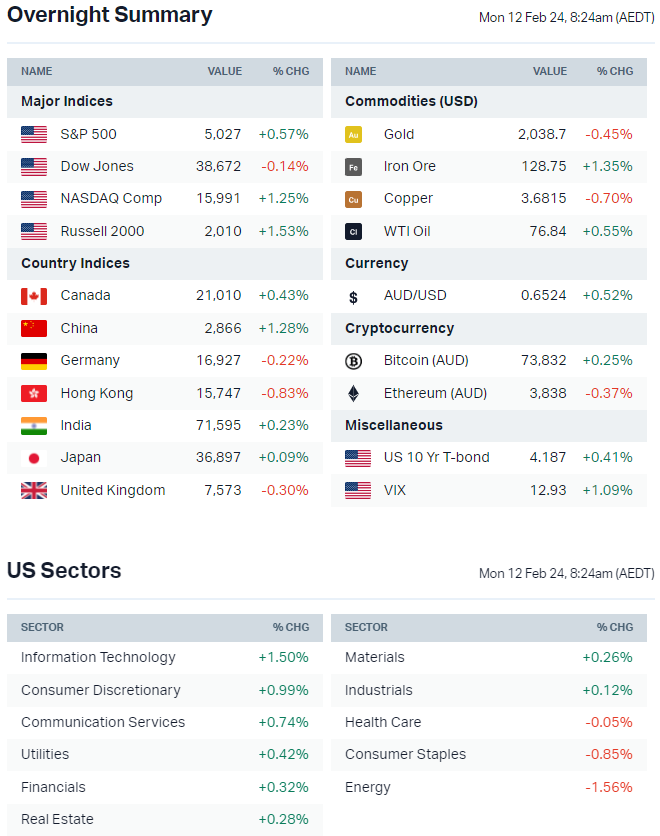

ASX 200 futures flat, S&P 500 closes above 5,000 for first time + Seek, JB Hi-Fi results

ASX 200 futures are trading flat as of 8:20 am AEDT.

S&P 500 SESSION CHART

ASX TODAY

- ASX 200 futures point towards another flattish open

- Stocks due to report on Monday include: Audinate, Aurizon, Beach Energy, Breville, Car Group, Challenger and JB Hi-Fi

- Breville consensus for 1H24 earnings include $944m revenue and $85.5m NPAT

- JBH consensus for 1H24 earnings include $5.15bn revenue and $246.3m NPAT

- Seek consensus for 1H24 earnings include $615m revenue and $121.5m NPAT (cont ops)

- Boral smashed earnings expectations last Friday, analysts from Jarden and CSLA have mixed ratings but upgrade the share price to $5.80 and $6.40 respectively

- Liontown Resources rallied 10.4% last Friday after minimum bid requirements expired in regards to Rinehart's acquisition of a 19.9% stake (The Australian)

- Myer looking to sell Sass & Bide, Marcs and David Lawrence (AFR)

- Carlyle, Hibiscus Petroleum and Jadestone Energy are the final contenders to acquire Woodside’s Macedon oil and gas assets, valued at around $500m (The Australian)

MARKETS

- S&P 500 higher, finished at best levels and closed above the 5000 for the first time in history

- S&P 500 and Nasdaq both higher last week, up for a 14th week in the past 15

- Russell 2000 outperformed but remains a big year-to-date laggard

- Oil staging a comeback after logging a five-day win streak, up 5.9%

- Bullish focus points for the week – Resilient US growth backdrop with Atlanta Fed GDPNow estimate for 1Q24 at 3.4%, AI proliferation, restructuring and cost cutting announcements attracting a positive view for margins and renewed China bounce

- Bearish focus points for the week – Yields continue to grind higher, Fedspeak continues to tilt towards hawkish, market breadth concerns, regional banks under pressure and China deflation

- S&P 500's forward PE ratio looking lofty, raising doubts over the market rally (Reuters)

- Historical trends suggest S&P could see double-digit returns (FT)

- Global buybacks rebounding amid improving profit growth (Bloomberg)

- Record cash piles at big tech firms paves way for capital return (Bloomberg)

EARNINGS

S&P 500 Q4 EPS growth currently sits at 2.9% compared to the 1.5% expected at the beginning of earnings season. Here are some aggregated numbers for the 67% of S&P 500 companies that have reported:

- 75% have beaten consensus EPS expectations, below the five-year average of 77%

- 65% have beaten consensus revenue expectations, below the five-year average of 68%

