ASX 200 notches new record as Fed, jobs data turbo charge gold and bank stocks

Today in Review

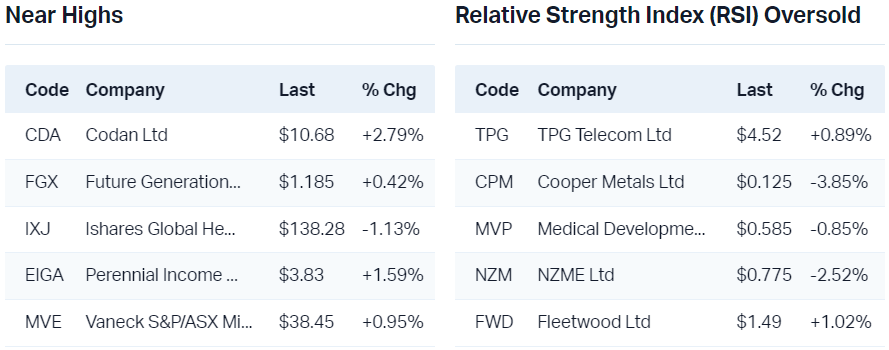

Markets

%20Intraday%20Chart%2021%20Mar%202024.png)

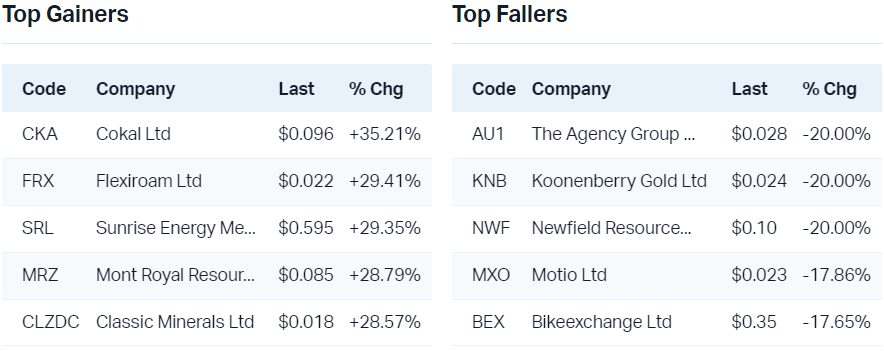

The S&P/ASX 200 (XJO) finished 86.2 points higher at 7,782.0, 1.1% from its session high/low and just 0.07% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 232 to 54. Both factors indicate a resounding vote of confidence in Aussie shares.

The Gold (XGD) (+3.8%) sub-index was the best performing sector today, continuing its two weeks of zebra moves on the candlestick chart. Could this be the decisive move? Check ChartWatch for further insights.

Also doing well today were the Financials (XFJ) (+1.7%), Consumer Discretionary (XDJ) (+1.5%), and Real Estate Investment Trusts (XPJ) (+1.4%) sectors. To be fair most sectors logged decent gains, and really only two sectors did it tough today, Health Care (XHJ) which fell -0.2%, and Utilities (XUJ) which dipped 0.6%.

ChartWatch

Gold Futures COMEX

Gold futures on COMEX enjoyed a nice bump on Wednesday as they received two-pronged benefits from the Fed meeting. Gold loves lower rates as the cost of carry with gold is substantial. This means as interest rates rise, so too does the opportunity cost of owning gold, and vice-versa.

Secondly, the prospect of lower US rates usually sinks the US dollar, as was the case Wednesday. Given gold is typically quoted against the US dollar, the weaker US dollar by default resulted in a stronger gold price.,

Spot prices have been exploring new highs for some time now, but as you can see from the above chart, gold futures are catching up.

Solid short and long term uptrends here, excellent price action (rising peaks and rising troughs), and the candles which count (i.e., the big ones) are predominantly white.

Demand now moves to the previous historical supply zone of 2171-2183, and below this it's 2149. The short term uptrend is intact while the price continues to close above 2117.

Supply? Above Wednesday's intraday high of 2225.3, there isn't any.

Ramelius Resources (ASX: RMS)

.png)

I wanted to highlight the ASX gold stock which I felt demonstrated the strongest demand-supply response to today's catalyst of higher gold prices.

