ASX 200 firms as short covering in lithium & battery materials stocks turns into full blown rally

Today in Review

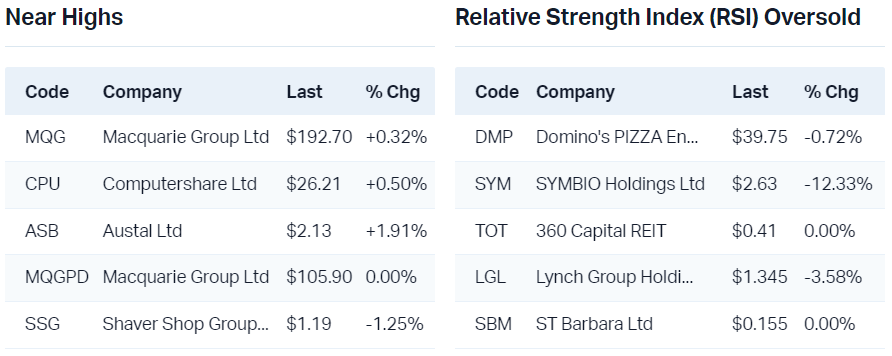

Markets

%20Intraday%20Chart%2016%20Feb%202024.png)

The S&P/ASX200 (XJO) finished 52.6 points higher at 7,658.3, 0.7% from its session high and just 0.3% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 170 to 105. For the week, the XJO finished up 13.5 points or 0.18% higher.

The Resources (XJR) (+1.5%) sector was the best performing sector today, helped partly by a modest rally in base metals and iron ore prices over the past 24-hours, but mainly due to a massive rally in lithium and other battery materials stocks.

Major lithium markets are closed this week for Chinese Lunar New Year holidays, so the rally is unlikely due to a recovery in lithium prices. Rather, as I expressed in Wednesday's Evening Wrap, the price action and volume indicated it was more likely short covering on selected beaten down lithium and battery materials plays like Sayona Mining (SYA), Core Lithium (CXO), Syrah Resources (SYR), Chalice Mining (CHN), and Novonix Ltd (NVX).

The short covering entered its third day today, and it appears to have grown into a sector-wide phenomenon, moving significantly up the market-cap chain to assist the likes of Pilbara Minerals (PLS), Mineral Resources (MIN), and IGO. How much is left in the rally? Check out today's ChartWatch!

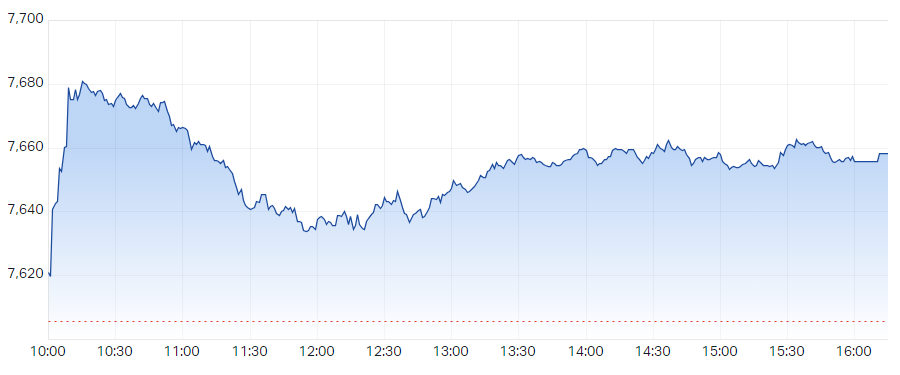

ChartWatch

Sayona Mining Ltd (SYA)

.png)

Wednesday 14 Feb. That candle. That volume spike. That's where this rally started! Well, that's what I think anyway! In my experience (circa 30-years of reading charts), when you see that candle and that volume in those trends...there's a very good chance some short covering is underway.

