ASX 200 notches important win as tech, consumer discretionary gain

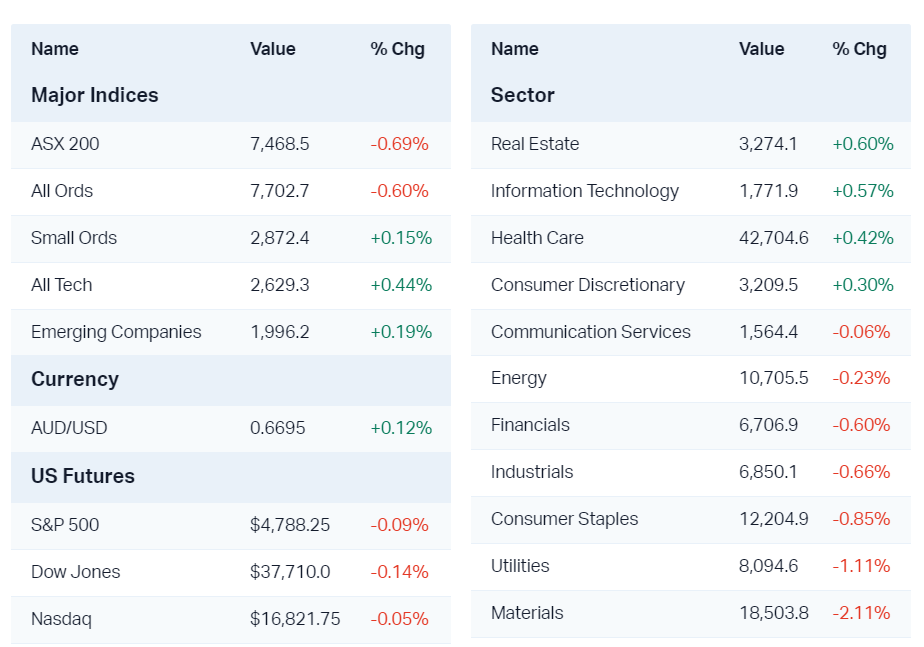

A fairly subdued holiday-style session today where not a great deal happened. In fact, the approval of several Bitcoin ETFs was probably the biggest news in local finance. But the gain logged by the S&P/ASX 200, albeit a modest +0.5%, was an important one in terms of the recent uptrend and with respect to how it was earned.

By this, I mean market breadth was good, and the growthier, risk-on sectors of Information Technology and Consumer Discretionary led the way. This indicates the bullish sentiment enjoyed towards the end of 2023 appears to be intact in the New Year, at least for now!

