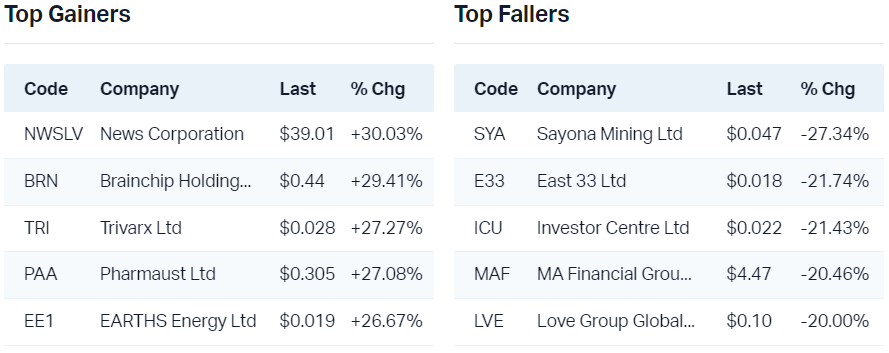

ASX 200 flat despite double digit earnings inspired moves in BGA, LOV, MAF, & TAH

Today in Review

The S&P/ASX200 (XJO) finished 2.8 points higher at 7,611.2, 0.35% from its session low and just 0.07% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 153 to 105.

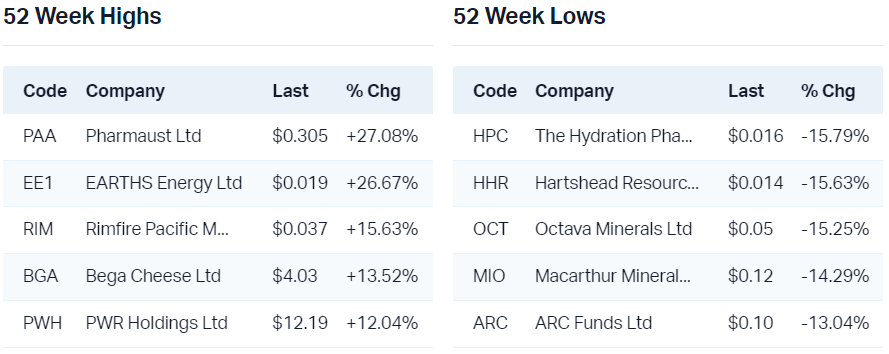

The Utilities (XUJ) (+2.0%) and Energy (XEJ) (+0.52%) were the best performing sectors today. There’s plenty of overlap between these two, and it’s common for them to move in the same direction either way. Once again Origin Energy (ORG) (+2.9%) was the star of the Utilities sector, while uranium company Nexgen Energy (NXG) (+1.6%) and Ampol (ALD) did well in Energy.

%20chart.png)

Doing it tough today was the Consumer Discretionary (XDJ) (-0.66%) sector, despite several stocks going in opposite directions in a big way. Tabcorp Holdings Ltd (TAH) (-10.3%), Super Retail Group (SUL) (-6.0%), and Eagers Automotive (APE) (-5.9%) all suffered after disappointing first half FY24 results, whereas results from PWR Holdings (PWH) (+11.9), and Lovisa Holdings (LOV) (+10.4%) clearly fell on the right side of market expectations.

Domino's Pizza Enterprises (DMP) (+7.7%) also had a very good day – or I should say – another good day. It rallied after it reported its first half results yesterday, and was the beneficiary of several broker ratings and price target upgrades today.

Not sure if you've noticed, but we're processing upwards of 150 broker notes each day in our Broker Moves section near the bottom of this Evening Wrap 👇. It's a massive undertaking given the deluge of activity during earnings season, but we want you to have the same access to this info as professional investors and fund managers. Give us a shout out in the comments at the bottom of this article if you're loving our Broker Moves coverage!

