. The company operates five underground mines in the Murchison and Bryah regions of WA. Last week, the company reported first-half revenue growth of 15% to $363 million, almost 500% net profit growth to $44 million and an interim dividend of 1 cent per share. To add some perspective, the net profit figure was 13% ahead of Macquarie estimates while the dividend was a surprise.

In the Morning Wrap, I noted a few small-to-mid cap names to watch including Emerald Resources (ASX: EMR), Southern Cross Gold (ASX: SXG), Auric Mining (ASX: AWJ) and Spartan Resources (ASX: SPR). I thought I'd briefly share why these stocks were on my radar:

- Emerald Resources (+3.5% from session high of +9.3%): High margin gold producer based in Cambodia. It was one of the best performing ASX 200 stocks from last year. In the midst of a pullback but today's rally seems to have hit a wall

- Southern Cross Gold (+8.3%): Shares were halted today pending "material exploration results at the company's Sunday Creek Project". It's got a pretty constructive chart – Let's just leave it at that.

- Auric Mining (+12.0%): Is a $18m market cap gold producer in WA – Which is a rarity. The company posted $4.9 million in operating cash flows for the December quarter, with $4.5 million cash at bank. A profitable microcap with a ton of cash in a rising gold environment ... that's a lot of leverage.

- Spartan Resources (+14.0%): Spartan (formerly Gascoyne Resources) was one of the best turnaround stories of 2023 – A beleaguered gold miner to exploration success kind of story. The stock rallied more than 400% between March and December 2023. After two or so months of sideways trade, it's back to trending higher.

Economy

Things were pretty quiet on the macro front. Some minor data of interest today include:

- Australian building permits fell 1.0% in January after a 10.1% fall in December, according to the ABS. This was well-below the 4.0% growth expected by economists and marks the fourth consecutive month of decline

- Australian company gross operating profits rose 7.4% in the December quarter, up from a 1.6% fall in the previous quarter

- Australian mineral exploration expenditure rose 0.9% quarter-on-quarter in the December quarter and up 7.3% year-on-year

Interesting Movers

Trading higher

- +32.4% Genex Power (GNX) – Takeover proposal

- +11.1% Jervois Global (JRV) – Removal from Index (as part of ASX rebalance)

- +9.6% Calix (CXL) – Leilac-2 update

- Gold sector move: Westgold (+12.8%), St Barbara (+10.3%) Pantoro (+9.8%)

- Uranium sector move: Lotus Resources (+7.3%), Bannerman (+6.4%), 92Energy (+6.3%)

Trading lower

- -11.1% Lake Resources (LKE) – Cost reduction and strategic partner process

- -6.0% Cettire (CTT) – CEO and founder selldown

- -4.1% Count (CUP) – Completes acquisition of Diverger (Fri)

- -3.6% City Chic Collective (CCX) – Removal from Index (as part of ASX rebalance)

- -1.5% AMA Group (AMA) – Removal from Index (as part of ASX rebalance)

Broker notes

- Overweight with $14.40 target price

- "Few ASX-listed businesses have a user base like Life360's. The introduction of advertising to non-paying MAU is capital light, and even at very modest monetisation rates, implies: 1. cons rev upgrades 2. Durable top-line growth 3. High group GM 4. Scope for more reinvestment & faster S&M payback."

- "The stock closed up 38% as investors absorbed the capacity for more durable growth with operating leverage. However no result is perfect. We feel areas of scrutiny include: 1) Subscriber growth; 2) Net subscriber revenue retention and 3) Stock based compensation."

- Upgraded to Outperform from Underperform with $152.60 target price

- "XRO has outlined an aspirational target to double sales while continuing growth in the Rule of 40 (FCF margin + sales growth)."

- "New KMP hires are leveraging the strengths in XRO's operating model to address our historical concerns directly, clearly articulating a sound capital allocation framework and fuelled by data-driven decisions. We see low- hanging fruit that can be addressed while margins expand."

- Upgrade to Outperform from Neutral with $3.40 target price

- "S32's slated divestment of metallurgical coal transforms it into a 100% base metals-focused producer, with 70% of NAV driven by aluminium."

- "Concentrated aluminium and base metals exposure provides upside into next year as prices potentially strengthen."

- Upgraded to Buy and hiked target price by 39% to $16.80

- "While Megaport’s valuation is elevated at ~9x FY25e revenue, especially as the turnaround could take longer than expected, we remain Buy-rated as i) Megaport’s focus on customers is resulting in higher share-of-wallet; ii) we continue to see upside to FY24e EBITDA guidance; and iii) we see Megaport as a beneficiary of increased cloud- adoption, especially multi-cloud, as Enterprises look to adopt GenAI."

4 stocks mentioned