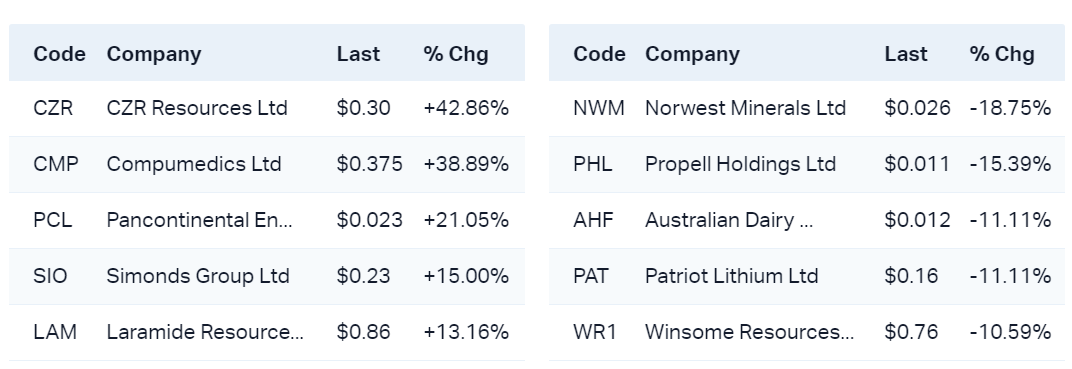

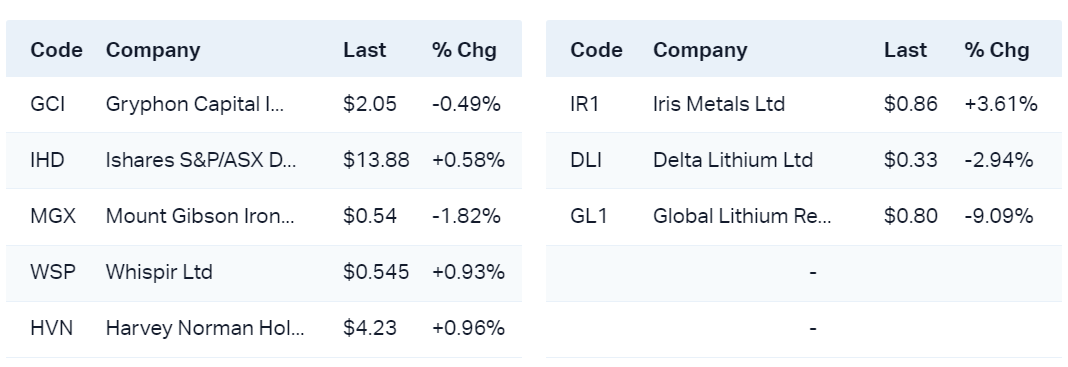

Today in Review

Markets

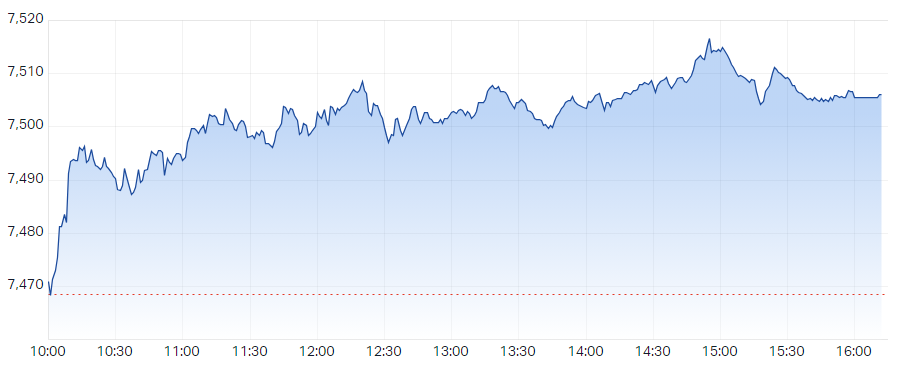

ASX 200 Session Chart

%20Intraday%20Chart%2011%20Jan%202024.png)

The S&P/ASX200 (XJO) finished 37.5 points higher at 7,506, 0.52% from its session low and just 0.15% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by an impressive 175 to 96. This is important because broad-based moves are more likely to be sustainable.