ChartWatch

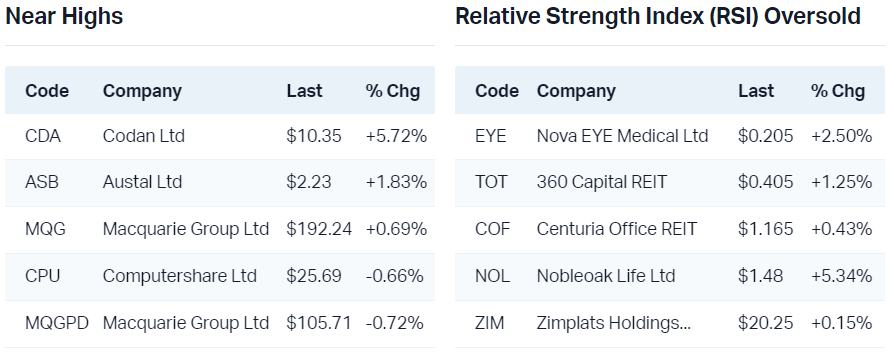

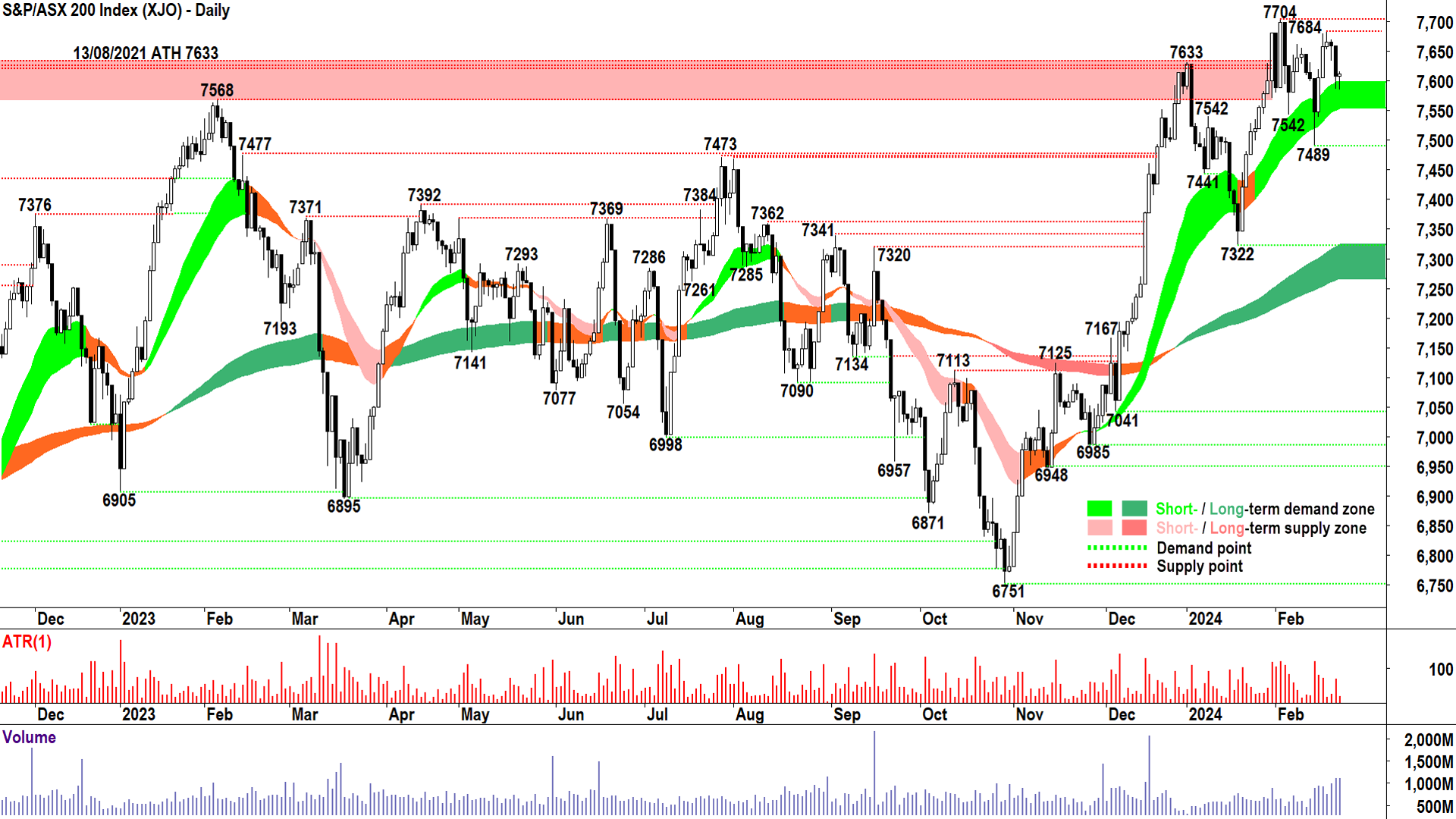

S&P/ASX 200 (XJO)

.png)

I haven't done the index for a while, so let's take a quick look! The price action is compressing near the historical all-time high of 7633, and in a range which I feel is clearly defined by 7704 to the upside and 7489 to the downside.

