ASX 200 higher, Westpac tops expectations, Lendlease downgrades full-year view

All the important stuff that happened on the Australian stock market today, all in one place.

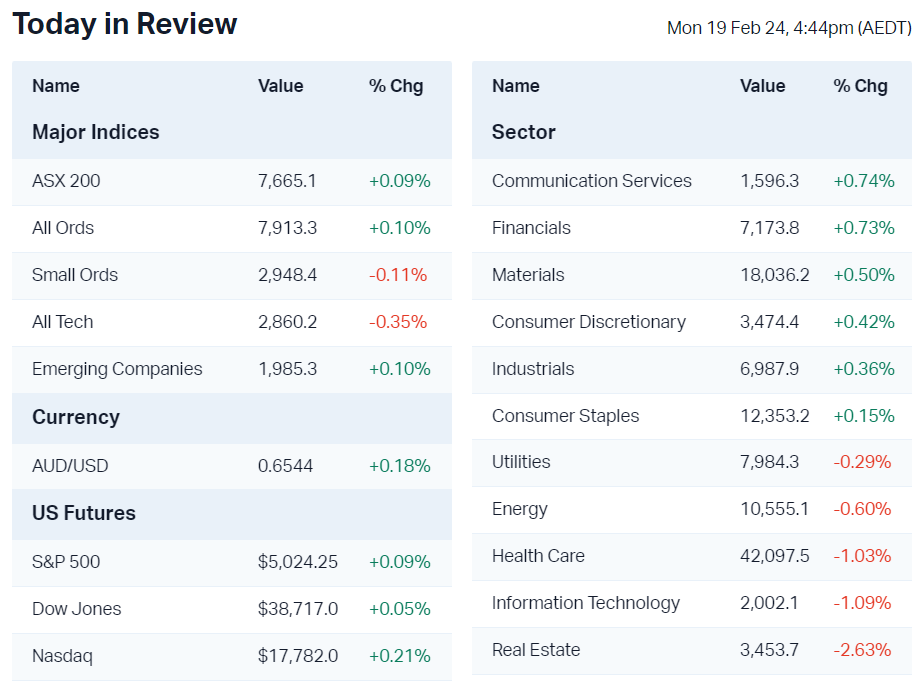

The S&P/ASX 200 finished higher for a third-straight session, up 0.09% to 7,665 points.

Markets

- ASX 200 finished slightly higher amid a pretty tight and rangebound session

- ASX 200 on a three-day win streak, up 1.56% and within 0.5% of 2 Feb all-time high

- Telcos and Financials pulled the market higher, led by a bounce for Telstra (+1.0%) and Westpac's (+2.7%) better-than-expected first quarter results

- Real Estate stocks eased, with Goodman Group (-1.9%) pulling back from all-time highs

- Tech stocks underperformed after a weak lead from Wall Street, led by decliners Xero (-2.5%), Wisetech (-1.6%) and Technology One (-1.3%)

- Resource stocks were rather volatile after China's market resumed trade after a week-long Lunar New Year holiday.

- Chinese lithium carbonate futures eased 1.5% to 95,650 yuan a tonne while iron ore futures are down around 0.4%

- ASX 200 would have finished lower without the support of Westpac's first quarter result (and follow through strength for the rest of the banks). The market is still working its way through a relatively choppy period where the path of least resistance calls for more sideways action. Stocks appear to have come to terms with the recent string of hotter-than-expected US inflation data. But overbought conditions and stretched sentiment continue to threaten a pullback

Earnings

Plenty of results today. Here are the highlights from the ones I found to be pretty interesting.

- Imdex (+17.5%) – Sizeable first-half net profit beat of $32.8 million versus $24.9 million consensus. Imdex provides drilling and geo-analytics software services to the resources sector. Management said they expect demand to be steady in the second-half.