Often, the shorts are first to move the market in a turnaround. In Sayona, they're probably reacting to the fact that with the stock trading around 3.7 cents, there was little more to gain, but also based upon the theory Sayona's impending removal from the S&P/ASX200 would force many passive fund managers to sell, and therefore trigger the call back of many short sellers' shares.

Regardless of the reasons, watch out for exactly the pattern I've described here to spot major lows in beaten down stocks. You might want to also check out the charts of Core Lithium (CXO), Syrah Resources (SYR), Chalice Mining (CHN), and Novonix Ltd (NVX) which each exhibit very similar technical patterns.

Can the rally in Sayona and Co. continue? I can't see why not. As long as the candles are white or exhibit downward pointing shadows, it likely will. Overhead resistance and the long term trend ribbon become the major impediments from here. For Sayona, they kick in at $0.074 and $0.082 respectively.

Economy

Today

No major economic news announcements today!

Later this week

Saturday

00:30 USA Core Producer Price Index (CPI): forecast +0.1% in Jan to 1.4% p.a. vs +0.0% in Dec to 1.0% p.a.

04:10 USA Preliminary University of Michigan Consumer Sentiment: 79.9 in Feb vs 79. in Jan

Latest News

Warren Buffett's Berkshire Hathaway trims Apple stake, exits homebuilders, adds energy

Wesfarmers focused on delivering "win-win" for consumers and shareholders

Why relentless innovation is Pro Medicus’ biggest opportunity and risk

Why Morgan Stanley analysts prefer Rio Tinto over BHP

Farewell Altium: Everything you need to know about the $9 billion takeover bid

South32 is unloved right now and that might be the best thing for long term investors

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

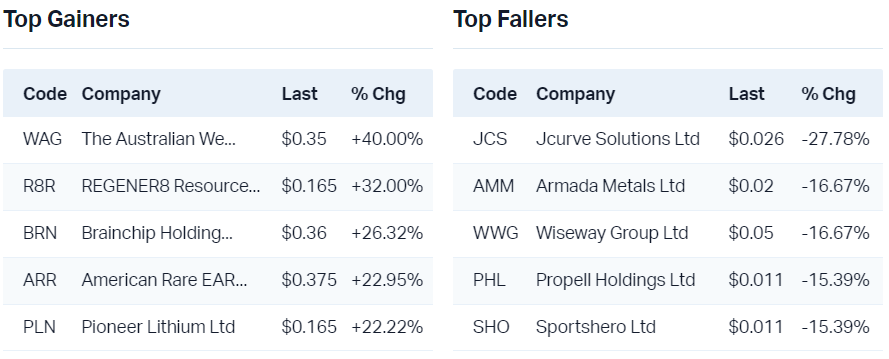

Interesting Movers

Trading higher

+26.3% Brainchip Holdings (BRN) - Virtual Investor Roadshow

+20.0% Novonix (NVX) - No news, I did tip earlier in the week in this section that several beaten down battery metals stocks were potentially seeing some short covering!

+11.9% Liontown Resources (LTR) - No news, short covering rally facilitates sector advance!

+10.0% Piedmont Lithium Inc (PLL) - No news, short covering rally facilitates sector advance!

+9.5% Core Lithium (CXO) - No news, short covering rally facilitates sector advance!

+8.7% IGO (IGO) - No news, short covering rally facilitates sector advance!

+8.7% Syrah Resources (SYR) - No news, short covering rally facilitates sector advance!

+7.8% Sayona Mining (SYA) - No news, short covering rally facilitates sector advance!

+7.4% Arafura Rare Earths (ARU) - No news, short covering rally facilitates sector advance!

+7.2% Pilbara Minerals (PLS) - No news, short covering rally facilitates sector advance!

+7.0% Nickel Industries (NIC) - No news, short covering rally facilitates sector advance!