It's not unusual to see some trepidation around all-time highs, and so, I'm not too surprised nor too concerned about how the current price action is playing out. In 7704 and 7489 we have two clear and important delineators of the current technicals. Above 7489, the demand-side is hanging in there, and below 7704 so too is the supply-side.

I expect a close above/below either will be decisive in determining the direction of the next leg in prices. There's little to go on in the candles, which are mixed, to suggest a break either way is more likely. But, I do note both short and long term trend ribbons continue to track higher, and in the case of the short term trend ribbon, provide dynamic support to price.

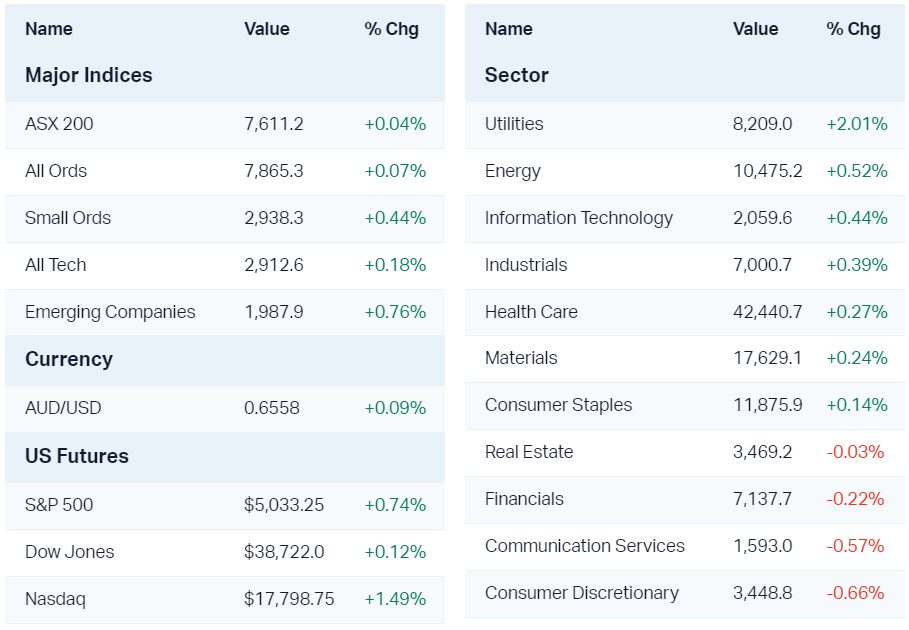

Pilbara Minerals Ltd (PLS)

.png)

Today I had the pleasure of interviewing Pilbara Minerals CEO Dale Henderson. He was both very generous with his time and with his answers. The message I got was: We can't control the lithium price, so we're going to focus on controlling what we can control. In this regard, we're going to continue to ramp up production in the most cost efficient and sustainable way we can. The market will take care of itself.

I've talked at length of the many companies which reported first half earnings today, and Pilbara was perhaps conspicuous by its absence from the major gainers/losers lists. As a technical analyst, for me, the most important aspect of today's trading was the white candle logged by the close. It represents excess demand, and when found frequently in a chart's price action, steady accumulation.

I do see some signs of accumulation in the PLS chart, but it is limited by the broader bearish price action of generally lower major peaks, and the dynamic resistance so clearly being provided by the long term downtrend ribbon. On the other hand, rising major troughs confirm there is at least some modest buy the dip activity, and the short term trend is flattening towards a possible turn higher.

So, we're very much stuck in the middle here. I'm happy to let the price action to the talking, and wait for a close above 4.01 to indicate the demand-side has regained control, or a close below 3.25 (but preferably 3.10) to indicate the supply-side has regained control.

