ASX 200 in sight of record on cooler inflation, investors play defence as staples and healthcare stocks lead

Today in Review

Markets

%20Intraday%20Chart%2027%20Mar%202024.png)

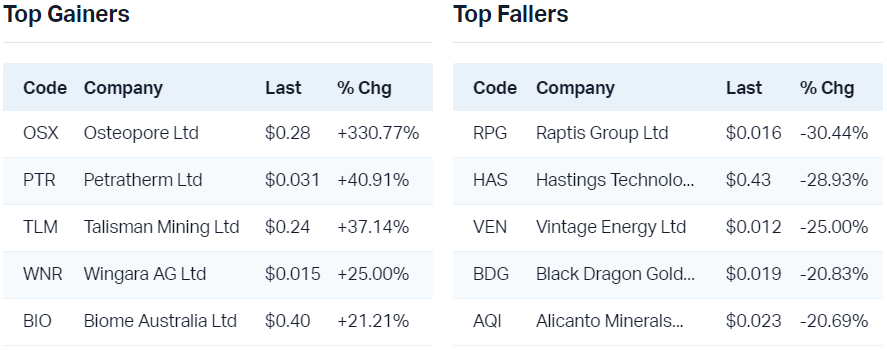

The S&P/ASX 200 (XJO) finished 39.4 points higher at 7,819.6, 0.62% from its session low smack-bang on its session high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 161 to 113.

The Consumer Staples (XSJ) (+1.4%) sector was the best performing sector today on the back of solid gains in sector leaders Woolworths Group (WOW) (+1.9%) and Coles Group (COL) (+1.6%), while animal feed and nutrition solutions company Ridley Corporation Ltd (RIC) (+4.2%) and almond grower Select Harvests Ltd (SHV) (+3.8%) topped the sector gainers list.

Also doing well today was the other key defensive sector, Health Care (XHJ), which gained +1.3%. The bulk of the sectors gains came from sector heavyweight CSL (CSL) (+1.4%), but there were several commendable performances including Resmed (RMD) (+2.0%), Ramsay Healthcare (RHC), and Pro Medicus (PME) (+1.9%).

Doing it tough for the second day today was the Information Technology (XIJ) (-0.5%) sector. They've largely followed US tech stocks for a second session.

ChartWatch

CSL (ASX: CSL)

.png)

In ChartWatch in Friday's Evening Wrap, I covered Ramsay Healthcare (RHC). Since, I've noted the Healthcare sector featuring highly on the daily sector performance tables. With this in mind, I thought I'd cover another two very popular Aussie healthcare stocks, sector leader CSL (CSL), and Resmed (RMD).

CSL has a habit of disappointing investors, then climbing back up that wall of disappointment. It appears to be on the way to doing that again after holding February's post-sell off trough, and respecting the long term uptrend ribbon.

That ribbon typically acts as a zone of dynamic support in long term uptrends, and it appears to be doing this job well over the past couple of months. As long as this remains the case, CSL's long term uptrend is intact.

It makes sense then, that a close below historical demand at 275 would likely confirm supply-side control and set the CSL price up for a deeper retracement of the October to February rally.

Candles, which are predominantly demand-side, are supportive as they indicate accumulation, but I'd like to see a return to rising peaks and rising troughs as soon as possible. A close above historical supply at 287.77 would also be a major step in the right direction in terms of confirming a return to demand-side control.

Resmed Inc (ASX: RMD)

.png)

Resmed has had its own share of shareholder disappointments, the massive plunge in August last year being the most recent. After a continued plunge, and multi-month basing pattern, it has been a steady increase since the October low.

Importantly, the RMD price has reclaimed the long term trend ribbon, which itself has transitioned to neutral, and through February’s pullback, still managed to offer dynamic support.

The price action has swung back to rising peaks and rising troughs, and the candles are generally trending towards a greater proportion of demand-side examples. It could be better though – and I suggest the almighty $30 major historical supply point is impeding more bullish candles and price action.

It makes sense that if the RMD price can close above this point, and therefore dispense with the supply there, it should spell an easier run on an ex-post basis. Historical supply at 31.70 would likely then feature in upside calculations in this scenario.