+6.6% Omni Bridgeway (OBL) - No news, short term trend has turned up

+6.6% Infomedia (IFM) - No news, possible positioning ahead of results on 20 Feb

+6.2% Myer Holdings (MYR) - No news, rise is consistent with short and long term uptrends

+5.8% Pepper Money (PPM) - No news, rise is consistent with short and long term uptrends

+5.6% Abacus Storage King (ASK) - HY24 4D and Financial Report

+5.3% SSR Mining Inc. (SSR) - Dead cat bounce after 14 Feb Announcing Suspension of Operations at Copler

+5.3% Arcadium Lithium (LTM) - No news, short covering rally facilitates sector advance!

+5.1% Nuix (NXL) - No news, rise is consistent with short and long term uptrends

+5.0% Latin Resources (LRS) - No news, short covering rally facilitates sector advance!

+4.9% Lynas Rare Earths (LYC) - No news, short covering moving up the market cap chain!?

+4.7% Mineral Resources (MIN) - No news, short covering rally facilitates sector advance!

+4.6% Iluka Resources (ILU) - No news, short covering rally facilitates sector advance!

Trading lower

-14.2% Neuren Pharmaceuticals (NEU) - Comment on research report

-12.5% Inghams Group (ING) - FY2024 Interim Financial Report and Appendix 4D

-9.5% Data#3 (DTL) - Continued negative response to 15 Feb Half Yearly Report and Accounts, 2 ratings downgrades and 3 price target cuts by the brokers (see Broker Moves section below)

-7.9% Strike Energy (STX) - Continued negative response to Feb 13 South Erregulla Update

-7.2% Pro Medicus (PME) - Continued negative response to 15 Feb Company Announcement - Interim Results, 2 ratings downgrades by the brokers (see Broker Moves section below), I do note director purchase today, though

-6.3% Silex Systems (SLX) - No news, part of broad weakness in ASX uranium sector today, short term uptrends are under significant pressure

-6.2% Domain Holdings Australia (DHG) - Downgraded to underweight from equalweight at Morgan Stanley; Price Target: cut to $2.80 from $3.80

-5.7% RPMGlobal Holdings (RUL) - Appendix 4D - Half Year Results

-4.9% Fineos Corporation Holdings (FCL) - No news, potential positioning ahead of H1 FY24 results on 21 Feb

-4.8% Kogan.Com (KGN) - No news 🤔

-4.0% ASX (ASX) - Appendix 4D and 2024 Half-Year Financial Statements

-3.9% Ridley Corporation (RIC) - Continued negative response to 14 Feb Half Yearly Report and Accounts

-3.8% Insurance Australia Group (IAG) - IAG 1H24 Appendix 4D and Half Year Report

-3.7% Bannerman Energy (BMN) - No news, part of broad weakness in ASX uranium sector today, short term uptrends are under significant pressure (hot money switching back to lithium?🤔)

Broker Notes

AGL Energy (AGL) retained at equalweight at Morgan Stanley; Price Target: $9.99

-

Altium (ALU)

Downgraded to sector perform from outperform at RBC Capital Markets; Price Target: $68.50 from $50.00

Downgraded to neutral from positive at E&P; Price Target: $68.50

Retained at positive at E&P; Price Target: $68.50 from $50.65

Retained at hold at Jefferies; Price Target: $68.50 from $47.08

Retained at hold at Bell Potter; Price Target: $66.75 from $44.00

Retained at hold at Ord Minnett; Price Target: $68.50 from $47.50

Retained at overweight at Morgan Stanley; Price Target: $50.00

-

AMP (AMP)

Upgraded to buy from neutral at Citi; Price Target: $1.25 from $0.90

Retained at sell at UBS; Price Target: $0.93 from $0.85

BHP Group (BHP) retained at equalweight at Morgan Stanley; Price Target: $45.75

Breville Group (BRG) retained at overweight at Morgan Stanley; Price Target: $28.00 from $29.00

Car Group (CAR) retained at overweight at Morgan Stanley; Price Target: $30.00

Challenger (CGF) retained at equalweight at Morgan Stanley; Price Target: $7.20 from $6.75