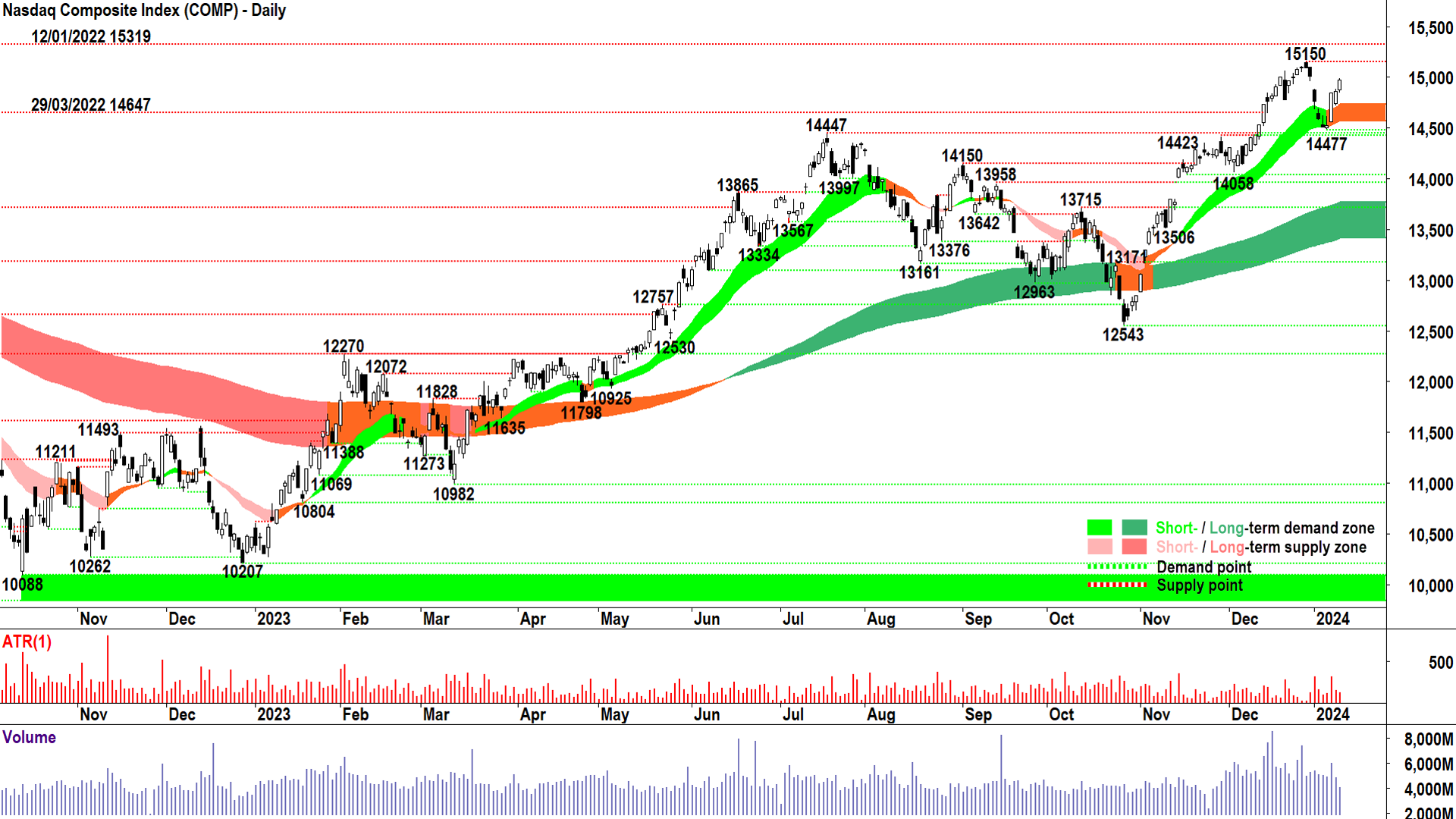

The S&P/ASX 200 Information Technology Sector (XIJ) +1.2% was the best performing sector today, likely in response to a similar gain on the tech-laden Nasdaq index in the USA on Wednesday. It's worth taking a look at that chart, which resembles the proverbial stairway to heaven!

Three white candles stemming from the old resistance zone around 14447 are important. In any uptrend, it's reassuring to see old resistance zones act as future support zones as it smacks of buy the dip activity. White candles are a reliable indicator of short term excess demand.

The next key zone of support is an important one, beginning at the 28 December minor peak of 15150, and up to the major peak set way back in January 2021 at 15319. It will be crucial to see how the Nasdaq performs there.

If we see white candles and or lower shadows, it would indicate demand remains fearless in the face of the potential supply usually associated with major supply points. Black candles and or upper shadows on the other hand, would indicate distribution, profit taking, and something fare more sinister is going on!

I pointed out the improving technicals for our own tech sector in Tuesday's Evening Wrap. Good news, it continues to perform well as it pushes off the key support zone between 1716-1736. It too looks well placed to tackle overhead resistance.

Also doing well today was the S&P/ASX 200 Consumer Discretionary Sector (XDJ) +0.9%, possibly still basking in the warm afterglow of the substantial Retail Sales beat which you can also read about in Tuesday's Evening Wrap.

A pretty decent sector chart here, also. Short, and long term uptrends, and predominantly demand side candles (i.e., those with white bodies and or lower shadows). The price action could be better, though, as I note lower troughs, but the test and hold of the short term trend ribbon is impressive. A break of the minor high of 3262 would further confirm the prevailing state of excess demand.

Economy

No major economic data releases today

What to watch out for...

Tomorrow:

USA Consumer Price Index (CPI) Friday 12 Jan at 12:30am, forecast to rise 3.2% p.a. to end of December.

Latest News

9 of the best stocks to buy in a sell-off

Why Core Lithium's mine closure was just the tip of the iceberg

The bargain hunter's guide to undervalued stocks for the start of 2024

Bitcoin ETFs are approved! Here’s everything you need to know

Kali Metals rallied 250% in three days. Here are key takeaways from the IPO

Morning Wrap: ASX 200 to rise, S&P 500 climbs to near all-time high ahead of inflation data

Interesting Movers

Trading higher

+12.2% Fineos Corporation Holdings (FCL) - No news since 05-Jan Becoming a substantial holder from AMP, move confirms long term trend reversal (back to up)

+6.5% Silex Systems (SLX) - No news since 10-Jan U.S. DOE Releases HALEU Enrichment Request for Proposal, move is consistent with prevailing short and long term uptrends

+5.6% Bravura Solutions (BVS) - Change in substantial holding

+5.0% South32 (S32) - Upgraded to buy from neutral at Goldman Sachs; Price Target: raised from $3.80 from $3.20

+4.7% Michael Hill International (MHJ) - No news, stronger consumer discretionary sector

+4.7% Rpmglobal Holdings (RUL) - No news, stronger information technology sector, move is consistent with prevailing short and long term uptrends

+4.5% Iluka Resources (ILU) - No news since 10-Jan Becoming a substantial holder

+3.9% Telix Pharmaceuticals (TLX) - No news since 08-Jan JP Morgan Healthcare Conference and Trading Update

+3.9% Accent Group (AX1) - No news day 2! 🤔 Stronger consumer discretionary sector

