ASX 200 flat, S&P 500 falls as Apple drags, US dollar extends gains on jobs data

ASX 200 futures are trading 7 points higher, up 0.09% as of 8:20 am AEST.

S&P 500 SESSION CHART

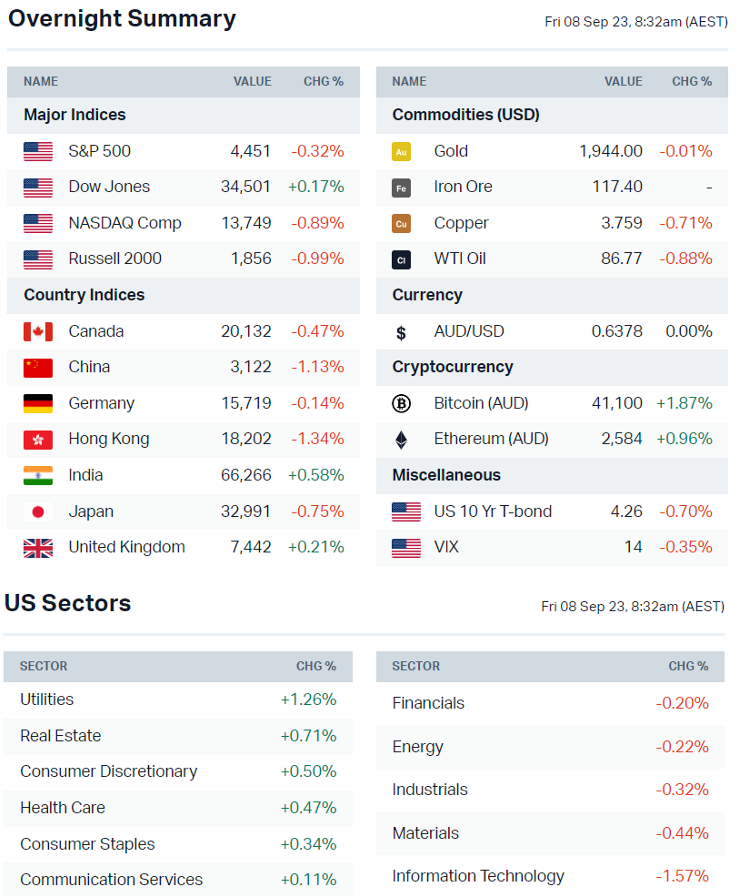

MARKETS

- S&P 500 logged its third straight decline but closed off session lows of -0.78%

- Megacap tech stocks led to the downside – Apple (-2.9%) and Nvidia (-1.7%

- Oversold Defensives such as Utilities, Real Estate and Healthcare offset some of the benchmark declines

- Market remains in a risk-off mood, weighed by reports that China is banning government officials from using iPhones

- Additional bearish focus points include renewed upward pressure on rates, geopolitical tensions and the spike in oil prices

- Apple’s 2-day slide nears US$200bn on China iPhone curbs (Bloomberg)

- Chinese rare earth prices jump to 20-month high as mining suspension in major producer Myanmar sparks stockpiling ahead of peak consumption season (Reuters)

- US dollar set for longest rally in 9 years as US defies global gloom (Bloomberg)

- Traders bet Wall Street’s fear gauge is due for 1,100% jump (Bloomberg)

STOCKS

- Walmart standardises pay for entry-level store workers to reduce costs (Reuters)

- Ford gives raise to 8,000 UAW workers ahead of strike deadline (Bloomberg)

- GM offers 16% pay hike ahead of strike deadline, rejected by UAW (Bloomberg)

- Tesla to install 2,000 charging stations at 2,000 Hiltons in North America (CNBC)

- Qualcomm tumbles after China woes hit Apple (Bloomberg)

- C3 AI guides for wider-than-expected loss, says profitability will take longer than expected, shares down 12% (Bloomberg)

CENTRAL BANKS

- Chicago Fed says rate hikes over past 18 months may be enough to return inflation to 2% target without a recession (Bloomberg)

CHINA

- China seeks to broaden iPhone ban to state firms (Bloomberg)

- China's share of US imports falls to lowest since 2006 (Bloomberg)

ECONOMY

- US initial jobless claims fall to lowest level since Feb, below economist expectations while productivity strongest in years (Reuters)

- US crude stocks fall for fourth straight week, inventories down 6% (Reuters)

- China exports and imports contact at a slower pace, Yuan hits 16-year low (FT)

Charts of the Week

Chris is away this week so I'll be taking care of Charts of the Week. As always, they are for illustrative and educational purposes only. Always do your own research.

Before we dive in: It's been a relatively heavy week for markets. We're on the backfoot again amid the resurgence in bond yields and oil prices as well as rising geopolitical tensions and trade disputes (aka China and iPhones). The rise in volatility and distribution makes it a rather difficult playing field for traders. You'll have charts that would have moved out last week or early this week, only to whipsaw back. Here are a few examples using last week's charts:

Emerald Resources (ASX: EMR) pushed out last Friday, up as much as 10.5% by Tuesday. The emerging gold name is now starting to struggle against the backdrop of a strong US dollar.

Stanmore (ASX: SMR) is another name that pushed out last Friday, up around 7-8% by Wednesday. But pulled back sharply on Thursday, in-line with the broad-based weakness across the Resource sector.

Trading breakouts and trending charts in choppy market's can be incredibly frustrating. The questions you need answers for aren't easy.

- Do I take a small profit or move my stop loss to breakeven?

- The chart looked really good so should I relax the stop (even if the broader market is deteriorating)?

- Should I stop trading when the market begins to turn like this?

Taking into consideration the choppy state of markets, there aren't too many charts that are easy on the eyes. So here's one of the more interesting ones.

Dalrymple Bay Infrastructure (ASX: DBI): A defensive infrastructure name that's been consolidating for around six months and trying to break the $2.80 level.

The only thing I'd note here is that being a larger defensive name, a potential breakout might not come with as much ferocity as other stocks.

China's Apple Ban

Apple has lost almost $200bn in market cap in just two days after China began targeting iPhone usage. The ban was initially for government officials but they're now planning to expand that to government-backed agencies and companies.

According to the Chinese government, there are approximately 10 million civil servants (those that work in government agencies and departments).

However, in 2021 there were approximately 56 million people working for state-owned enterprises (companies owned by the government).

For perspective, the UK has a population of around 68 million. Image potentially losing a market the size of the UK overnight (if not more).

KEY EVENTS

ASX corporate actions occurring today:

Trading ex-div: Nine Entertainment (NEC) – $0.05

- See full list of ASX stocks and ETFs trading ex-dividend here

- Dividends paid: JB Hi-Fi (JBH) – $1.15, Probiotec (PBP) – $0.035, Baby Bunting (BBN) – $0.048

- Listing: None

Economic calendar (AEST):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

3 stocks mentioned

1 contributor mentioned