CSL (CSL) retained at overweight at Morgan Stanley; Price Target: $310.00 from $318.00

-

Domain Holdings Australia (DHG)

Retained at lighten at Ord Minnett; Price Target: $2.50

Downgraded to underweight from equalweight at Morgan Stanley; Price Target: $2.80 from $3.80

-

Data#3 (DTL)

Downgraded to equal-weight from overweight at Morgan Stanley; Price Target: $8.10 from $8.20

Downgraded to neutral from buy at UBS; Price Target: $8.40 from $8.20

Retained at neutral at JP Morgan; Price Target: $8.50 from $8.80

Retained at negative at Goldman Sachs; Price Target: $8.10 from $8.30

Retained at overweight at Wilsons; Price Target: $9.60

Fletcher Building (FBU) retained at buy at Ord Minnett; Price Target: $5.70

-

Goodman Group (GMG)

Downgraded to neutral from buy at UBS; Price Target: $29.25 from $26.50

Retained at outperform at Macquarie; Price Target: $31.81 from $26.52

Retained at neutral at JP Morgan; Price Target: $29.25 from $26.50

Retained at overweight at Barrenjoey; Price Target: $28.00 from $24.25

Retained at buy at Jefferies; Price Target: $32.98 from $31.04

Retained at overweight at Morgan Stanley; Price Target: $31.35 from $28.00

Graincorp Class A (GNC) retained at hold at Ord Minnett; Price Target: $7.40

GUD Holdings (GUD) upgraded to buy from neutral at Citi; Price Target: $12.80 from $12.90

Healthco Healthcare and Wellness REIT (HCW) retained at equalweight at Morgan Stanley; Price Target: $1.65

Healius (HLS) retained at underweight at Morgan Stanley; Price Target: $1.30

Hotel Property Investments (HPI) retained at hold at Ord Minnett; Price Target: $3.40 from $3.30

Incitec Pivot (IPL) retained at buy at UBS; Price Target: $3.21 from $3.30

-

James Hardie Industries (JHX)

Retained at buy at UBS; Price Target: $66.50

Retained at overweight at Morgan Stanley; Price Target: $65.00

-

Magellan Financial Group (MFG)

Retained at buy at UBS; Price Target: $10.25

Retained at hold at Ord Minnett; Price Target: $9.60

Retained at underweight at Morgan Stanley; Price Target: $7.85 from $6.65

Macquarie Group (MQG) retained at overweight at Morgan Stanley; Price Target: $202.00

Neuren Pharmaceuticals (NEU) initiated buy at Canaccord Genuity; Price Target: $31.00

NIB Holdings (NHF) retained at equalweight at Morgan Stanley; Price Target: $8.15

NRW Holdings (NWH) retained at buy at UBS; Price Target: $3.15

-

Origin Energy (ORG)

Downgraded to neutral from overweight at JPMorgan; Price Target: $9.10 from $9.00

Retained at buy at UBS; Price Target: $10.00 from $9.60

Retained at hold at Ord Minnett; Price Target: $9.00

Downgraded to equalweight from overweight at Morgan Stanley; Price Target: $8.88

Retained at outperform at Macquarie; Price Target: $9.26

Retained at outperform at RBC Capital Markets; Price Target: $10.50

Retained at overweight at Jarden; Price Target: $9.20

-

Orica (ORI)

Retained at buy at UBS; Price Target: $19.40 from $19.00

Retained at overweight at Morgan Stanley; Price Target: $19.50

-

Pro Medicus (PME)

Downgraded to underperform from outperform at CLSA; Price Target: $100.00 from $88.80

Downgraded to sell from hold at Bell Potter; Price Target: $75.00

Retained at overweight at JP Morgan; Price Target: $104.00 from $100.00

Retained at neutral at Barrenjoey; Price Target: $93.00 from $72.00

Retained at neutral at E&P; Price Target: $94.09 from $78.85

Retained at hold at Morgans; Price Target: $85.00 from $74.00

Retained at sell at Ord Minnett; Price Target: $34.50

REA Group (REA) retained at overweight at Morgan Stanley; Price Target: $210.00 from $200.00