Looking down, 28.67 is the key point of demand. As long as the RMD price remains above this, and also preferably the dynamic support of the short term uptrend ribbon, the short term uptrend remains intact.

Economy

Today

-

AUS Consumer Price Index February (CPI)

+3.4% p.a. vs +3.5% p.a. forecast and +3.4% p.a. in January

Underlying inflation, i.e., excluding volatile items of fruit and vegetables, automotive fuel, and holiday travel was 3.9% p.a. vs 4.1% p.a. in January

Rising: Housing (+4.6%), Food and non-alcoholic beverages (+3.6%), Alcohol and tobacco (+6.1%) and Insurance and financial services (+8.4%)

Falling: Meat and seafood (-2.0%), Fruit and vegetables (-0.5%), Holiday travel and accommodation (-1.3%)

The headline result is slightly better than expected, but greater level of underlying inflation is partly due cheaper fruit and vegetables, and rolling off of holiday inflation post-Taylor Swift Effect

Later this week

Wednesday

01:00 USA Conference Board Consumer Confidence March (106.9 forecast vs +106.7 February)

Thursday

11:30 AUS Retail Sales February (+0.4% forecast vs +1.1% January)

Friday

All day AUS Good Friday Holiday

23:30 USA Core PCE Price Index February (+0.3% forecast vs +0.4% January)

Saturday

02:30 USA Federal Reserve Chairman Powell speech at Monetary Policy Conference, in San Francisco

Latest News

Inside the recent ETF listings on the ASX

How to ride the highs of US mega-caps (with fewer of the crushing lows)

Is 29Metals a leveraged copper play? Or a trap?

Morning Wrap: ASX 200 to fall ahead of CPI report, S&P 500 tumbles in the last hour of trade

ASX Microcaps with a blue-chip profile: Austin Engineering

Interesting Movers

Trading higher

+11.1% Wildcat Resources (WC8) - No news, rebound after two solid days of selling, closed back above short term uptrend ribbon, rise is consistent with long term uptrend

+10.0% Cooper Energy (COE) - No news, rise is consistent with prevailing short and long term uptrends

+6.3% EML Payments (EML) - No news, rise is consistent with prevailing short and long term uptrends

+5.9% Spartan Resources (SPR) - Change in substantial holding (increase), rise is consistent with prevailing short and long term uptrend

+5.4% Emerald Resources (EMR) - No news, rise is consistent with prevailing short and long term uptrends

+5.4% Mayne Pharma Group (MYX) - No news, rise is consistent with prevailing short and long term uptrends

+5.1% Arafura Rare Earths (ARU) - No news, rise is consistent with prevailing short term uptrend, trying to hold above long term trend ribbon

+4.8% Jupiter Mines (JMS) - No news, rise is consistent with prevailing short term uptrend, long term trend ribbon is transitioning to up

+4.2% Opthea (OPT) - No news, rise is consistent with prevailing short term uptrend, long term trend ribbon is transitioning to up

+4.2% Ridley Corporation (RIC) - No news, closed back above short term trend ribbon, appears holding/bouncing off long term trend ribbon

+4.2% Vulcan Steel (VSL) - No news, rise is consistent with prevailing short term uptrend, long term trend ribbon is transitioning to up

+3.9% Bannerman Energy (BMN) - No news, rise is consistent with prevailing short and long term uptrends

Trading lower

-21.1% Platinum Asset Management (PTM) - PTM turnaround program update (in the announcement) an undisclosed client withdrew 1.4 billion invested with the asset manager representing about 9% of funds under management, fall is consistent with prevailing long term downtrend, rejected by long term downtrend ribbon

-7.3% Catapult Group International (CAT) - Response to ASX Price Query

-6.1% Brainchip Holdings (BRN) - Capital Call Notice, fall is consistent with prevailing short and long term downtrends

-5.3% Myer Holdings (MYR) - Ex-dividend $0.03 fully franked

-3.9% Immutep (IMM) - No news 🤔

-3.8% Lotus Resources (LOT) - No news 🤔

-3.7% Resimac Group (RMC) - Investor Presentation

-3.5% Weebit Nano (WBT) - No news, fall is consistent with prevailing short and long term downtrends