Economy

Today

Judo Bank Flash PMIs

- "Higher new business supported the expansions in output and employment. Concurrently, inflation rose as both average input costs and output prices increased at faster rates. Overall sentiment remained positive, though the level of optimism eased to a three-month low." –Judo Bank

- AU Flash Manufacturing PMI: 47.7 in Feb vs 50.1 in Jan

- AU Flash Services PMI: 52.8 in Feb vs 49.1 in Jan

-

AU Flash Composite PMI: 51.8 in Feb vs 49.0 in Jan

10 month high

(Note: PMI readings >50 indicates expansion, vs <50 indicates contraction)

Later this week

Thursday

USA FOMC Meeting Minutes

Friday

USA Flash Manufacturing PMI: forecast 50.5 vs 50.7 previous

USA Flash Services PMI: forecast 52.1 vs 52.5 previous

Latest News

Pilbara vs Mineral Resources: Which lithium miner comes out on top?

3 brokers run the ruler on Rio Tinto's 12% profit drop and unexpectedly strong dividend

Nvidia smashes sky-high Q4 earnings expectations + Key earnings call takeaways

As Wisetech shares surge another 10%, is it worth the price?

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

Interesting Movers

Trading higher

+26.5% Brainchip Holdings (BRN) - No news, continued positive response to 16 Feb Virtual Investor Roadshow, strengthening short term uptrend

+13.7% Insignia Financial (IFL) - Half Yearly Report and Accounts

+13.0% Bega Cheese (BGA) - Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

+11.9% Power Holdings (PWH) - Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

+10.4% Lovisa Holdings (LOV) - Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

+8.4% Fletcher Building (FBU) - No news 🤔

+7.7% Domino's Pizza Enterprises (DMP) - Continued positive response to yesterday's Half Yearly Report and Accounts, several broker upgrades today (see Broker Moves)

"+6.8% APM Human Services International (APM) - Continued positive response to Monday's Response to Press Speculation (confirms that it has been in discussions with CVC Asia Pacific)"

+5.8% Service Stream (SSM) - Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

+5.7% Codan (CDA) - Continued positive response to yesterday's Half Yearly Report and Accounts, several broker price target upgrades today (see Broker Moves), rise is consistent with prevailing short and long term uptrends

+5.4% Ventia Services Group (VNT) - Continued positive response to yesterday's Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

+5.3% Weebit Nano (WBT) - No news, possibly some of BRN's enthusiasm rubbing off? 🤔

+5.3% SG Fleet Group (SGF) - Continued positive response to yesterday's Half Yearly Report and Accounts, several broker price target upgrades today (see Broker Moves), rise is consistent with prevailing short and long term uptrends

+5.2% CSR (CSR) - Response to media speculation

+4.6% Smartgroup Corporation (SIQ) - Continued positive response to yesterday's Half Yearly Report and Accounts, several broker price target upgrades today (see Broker Moves), rise is consistent with prevailing short and long term uptrends

+4.2% Healius (HLS) - Continued recovery from drop on yesterday's open due to Healius announces Trading Update for FY 2024

+4.0% Megaport (MP1) - Continued positive response to Tuesday's Half Yearly Report and Accounts, rise is consistent with prevailing short and long term uptrends

Trading lower

-20.5% MA Financial Group (MAF) - Appendix 4E and FY23 Results

-12.1% Clinuvel Pharmaceuticals (CUV) - Half Yearly Report and Accounts, fall is consistent with prevailing short and long term downtrends

-10.3% Tabcorp Holdings (TAH) - Half Yearly Report and Accounts, fall is consistent with prevailing short and long term downtrends

-8.7% Nine Entertainment Co. Holdings (NEC) - Half Yearly Report and Accounts, fall is consistent with prevailing short and long term downtrends

-6.8% Qantas Airways (QAN) - Half Yearly Report and Accounts

-6.4% Perenti (PRN) - No news, pullback after post Half Yearly Report and Accounts on Monday

-6.3% Strike Energy (STX) - Still reeling from Monday's South Erregulla Update, fall is consistent with prevailing short and long term downtrends

-6.0% Super Retail Group (SUL) - Half Yearly Report and Accounts

-5.9% Eagers Automotive (APE) - Appendix 4E and FY23 Results

-5.4% Medibank Private (MPL) - Half Yearly Report and Accounts

Broker Notes

Acrow (ACF) retained at buy at Shaw and Partners; Price Target: $1.30

Alkane Resources (ALK) retained at buy at Bell Potter; Price Target: $1.00

-

Ansell (ANN)