- A2 Milk (+12.5%) – Beat pretty much all metrics, first-half net profit of NZ$85.3 million was well-above NZ$71.6 million consensus, driven by higher sales and margins. Market share in the China MBS channel grew to 3.5% from 3.4% despite significant store closures. Medium term revenue goal of $2 billion pushed out from FY26 to FY27 or later. FY24 guidance upgraded from low single digit to low-to-mid single digit revenue growth

- Bendigo Bank (-1.7%) – Missed most key earnings metrics, first-half net profit of $268.2 million fell short of $265.5 million consensus. All-important net interest margins came in at 1.83% versus Citi estimates of 1.88%. Dividend and CET1 ratios also missed. The stock managed to recover from session lows of -4.4%

- Lendlease (-13.9%) – This marks the largest intraday drop since mid-March 2020. Core operating profit after tax fell 42% to $61 million (also 70% below consensus expectations). Full-year return on equity guidance downgraded to 7% from prior 8-10% range. Earnings call noted a more than 50% drop in transactional activity due to low capital markets, impacting RoE guidance.

Economy

No major economic announcements. It's a relatively quiet week on the data and central bank front.

Interesting Movers

Trading higher

- +50.0% APM Human Services (APM) – Rejects takeover bid

- +43.2% 29Metals (29M) – Bounce after down 22.9% in last three

- +16.95% Imdex (IMD) – First-half results

- +11.7% A2 Milk (A2M) – First-half results

- +7.9% Genworth Mortgage Insurance (GWA) – First-half results

- +6.8% Calidus (CAI) – Maiden Bulletin indicated resource

- +4.4% Boral (BLD) – Seven takeover offer

- +4.0% Neuren Pharma (NEU) – Response to short seller report (Friday)

Trading lower

- -14.8% Lendlease (LLC) – Half-year results

- -11.1% Nuix (NXL) – First-half results, secures $30m debt facility

- -10.3% Starpharma (SPL) – FDA requires additional data for VivaGel BV

- -7.8% New Hope (NHC) – First-half results, reaffirms FY guidance

- -7.1% Orora (ORA) – First-half result

- -5.6% Inghams (ING) – Continuation selloff

- -3.8% Block (SQ2) – Regulators investigating whistleblower allegations

Broker Notes

Here are some of the interest broker notes/commentary for recent results.

Citi's take on Westpac (ASX: WBC):

- Neutral with $22.25 target price

- "In its 1Q24 update, WBC has disclosed an unaudited net profit ex. notable items of ~$1.8bn, >5% better than consensus estimates (~$1.6bn)."

- "Investors should also be pleased with the core NIM at 1.80%, down only 1bpt as mortgage pricing headwinds ease."

- "WBC’s 1Q24 CET 1 of ~12.3% was ~25bpts better than Citi’s expectations (12.06%), driven by an unexpected fall in both credit and IRRBB RWAs."

Citi's take on QBE (ASX: QBE):

- Buy with $18.00 target price

- "While we still believe QBE should be performing better than it is, at this stage of the strongest insurance market for at least 20 years, there is evidence of lower risk and underlying improvement."

- "While we still remain sceptical of its ability to turn around the troublesome US business and it flags likely deterioration in International in FY24, in our view, its relatively inexpensive multiple sees it remain attractive."

Macquarie's take on Inghams (ASX: ING):

- Outperform with $4.20 target price

- "ING delivered a 1H24 in-line with prior guidance, with pricing growth achieved in both Aus (+8.4%) and NZ (+9.4%) as it managed to pass through input cost pressures faced over the half."

- Management flagged a shift toward in-home consumption, with restaurant volumes (down 3,100 tonnes on the prior corresponding period)

- "With further cost efficiency programs to be delivered in the coming periods, and relatively stable top-line growth, we see upside risks to margins in the medium term."

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Kerry is a Content Strategist at Market Index. He writes the daily Morning Wrap and Weekend Newsletter. Kerry is passionate about trading and the catalysts that influence the market. His content focuses on highlighting the key data and insights that matter most to investors.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

3 stocks mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

Investing for the biggest market shift since the GFC

Livewire Markets

Equities

Why ex-20 is the prime hunting ground for ASX returns

Livewire Markets