+3.8% JB HI-FI (JBH) - No news, stronger consumer discretionary sector, move is consistent with prevailing short and long term uptrends

+3.5% Beacon Lighting Group (BLX) - No news, stronger consumer discretionary sector, move is consistent with prevailing short and long term uptrends

Trading lower

-12.1% 29METALS (29M) - No news, which is the main issue, was yesterday's biggest gainer…buy the rumour, sell the fact!? See: Response to ASX Price Query

-4.6% Lotus Resources (LOT) - No news, some uranium stocks pulling back after yesterday's strong gains

-4.4% Insignia Financial (IFL) - Final distribution for December 2023 updated; Downgraded to underweight from equalweight at Morgan Stanley with Price Target lowered to $2.15 from $2.85

-4.1% Infomedia (IFM) - No news, move is consistent with short and long term downtrend

-3.6% Ainsworth Game Technology (AGI) - No news, pullback from recent strong performance

-3.3% Chrysos Corporation (C79) - Pullback from recent strong performance, record highs

Broker Notes

Aussie Broadband (ABB) retained at underperforrm JP Morgan; Price Target: $3.60 from $3.45

AGL Energy (AGL) retained at overweight JP Morgan; Price Target: $13.40 from $14.00

-

Ampol (ALD)

Downgraded to neutral from overweight at JP Morgan; Price Target: $38.10

Downgraded to hold from buy at Jefferies; Price Target: $38.00

APA Group (APA) retained at overweight JP Morgan; Price Target: $9.85 from 9..80

Alumina (AWC) downgraded to neutral from buy at Citi; Price Target: $1.15 from $1.10

Bellevue Gold (BGL) initiated at hold Argonaut Securities; Price Target: $1.50

Beach Energy (BPT) retained at overweight JP Morgan; Price Target: $1.75

Capricorn Metals (CMM) initiated at buy Argonaut Securities; Price Target: $6.00

Cooper Energy (COE) retained at overweight JP Morgan; Price Target: $0.17

Carnarvon Energy (CVN) downgraded to neutral from overweight at JP Morgan; Price Target: $0.19 from $0.20

Delta Lithium (DLI) retained at buy Bell Potter; Price Target: $0.75 from $1.35

Genesis Minerals (GMD) initiated at buy Argonaut Securities; Price Target: $2.40

Genetic Signatures (GSS) retained at buy Bell Potter; Price Target: $0.80 from $0.83

Hub24 (HUB) initiated at overweight Morgan Stanley; Price Target: $41.00

Insignia Financial (IFL) downgraded to underweight from equalweight at Morgan Stanley; Price Target: $2.15 from $2.85

Karoon Energy (KAR) retained at overweight JP Morgan; Price Target: $2.80 from $2.75

Lynas Rare Earths (LYC) retained at buy Bell Potter; Price Target: $8.50 from $8.80

Northern Star Resources (NST) initiated at buy Argonaut Securities; Price Target: $16.50

Netwealth Group (NWL) initiated at overweight Morgan Stanley; Price Target: $17.50

Origin Energy (ORG) retained at buy Bank of America; Price Target: $9.60

Platinum Asset Management (PTM) retained at sell Bell Potter; Price Target: $0.84

Ramelius Resources (RMS) initiated at hold Argonaut Securities; Price Target: $1.70

Regis Resources (RRL) initiated at hold Argonaut Securities; Price Target: $2.30

South32 (S32) upgraded to buy from neutral at Goldman Sachs; Price Target: $3.80 from $3.20

Sandfire Resources (SFR) upgraded to neutral from sell at Goldman Sachs; Price Target: $6.70 from $5.40

Sims (SGM) downgraded to neutral from buy at Goldman Sachs; Price Target: $16.20 from $15.30

Silver Lake Resources (SLR) initiated at hold Argonaut Securities; Price Target: $1.15

Santos (STO) retained at overweight JP Morgan; Price Target: $9.40 from $8.05

Transurban Group (TCL) downgraded to neutral from buy at Bank of America; Price Target: $13.89 from $13.22

Telstra Group (TLS) retained at overweight JP Morgan; Price Target: $4.80 from $4.75

TPG Telecom (TPG) retained at neutral JP Morgan; Price Target: $5.25

Viva Energy Group (VEA) downgraded to underperforrm from neutral at JP Morgan; Price Target: $3.30 from $3.15

West African Resources (WAF) retained at outperform Macquarie; Price Target: $1.60

Woodside Energy Group (WDS) upgraded to neutral from overweight at JP Morgan; Price Target: $34.80 from $34.20

Worley (WOR) retained at underperforrm JP Morgan; Price Target: $13.50 from $13.00

This article first appeared on Market Index on 11 January 2024.

5 topics

8 stocks mentioned