Retained at hold at Jefferies; Price Target: $26.00 from $27.90

Retained at negative at JP Morgan; Price Target: $26.00 from $25.00

Retained at underweight at Barrenjoey; Price Target: $22.80 from $21.50

Retained at underperform at CLSA; Price Target: $25.40 from $25.70

-

ARB Corporation (ARB)

Upgraded to accumulate from hold at Ord Minnett; Price Target: $41.00 from $36.00

Retained at overweight at Wilsons; Price Target: $45.69 from $35.30

Retained at hold at Morgans; Price Target: $38.30 from $31.15

BHP Group (BHP) retained at outperform at Macquarie; Price Target: $48.00 from $49.00

Beach Energy (BPT) retained at equalweight at Morgan Stanley; Price Target: $1.79

-

Cobram Estate Olives (CBO)

Downgraded to hold from buy at Bell Potter; Price Target: $1.80 from $1.70

Retained at buy at Shaw and Partners; Price Target: $2.05 from $1.80

-

Codan (CDA)

Retained at outperform at Macquarie; Price Target: $10.65 from $9.35

Retained at buy at Canaccord Genuity; Price Target: $10.83 from $8.17

Retained at outperform at CLSA; Price Target: $10.60 from $9.20

Retained at hold at Moelis Australia; Price Target: $10.22 from $8.52

-

Charter Hall Group (CHC)

Retained at buy at Citi; Price Target: $13.40 from $13.50

Retained at outperform at Macquarie; Price Target: $12.90 from $13.15

Retained at overweight at Morgan Stanley; Price Target: $13.25

Retained at neutral at Barrenjoey; Price Target: $12.10 from $11.85

Retained at overweight at Jarden; Price Target: $13.60 from $13.30

Retained at neutral at UBS; Price Target: $11.25

Retained at overweight at JP Morgan; Price Target: $13.50 from $14.00

Retained at underperform at CLSA; Price Target: $11.74 from $11.36

Centuria Capital Group (CNI) retained at hold at Bell Potter; Price Target: $1.70 from $1.60

Cosol (COS) downgraded at hold at Bell Potter; Price Target: $1.05 from $1.08

Clean Seas Seafood (CSS) retained at hold at Bell Potter; Price Target: $0.27 from $0.26

-

Corporate Travel Management (CTD)

Downgraded to neutral from buy at Citi; Price Target: $17.55 from $22.55

Downgraded to market-weight from overweight at Wilsons; Price Target: $15.25 from $21.31

Upgraded to underperform from sell at CLSA; Price Target: $16.25 from $17.50

Retained at outperform at RBC Capital Markets; Price Target: $20.00 from $25.00

Retained at hold at Jefferies; Price Target: $17.50 from $20.50

Retained at positive at E&P; Price Target: $19.44 from $22.41

Retained at buy at UBS; Price Target: $21.80 from $25.60

Retained at overweight at Morgan Stanley; Price Target: $19.00 from $29.00

-

Domino's Pizza Enterprises (DMP)

Upgraded to positive from neutral at E&P; Price Target: $49.70 from $48.72

Upgraded to neutral from sell at UBS; Price Target: $42.00

Upgraded to buy from hold at Jefferies; Price Target: $45.50 from $44.00

Downgraded to neutral from outperform at Macquarie; Price Target: $42.00 from $48.00

Retained at neutral at Citi; Price Target: $44.50 from $61.57

Retained at overweight at Morgan Stanley; Price Target: $68.00

Upgraded to overweight from neutral at Jarden; Price Target: $49.00 from $50.00

Emeco Holdings (EHL) retained at outperform at Macquarie; Price Target: $1.03

Fineos Corporation Holdings (FCL) retained at neutral at Goldman Sachs; Price Target: $2.20

Global Lithium Resources (GL1) retained at buy at Shaw and Partners; Price Target: $2.20 from $3.20

Helloworld Travel (HLO) retained at buy at Shaw and Partners; Price Target: $3.80 from $3.50

Healius (HLS) retained at neutral at Macquarie; Price Target: $1.40 from $1.50

-

HMC Capital (HMC)