RMS's Thursday candle is attractive due to the opening gap up – nothing speaks of highly motivated excess demand than a large opening gap up, but also due to the long white candle and close at the high of the session. Again, each is a great indicator of unquenched and motivated excess demand.

Technical analysts look for exactly these signals to help them understand the probabilities around a rise/fall in a stock's price. Typically, the greater the showing of excess demand, the greater the probability the price will continue to reflect this going forward.

But, candles are only indicative of the next few periods at best. Longer term indicators such as the trend ribbons and price action help the technical analyst to understand longer term manifestations of excess demand or excess supply.

There are some encouraging signs here as well. The short term uptrend has re-established, and the price is bouncing strongly off the long term uptrend ribbon, confirming it is acting as dynamic support.

The price action is rising peaks and rising troughs, which indicates a buy the dip mentality among market participants.

It's unlikely to be all plain sailing for RMS though, as I note the major historical supply point of 1.785 is approaching. It's worth watching the price action and candles here closely. A continuance of the current price action as well as white candles would signal a higher probability of a break out of this key level.

Support moves to 1.635. The short term trend remains up as long as the price continues to close above this point.

Economy

Today

-

Australia February Employment Growth & Unemployment Rate

Employment growth +116,500 vs +39,700k forecast and +15,200 in January (revised up from +500)

Unemployment rate to 3.7% vs 4.0% forecast and 4.1% in January

Biggest monthly gain in 10 years and significantly better than expected

ABS blamed shifting seasonal factors, including greater than expected number of people delaying job starts until February to enjoy summer holidays

Magnitude of expected interest rate cuts by the end of the year dipped to 0.37% vs 0.44% prior

Later this week

Friday

00:45 USA Flash Manufacturing PMI (51.8 forecast vs 52.2 previous) & Flash Services PMI (52.0 forecast vs 52.3 previous)

Saturday

00:00 USA Federal Reserve Chairman Jerome Powell speaks

Latest News

South32's shutdown drives upside for Jupiter Mines – The ASX's largest manganese miner

Gold prices are surging higher – But here's the kicker for ASX gold stocks

Top 10 most consistent ASX ETFs for your portfolio

How to earn sustainable income using ETFs and LICs (plus 8 ideas for your watchlist)

The contrarian take on the Australian market (and stocks to watch)

Interesting Movers

Trading higher

+16.7% Brainchip Holdings (BRN) - No news, characteristically volatile, did bounce off long term trend ribbon though

+10.3% Jupiter Mines (JMS) - No news, retained at outperform at Macquarie, price target increased to $0.30 from $0.25

+10.2% WA1 Resources (WA1) - No news, bounced off short term uptrend ribbon, rise is consistent with prevailing short and long term uptrends

+9.2% Webjet (WEB) - WebBeds Strategy Day Investor Presentation, rise is consistent with prevailing short and long term uptrends

+8.4% Zip Co (ZIP) - No news, rise is consistent with prevailing short and long term uptrends

+8.4% Bannerman Energy (BMN) - No news, uranium futures continue to bounce off long term uptrend ribbon +3.2% Weds, close above key historical supply zone at 3.26-3.39

+8.2% Bellevue Gold (BGL) - No news, rising gold price supported sector, rise is consistent with prevailing short and long term uptrends

+8.1% Resolute Mining (RSG) - No news, rising gold price supported sector, closed back above long term trend ribbon

+7.8% West African Resources (WAF) - No news, rising gold price supported sector, rise is consistent with prevailing short term trend, long term trend transitioning to up

+7.1% Ramelius Resources (RMS) - No news, rising gold price supported sector, rise is consistent with prevailing short and long term uptrends

+6.2% Telix Pharmaceuticals (TLX) - No news, rise is consistent with prevailing short and long term uptrends

+6.1% Deep Yellow (DYL) - No news, uranium futures continue to bounce off long term uptrend ribbon +3.2% Weds

+6.0% Red 5 (RED) - No news, rising gold price supported sector, rise is consistent with prevailing short and long term uptrends

+5.7% Paladin Energy (PDN) - No news, uranium futures continue to bounce off long term uptrend ribbon +3.2% Weds

