ASX 200 futures flat, renewed AI hype pushes S&P 500 higher + Has China stabilised?

ASX 200 futures are trading 4 points higher, up 0.05% as of 8:00 am AEST.

S&P 500 SESSION CHART

MARKETS

- S&P 500 extends gains for a fourth straight session, led by big tech

- Rate reprieve has been a major driver of recent gains, with the US 2-year yield down 22 bps since Monday, 28 August

- Additional bullish drivers include: Renewed AI hype, pickup in M&A and further stimulus measures out of China

- Latest Investors Intelligence report notes percentage of bulls slipping to 43.1% from 44.3%, the lowest since March 2023 – Reset in sentiment and positioning indicators flagged as supportive of a recent market bounce

- Aluminium price slump 'nearing a bottom' as clean energy demand rises (FT)

- Defaults of risky high-yield corporate debt are rising at the fastest pace since the pandemic (Business Insider)

STOCKS

- Apple sends invites for Sep 12 launch event, new iPhone 15 expected (CNBC)

- OpenAI passes $1bn revenue pace (The Information)

- HP tumbles most in three years on tepid PC demand (Bloomberg)

- Mastercard, Visa plan to add new card fees in coming months (Bloomberg)

CENTRAL BANKS

- Markets raise bets on Eurozone rate hike after German inflation data (Bloomberg)

- BOJ policymaker signals chance of policy tweak early next year (Reuters)

- BoE is facing major losses on its bond purchases (CNBC)

- Australia inflation cools, boosting RBA case to extend rate pause (Bloomberg)

CHINA

- Goldman Sachs' note on China: “Our data show signs of capitulatory selling during the first 3 weeks of August ... We are starting to see some institutions use recent weakness as a buying opportunity. I am watching for the group to stabilize and inflect higher."

ECONOMY

- US jobs data approaching pre-covid levels in July, fueling soft-landing hopes (Reuters)

- Spanish inflation accelerates in August, hits highest annual pace since May (Bloomberg)

- Germany inflation eases less-than-expected in August (Reuters)

- EU car sales jump 17% on EV demand (Bloomberg)

-

Australia inflation declined in July, but rent and power prices higher (Bloomberg)

Sectors to Watch

Our Overnight ETFs exhibited weakness across most resource-related sectors (less energy and agriculture) and the outperformance of tech-related ones.

Correlation Does Not Equal Causation (Or Does It?)

There's a saying in financial markets that correlation does not always equal causation. That is, one data point or factor may look like it is linked to another data point or insight. But this is not always the case.

Or is it?

In another edition of Hans' Charts, I'm taking a look at two charts which suggest the market consensus may be left Waiting for Godot. In this case, the Godot's (or the things that never turn up) in question are the US-led recession and b) winning the battle over inflation.