-3.3% GWA Group (GWA) - No news, closed below short term uptrend ribbon

-3.1% Boss Energy (BOE) - No news, fall is consistent with prevailing short term downtrend

Broker Notes

-

29METALS (29M)

Downgraded to underperform from neutral at Macquarie; Price Target: $0.25 from $0.45

Retained at overweight at Morgan Stanley; Price Target: $0.50

Alpha HPA (A4N) - Retained at buy at Bell Potter; Price Target: $1.60 from $1.68

Aeris Resources (AIS) - Retained at buy at Bell Potter; Price Target: $0.23

Aristocrat Leisure (ALL) - Retained at hold at Ord Minnett; Price Target: $45.00

ALS (ALQ) - Retained at buy at Goldman Sachs; Price Target: $13.60

AMP (AMP) - Retained at hold at Ord Minnett; Price Target: $1.20

APA Group (APA) - Upgraded to outperform from neutral at Macquarie; Price Target: $9.40 from $8.80

Accent Group (AX1) - Retained at accumulate at Ord Minnett; Price Target: $2.40

Challenger (CGF) - Retained at hold at Ord Minnett; Price Target: $7.40

Champion Iron (CIA) - Retained at buy at Citi; Price Target: $9.60

Collins Foods (CKF) - Retained at accumulate at Ord Minnett; Price Target: $14.40

Coles Group (COL) - Retained at lighten at Ord Minnett; Price Target: $15.00

Domino's Pizza Enterprises (DMP) - Retained at accumulate at Ord Minnett; Price Target: $61.00

Endeavour Group (EDV) - Retained at accumulate at Ord Minnett; Price Target: $6.10

Flight Centre Travel Group (FLT) - Retained at buy at Citi; Price Target: $24.15

Harvey Norman Holdings (HVN) - Retained at lighten at Ord Minnett; Price Target: $4.00

Insignia Financial (IFL) - Retained at accumulate at Ord Minnett; Price Target: $3.60

JB HI-FI (JBH) - Retained at sell at Ord Minnett; Price Target: $37.50

Karoon Energy (KAR) - Retained at overweight at Morgan Stanley; Price Target: $2.49

Kogan.Com (KGN) - Retained at accumulate at Ord Minnett; Price Target: $10.70

Lovisa Holdings (LOV) - Retained at lighten at Ord Minnett; Price Target: $23.50

Magellan Financial Group (MFG) - Retained at hold at Ord Minnett; Price Target: $9.60

Monadelphous Group (MND) - Initiated at buy at Bell Potter; Price Target: $15.40

Metcash (MTS) - Retained at hold at Ord Minnett; Price Target: $4.00

Myer Holdings (MYR) - Retained at hold at Ord Minnett; Price Target: $0.75

-

Premier Investments (PMV)

Retained at buy at Citi; Price Target: $30.20

Retained at positive at E&P; Price Target: $33.87 from $31.97

Retained at sell at Goldman Sachs; Price Target: $25.10 from $22.30

Retained at sell at Goldman Sachs; Price Target: $25.10 from $23.50

Retained at neutral at Jarden; Price Target: $32.00

Retained at overweight at Morgan Stanley; Price Target: $38.00 from $32.00

Retained at sell at Ord Minnett; Price Target: $20.50 from $19.50

Upgraded to neutral from sell at UBS; Price Target: $31.00 from $27.00

Retained at buy at Unified Capital Partners; Price Target: $35.86 from $32.10

Perpetual (PPT) - Retained at hold at Ord Minnett; Price Target: $27.50

-

Platinum Asset Management (PTM)

Downgraded to sell from underperform at CLSA; Price Target: $1.00 from $1.02

Retained at hold at Ord Minnett; Price Target: $1.25

Serko (SKO) - Retained at buy at Citi; Price Target: $4.90

Super Retail Group (SUL) - Retained at sell at Ord Minnett; Price Target: $10.50

Wesfarmers (WES) - Retained at sell at Ord Minnett; Price Target: $43.00

Woolworths Group (WOW) - Retained at lighten at Ord Minnett; Price Target: $27.50

Scans

This article first appeared on Market Index on Wednesday 27 March.

5 topics

15 stocks mentioned