+5.6% Adriatic Metals (ADT) - No news, rising gold price supported sector, rise is consistent with prevailing short and long term uptrends

+5.4% Emerald Resources (EMR) - No news, rising gold price supported sector, rise is consistent with prevailing long term uptrend, bounced off long term uptrend ribbon

Trading lower

-5.6% K&S Corporation (KSC) - Half Year FY24 Results

-4.8% Cooper Energy (COE) - No news, pullback after very strong short term uptrend move

-4.0% Strike Energy (STX) - No news, rebounding lower from short term downtrend ribbon, fall is consistent with prevailing short and long term downtrends

-3.7% Spark New Zealand (SPK) - No news, fall is consistent with prevailing short term downtrend, long term trend is transitioning from up to down

-3.3% IGO (IGO) - No news, fall is consistent with prevailing short and long term downtrends

-3.0% Brickworks (BKW) - Analyst Presentation and notes HY Jan 24

-3.0% New Hope Corporation (NHC) - No news, fall is consistent with prevailing short and long term downtrends

-3.0% AGL Energy (AGL) - No news, fall is consistent with prevailing short and long term downtrends

-2.6% Healthco Healthcare and Wellness REIT (HCW) - March 2024 Distribution Declaration, fall is consistent with prevailing short and long term downtrends

Broker Notes

AGL Energy (AGL) retained at accumulate at Ord Minnett; Price Target: $11.50 from $12.00

Amcor (AMC) retained at neutral at Citi; Price Target: $15.50

Arafura Rare Earths (ARU) downgraded to hold from buy at Bell Potter; Price Target: $0.19

Bapcor (BAP) upgraded to equal-weight from underweight at Morgan Stanley; Price Target: $5.75 from $5.00

Bellevue Gold (BGL) retained at neutral at UBS; Price Target: $1.45

-

Boral (BLD)

Retained at buy at BofA; Price Target: $7.00 from $6.75

Retained at underperform at CLSA; Price Target: $6.35 from $6.25

Retained at neutral at Jarden; Price Target: $5.90 from $5.80

Retained at hold at Jefferies; Price Target: $5.70

Car Group (CAR) retained at neutral at Citi; Price Target: $34.70

Champion Iron (CIA) retained at neutral at Macquarie; Price Target: $7.50

Cochlear (COH) retained at underweight at Morgan Stanley; Price Target: $256.00 from $276.00

-

Coles Group (COL)

Retained at sell at Goldman Sachs; Price Target: $15.10

Retained at outperform at Macquarie; Price Target: $17.50 from $17.85

Corporate Travel Management (CTD) retained at overweight at JP Morgan; Price Target: $19.50

De Grey Mining (DEG) retained at buy at UBS; Price Target: $1.50

-

Evolution Mining (EVN)

Upgraded to overweight from equal-weight at Morgan Stanley; Price Target: $3.95 from $3.35

Retained at buy at UBS; Price Target: $3.65

Flight Centre Travel Group (FLT) retained at neutral at JP Morgan; Price Target: $21.50

Global Lithium Resources (GL1) retained at buy at Shaw and Partners; Price Target: $2.20

Genesis Minerals (GMD) retained at neutral at UBS; Price Target: $1.75

Gold Road Resources (GOR) retained at buy at UBS; Price Target: $2.00

Helloworld Travel (HLO) retained at overweight at JP Morgan; Price Target: $3.80

IGO (IGO) retained at equal-weight at Morgan Stanley; Price Target: $7.20

Iperionx (IPX) initiated speculative buy at Bell Potter; Price Target: $3.70

James Hardie Industries (JHX) retained at buy at Citi; Price Target: $63.00

Jupiter Mines (JMS) retained at outperform at Macquarie; Price Target: $0.30 from $0.25

Jervois Global (JRV) retained at neutral at Macquarie; Price Target: $0.03

Karoon Energy (KAR) initiated overweight at Wilsons; Price Target: $2.71

Lunnon Metals (LM8) retained at outperform at Macquarie; Price Target: $0.70

Mineral Resources (MIN) retained at equal-weight at Morgan Stanley; Price Target: $62.50