Downgraded to hold from buy at Bell Potter; Price Target: $7.05 from $5.85

-

Hansen Technologies (HSN)

Downgraded to sector perform from outperform at RBC Capital Markets; Price Target: $5.60 from $6.50

Retained at buy at Shaw and Partners; Price Target: $6.90

Retained at buy at UBS; Price Target: $6.50 from $6.75

Retained at neutral at Goldman Sachs; Price Target: $5.20 from $5.75

Retained at overweight at Morgan Stanley; Price Target: $6.40

Hub24 (HUB) retained at underweight at JP Morgan; Price Target: $29.00

Integral Diagnostics (IDX) retained at neutral at Citi; Price Target: $2.20 from $1.95

-

Iluka Resources (ILU)

Upgraded to overweight from neutral at Barrenjoey; Price Target: $8.40 from $7.20

Retained at sell at UBS; Price Target: $6.70 from $6.40

Retained at buy at Goldman Sachs; Price Target: $9.20 from $9.80

Retained at neutral at Citi; Price Target: $7.60 from $7.50

Retained at equalweight at Morgan Stanley; Price Target: $7.15

-

IRESS (IRE)

Downgraded to neutral from outperform at Macquarie; Price Target: $8.55 from $8.35

Retained at buy at Shaw and Partners; Price Target: $8.30 from $7.70

Mineral Resources (MIN) retained at buy at Citi; Price Target: $71.00

-

McMillan Shakespeare (MMS)

Upgraded to accumulate from hold at Ord Minnett; Price Target: $21.10 from $20.50

Retained at buy at CLSA; Price Target: $22.30 from $19.35

-

National Australia Bank (NAB)

Downgraded to neutral from buy at BofA; Price Target: $33.50 from $31.50

Retained at sell at UBS; Price Target: $26.00

Retained at buy at Goldman Sachs; Price Target: $33.73 from $31.17

Retained at equalweight at Morgan Stanley; Price Target: $30.30

Retained at overweight at Jarden; Price Target: $31.80 from $31.50

-

National Storage REIT (NSR)

Retained at buy at Citi; Price Target: $2.60

Retained at neutral at Macquarie; Price Target: $2.34 from $2.31

Retained at underweight at Morgan Stanley; Price Target: $2.30

Orora (ORA) retained at buy at Goldman Sachs; Price Target: $3.40 from $3.50

-

Orica (ORI)

Retained at buy at UBS; Price Target: $19.50 from $19.40

Retained at outperform at Macquarie; Price Target: $18.82 from $19.00

Retained at buy at Jarden; Price Target: $17.75 from $16.85

Retained at overweight at Morgan Stanley; Price Target: $19.00

Retained at overweight at Barrenjoey; Price Target: $18.00 from $17.80

Retained at outperform at UBS; Price Target: $18.82 from $19.00

Retained at outperform at RBC Capital Markets; Price Target: $21.50 from $22.00

-

Propel Funeral Partners (PFP)

Retained at buy at Bell Potter; Price Target: $6.10 from $6.20

Retained at outperform at Macquarie; Price Target: $6.06

Retained at overweight at Morgan Stanley; Price Target: $6.30

-

PSC Insurance Group (PSI)

Retained at buy at UBS; Price Target: $5.40

Retained at overweight at Morgan Stanley; Price Target: $5.85

Peter Warren Automotive Holdings (PWR) retained at overweight at Morgan Stanley; Price Target: $3.40

Retail Food Group (RFG) retained at buy at Bell Potter; Price Target: $0.13

-

Rio Tinto (RIO)

Retained at neutral at UBS; Price Target: $125.00

Retained at buy at Goldman Sachs; Price Target: $138.30 from $140.50

Retained at buy at Citi; Price Target: $139.00

Retained at neutral at Macquarie; Price Target: $120.00

Retained at overweight at Morgan Stanley; Price Target: $144.50

South32 (S32) retained at buy at UBS; Price Target: $3.75

St Barbara (SBM) retained at neutral at Macquarie; Price Target: $0.17 from $0.19

-

Scentre Group (SCG)

Upgraded to neutral from underperform at Macquarie; Price Target: $3.03 from $2.72