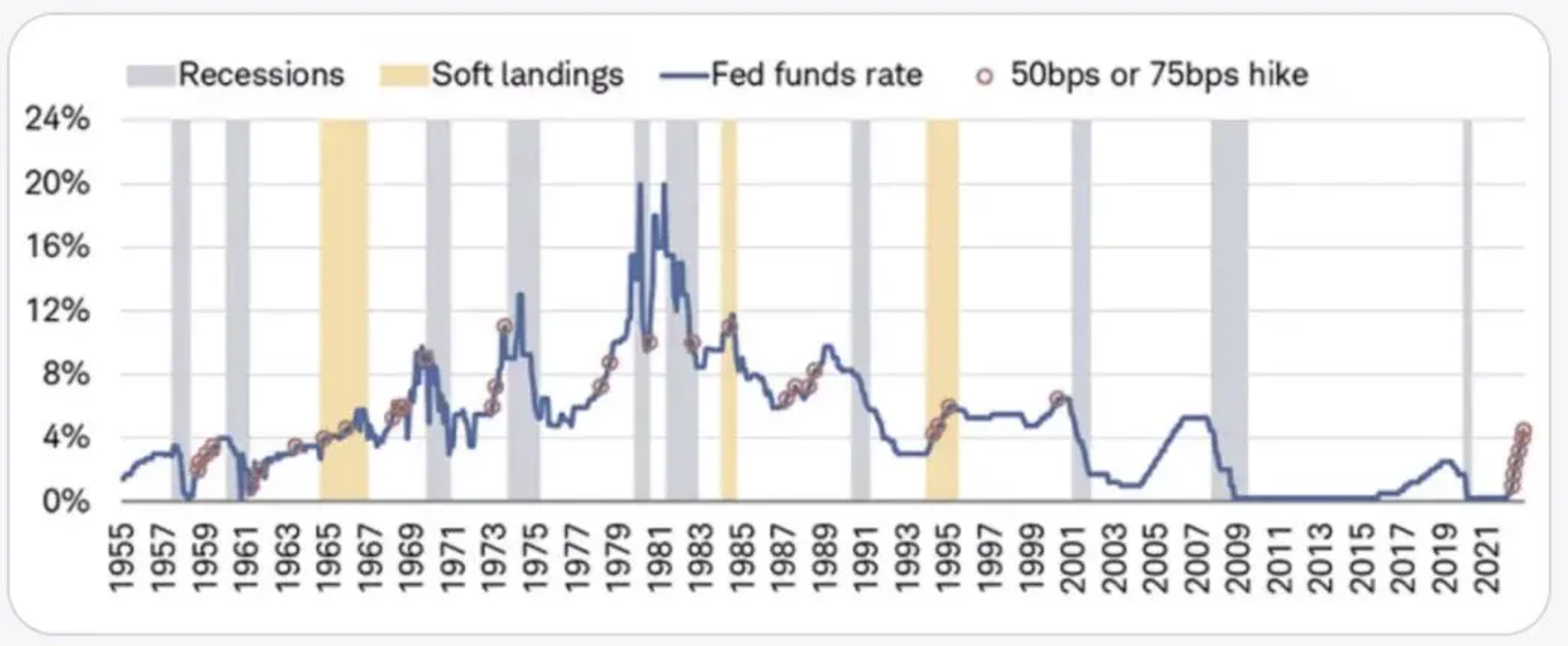

In the case of Chart A, JPMorgan recently published this chart about the incidence of soft landings vs recessions. As you can see, the Federal Reserve achieved a soft landing (at least by JPM's definition) three times in the last 60 years despite raising rates by well over 2% in each cycle. Not only that, the economy continued to expand even in the face of such rate hikes!

How is this possible? Two additional factors were there in the 1960s, 1984, and the early 1990s:

Easing began within six months of the last rate hike

The Federal Reserve was acting proactively to inflation in each case - and just as crucially, it did not hike too far.

That last point is important because the Fed did not hike this cycle until headline inflation hit 8.5% - four times the central bank's own target. In essence, it's been acting retroactively to inflation rather than proactively. Easing, and the timing of it, is a whole other question and a whole other kettle of fish. US rates pricing currently suggests the first meaningful chance of a hike won't come until May 2024 ... which is not six months from now!

In the case of Chart B, we're using the job openings data from the US which was released yesterday. To cut a long story short, the figure was a huge miss on analyst expectations and traders took it as reason to believe the labour market is finally loosening in the US. A looser labour market means the Fed will be more empowered not to hike rates which meant asset prices soared.

But the Fed's number one fight is still inflation and as this chart from Andreas Steno Larsen shows, you won't get core inflation down meaningfully until job openings also come down meaningfully. As his analysis shows, the ratio needed is 1:1 between job openings and the number of people unemployed. Conclusion? This battle is not over yet.

KEY EVENTS

ASX corporate actions occurring today:

Trading ex-div: Treasury Wine Estates (TWE) – $0.17, Tabcorp (TAH) – $0.01, Whitehaven Coal (WHC) – $0.42, Platinum Asset Management (PTM) – $0.07, Woolworths (WOW) – $0.58, Woodside Energy (WDS) – $1.25, REA Group (REA) – $0.83

- See full list of ex-ASX 200 stocks trading ex-dividend here

- Dividends paid: Lots of companies paying out dividends – Full list here

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Housing Credit

- 11:30 am: NBS Manufacturing PMI

- 7:00 pm: Eurozone Inflation

- 10:00 pm: India GDP Growth

- 10:30 pm: US Personal Consumption Index

2 topics

2 contributors mentioned