Medibank Private (MPL) retained at neutral at Macquarie; Price Target: $3.60

Metcash (MTS) retained at neutral at Goldman Sachs; Price Target: $3.70

Monash IVF Group (MVF) retained at outperform at Macquarie; Price Target: $1.55

Newmont Corporation (NEM) retained at neutral at UBS; Price Target: $60.00

New Hope Corporation (NHC) retained at sell at Goldman Sachs; Price Target: $3.70 from $3.50

NIB Holdings (NHF) retained at neutral at Macquarie; Price Target: $7.30

Nickel Industries (NIC) initiated overweight at Morgan Stanley; Price Target: $0.95

Orecorp (ORR) retained at hold at Bell Potter; Price Target: $0.58 from $0.55

Pilbara Minerals (PLS) retained at underweight at Morgan Stanley; Price Target: $3.30

Pepper Money (PPM) retained at neutral at Citi; Price Target: $1.55

Perseus Mining (PRU) retained at neutral at Citi; Price Target: $1.85

Regis Resources (RRL) retained at sell at UBS; Price Target: $1.90

South32 (S32) retained at outperform at Macquarie; Price Target: $3.80 from $3.90

Siteminder (SDR) retained at neutral at JP Morgan; Price Target: $5.50

-

Sonic Healthcare (SHL)

Upgraded to neutral from underweight at JPMorgan; Price Target: $26.20 from $26.00

Retained at accumulate at Morgans; Price Target: $34.94 from $34.05

Smartpay Holdings (SMP) retained at buy at Bell Potter; Price Target: $1.76 from $1.75

SSR Mining (SSR) retained at neutral at UBS; Price Target: $7.40

Telix Pharmaceuticals (TLX) retained at buy at UBS; Price Target: $18.50

Technology One (TNE) retained at buy at Bell Potter; Price Target: $18.50

Tuas (TUA) retained at overweight at Morgan Stanley; Price Target: $4.30 from $3.15

Webjet (WEB) retained at neutral at JP Morgan; Price Target: $7.40

-

Woolworths Group (WOW)

Retained at buy at Goldman Sachs; Price Target: $40.40

Upgraded to outperform from neutral at Macquarie; Price Target: $35.00 from $36.00

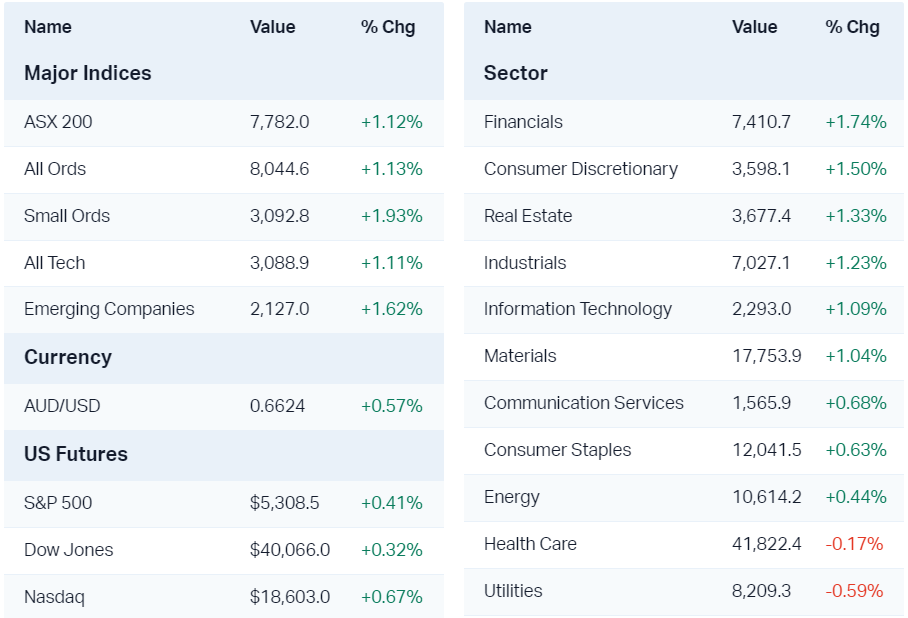

Scans

This article first appeared on Market Index on Thursday 21 March 2024.

5 topics

13 stocks mentioned