- Earnings beats are 3.8% above expectations, below the five-year average of 8.5%

- Revenue beats are 1.2% above expectations, below the five-year average of 2.0%

CENTRAL BANKS

- Fed still set to cut rates this year despite strong labor market, immigration-led GDP tailwind (FT)

- ECB's Kazaks says hopes for cuts at one of the next two meetings might be too aggressive (Bloomberg)

- ECB's Villeroy says will likely lower interest rates in 2024 as the pace of price increases eases toward 2% by next year (Bloomberg)

- BoE's Haskel wants more evidence of waning inflation before voting for a cut (Reuters)

- RBA Governor Bullock not ruling out more hikes, but leaves door open to cut (Reuters)

GEOPOLITICS

- Biden eyes ban on Chinese smart cars, citing data security fears (Bloomberg)

- Biden seeks to crack down on Iranian crude without disrupting global markets (Bloomberg)

- US lawmakers urge commerce department to add Tiktok owner ByteDance to an export control list (Reuters)

CHINA

- China's real estate crisis starts to ripple across the world (Bloomberg)

- China equity flows turn positive but likely driven by state-backed offshore arms (FT)

- China unleashes loan flood to rescue sputtering economy, January sees record high borrowing (Reuters)

Sectors to Watch

The overnight session was rather uneventful in terms of its impact on the ASX.

Buy now, pay later: The BNPL sector has been on a tear in recent months but the US-listed Affirm hit a wall last Friday. The company's quarterly reported topped revenue and earnings expectations though transaction costs were higher-than-expected. Analysts were cautious on the guidance (which was also a beat). The stock finished the session down 10.9%. Block also down 2.8%. Could this see some negative flow for names like Zip (ASX: ZIP) and Humm (ASX: HUM)?

Tech: Tech was the best performing sector on Wall Street thanks to gains from Nvidia (+3.6%), Amazon (+2.7%) and Alphabet (+2.0%). Local names are starting to push out, including:

- Wisetech (ASX: WTC) – Near 6-month high

- Altium (ASX: ALU) – Near all-time highs

- Life360 (ASX: 360) – Near 3-month high

Resources: Pretty heavy session for resource-related ETFs, notably Uranium (-0.77%), Gold Miners (-1.2%) and Copper Miners (-1.2%). SPDR Energy and Materials also down -1.5% and -0.1% respectively.

Why We're Far From a Bubble

"At this point, valuations at the top are no where near as frothy as they were at the height of the Dot Com Bubble. The 5 largest stocks traded at 43x Fwd PE in March ‘00, a 59% premium to the Mag 7’s current multiple of 27x," says Goldman Sachs.

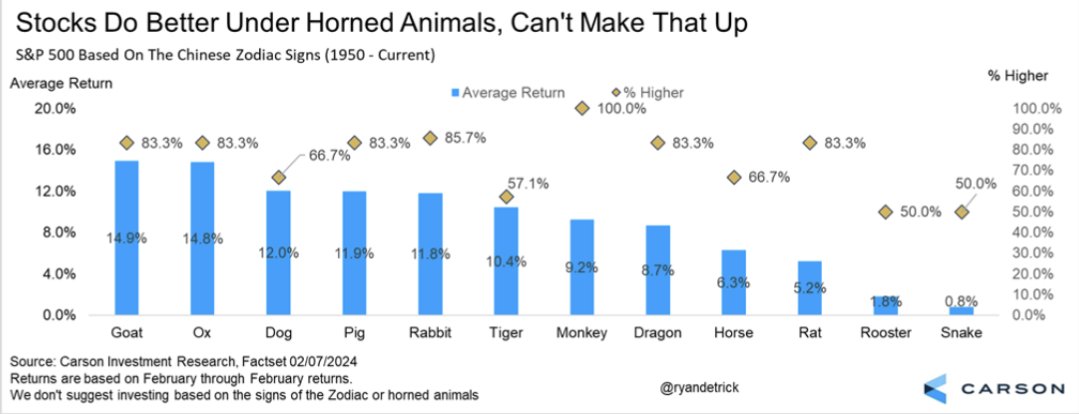

Happy Lunar New Year!

Carson Investment Group has charted the average annual S&P 500 return based on The Chinese Zodiac Signs. Dragons appear to have relatively average returns but higher 83.3% of the time! I'll try run the numbers for the ASX today.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Bailador Technology Investments (BTI) – $0.035

- Dividends paid: None

- Listing: None

Economic calendar (AEDT):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

5 stocks mentioned

1 contributor mentioned