Ramsay Health Care (RHC) retained at equalweight at Morgan Stanley; Price Target: $49.60 from $51.60

Rio Tinto (RIO) retained at overweight at Morgan Stanley; Price Target: $144.50

Reckon (RKN) retained at equalweight at Morgan Stanley; Price Target: $0.65 from $0.60

Reliance Worldwide Corporation (RWC) retained at equalweight at Morgan Stanley; Price Target: $4.20

South32 (S32) retained at overweight at Morgan Stanley; Price Target: $3.70

Seek (SEK) retained at overweight at Morgan Stanley; Price Target: $29.00

Sonic Healthcare (SHL) retained at overweight at Morgan Stanley; Price Target: $35.55

Seven Group Holdings (SVW) retained at lighten at Ord Minnett; Price Target: $30.50 from $27.50

Seven West Media (SWM) retained at underperform at Morgan Stanley; Price Target: $0.23

-

Telstra Group (TLS)

Downgraded to underperform from outperform at CLSA; Price Target: $4.10 from $4.30

Retained at buy at Jarden; Price Target: $4.40

Retained at hold at Bell Potter; Price Target: $4.25 from $4.15

Retained at outperform at Macquarie; Price Target: $4.40 from $4.23

Retained at buy at UBS; Price Target: $4.40 from $4.50

Retained at accumulate at Ord Minnett; Price Target: $4.50

Retained at overweight at Morgan Stanley; Price Target: $4.75

Technology One (TNE) retained at equalweight at Morgan Stanley; Price Target: $14.50

Temple & Webster Group (TPW) retained at overweight at Morgan Stanley; Price Target: $12.25 from $9.25

-

Treasury Wine Estates (TWE)

Retained at add at Morgans; Price Target: $14.03 from $14.15

Retained at overweight at Morgan Stanley; Price Target: $13.75

Retained at underweight at Barrenjoey; Price Target: $10.00 from $9.50

Retained at outperform at Macquarie; Price Target: $13.80 from $14.00

Retained at positive at E&P; Price Target: $13.59 from $13.25

Retained at buy at UBS; Price Target: $14.00

Retained at hold at Ord Minnett; Price Target: $11.50

Tyro Payments (TYR) initiated buy at Shaw and Partners; Price Target: $1.60

Vicinity Centres (VCX) retained at underweight at Morgan Stanley; Price Target: $1.95

-

Wesfarmers (WES)

Downgraded to hold from add at Morgans; Price Target: $62.30 from $55.15

Downgraded to underperform from outperform at CLSA; Price Target: $60.40 from $56.85

Retained at hold at Jefferies; Price Target: $60.00 from $57.00

Retained at underweight at Barrenjoey; Price Target: $50.00 from $45.00

Retained at neutral at Macquarie; Price Target: $61.20 from $56.30

Retained at neutral at E&P; Price Target: $57.13 from $55.35

Retained at neutral at UBS; Price Target: $61.00 from $55.00

Retained at sell at Ord Minnett; Price Target: $43.00 from $42.15

Retained at equalweight at Morgan Stanley; Price Target: $51.90 from $48.70

-

Whitehaven Coal (WHC)

Upgraded to neutral from underweight at Barrenjoey; Price Target: $7.15 from $7.30

Upgraded to buy from accumulate at Ord Minnett; Price Target: $8.60 from $8.80

Retained at overweight at Morgan Stanley; Price Target: $8.50 from $8.80

Wisetech Global (WTC) retained at overweight at Morgan Stanley; Price Target: $85.00

Xero (XRO) retained at overweight at Morgan Stanley; Price Target: $125.00

Scans

This article first appeared on Market Index on 16 February 2024.

5 topics

10 stocks mentioned