Retained at neutral at Citi; Price Target: $3.10 from $2.95

Retained at overweight at Morgan Stanley; Price Target: $3.30

Retained at buy at Jarden; Price Target: $3.50

Seek (SEK) retained at overweight at Morgan Stanley; Price Target: $31.00 from $28.00

SG Fleet Group (SGF) retained at buy at Canaccord Genuity; Price Target: $3.58 from $3.43

Sims (SGM) upgraded to neutral from sell at Citi; Price Target: $13.50 from $14.30

-

Stockland (SGP)

Retained at overweight at Morgan Stanley; Price Target: $5.10 from $4.70

Retained at overweight at Jarden; Price Target: $5.05 from $4.90

Retained at neutral at UBS; Price Target: $4.64 from $4.52

Retained at underweight at JP Morgan; Price Target: $4.50

Retained at overweight at Barrenjoey; Price Target: $4.55 from $4.50

-

Smartgroup Corporation (SIQ)

Downgraded to neutral from outperform at Macquarie; Price Target: $9.51 from $9.47

Retained at equalweight at Morgan Stanley; Price Target: $9.10

-

Santos (STO)

Retained at buy at UBS; Price Target: $9.00 from $9.15

Retained at buy at Goldman Sachs; Price Target: $8.35

Retained at outperform at Macquarie; Price Target: $9.05 from $9.95

Retained at equalweight at Morgan Stanley; Price Target: $7.77 from $7.71

Retained at overweight at Jarden; Price Target: $8.00 from $8.05

-

The Lottery Corporation (TLC)

Retained at overweight at Barrenjoey; Price Target: $6.00 from $5.50

Downgraded to neutral from overweight at JP Morgan; Price Target: $5.15 from $5.05

Downgraded to neutral from buy at Citi; Price Target: $5.50 from $5.60

Retained at outperform at CLSA; Price Target: $5.60 from $5.00

Retained at neutral at Macquarie; Price Target: $5.25 from $5.05

Retained at buy at UBS; Price Target: $5.75 from $5.70

Downgraded to hold from add at Morgans; Price Target: $5.40

Upgraded to positive from neutral at E&P; Price Target: $6.00

Retained at equalweight at Morgan Stanley; Price Target: $5.35

-

Viva Energy Group (VEA)

Retained at buy at UBS; Price Target: $3.75 from $3.50

Retained at neutral at Goldman Sachs; Price Target: $3.43 from $3.40

Retained at outperform at Macquarie; Price Target: $4.50

Retained at equalweight at Morgan Stanley; Price Target: $3.34

Ventia Services Group (VNT) retained at outperform at Macquarie; Price Target: $3.75 from $3.30

-

Woolworths Group (WOW)

Downgraded to neutral from buy at UBS; Price Target: $36.00 from $40.50

Downgraded to hold from add at Morgans; Price Target: $34.70 from $39.45

Retained at buy at Goldman Sachs; Price Target: $40.40 from $42.30

Retained at buy at Citi; Price Target: $39.00 from $42.00

Retained at neutral at Macquarie; Price Target: $36.00 from $37.00

Retained at underweight at Morgan Stanley; Price Target: $32.00 from $34.00

Retained at overweight at Jarden; Price Target: $40.40 from $42.90

Retained at hold at Jefferies; Price Target: $35.00 from $38.00

Retained at neutral at JP Morgan; Price Target: $34.80 from $37.50

-

WiseTech Global (WTC)

Downgraded to neutral from overweight at JPMorgan; Price Target: $82.00 from $80.00

Downgraded to neutral from positive at E&P; Price Target: $85.49 from $82.63

Retained at sector perform at RBC Capital Markets; Price Target: $90.00 from $75.00

Retained at overweight at Barrenjoey; Price Target: $96.00 from $78.00

Retained at hold at Jefferies; Price Target: $84.34 from $72.87

Retained at hold at Bell Potter; Price Target: $92.75 from $72.75

Retained at buy at UBS; Price Target: $102.00 from $79.50

Retained at neutral at Goldman Sachs; Price Target: $85.00 from $80.00

Retained at neutral at Macquarie; Price Target: $81.90 from $58.00

Retained at overweight at Morgan Stanley; Price Target: $85.00

Retained at neutral at Jarden; Price Target: $79.00 from $68.00

Scans

This article first appeared on Market Index on Thursday 22 February.

5 topics

10 stocks mentioned